Almadex Minerals Ltd. ("Almadex" or the "Company")

(TSX-V: “DEX”) is pleased to announce it has acquired 100%

ownership of the Logan Zinc, Silver project (“Logan”, or the

“Project”) located in the Yukon, Canada. As fully outlined below, a

Company predecessor discovered the Logan Project in 1979. The

project was then joint ventured, leaving Almadex’s predecessor a

retained 40% interest carried to “Positive Production Decision”.

The majority interest subsequently changed ownership, but the

property was never the focus for the various operators. Almadex has

been able to acquire 100% of the Logan project legally through a

bankruptcy receivership, finally allowing for the project to be

advanced. Key take aways for the Logan Project include:

- Located 38 km north of the Alaska

Highway, accessed historically by 52 km long winter road;

- Historic inferred resource prepared

in 2012 for the Logan Main Zone reporting 42.7 Mt with average

grades of 2.76% zinc and 12.89 ppm silver at a 1% zinc cut-off

grade (see below for details and disclosure);

- Deposit remains open along strike

and down dip.

Duane Poliquin, Chairman of Almadex, stated, “We

have long been pushing to advance the Logan project but have been

constrained by the joint venture agreement and the unresponsive

nature of the prior majority owners. With this transaction we are

now finally able to start the work necessary to surface the

tremendous potential which exists at this project. We look forward

to meeting and consulting with all rightsholders including the Ross

River Dena Council and Liard First Nation to discuss exploration

and development approaches that can meet the expectations of local

people, the Indigenous owners, the Yukon government and other

Company stakeholders.”

Logan Project Details and Historic

Mineral Resource Estimate

The Logan Project is located 108 km northwest of

Watson Lake in south central Yukon. The Project consists of 156

contiguous quartz mining claims located in the Watson Lake Mining

District, covering over 3,200 hectares. The Project is located on

the traditional territory of the Ross River Dena Council and Liard

First Nation, 38 km north of the Alaska Highway. Access for past

major work programs was facilitated with a 52 km long winter road

from the Alaska Highway. In 1987, a 700 m long by 20 m wide gravel

airstrip was established on the Property; future use of the

airstrip would require surface re-levelling, but small, short

runway aircraft may be able to land at this time. The winter road

permit was not renewed past 2009 and re-opening the road would

require further permitting. Currently, the Project can be accessed

via helicopter.

According to historic reports, Logan contains a

zinc-silver deposit consisting of fracture and vein hosted

zinc-silver mineralization within a granitic intrusion. The Main

Zone occurs along an 8,000m long NE-trending fault-related

structure. The Main Zone is tabular, dips 70 degrees to the NW,

extends for 1,100m along strike, varies from 50m to 150m in width,

and has been traced to depths of 275m and remains open. The

mineralization is up to 90 metres thick in relatively gentle

terrain and minimal overburden, making it attractive for open pit

mining. In March, 2004, in its public filings prior to bankruptcy,

Yukon Zinc Corp. noted that exploration defined low grade zinc

mineralization in the East and West Zones of the deposit that

require more drilling to better define resources, that historic

drilling in the deeper parts of the Main Zone includes important

intersections, such as 9 metres grading 10.07% zinc and 65.2 g/t

silver, that could be amenable to underground mining, and that the

deposit remains open at depth and along strike.

Logan has been explored by means of sequential

programs of mapping, soil sampling, geophysics, and diamond

drilling since the 1980s. The work conducted by or on behalf of

Cordilleran Engineering, Getty Resources Ltd., Fairfield Minerals,

Total Energold Minerals Inc., Expatriate Resources, and Yukon Zinc

Corp. (Yukon Zinc) is briefly summarised as follows:

1979: Staking of Logan 1 to 36 quartz mining

claims to cover new zinc-silver-tin-copper gossan. Geological

mapping, soil and stream sediment geochemistry, hand trenching, and

test IP, EM and magnetometer geophysical surveys.

1980-1985: Additional soil geochemistry, claim

staking, hand trenching, and geophysical surveys were

completed.

1986-1989: Exploration drilling of 103 holes

totalling 16,438 metres. Fifteen trenches totalling 2,412 metres

and ongoing soil geochemistry and geophysical surveys.

Metallurgical testwork at Lakefield Research Laboratories under

supervision of Strathcona Mineral Services Limited. Flotation of

both high- and low-grade zinc samples indicated that recoveries of

93-95% zinc and 85-90% silver could be projected to a zinc

concentrate.

2003: Additional staking and completion of a

baseline environmental survey was conducted in and around the Logan

property.

2006: Yukon Zinc Corp. retained Bell Geospace to

conduct an Air Full Tensor Gravity (Air-FTG) survey.

