Almadex Minerals Ltd. ("Almadex" or the "Company")

(TSX-V: “DEX”) is pleased to provide an update on activities

commenced and planned for the coming year at its mineral properties

in British Columbia, Nevada, and Mexico.

Duane Poliquin, Chairman of Almadex, stated “We

expect 2021 to be an exciting year for Almadex. Several of our

directly owned and optioned properties could be drilled this year,

pending receipt of the necessary permits and allocation of budgets

by some of our partners. At the same time, there are some exciting

developments in our royalty portfolio, which continues to advance.

Almadex has the necessary funds to execute on its 2021 exploration

plans.”

Additional detail on the Company’s mineral

property and royalty assets is provided below.

Nevada Optioned Properties

Davis/Paradise Valley

Almadex optioned 60% of the above properties to

Makara Mining Corp. (“MAKA”) in 2020 (see press release dated

September 14, 2020). Since that time, preliminary geological

mapping and alteration studies have been completed, and MAKA

intends to drill the project this year. Almadex is the Operator of

the exploration program, and has mobilised one of its drills into

Nevada in order to conduct the drilling program. MAKA recently

announced that the first phase drilling program (5000 ft, 1500 m)

is planned to be underway during April 2021, weather

permitting.

To date, MAKA has issued 100,000 shares to

Almadex as part of the option agreement.

Willow

Almadex, through its predecessor Company, Azucar

Minerals Ltd., optioned up to 75% of the Willow property to Abacus

Mining and Exploration Corp. (“AME”) in 2017. AME’s work since this

time has included geological, geochemical and geophysical work, as

well as a short core drilling program in 2018.

Willow is located in the Yerington camp,

southeast of Reno, NV. The Yerington camp contains four known

porphyry copper-molybdenum (Cu-Mo) deposits, all associated with a

particular intrusive rock known as the Luhr Hill Granite. AME

states that its work points to the existence of a fifth porphyry on

the Willow property, the first major discovery in the camp in over

40 years. Drilling in 2018 identified Cu values in the 0.1% to 0.2%

Cu range along with elevated Mo, associated with the Luhr Hill

Granite. Abacus is currently planning a drill campaign to begin in

Q2 2021.

To date, AME has issued 250,000 shares to

Almadex as part of the option agreement.

Spences Bridge District Optioned

Properties

Merit and Nicoamen

Almadex optioned 60% of the above two properties

to Independence Gold Corp. (“IGO”) in 2019 (see press release dated

February 27, 2019). To date, the Company has received 800,000

shares of IGO under these option agreements as IGO continues to

earn its 60% interest in the properties. Almadex is highly

encouraged by IGO’s exploration work at the two properties to date,

which has resulted in the discovery of several new gold zones at

each property.

Ponderosa

Almadex optioned 60% of the above property to a

private numbered company in 2019. Since that time, the numbered

company has completed its listing process onto the TSX Venture

Exchange, and changed its name to AU Gold Corp. (trading under

symbol “AUGC”). Almadex currently holds 332,791 shares of AUGC.

Mexico Properties

Almadex is pleased to announce its intention to

drill at least three of its Mexican mineral properties over the

course of 2021, using its own drill rigs and teams. The Company

will release material results if and as they are received.

Royalty Portfolio

Developments

Elk Property – 2.0% NSR, British Columbia,

Canada

The Elk property is owned by Gold Mountain

Mining Corp. (“GMTN”). GMTN has commenced a pre-feasibility study

on the Elk project as well as a drill program aimed at

demonstrating resource expansion potential along strike and down

dip of the existing resource. GMTN has also recently announced the

signing of a mining contract and ore purchase contract in support

of commencement of mining activities in the near term, pending

receipt of necessary permits. The Elk project could soon become the

first consistent cash flow generating royalty in Almadex’s royalty

portfolio. Almadex is pleased to see this property once again owned

by a well funded group focused on near-term production and resource

growth.

El Cobre Property – 1.75% NSR, Veracruz,

Mexico

The El Cobre property is owned by Azucar

Minerals Ltd. (“AMZ”). In September 2020, AMZ announced an initial

resource at the Norte Zone of the El Cobre property comprising an

indicated resource containing 748,000 ounces of gold and 221Mlbs

copper (47.2 million tonnes grading 0.49 g/t Au, 0.21% Cu and 1.4

g/t Ag) and an inferred resource containing 860,000 ounces of gold

and 254Mlbs copper (64.2 million tonnes grading 0.42 g/t Au, 0.18%

Cu and 1.3 g/t Ag).

This is a significant mineral endowment at one

of several identified gold-copper porphyry centres at this

property, which is located in an area of excellent infrastructure.

Almadex looks forward to further developments at this high

potential project. Please see Note 1 below regarding the details of

the technical disclosure regarding the El Cobre property.

In addition to the 1.75% NSR, Almadex holds

3,700,000 shares of AMZ.

Ixtaca Project - 2.0% NSR, Puebla State,

Mexico

The Ixtaca project is owned by Almaden Minerals

Ltd. (“AMM”). Ixtaca is at the feasibility stage and hosts a proven

and probable reserve containing 1.38 million ounces of gold and

85.1 million ounces of silver (73.1 million tonnes grading 0.59 g/t

Au and 36.3 g/t Ag). The Ixtaca project is currently in the mine

permitting phase, which has taken longer than expected. Pending a

favourable permitting outcome, Ixtaca has the potential to generate

significant royalty cash flows for the Company. Please see Note 2

below regarding the details of the technical disclosure regarding

the Ixtaca project.

