BRAMPTON, ON, July 25, 2012 /CNW/ - Loblaw Companies Limited

("Loblaw" or the "Company") today announced its unaudited financial

results for the second quarter ended June 16, 2012. The Company's

second quarter report will be available in the Investor Centre

section of the Company's website at loblaw.ca and will be filed

with SEDAR and available at sedar.com. 2012 Second Quarter

Summary((1)) -- Basic net earnings per common share of $0.57, down

18.6% compared to the second quarter of 2011. -- EBITDA margin(2)

of 6.4% compared to 6.9% in the second quarter of 2011. -- Revenue

of $7,375 million, an increase of 1.3% over the second quarter of

2011. -- Retail sales and same-store sales growth of 1.1% and 0.2%,

respectively, compared to the second quarter of 2011. "In the

second quarter we continued to execute our plan," said Galen G.

Weston, Executive Chairman, Loblaw Companies Limited. "We are

beginning to gain traction on the top-line, particularly in our

core food and drug businesses, as we continued our disciplined

approach to improving our customer proposition. We remain confident

that our ongoing investments in infrastructure, including the

completion of our IT implementation, will enable efficiencies and

expense leverage to drive future earnings growth. Our outlook for

2012 is unchanged - we continue to expect full-year net earnings to

be down year-over-year." Consolidated Quarterly Results of

Operations For the periods ended June 16, 2012 and June 18, 2011

(unaudited) (millions of Canadian dollars except where 2011

otherwise 2012 2011 2012 (24 indicated) (12 weeks) (12 weeks) $

Change % Change (24 weeks) weeks) $ Change % Change Revenue $ 7,375

$ $ 1.3% $ 14,312 $ $ 1.1% 7,278 97 14,150 162 Operating 290 345

(55) (15.9%) 529 648 (119) (18.4%) income Net 159 197 (38) (19.3%)

285 359 (74) (20.6%) earnings Basic net 0.57 0.70 (0.13) (18.6%)

1.01 1.28 (0.27) (21.1%) earnings per common share ($) Operating

3.9% 4.7% 3.7% 4.6% margin EBITDA(2) $ 469 $ $ (6.9%) $ $ $ (8.4%)

504 (35) 878 959 (81) EBITDA 6.4% 6.9% 6.1% 6.8% margin(2) (1) This

News Release contains forward-looking information. See

Forward-Looking Statements in this News Release for a discussion of

material factors that could cause actual results to differ

materially from the conclusions, forecasts and projections herein

and of the material factors and assumptions that were used when

making these statements. This News Release should be read in

conjunction with Loblaw Companies Limited's filings with securities

regulators made from time to time, all of which can be found at

sedar.com and at loblaw.ca. (2) See Non-GAAP Financial Measures in

this News Release. -- The $97 million increase in revenue compared

to the second quarter of 2011 was driven by increases in both the

Company's Retail and Financial Services operating segments, as

described below. -- As previously disclosed, for full-year 2012,

the Company expects that $40 million of incremental investment in

its customer proposition will not be covered by operations. Of this

amount, $15 million was incurred in the second quarter of 2012, $10

million of which was in gross profit and $5 million in labour.