2012: Wardrop, a Tetra Tech Company (Tetra Tech)

was retained by Yukon Zinc to prepare a Technical Report, including

an historical mineral resource estimate, on the Logan Property in

2012. The 2012 Tetra Tech Technical Report is treated as a

historical mineral resource. A Qualified Person has not done

sufficient work to classify the historical estimate as a current

mineral resource and Almadex is not treating this historical

estimate as current mineral resources.

The 2012 Logan historical mineral resource

estimate is considered to be relevant and reliable. The Tetra Tech

historical estimate for the Logan Main Zone deposit, used sample

assay data from 56 drillholes which intersect the deposit

containing 4,314 zinc and silver assays. Samples were composited to

2 m lengths and no assay values were capped. The Logan Main Zone

deposit was modeled as a single mineralized geological wireframe

bounded by two faults (the hanging wall and footwall faults)

striking southwest and dipping moderately northwest. Where the

position of the upper and lower faults bounds is uncertain a grade

cut-off of 0.5% zinc was used to constrain the model. Bulk density

values of 2.95 and 2.7 were assigned to mineralization and waste

rock based on 53 separate SG determinations from drill core pulp

composite samples representing 556 m of diamond drill core.

Interpolation was done using Ordinary Kriging on blocks 10 m x 10 m

x 10 m in size. Only zinc and silver were consistently assayed

throughout the three years of drilling, and therefore these were

the only metals estimated. At a 1% zinc cut-off grade, the Logan

Main Zone was estimated to contain 42.7 Mt at an average grade of

2.76% zinc and 12.89 ppm silver1.

The 2012 Tetra Tech historical estimate,

reported at a % zinc cut-off grade, is summarized in Table 1. The

entire resource was classified as an inferred historical resource,

based on a lack of QA/QC and specific gravity (SG) data, a lack of

original assay certificates to validate the data, and an inability

to confirm the locations of any drillholes. The Logan Main Zone

historical estimate was classified using the definitions set out in

CIM Definition Standards for Mineral Resources and Mineral Reserves

(2010), which was superseded by CIM (2014). Similarly, the Main

Zone estimate predates CIM Estimation of Mineral Resources and

Mineral Reserves Best Practice Guidelines (2019). To verify the

historical estimate as a current mineral resource a Qualified

Person would need to prepare an updated mineral resource estimate

and NI 43-101 technical report with respect to the Logan

Property.

Subject to permitting and stakeholder

engagement, Almadex plans to commence an Independent QP review of

the previous work towards the preparation of a new Technical Report

and a QP site visit in the summer of 2022 after snow melt. Data

review to date indicates that there is potential to enlarge the

mineralised envelope of the historic resource as the deposit was

generally drilled to 120-240m down dip (only one hole was drilled

to 400m down dip), and the deposit remains open, particularly on

the northeast side.

Table 1: Logan Main Zone Deposit

Historical Inferred Resource Estimate – (Tetra Tech

2012)

|

Zn Cut-off |

Volume (m3) >

Cut-off |

Tonnes > Cut-off |

Grade > Cut-off |

|

|

Zn Grade (%) |

Ag Grade (pm) |

|

|

|

|

0.5 |

19,369,095 |

57,138,829 |

2.25 |

10.6 |

|

|

1 |

14,462,266 |

42,663,685 |

2.76 |

12.89 |

|

|

2 |

7,830,622 |

23,100,336 |

3.88 |

17.45 |

|

|

3 |

4,832,848 |

14,256,903 |

4.77 |

20.82 |

|

|

4 |

2,882,300 |

8,502,785 |

5.65 |

23.76 |

|

|

5 |

1,575,225 |

4,646,915 |

6.64 |

25.7 |

|

|

7 |

457,511 |

1,349,657 |

8.74 |

31.52 |

|

Table 1 above illustrates the sensitivity of the

historical mineral resource estimate to different cut-off grades

for a potential open-pit operation scenario with reasonable outlook

for economic extraction. The reader is cautioned that the figures

provided in the above table, other than those relating to the 1.0%

base case cut-off, should not be interpreted as a statement of

historical or current mineral resources. Quantities and estimated

grades for different cut-off grades are presented for the sole

purpose of demonstrating the sensitivity of the historical resource

model to the choice of a specific cut-off grade.

Transaction

Logan has been explored by multiple parties over

the past forty years. Almaden Minerals Ltd. (“Almaden”) assumed

ownership of a 40% joint venture interest in the Project through a

joint venture agreement when it amalgamated with Fairfield Minerals

in 2002. Under the joint venture agreement, Almaden was carried to

a production decision, and both parties had certain rights and

restrictions regarding ownership transfer. In its spinout by way of

Plan of Arrangement in 2015, Almaden was not able to secure the

necessary waivers of rights or restrictions from the majority joint

venture owner to transfer the minority Logan interest to Azucar

Minerals Ltd. (“Azucar”), but undertook to Azucar to do so once

these were attained. Likewise, when Azucar completed its spinout by

way of Plan of Arrangement in 2018 to create Almadex (the spinouts

of 2015 and 2018 are collectively referred to as the “Spinout

Arrangements” below), Azucar undertook to complete the spinout of

the Logan interest to Almadex once Azucar was in a position to do

so.