Almaden has recently noted the exploration

potential remaining at the Ixtaca project and the Company looks

forward to the results of the Ixtaca exploration programs over the

course of 2021.

Other Royalties

In addition to the above royalty interests,

Almadex holds royalties on thirteen additional properties located

in Mexico, Nevada, and Canada, some of which will also be subject

to exploration in 2021. The Company will report material results if

and as they are announced by project operators.

Morgan J. Poliquin, Ph.D., P. Eng., President

and CEO of Almaden, and a Qualified Person as defined by National

Instrument 43-101 ("NI 43-101"), has reviewed and approved the

scientific and technical contents of this news release.

About AlmadexAlmadex Minerals

Ltd. is an exploration company that holds a large mineral portfolio

consisting of projects and NSR royalties in Canada, the U.S., and

Mexico. This portfolio is the direct result of over 35 years of

prospecting and deal-making by Almadex's management team. The

Company owns a number of portable diamond drill rigs, enabling it

to conduct cost effective first pass exploration drilling in

house.

On behalf of the Board of Directors,

“J. Duane Poliquin”

J. Duane Poliquin, ChairmanAlmadex Minerals

Ltd.

Note 1: For details on the estimation of mineral

resources and reserves, including the key assumptions, parameters

and methods used to estimate the Mineral Resources and Mineral

Reserves at the El Cobre property, Canadian investors should refer

to the report dated effective November 13, 2020, and titled “NI

43-101 Technical Report Mineral Resource Estimate on the El Cobre

Copper-Gold-Silver Property, Veracruz State, Mexico” which is

available under Azucar Minerals’ profile on SEDAR (www.sedar.com).

The Technical Report was authored by Kris Raffle, P.Geo. of APEX

Geoscience Ltd., and Sue Bird, M.Sc., P.Eng. of Moose Mountain

Technical Services.

Note 2: For details on the estimation of mineral

resources and reserves at the Ixtaca project, including the key

assumptions, parameters and methods used to estimate the Mineral

Resources and Mineral Reserves of the Ixtaca project, Canadian

investors should refer to Almaden Minerals’ Technical Report on the

Feasibility Study which was updated on SEDAR on October 3, 2019

(“FS”) and is available under Almaden Minerals’ SEDAR profile. The

independent qualified persons responsible for preparing the FS are

Jesse Aarsen, P.Eng. and Tracey Meintjes, P.Eng. of Moose Mountain

Technical Services (“MMTS”), Edward Wellman PE, PG, CEG and Clara

Balasko, P.E. of SRK, Kris Raffle, P.Geo. of APEX Geoscience Ltd.,

and Gary Giroux, M.A.Sc., P.Eng. of Giroux Consultants Ltd.

Technical and Third-Party

Information

Except where otherwise stated, the disclosure in

this press release relating to El Cobre, Ixtaca, and Elk properties

is based on information publicly disclosed by the owners or

operators of these properties and information/data available in the

public domain as at the date hereof and none of this information

has been independently verified by Almadex. Specifically, as a

royalty holder, Almadex has limited, if any, access to the

properties subject to the royalties. Although Almadex does not have

any knowledge that such information may not be accurate, there can

be no assurance that such third-party information is complete or

accurate. Some information publicly reported by the operator may

relate to a larger property than the area covered by Almadex’s

royalty interests. Almadex’s royalty interests may cover less than

100% and sometimes only a portion of the publicly reported mineral

reserves, mineral resources and production of a property. Unless

otherwise indicated, the technical and scientific disclosure

contained or referenced in this press release, including any

references to mineral resources or mineral reserves, was prepared

in accordance with Canadian National Instrument 43-101 (“NI

43-101”), which differs significantly from the requirements of the

U.S. Securities and Exchange Commission (the “SEC”) applicable to

U.S. domestic issuers. Accordingly, the scientific and technical

information contained or referenced in this press release may not

be comparable to similar information made public by U.S. companies

subject to the reporting and disclosure requirements of the SEC.

“Inferred mineral resources” have a great amount of uncertainty as

to their existence and great uncertainty as to their economic and

legal feasibility. It cannot be assumed that all or any part of an

inferred mineral resource will ever be upgraded to a higher

category. Historical results or feasibility models presented herein

are not guarantees or expectations of future performance.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

This news release includes forward-looking

statements that are subject to risks and uncertainties. All

statements within it, other than statements of historical fact, are

to be considered forward looking. Although the Company believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in forward-looking statements. Factors that

could cause actual results to differ materially from those in

forward-looking statements include market prices, exploitation and

exploration successes, permitting, continued availability of

capital and financing, and general economic, market or business

conditions. There can be no assurances that such statements will

prove accurate and, therefore, readers are advised to rely on their

own evaluation of such uncertainties. The Company does not assume

any obligation to update any forward-looking statements, other than

as required pursuant to applicable securities laws.

Contact Information:Almadex Minerals Ltd.Tel.

604.689.7644Email:

info@almadexminerals.comhttp://www.almadexminerals.com/

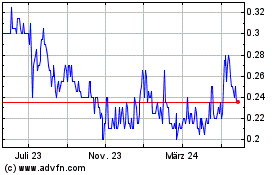

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

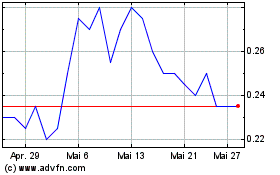

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025