Year-to-date, the amount is an estimated $25 million. -- Operating

income decreased by $55 million compared to the second quarter of

2011 as a result of a decrease in Retail operating income of $58

million and an increase in Financial Services operating income of

$3 million. Operating margin was 3.9% for the second quarter of

2012 compared to 4.7% in the same quarter in 2011. The $58 million

decrease in Retail operating income was mainly driven by an

increase in labour and other operating costs, declines in gross

profit and foreign exchange gains and the notable items as

described below, partially offset by changes in the value of the

Company's investments in its franchise business. -- Consolidated

operating income included the following notable items: o

Incremental costs of $20 million related to investments in

information technology ("IT") and supply chain, including the

following charges: # $66 million (2011 - $60 million) related to IT

costs; # $52 million (2011 - $38 million) related to depreciation

and amortization; # $6 million (2011 - $2 million) related to

changes in the distribution network; and # $2 million (2011 - $6

million) related to other supply chain projects costs; o A $10

million charge (2011 - nil) related to the transition of certain

Ontario conventional stores to the more cost effective and

efficient operating terms under collective agreements ratified in

the third quarter of 2010; o A $5 million charge (2011 -$15

million) related to the effect of share-based compensation net of

equity forwards; and o A nil charge (2011 - $15 million) related to

certain prior years' commodity tax matters. -- The decrease in net

earnings of $38 million compared to the second quarter of 2011 was

primarily due to the decrease in operating income partially offset

by a decline in the Company's effective income tax rate. -- Basic

net earnings per common share were impacted by the following

notable items: o A $0.05 charge related to incremental investments

in IT and supply chain; o A $0.02 charge (2011 - nil) related to

the transition of certain Ontario conventional stores to the

operating terms under collective agreements ratified in 2010; o A

$0.02 charge (2011 - $0.04) related to the effect of share-based

compensation net of equity forwards; and o A nil charge (2011 -

$0.04) related to certain prior years' commodity tax matters. -- In

the second quarter of 2012, the Company invested $233 million in

capital expenditures. The consolidated quarterly results by

reportable operating segments were as follows: Retail Results of

Operations For the periods ended June 16, 2012 and June 18, 2011

(unaudited) (millions of Canadian dollars except where 2011

otherwise 2012 2011 $ 2012 (24 indicated) (12 weeks) (12 weeks)

Change % Change (24 weeks) weeks) $ Change % Change Sales $ 7,236 $

$ 1.1% $ $ $ 0.9% 7,157 79 14,044 13,914 130 Gross 1,611 1,626 (15)

(0.9%) 3,140 3,180 (40) (1.3%) profit Operating 275 333 (58)

(17.4%) 500 618 (118) (19.1%) income Same-store 0.2% (0.4%) (0.3%)

(0.3%) sales growth (decline) Gross 22.3% 22.7% 22.4% 22.9% profit

percentage Operating 3.8% 4.7% 3.6% 4.4% margin -- In the second

quarter of 2012, the increase of $79 million, or 1.1%, in Retail

sales over the same period in the prior year was impacted by the

following factors: o Same-store sales growth was 0.2% (2011 - 0.4%

decline); o Sales growth in food was moderate; o Sales growth in

drugstore was modest; o Gas bar sales declined marginally; o Sales

in general merchandise, excluding apparel, declined moderately; o

Sales in apparel were flat; o The Company experienced modest

average quarterly internal food price inflation during the second

quarter of 2012 and moderate average quarterly food price inflation

during the second quarter of 2011, lower than the average quarterly

national food price inflation of 2.5% (2011 - 4.0%) as measured by

"The Consumer Price Index for Food Purchased from Stores" ("CPI").

CPI does not necessarily reflect the effect of inflation on the

specific mix of goods sold in Loblaw stores; and o 22 corporate and

franchise stores were opened and seven corporate and franchise

stores were closed in the last twelve months, resulting in a net

increase of 0.4 million square feet, or 0.8%. -- In the second

quarter of 2012, gross profit decreased by $15 million compared to

the second quarter of 2011 and gross profit percentage was 22.3%, a

decline from 22.7% in the second quarter of 2011. These declines

were primarily driven by higher input costs outpacing internal food

price inflation and increased transportation costs. Higher input

costs that were not entirely passed on to the consumer included an

estimated $10 million of the incremental investment in the

Company's customer proposition that was not covered by operations.

