Fredonia Mining Inc. (formerly Richmond Road Capital Corp.)

(“Fredonia” or the “Company”) (TSXV: FRED) is pleased to announce

that further to the press release issued on June 28, 2021 in

respect of the subscription receipt financing of $6.4 million (the

"Offering"), the escrow release conditions under the Offering have

been satisfied and Fredonia has received approval from the TSX

Venture Exchange ("TSXV") to list its common shares on the TSXV

under the symbol "FRED", with trading to commence on Wednesday,

July 14, 2021. At the request of TSXV, an additional 10,138,837

shares issued in 2017 pursuant to the acquisition of the El Dorado

project will be subject to Tier 2 value escrow.

“In parallel with the completion of our listing process, our

team in Argentina has been calibrating our strategies and timelines

for the upcoming drilling campaign,” said Estanislao Auriemma,

Chief Executive Officer of Fredonia Mining Inc. “We expect to

finalize all permitting in the upcoming weeks and to be drilling

per our plan at our primary targets with a view to have initial

results within 120 days.”

The Company’s immediate drilling program will encompass a total

of 6,000 meters of drilling in two tranches, with the initial 3,000

meters commencing as early as August 2021 at its Monserrat Oeste

and La Herradura targets, in EDM.

The TSXV has in no way passed upon the merits of the

proposed transaction and has neither approved nor disapproved the

contents of this press release.

Neither the TSXV nor its Regulation Services Provider

(as that term is defined in the policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this

release.

This press release is intended for distribution in Canada only

and is not intended for distribution to United States newswire

services or dissemination in the United States. The securities

being offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, or any state

securities laws and may not be offered or sold within the United

States or to, or for the account or benefit of, U.S. persons absent

U.S. registration or an applicable exemption from the U.S.

registration requirements. This release does not constitute an

offer for sale of securities in the United States.

About Fredonia

Fredonia, incorporated under the laws of the British Virgin

Islands, directly or indirectly, owns 100% interest in certain

license areas (totaling approximately 18,300 ha.) (collectively,

the “Project”), all within the Deseado Massif geological region in

the Province of Santa Cruz, Argentina, including the following

principal areas: El Aguila, approx. 9,100ha, Petrificados, approx.

3,000ha, and the flagship, advanced El Dorado-Monserrat (“EDM”)

covering approx. 6,200ha located close to Anglo Gold Ashanti’s

Cerro Vanguardia mine, subject to a 1.5% net smelter return royalty

on the EDM project, 0.5% net profits interest on Winki II, El

Aguila I, El Aguila II and Petrificados.

El Dorado-Monserrat (‘EDM’) Project

The EDM property is located in an area of low rolling hills in

the Deseado Massif of Santa Cruz Province, close to a number of

known mines and prospects. Santa Cruz Province is part of the

region of Patagonia which has the Andes Mountains to the west and

the Atlantic coast to the east. In general, the area is very

sparsely populated, and a large proportion of employment is in

sheep farming which is managed from widely scattered ‘estancias’.

However, in 2011 sheep farming was the second ranking economic

activity in this area, as oil, gas and mining (coal and gold)

overtook agriculture, giving Santa Cruz the highest GDP per capita

in Argentina.

The nearest major centres to the Fredonia licences are Puerto

Deseado (population 10,000), Puerto San Julian (population 6,000)

and Comodoro Rivadavia (population 140,000). Rio Gallegos

(population 79,000), the capital of Santa Cruz Province, lies to

the south of the project areas. The major centres can provide basic

goods and services, and the national power grid serves these

centres. Comodoro Rivadavia and Rio Gallegos are serviced with

national airports. A well-maintained concrete airstrip is located

at Puerto Deseado, serviced via small to mid-size charter aircraft.

Workers are readily available from the surrounding area.

There is reasonable access to the region, with numerous tracks

accessible to four-wheel drive vehicles. However, apart from the

major paved north-south highway 3 in the east of the province and

the east-west highway 43 in the northern part of the Massif,

highways are unpaved and may be in poor condition though are

readily accessible. Tracks may become temporarily impassable after

rain, but work can continue throughout the year.

