Almadex Announces Proposed Private Placement

02 Oktober 2020 - 1:30PM

Almadex Minerals

Ltd.

(“Almadex” or the

“Company”; TSX-V:

DEX) is pleased to announce a

proposed non-brokered private placement financing (the "Offering")

of up to 5,400,000 units (the “Units”) to raise approximately

$1,350,000 at a price of $0.25 per Unit.

Each Unit will consist of one common share of

the Company and one whole non-transferable common share purchase

warrant, each whole share purchase warrant (a "Warrant") entitling

the holder thereof to purchase one common share of the Company at a

price of $0.40 per share for a period of two (2) years following

the closing of the Offering.

Duane Poliquin, Chairman of Almadex, stated “We

have $1,000,000 in lead orders from long term shareholders for this

Offering, and are pleased to raise additional funding to provide

more flexibility as we pursue property research and acquisition in

Canada, the U.S., and Mexico.”

Almadex intends to use the net proceeds of the

Offering for general corporate purposes. Certain insiders of the

Company may participate in the Offering. The issuance of Units to

insiders of the Company pursuant to the Offering will be considered

related party transactions within the meaning of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions (MI 61-101). The Company intends to rely on

exemptions from the formal valuation and minority approval

requirements of sections 5.5(a) and 5.7(1)(a) of MI 61-101 in

respect of such insider participation, based on a determination

that the fair market value of the participation in the Offering by

insiders will not exceed 25% of the market capitalization of the

Company, as determined in accordance with MI 61-101.

The Company may pay finders’ fees in connection

with the Offering in cash, shares, warrants or combination thereof.

The Offering and payment of finders’ fees are subject to regulatory

approval. All securities issued pursuant to this Offering will be

subject to a four month plus one day hold period in Canada.

About Almadex

Almadex Minerals Ltd. is an exploration company

that holds a large mineral portfolio consisting of projects and NSR

royalties in Canada, the U.S., and Mexico. This portfolio is the

direct result of over 35 years of prospecting and deal-making by

Almadex's management team. The Company owns a number of portable

diamond drill rigs, enabling it to conduct cost effective first

pass exploration drilling in house.

On behalf of the Board of Directors,

“J. Duane Poliquin”J. Duane

PoliquinChairmanAlmadex Minerals Ltd.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Contact Information:

Almadex Minerals Ltd.Tel. 604.689.7644Email:

info@almadexminerals.comhttp://www.almadexminerals.com/

THIS NEWS RELEASE,

PROVIDED PURSUANT TO APPLICABLE CANADIAN REQUIREMENTS, IS NOT FOR

DISTRIBUTION TO UNITED STATES NEWS SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES, AND DOES NOT CONSTITUTE AN

OFFER OF THE SECURITIES DESCRIBED HEREIN. THE

OFFERING IN QUESTION HAS NOT

BEEN REGISTERED UNDER THE UNITED STATES

SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS,

AND THE SECURITIES SOLD IN SUCH OFFERING MAY NOT BE OFFERED OR SOLD

IN THE UNITED STATES OR TO U.S. PERSONS ABSENT REGISTRATION OR

APPLICABLE EXEMPTION FROM REGISTRATION REQUIREMENTS.

Forward-Looking InformationThis release includes

certain statements that may be deemed "forward-looking statements".

All statements in this release, other than statements of historical

facts, that address exploration drilling and other activities and

events or developments that Almadex Minerals Ltd. ("Almadex")

expects to occur, are forward-looking statements. Forward-looking

statements in this news release include statements regarding the

Offering and future exploration, property research and acquisition

plans and expenditures. Although Almadex believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those forward-looking statements. Factors that

could cause actual results to differ materially from those in

forward looking statements include market prices, exploration

successes, and continued availability of capital and financing and

general economic, market or business conditions. These statements

are based on a number of assumptions including, among other things,

assumptions regarding general business and economic conditions, the

timing and receipt of regulatory and governmental approvals for the

transactions described herein, the ability of Almadex and other

parties to satisfy stock exchange and other regulatory requirements

in a timely manner, the availability of financing for Almadex’s

proposed transactions and programs on reasonable terms, and the

ability of third party service providers to deliver services in a

timely manner. Investors are cautioned that any such statements are

not guarantees of future performance and actual results or

developments may differ materially from those projected in the

forward-looking statements. Almadex does not assume any obligation

to update or revise its forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

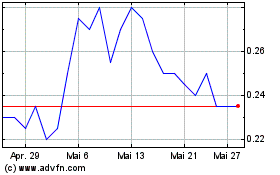

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

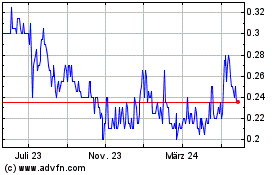

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025