The decline in gross profit percentage was also attributable to a

higher proportion of food sales. -- Operating income decreased by

$58 million compared to the second quarter of 2011 and operating

margin was 3.8% for the second quarter of 2012 compared to 4.7% in

the same period in 2011. In addition to the notable items described

in the Consolidated Quarterly Results of Operations above,

operating income and operating margin were negatively impacted by

an increase in labour and other operating costs and decreases in

gross profit and foreign exchange gains, partially offset by

changes in the value of the Company's investments in its franchise

business. The increase in labour costs included an estimated $5

million of the incremental investment in the Company's customer

proposition related to improved service in stores that was not

covered by operations. Financial Services Results of Operations For

the periods ended June 16, 2012 and June 18, 2011 (unaudited)

(millions of Canadian dollars except where 2012 2011 2012 2011

otherwise (12 (12 $ % (24 (24 $ % indicated) weeks) weeks) Change

Change weeks) weeks) Change Change Revenue $ $ $ 14.9% $ $ $ 13.6%

139 121 18 268 236 32 Operating 15 12 3 25.0% 29 30 (1) (3.3%)

income Earnings 4 2 2 100.0% 8 7 1 14.3% before income taxes As at

As at (millions of June 16, June 18, $ Change % Change Canadian

2012 2011 dollars except where otherwise indicated) (unaudited)

Average $ 2,049 $ 1,953 $ 96 4.9% quarterly net credit card

receivables Credit card 2,058 1,974 84 4.3% receivables Allowance

36 33 3 9.1% for credit card receivables Annualized 12.7% 12.6%

yield on average quarterly gross credit card receivables Annualized

4.4% 4.8% credit loss rate on average quarterly gross credit card

receivables -- Revenue for the second quarter of 2012 increased by

14.9% compared to the second quarter of 2011. The increase was

primarily driven by increased credit card transaction values and

receivable balances, resulting in higher interchange fee and

interest income. Higher PC Telecom revenues resulting from the 2011

launch of the new Mobile Shop kiosks also contributed to the

increase. -- Operating income for the second quarter of 2012

increased by $3 million compared to the second quarter of 2011. The

increase was as a result of the increase in revenue as described

above, partially offset by higher PC Points loyalty costs and

operational costs related to an increase in active accounts. --

Earnings before income taxes increased by $2 million in the second

quarter of 2012 compared to the second quarter of 2011. The

increase was primarily a result of the increase in operating

income, partially offset by an increase in net interest and other

financing charges. Outlook((1)) -- For fiscal 2012, the Company

continues to expect: o Capital expenditures to be approximately

$1.1 billion, with approximately 40% to be dedicated to investing

in the IT infrastructure and supply chain projects and the

remaining 60% to be spent on retail operations; o Costs associated

with the transition of certain Ontario conventional stores under

collective agreements ratified in 2010 to range from $30 million to

$40 million; o Incremental costs related to investments in IT and

supply chain to be approximately $70 million; o $40 million of

incremental investment in its customer proposition will not be

covered by operations; and o Net earnings per share to be down

year-over-year, with more pressure in the first half of the year,

as a result of the Company's expectation that operations will not

cover the incremental costs related to the investments in IT and

supply chain and its customer proposition. (1) See Forward-Looking

Statements in this News Release. Forward-Looking Statements This

News Release for Loblaw Companies Limited contains forward-looking

statements about the Company's objectives, plans, goals,

aspirations, strategies, financial condition, results of

operations, cash flows, performance, prospects and opportunities.

These forward-looking statements are typically identified by words

such as "anticipate", "expect", "believe", "foresee", "could",

"estimate", "goal", "intend", "plan", "seek", "strive", "will",

"may" and "should" and similar expressions, as they relate to the

Company and its management. In this News Release, forward-looking

statements include the Company's continued expectation that for

fiscal 2012: -- its capital expenditures will be approximately $1.1

billion; -- costs associated with the transition of certain Ontario

conventional stores under collective agreements ratified in 2010

will range from $30 million to $40 million; -- incremental costs

related to investments in information technology ("IT") and supply

chain will be approximately $70 million; -- $40 million of

incremental costs associated with strengthening its customer

proposition will not be covered by operations; and -- net earnings

per share to be down year-over-year, with more pressure in the

first half of the year, as a result of the Company's expectation

that operations will not cover the incremental costs related to the

investments in IT and supply chain and its customer proposition.