In 2003, Expatriate Resources Limited acquired

the majority 60% interest in the Logan joint venture agreement from

Total Energold. At the time, Expatriate was investigating the

Project as part of a broader evaluation of the combined resources

of Logan and the Wolverine property, located approximately 100

kilometers to the north. In 2004, Expatriate re-organized its

business and changed its name to Yukon Zinc Corp. (“YZC”), focused

on the development of the Wolverine project. In 2008, YZC was

acquired by

Jinduicheng Canada Resources Corporation Limited

(“JCR”), which is majority-owned by Jinduicheng Molybdenum Group,

which in turn is wholly owned by Shaanxi Non-ferrous Metals Holding

Group Co., Ltd.

YZC went on to construct and develop the

Wolverine mine, which reached commercial production in 2012, but

was put on care and maintenance in 2015. In 2019,

PricewaterhouseCoopers Inc. was appointed Receiver over YZC.

Almaden, acting on behalf of the Company under the terms of the

Joint Venture Agreement and consistent with the Spinout

Arrangements, was able to acquire the remaining 60% joint venture

interest in the Project, dissolve the joint venture agreement, and

transfer Logan to the Company for CAD$121,100 in cash, with the

Company assuming all costs and obligations, including an

indemnification to Almaden, related thereto.

Next Steps

Almadex is now focused on stakeholder mapping

and data review. As noted above, Almadex recognizes and respects

the Ross River Dena Council and Liard First Nation as traditional

owners of the area within which the Project is located and hopes to

have the opportunity to meet with them in the near term to

understand their view of the Project and hopes for the area and to

consult with them prior to any work programs. It is anticipated

that future work programs would initially consist of a QP site

visit which would direct a possible updated resource estimate and

filing of a NI 43-101 Technical Report.

Qualified Persons

The scientific and technical information

contained in this news release has been reviewed and approved by

Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX

Geoscience Ltd. of Edmonton, AB, and an independent “Qualified

Person” as defined in National Instrument 43-101 – Standards of

Disclosure for Mineral Projects. Mr. Raffle verified the data

disclosed which includes a review of the analytical and test data

underlying the information and opinions contained therein.

About Almadex

Almadex Minerals Ltd. is an exploration company

that holds a large mineral portfolio consisting of exploration

projects and NSR royalties in Canada, the U.S., and Mexico. This

portfolio is the direct result of many years of prospecting and

deal-making by Almadex's management team. The Company remains

focussed on grassroots exploration, acquisition and drilling

mineral projects, on its own and in partnership with others, with

the goal of creating new mineral resources and royalty holdings.

The Company owns several portable diamond drill rigs, enabling it

to conduct cost effective first pass exploration drilling in

house.

On behalf of the Board of Directors,

“J. Duane Poliquin”

J. Duane Poliquin, ChairmanAlmadex Minerals

Ltd.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

This news release includes forward-looking

statements that are subject to risks and uncertainties. All

statements within it, other than statements of historical fact, are

to be considered forward looking. Forward-looking statements in

this news release relating to the Company include, among other

things, the planned data review, stakeholder mapping and

stakeholder development. Although the Company believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in forward-looking statements. Factors that

could cause actual results to differ materially from those in

forward-looking statements include market prices, exploitation and

exploration successes, permitting, continued availability of

capital and financing, equipment availability, relationships with

third-party clientele and their willingness or ability to continue

to use the Company’s drills for exploration, and general economic,

market or business conditions. There can be no assurances that such

statements will prove accurate and, therefore, readers are advised

to rely on their own evaluation of such uncertainties. The Company

does not assume any obligation to update any forward-looking

statements, other than as required pursuant to applicable

securities laws.

Contact Information:Almadex Minerals Ltd.Tel.

604.689.7644Email:

info@almadexminerals.comhttp://www.almadexminerals.com/

1 Harder, M. P.Geo. and O’Brien, M. Msc., Pr.Sci.Nat., FGSSA,

FAusIMM, MSAIMM (2012) NI 43-101 Technical Report on the Logan

Property, Yukon prepared for Yukon Zinc Corp., Effective Date May

30, 2012, Wardrop, Tetra Tech, pp. 95

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/732fe571-4f88-477a-8ea4-46c5377cb78d

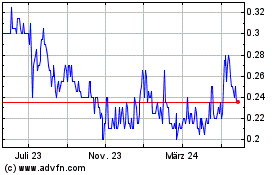

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

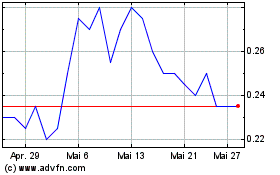

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025