Almadex Minerals Ltd. ("Almadex" or the "Company")

(TSX-V: DEX) is pleased to provide an update on some of its

exploration activities.

Acquisition of New Project in

Nevada

In 2019 the Company acquired an option to

purchase 100% (subject to royalty provisions) of 34 claims covering

the Davis project area of alteration and gold-silver veining north

of the Company’s existing Paradise claim block in Nye County

Nevada. Almadex subsequently acquired through staking an additional

79 claims which are subject to the Davis Agreement due to their

proximity to the claims covered by such agreement.

Collectively these 113 claims totalling almost

900 hectares with multiple targets will be referred to as the Davis

property, which is situated immediately north of the Company’s

existing Paradise Valley property. The property is located

approximately eight miles southeast of Gabbs, Nevada and five miles

northeast of the Paradise Peak gold mine, which was active from

1984 to 1994. Geologically-speaking, it is located in the Walker

Lane, a structural zone of mainly northwest-trending, strike-slip

faults along the western edge of the Great Basin that hosts

significant, historic and currently producing, epithermal precious

metal deposits including the Comstock Lode at Virginia City, the

Round Mountain gold deposit, Paradise Peak, Tonopah and

Goldfield.

The Davis property covers an area of

hydrothermal alteration hosting gold-silver zones and veins on

which there has been historic mining and exploration

drilling. The property has been explored historically with

various targets drilled by several operators. The property was held

by USSRAM Exploration and from 1979 to around 2004 during which

time various exploration and drilling programs were carried out on

the property. One of the targets tested during this time was the

Davis Mine area with a total of eleven drill holes to investigate

mineralisation in the vicinity of the shaft of the historic Davis

mine. More recently another operator drilled additional holes in

the same general area of the previous drilling. While this historic

Davis Mine area drilling cannot be verified by the Company, was not

completed in accordance with N.I. 43-101 and therefore should not

be relied upon, it provides clear exploration focus. One of the

significant intercepts from this historic drilling program is

reported to have returned 40 feet (12.2 metres) of 0.18 oz/t gold

(6.2 g/t gold) and 0.62 oz/t silver (21 g/t silver). The strike and

dip of the Davis vein was interpreted by the historic operators but

cannot be verified by the Company at this time so true widths

cannot be estimated or confirmed by the Company.

The terms of the Davis property acquisition are

as follows:

- Nov. 22, 2019: US$100,000 (paid);

- Nov. 15, 2020: US$50,000;

- Nov. 15, 2021: US$50,000;

- Nov. 15, 2022: US$50,000;

- Nov. 15, 2023: US$100,000;

- Nov. 15, 2024: The greater of US$200,000, or the value of 140

ounces of gold.

Upon payment of the above amounts, which may be

accelerated, Almadex will have the option to purchase the claims

for an amount equal to the greater of US$250,000 or 180 ounces of

gold, subject to a 2.0% NSR production royalty which can be reduced

to 1.0% with the payment of the greater of US$2 million or 1,400

troy ounces of gold. If reduced to a 1.0% NSR royalty, the

remaining 1.0% NSR royalty shall be capped at an amount equal to

the greater of US$6 million and 4,000 troy ounces of gold.

The previous operators have identified numerous

areas for target follow-up from the historic work programs and

describe high level epithermal alteration zones. Almadex plans to

review the existing project information and to undertake a program

of surface mapping, sampling and geophysics in order to confirm the

alteration described and increase our confidence in targets for a

future drilling program.

Spences Bridge Properties Optioned in

2019

Merit: In February 2019,

Almadex announced an option agreement with Independence Gold Corp.

(“Independence”), whereby Independence would hold the right to

acquire a 60% interest in the Merit property.

On November 4th, 2019 Independence announced the

discovery of seven distinct gold-silver targets at the property.

Independence intended to drill test several target zones at Merit

in 2020, but these plans were ultimately placed on hold due to

restrictions surrounding Covid-19.

Independence may earn a 60% interest in the

Merit property by making a cash payment of $10,000 (paid), the

issuance of an aggregate of 650,000 common shares (200,000 issued)

and completing work commitments of $725,000 including a commitment

to drill 1,000 m over a three year period. Upon completion of the

60% earn-in, Independence and the Company will form a joint venture

for the purpose of carrying out further exploration work on the

Merit property. If either party’s participation interest falls

below 15%, their interest will be converted into a 2% NSR

royalty.

Nicoamen: Almadex optioned the

Nicoamen property to Independence at the same time as the Merit

property (above). The option terms are identical to those for the

Merit property.

On November 14th, Independence announced the

results from their summer program on the Nicoamen property. Results

included the discovery of four distinct gold targets that host gold

mineralization in chalcedonic quartz veins. Independence had

intended to drill test several target zones at Nicoamen in 2020,

but these plans were ultimately placed on hold due to restrictions

surrounding Covid-19.

Royalties

Almadex currently holds over 15 NSR royalties on

mineral properties at various stages in Mexico, the U.S., and

Canada. The most advanced of these royalties includes a 2.0% NSR on

the feasibility-stage Ixtaca project (Almaden Minerals), a 2.0% NSR

on the high grade Elk gold project (Bayshore Minerals) located near

Merit, B.C., and a 1.75% NSR on the El Cobre project (Azucar

Minerals). Almadex also holds 2% NSR royalties on two of Westhaven

Ventures’ projects in the Spences Bridge district (Prospect Valley

and Skoonka Creek).

Almadex has generated these royalties

organically through its exploration efforts over the past three

decades, and will continue to seek opportunities to add to its

mineral property asset base.

J. Duane Poliquin, Chairman of Almadex, stated,

“Almadex is very well positioned for the improving market

fundamentals for gold, silver and copper projects. In addition to

the assets mentioned above we still have some promising properties

in Mexico. We look forward to updating shareholders on developments

over the coming months.”

Morgan J. Poliquin, P. Eng., the President and

CEO of Almadex and a Qualified Person under the meaning of National

Instrument 43-101 reviewed and approved the technical information

in this news release.

About Almadex

Almadex is an exploration company specializing

in the discovery of new mineral prospects. The Company currently

has an asset portfolio comprised of wholly-owned exploration

properties, optioned exploration property interests, numerous NSR

royalties, equities and cash. This portfolio of assets is the

direct result of over 35 years of prospecting, discovery and deal

making by Almadex's management team. Almadex seeks to

continue the legacy of discovery by its respected technical team

through responsible and cost-effective idea generation and

exploration using its seasoned staff of Mexican geologists and

drillers, company-owned drills, and strong working capital

position.

On behalf of the Board of Directors,

“Morgan Poliquin”

Morgan J. Poliquin, Ph.D., P.Eng.President, CEO and

DirectorAlmadex Minerals Ltd.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell any securities in the

United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

Contact Information:

Almadex Minerals Ltd. Tel. 604.689.7644 Email:

info@almadexminerals.comhttp://www.almadexminerals.com/

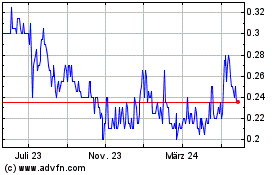

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

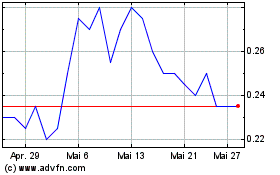

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025