These forward-looking statements are not historical facts but

reflect the Company's current expectations concerning future

results and events. They also reflect management's current

assumptions regarding the risks and uncertainties referred to below

and their respective impact on the Company. In addition, the

Company's expectation with regard to its net earnings in 2012 is

based in part on the assumptions that tax rates will be similar to

those in 2011, the Company achieves its plan to increase net retail

square footage by 1% and there are no unexpected adverse events or

costs related to the Company's investments in IT and supply chain.

The forward-looking statements contained in this News Release are

subject to a number of risks and uncertainties that could cause

actual results or events to differ materially from current

expectations, including, but not limited to: -- failure to realize

revenue growth, anticipated cost savings or operating efficiencies

from the Company's major initiatives, including investments in the

Company's IT systems, including the Company's IT systems

implementation, or unanticipated results from these initiatives; --

the inability of the Company's IT infrastructure to support the

requirements of the Company's business; -- heightened competition,

whether from current competitors or new entrants to the

marketplace; -- changes in economic conditions including the rate

of inflation or deflation, changes in interest and currency

exchange rates and derivative and commodity prices; -- public

health events including those related to food safety; -- failure to

achieve desired results in labour negotiations, including the terms

of future collective bargaining agreements, which could lead to

work stoppages; -- the inability of the Company to manage inventory

to minimize the impact of obsolete or excess inventory and to

control shrink; -- failure by the Company to maintain appropriate

records to support its compliance with accounting, tax or legal

rules, regulations and policies; -- failure of the Company's

franchise stores to perform as expected; -- reliance on the

performance and retention of third-party service providers

including those associated with the Company's supply chain and

apparel business; -- supply and quality control issues with

vendors; -- changes to or failure to comply with laws and

regulations affecting the Company and its business, including

changes to the regulation of generic prescription drug prices and

the reduction of reimbursement under public drug benefit plans and

the elimination or reduction of professional allowances paid by

drug manufacturers; -- changes in the Company's income, commodity,

other tax and regulatory liabilities including changes in tax laws,

regulations or future assessments; -- any requirement of the

Company to make contributions to its registered funded defined

benefit pension plans or the multi-employer pension plans in which

it participates in excess of those currently contemplated; -- the

risk that the Company would experience a financial loss if its

counterparties fail to meet their obligations in accordance with

the terms and conditions of their contracts with the Company; and

-- the inability of the Company to collect on its credit card

receivables. This is not an exhaustive list of the factors that may

affect the Company's forward-looking statements. Other risks and

uncertainties not presently known to the Company or that the

Company presently believes are not material could also cause actual

results or events to differ materially from those expressed in its

forward-looking statements. Additional risks and uncertainties are

discussed in the Company's materials filed with the Canadian

securities regulatory authorities from time to time, including the

Enterprise Risks and Risk Management section of the Management's

Discussion and Analysis ("MD&A") and the MD&A included in

the Company's 2011 Annual Report - Financial Review. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which reflect the Company's expectations only as of the

date of this News Release. The Company disclaims any intention or

obligation to update or revise these forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law. Non-GAAP Financial Measures The Company

uses the following non-GAAP financial measures: EBITDA and EBITDA

margin. The Company believes these non-GAAP financial measures

provide useful information to both management and investors in

measuring the financial performance of the Company for the reasons

outlined below. These measures do not have a standardized meaning

prescribed by GAAP and therefore they may not be comparable to

similarly titled measures presented by other publicly traded

companies, and should not be construed as an alternative to other

financial measures determined in accordance with GAAP. EBITDA and

EBITDA Margin The following table reconciles earnings before income

taxes, net interest expense and other financing charges and

depreciation and amortization ("EBITDA") to operating income which

is reconciled to GAAP net earnings measures reported in the

consolidated statements of earnings for the 12 and 24 week periods

ended June 16, 2012 and June 18, 2011. EBITDA is useful to

management in assessing performance of its ongoing operations and

its ability to generate cash flows to fund its cash requirements,

including the Company's capital investment program. EBITDA margin

is calculated as EBITDA divided by revenue. 2012 2011 2012 2011

(millions of (12 (12 weeks) (24 weeks) (24 weeks) Canadian weeks)