The Deseado Massif is a large tectonic block in Santa Cruz

Province. During the Jurassic and Cretaceous Periods, widespread

volcanic activity included the outpouring of rhyolitic ignimbrites

and deposition of sediments which together form the Bahia Laura

Group. This Group includes the Chon Aike, La Matilde Formations,

overlying the Bajo Pobre Formation. Hydrothermal systems associated

with the Chon Aike (and Bajo Pobre) volcanism produced important

epithermal AuAg vein deposits in the Deseado Massif. Since 1976,

the San Jose, Cerro Negro, Mina Martha, Manantial Espejo, Cerro

Moro, Cerro Vanguardia and other deposits have been discovered.

Epithermal veins are the most common ore deposits. Vein systems can

be followed for kilometres, often with a north-westerly trend as at

Cerro Vanguardia and Cerro Moro. The quartz veins may be brecciated

and contain limonitic and manganiferous veining and breccia fill.

Barite, adularia, and haematite may occur in the quartz veins. The

quartz veining may be associated with rhyolitic domes that are the

source of the mineralising fluids and provide structural loci for

their deposition.

Extensive low sulphidation epithermal vein style mineralisation,

including a significant north-south trending system termed the Main

Vein zone, was initially discovered in the early 1980s on the EDM

Property during a survey conducted by Government geologists for

barite. The Main Vein and Abanico areas extend in a north-south

direction and carry significant gold and silver values, their total

strike length, from trench intercepts in the south-southwest to

drill hole intercepts in the north-northeast, is approximately 2.8

km and mineralised zones vary in thickness from less than 1 m to

over 10 m. The veins occupy a north striking, sinistral shear zone.

In the south, the system swells to around 1 km in width, hosted by

andesitic Bajo Pobre Formation rocks. The Main Veins area was the

focus of a NI-43101 Exploration Target report in 2018 and updated

in 2021.

The Monserrat Oeste area is located 2 km west of the Main Vein

zone in a northwest oriented dilational corridor. At surface, a

silica cap, secondary oxidation, leaching, breccia and residual

quartz textures are reported by Fredonia. Surface mapping by

previous owners Samco Gold and drilling data from Aur Resources

indicates that Monserrat Oeste is located within the Chon Aike

Formation, while drilling data suggests that mineralised zones are

related to veining and brecciation and have a north to

north-northeast trend, dipping 55 to 75° to the east. Mineralised

zones are characterised by argilisation and intense silicification

with dense veins of quartz, barite, pyrite, limonite, haematite and

clays.

Fredonia geologists note that two phases of the mineralisation

have been recognised. The first is dominated by barite, silver,

pyrite, sphalerite, galena, iron oxides, limonite and clays. The

second is characterized by silica-rich fluids, partially or

completely replacing barite. It is thought that this phase was the

main contributor for the gold mineralisation, either bringing in

additional silver or remobilising silver from the first phase.

Reinterpretation of the available data suggests that the Monserrat

Oeste prospect is analogous to the Cerro Negro model of a buried

epithermal system.

La Herradura and Beethoven, in the south of the Project area,

are considered to be part of the same system, located close to a

volcanic centre.

Mineralisation at the La Herradura prospect is hosted by veins

and veinlets of massive quartz with iron oxide staining.

Hydrothermal breccias composed of sub-angluar clasts up to 1 cm are

also present. Fredonia reports that the veins have an azimuth of

around 300° and a dip of 65 to 75° to the northeast. It is reported

that average vein lengths are 120 to 250 m, with thicknesses from

0.15 to 0.5 m. Depths of mineralised zones at La Herradura vary

from surface to around 220 m below surface. The footprint of the

main mineralised area is approximately 480 m in length and 70 to

130 m wide, though mapping indicates the structure continues to

1400m and remains open.

