Fredonia to Seek Shareholder Approval to Implement Amendments to CPC Escrow Agreement

17 September 2021 - 2:00PM

Fredonia Mining Inc. (TSXV: FRED) (the

“Company” or

“Fredonia”)

announces that, pursuant to the amalgamation agreement between

Fredonia Management Limited and the Company (formerly Richmond Road

Capital Corp.) dated April 7, 2021, pursuant to which the Company

completed its “qualifying transaction” under TSXV Policy 2.4 –

Capital Pool Companies ("

Policy 2.4"), and as

permitted by Policy 2.4 (as amended as at January 1, 2021) (the

"

New CPC Policy"), the Company intends to, subject

to shareholder and TSXV approval, amend the escrow term of existing

CPC Escrow Agreements to 18 months, being the minimum allowable

escrow period under Policy 2.4, and, if applicable, release from

escrow any securities that were issued at or above $0.10 and that

are held by a member of the Pro Group who is not a Principal. The

Company will ask shareholders to vote on the amendments at its

annual general and special meeting of Shareholders (the

"

Meeting") scheduled to be held on October 12,

2021.

Capitalized terms used herein and not otherwise

defined have the meaning ascribed to them in the TSXV Corporate

Finance Manual or the New CPC Policy.

Amendments to the Escrow

Agreement

Under the New CPC Policy, the escrow term of a

CPC Escrow Agreement may be amended such that the escrow term can

be reduced to not less than 18-months, with escrowed securities

being released as to 25% upon completion of a qualifying

transaction, and an additional 25% every six months thereafter.

At the Meeting, shareholders of the Company (the

“Shareholders”) will be asked, among other

matters, to pass an ordinary resolution by an affirmative vote of

not less than a majority of the votes cast by disinterested

Shareholders who vote in respect thereof, in person or by proxy

("Disinterested Approval"), to amend the terms of

the CPC Escrow Agreement to which it is a party to reduce the

length of the term of any escrow provision to the 18-month escrow

term permitted by the New CPC Policy. In seeking such Disinterested

Approval, the Company shall exclude all votes attached to Common

Shares held by Shareholders who are parties to the CPC Escrow

Agreement, as well as their Associates and Affiliates.

The proposed amendments will be described in

further detail in the management information circular of the

Company, which will be mailed to shareholders and filed on SEDAR on

or before the prescribed mailing date. The proposed amendments

remain subject to the final approval of the TSXV.

About Fredonia

Fredonia, incorporated under the laws of the

British Virgin Islands, directly or indirectly, owns 100% interest

in certain license areas (totaling approximately 18,300 ha.)

(collectively, the “Project”), all within the

Deseado Massif geological region in the Province of Santa Cruz,

Argentina, including the following principal areas: El Aguila,

approx. 9,100ha, Petrificados, approx. 3,000ha, and the flagship,

advanced El Dorado-Monserrat (“EDM”) covering

approx. 6,200ha located close to Anglo Gold Ashanti’s Cerro

Vanguardia mine, subject to a 1.5% net smelter return royalty on

the EDM project, 0.5% net profits interest on Winki II, El Aguila

I, El Aguila II and Petrificados.

For further information please visit the Company website

www.fredoniamanagement.com or contact:

Carlos EspinosaChief Financial OfficerDirect:

+1-647-401-9292Email: cespinosa@slgmexico.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This news release may contain forward-looking

statements and forward-looking information (together,

“forward-looking statements”) within the meaning of applicable

securities laws and the United States Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, are forward-looking statements, including,

without limitation, statements as to the holding and timing of the

Meeting and amendment of the CPC Escrow Agreements. Generally,

forward-looking statements can be identified by the use of

terminology such as “plans”, “expects”, “estimates”, “intends”,

“anticipates”, “believes” or variations of such words, or

statements that certain actions, events or results “may”, “could”,

“would”, “might”, “occur” or “be achieved”. Forward-looking

statements involve risks, uncertainties and other factors that

could cause actual results, performance, and opportunities to

differ materially from those implied by such forward-looking

statements. Factors that could cause actual results to differ

materially from these forward-looking statements include the

failure to obtain regulatory approvals for the loan amendments and

are also set forth in the management discussion and analysis and

other disclosures of risk factors for Fredonia, filed on SEDAR at

www.sedar.com. Although Fredonia believes that the information and

assumptions used in preparing the forward-looking statements are

reasonable, undue reliance should not be placed on these

statements, which only apply as of the date of this news release,

and no assurance can be given that such events will occur in the

disclosed times frames or at all. Except where required by

applicable law, Fredonia disclaims any intention or obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

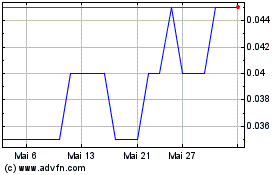

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Feb 2024 bis Feb 2025