dollars) (unaudited) Net earnings $ $ 197 $ 285 $ 359 159 Add

impact of the following: Income taxes 54 70 93 138 Net interest 77

78 151 151 expense and other financing charges Operating 290 345

529 648 income Add impact of the following: Depreciation 179 159

349 311 and amortization EBITDA $ $ 504 $ 878 $ 959 469 Selected

Financial Information The following includes selected quarterly

financial information, which is prepared by management in

accordance with International Financial Reporting Standards

("IFRS") and is based on the Company's 2012 Second Quarter Report

to Shareholders. This financial information does not contain all

interim period disclosures required by IFRS, and accordingly,

should be read in conjunction with the Company's 2011 Annual Report

- Financial Review and 2012 Second Quarter Report to Shareholders

which are available in the Investor Centre section of the Company's

website at www.loblaw.ca. Condensed Consolidated Statements of

Earnings June 16, June 18, June 16, June 18, 2011 2012 2011 2012

(millions of (12 weeks) (12 weeks) (24 weeks) (24 weeks) Canadian

dollars except where otherwise indicated) (unaudited) Revenue $

7,375 $ 7,278 $ 14,312 $ 14,150 Cost of 5,632 5,533 10,916 10,736

Merchandise Inventories Sold Selling, 1,453 1,400 2,867 2,766

General and Administrative Expenses Operating 290 345 529 648

Income Net interest 77 78 151 151 expense and other financing

charges Earnings 213 267 378 497 Before Income Taxes Income taxes

54 70 93 138 Net Earnings $ 159 $ 197 $ 285 $ 359 Net Earnings per

Common Share ($) Basic $ 0.57 $ 0.70 $ 1.01 $ 1.28 Diluted $ 0.56 $

0.69 $ 1.01 $ 1.27 Condensed Consolidated Balance Sheets As at As

at As at (millions of June 16, 2012 June 18, 2011 December 31, 2011

Canadian dollars) (unaudited) Assets Current Assets Cash and cash $

923 $ 774 $ 966 equivalents Short term 718 699 754 investments

Accounts 459 408 467 receivable Credit card 2,058 1,974 2,101

receivables Inventories 1,890 1,962 2,025 Income taxes 5 12 -

recoverable Prepaid expenses 147 136 117 and other assets Assets

held for 23 66 32 sale Total Current 6,223 6,031 6,462 Assets Fixed

Assets 8,765 8,413 8,725 Investment 95 73 82 Properties Goodwill

& 1,063 1,026 1,029 Intangible Assets Deferred Income 263 193

232 Taxes Security Deposits 244 183 266 Franchise Loans 358 313 331

Receivable Other Assets 258 347 301 Total Assets $ 17,269 $ 16,579

$ 17,428 Liabilities Current Liabilities Trade payables 3,356 3,273

3,677 and other liabilities Provisions 40 75 35 Income taxes - - 14

payable Short term debt 905 905 905 Long term debt 226 81 87 due

within one year Total Current 4,527 4,334 4,718 Liabilities

Provisions 47 50 50 Long Term Debt 5,369 5,364 5,493 Deferred

Income 18 26 21 Taxes Capital Securities 222 221 222 Other

Liabilities 971 701 917 Total Liabilities 11,154 10,696 11,421

Shareholders' Equity Common Share 1,544 1,539 1,540 Capital

Retained Earnings 4,513 4,300 4,414 Contributed Surplus 53 39 48

Accumulated Other 5 5 5 Comprehensive Income Total Shareholders'