At the Beethoven prospect immediately east of and contiguous

with La Herradura, numerous veins have been identified at surface

along with hydrothermal breccias, the prospect extends to 5km of

strike. Veins consist of quartz, chalcedony and jasper with barite,

adularia, calcite, pyrite, arsenopyrite, sphalerite, limonite, iron

oxides, jarosite and sericite. Sulphides, predominantly pyrite,

reach up to 10% in vein volume. To date, the main mineralised zones

intersected in drilling have been on the southernmost vein from a

drilled depth of around 15 m.

Other prospect areas in the Property include Bajo Pedernal,

Monserrat East, Pamela and Vanina.

Exploration Programme

Fredonia plans to conduct a comprehensive exploration programme

to enable the further assessment of the potential of the El

Dorado-Monserrat Property. Initially improvement to access and

re-establishing the camp at the Monserrat homestead will enable

completion of the Environmental Impact Assessment report ahead of

exploration drilling.

The EDM Project area is considered to contain significant

potential and the drilling, trenching and surface exploration

conducted on the prospects by prior operators are adequate to

demonstrate the overall potential of the property.

The exploration programme planned includes mapping, surface

sampling, trenching and geophysics. However, the near term

emphasise of future exploration will be drill focussed at both

Monserrat Oeste and La Herradura. Additional drilling as well as

resampling of historic drill core will be required to fully assess

the potential and to enable the reporting of a Mineral Resource for

the Main Vein area. Outside the three primary prospect areas: Main

Vein Monserrat Oeste and La Herradura, there is also considerable

potential for additional mineralised zones to be identified.

Follow-up drilling at Abanico and Bajo Perdernal, initial drilling

at Monserrat Este will enable an improved understanding of the

geometry and extent of the mineralised zones in these areas.

Further to this, additional exploration of the Anita, Vanina,

Pamela and Juan Luis to the north of the Main Veins will determine

the potential for additional significant mineralised zones.

Technical Information

The technical contents of this press release have been reviewed

and approved by Marc J. Sale FAustIMM MAIG, a qualified person

pursuant to National Instrument 43-101 (“NI 43-101”). Mr. Sale is

qualified as a geologist with a technical background in mineral

exploration, including specifically gold and silver deposits.

ACA Howe’s Senior Associate Geologist, Marc J. Sale (QP), was

onsite for several days during Fredonia’s drilling in March 2018.

During this period, the drilling, sampling and security procedures

were witnessed and all were considered to be in line with industry

best practices. Drill core and sampled drill core were under the

continuous supervision by Fredonia. At the drill site a dedicated

assistant supervised drill core quality control, including

observing the removal from the core barrel, placement in the core

box, cleaning and correct insertion of the ‘core block’. There were

very frequent visits by geological staff during both day and night

drill shifts. Drill core, having been correctly orientated, was

cleaned and then in sealed wooden boxes before being transported to

the core logging area; a secure area removed for the main camp and

cordoned off with restricted access signs. Once core was logged and

‘marked’ up for sampling it was moved to the core cutting shed

which was kept locked when not operational. The half core in the

designated sample intervals was bagged, labelled and sealed. Prior

to transport to the laboratory all samples were kept in a secure

shed which was locked by the supervising geologist. Samples were

periodically transported by 4WD to the laboratory by Fredonia field

staff in secured hessian bags. The bags were checked for any signs

of damage when delivered before being handed into the custody of

the laboratory for sample preparation.

All drill core sampled by Fredonia, as well as verification

samples collected by Marc Sale (QP), were assayed by Alex Stewart

Laboratories in Mendoza. Samples were prepared in their laboratory

in San Julian some 155 km east-southeast of the EDM property. Alex

Stewart Laboratories is accredited to ISO standards and has ISO

9001:2015 and ISO 14001:2015 certification for its facility in

Mendoza where all analyses were conducted. Alex Stewart

Laboratories is independent of Fredonia and acts as a service

provider as and when required. On receipt at the laboratory the

samples were logged in and ascribed a unique bar code. Samples were

then weighed and dried at 40°C, before being crushed to #10 mesh.