6,115 5,883 6,007 Equity Total Liabilities $ 17,269 $ 16,579 $

17,428 and Shareholders' Equity Condensed Consolidated Statements

of Cash Flow (millions of June June June 18, Canadian June 16, 18,

2011 16, 2012 2011 dollars) 2012 (12 (24 (24 (unaudited) (12 weeks)

weeks) weeks) weeks) Operating Activities Net earnings $ $ 197 $

285 $ 359 159 Income taxes 54 70 93 138 Net interest 77 78 151 151

expense and other financing charges Depreciation 179 159 349 311

and amortization Income taxes (53) (55) (122) (96) paid Interest 20

26 27 36 received Change in (71) (87) 43 23 credit card receivables

Change in 241 89 (292) (413) non-cash working capital Fixed assets

- 5 3 9 and other related impairments Loss on (2) 1 (2) 1 disposal

of assets Other (5) (2) 7 (19) Cash Flows from 599 481 542 500

Operating Activities Investing Activities Fixed asset (233) (161)

(367) (316) purchases Change in 79 (23) 36 41 short term

investments Proceeds from 15 1 16 6 fixed asset sales Change in 20

28 3 28 franchise investments and other receivables Change in 8 -

22 167 security deposits Intangible (41) (4) (41) (5) asset

additions Other - 7 - - Cash Flows used (152) (152) (331) (79) in

Investing Activities Financing Activities Change in bank - - - (10)

indebtedness Change in - - - 370 short term debt Long term debt

Issued 14 159 37 216 Retired (44) (7) (73) (865) Interest paid (96)

(131) (159) (213) Dividends paid (59) (16) (59) (16) Common shares

Issued 2 16 4 19 Purchased (2) (3) (4) (3) for cancellation Cash

Flows from (185) 18 (254) (502) (used in) Financing Activities

Effect of 4 - - (2) foreign currency exchange rate changes on cash

and cash equivalents Change in Cash 266 347 (43) (83) and Cash

Equivalents Cash and Cash 657 427 966 857 Equivalents, Beginning of

Period Cash and Cash $ $ 774 $ 923 $ 774 Equivalents, End 923 of

Period 2011 Annual Report and 2012 Second Quarter Report to

Shareholders The Company's 2011 Annual Report and 2012 Second

Quarter Report to Shareholders are available in the Investor Centre

section of the Company's website at www.loblaw.ca or at

www.sedar.com. Investor Relations Shareholders, security analysts

and investment professionals should direct their requests to Kim

Lee, Vice President, Investor Relations at the Company's National

Head Office or by e-mail at investor@loblaw.ca. Additional

information has been filed electronically with various securities

regulators in Canada through the System for Electronic Document

Analysis and Retrieval (SEDAR) and with the Office of the

Superintendent of Financial Institutions (OSFI) as the primary

regulator for the Company's subsidiary, President's Choice Bank.

Conference Call and Webcast Loblaw Companies Limited will host a

conference call as well as an audio webcast on July 25, 2012 at

11:00 a.m. (EST). To access via tele-conference please dial (647)

427-7450. The playback will be made available two hours after the

event at (416) 849-0833, access code: 87338061. To access via audio

webcast please visit www.loblaw.ca, go to Investor Centre section

and click on webcast. Pre-registration will be available. Full

details are available on the Loblaw Companies Limited website at

www.loblaw.ca. Loblaw Companies Limited CONTACT: Kim Lee, Vice

President, Investor Relations at the Company'sNationalHead Office

or by e-mail at investor@loblaw.ca.

Copyright

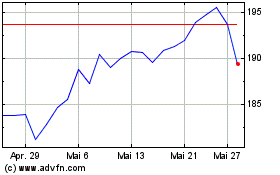

George Weston (TSX:WN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

George Weston (TSX:WN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024