The bulk of the coarse sample was stored. The ~600 g sub-sample was

pulverised until 95% passed #140 mesh. Gold was assayed by Fire

Assay using a precise 50g charge, fused at 1050°C with flux, then

smelted and refined to produce a lead alloy. This was followed by

cupellation of the lead alloy, before dissolving in Aqua Regia from

which 10 ml was analysed by an Atomic Absorption Spectrometer to

determine the gold assay value. For silver assays the process is

similar, although the finish is by 10 ml being dissolved in HNO3

but also with an AA spectrometer finish. All samples were also

analysed by ICP for a suite of 39 elements.

QA/ QC comprised of blanks and certified reference material

(CRM) being inserted into the sample stream, on average 10% of

material analysed was either a blank or CRM. Blanks were derived

from a mixture of laboratory sources and white quartz of unknown

origin. CRM was bought from a certified source – GeoLabs of

Australia. All blanks were reported in assay as being below

detection limit for both gold and silver. This indicates that

contamination is not present in any significant quantity. Analysis

of CRM samples indicates that the laboratory accuracy is generally

acceptable, with 95% CRM analyses within three standard deviations

of the mean.

As well as the QA/QC reported above, for the 2018 drilling

programme, 31 pulps and coarse rejects were re-assayed by Alex

Stewart Laboratories (ASL). In addition, a 50% split of the 31

coarse rejects were sent to Bureau Veritas Minerals (ACME Labs) in

Canada for further re-analysis. Comparison of results with the

original assays for both gold and silver shows a strong positive

correlation, providing confidence in the original assays.

About the Project

The Deseado massif is a tectonic block which comprises Jurassic

and Cretaceous volcanic outpouring, containing two important

geological groups: the Bajo Pobre and Chon Aike both of which are

prospective for low sulphidation epithermal style gold-silver

mineralisation, such as being exploited at the Cerro Vanguardia

gold – silver mine.

The property contains other prospects which are interpreted as

prospective on the basis of drilling so far conducted, and several

other prospects with identified structures containing significant

gold-silver values in rock chip, channel and drill samples.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains certain “Forward-Looking Statements”

within the meaning of applicable securities legislation relating to

the Resulting Issuer and the El Dorado Monserrat project, including

statements regarding the commencement of trading the Resulting

Issuer shares, and the business of the Company following completion

of the Qualifying Transaction. Words such as “might”, “will”,

“should”, “anticipate”, “plan”, “expect”, “believe”, “estimate”,

“forecast” and similar terminology are used to identify forward

looking statements and forward-looking information. Such statements

and information are based on assumptions, estimates, opinions and

analysis made by the Company in light of its experience, current

conditions and its expectations of future developments as well as

other factors which it believes to be reasonable and relevant.

Forward-looking statements and information involve known and

unknown risks, uncertainties and other factors that may cause

actual results to differ materially from those expressed or implied

in the forward-looking statements and information and accordingly,

readers should not place undue reliance on such statements and

information. Although the Company believes, in light of the

experience of its officers and directors, current conditions and

expected future developments and other factors that have been

considered appropriate, that the expectations reflected in this

forward-looking information are reasonable, undue reliance should

not be placed on them because the Company can give no assurance

that they will prove to be correct. In evaluating forward-looking

statements and information, readers should carefully consider the

various factors which could cause actual results or events to

differ materially from those expressed or implied in the forward

looking statements and forward-looking information. The statements

in this press release are made as of the date of this release. The

Company undertakes no obligation to comment on analyses,

expectations or statements made by third parties in respect of the

Company, Fredonia, their respective securities or their respective

financial or operating results (as applicable).

For further information: Please visit the Company website

www.fredoniamanagement.com or contact: Carlos Espinosa, Chief

Financial Officer, Direct: +1-647-401-9292, Email:

cespinosa@slgmexico.com

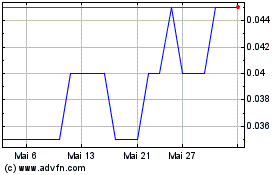

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Nov 2023 bis Nov 2024