Wallbridge Mining Company Limited (TSX:WM,

OTCQB:WLBMF) (“

Wallbridge” or the

“

Company”) is pleased to announce that it has

completed a non-brokered private placement of 22,937,500 national

flow-through common shares (the “

National FT

Shares”) and 48,844,333 Québec flow-through common shares

(the “

Québec FT Shares”) for aggregate gross

proceeds of $6,230,990 (the “

FT Share Private

Placement”). The National FT Shares were issued at a price

of $0.08 and the Québec FT Shares were issued at a price of $0.09.

In addition, Agnico Eagle Mines Limited

(“Agnico”) subscribed for 8,598,843 common shares

for aggregate gross proceeds of $601,919 (the “AEM Private

Placement”, and together with the FT Share Private

Placement, the “Private Placements”). The AEM

Private Placement closed concurrently with the FT Share Private

Placement and was undertaken pursuant to certain participation

rights set out in a pre-existing participation agreement between

the Company and a predecessor of Agnico. The AEM Shares will be

issued at a price of $0.07.

With the net proceeds from these Private

Placements the Company expects to have an estimated year end cash

balance of approximately $20 million which, based on preliminary

budgeting, is sufficient to fund the 2025 exploration program on

the Company’s Detour-Fenelon Gold Property (the

“Detour-Fenelon Gold Trend Property”) as currently

contemplated. The Company will announce details of its exploration

plans once board approval has been obtained.

In connection with the FT Share Private

Placement, the Company paid a cash finder’s fee other than in

respect of subscriptions by president’s list investors. Topleft

Securities Ltd. acted as an advisor to Wallbridge in connection

with the transaction. All securities issued pursuant to the Private

Placements will have a four month and one day statutory hold

period.

Each National FT Share and Québec FT Share (the

“FT Shares”) will qualify as a “flow-through

share” within the meaning of subsection 66(15) of the Income Tax

Act (Canada) and, in respect of eligible Québec resident

subscribers, section 359.1 of the Taxation Act (Québec). The FT

Shares will be renounced with an effective date no later than

December 31, 2024, to the initial purchasers of the FT Shares in an

aggregate amount not less than the gross proceeds raised.

None of the securities offered in the Private

Placements have been registered under the U.S. Securities Act of

1933, as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements. This press release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

The FT Share Private Placement constituted a

related party transaction within the meaning of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions (“MI 61-101”) as certain

insiders of the Company subscribed for 1,687,500 in aggregate of

National FT Shares and 400,000 in aggregate of Québec FT Shares.

The Company is relying on the exemptions from the valuation and

minority shareholder approval requirements of MI 61-101 contained

in sections 5.5(a) and 5.7(1)(a) of MI 61-101, as the fair market

value of the participation in the FT Share Private Placement by the

insiders does not exceed 25% of the market capitalization of the

Company in accordance with MI 61-101. The Company did not file a

material change report in respect of the related party transaction

at least 21 days before the closing of the FT Share Private

Placement, which the Company deems reasonable in the circumstances

in order to price and close the FT Share Private Placement in an

expeditious manner. A material change report has been filed under

the Company’s profile at www.sedarplus.ca, which may be sent to any

shareholder upon request.

Qualified Person

The Qualified Person responsible for the

technical content of this news release is Francois Chabot, Eng.,

Technical Studies Manager for Wallbridge.

About Wallbridge Mining

Wallbridge is focused on creating value through

the exploration and sustainable development of gold projects along

the Detour-Fenelon Gold Trend in Québec’s Northern Abitibi region

while respecting the environment and communities where it

operates.

Wallbridge’s most advanced projects, Fenelon

Gold (“Fenelon”) and Martiniere Gold (“Martiniere”) incorporate a

combined 3.05 million ounces of indicated gold resources and 2.35

million ounces of inferred gold resources. Fenelon and Martiniere

are located within an 830 square km exploration land package in the

Northern Abitibi region of Quebec.

Wallbridge has reported a positive Preliminary

Economic Assessment (“PEA”) at Fenelon that estimates average

annual gold production of 212,000 ounces over 12 years.

For further information please visit the

Company’s website at https://wallbridgemining.com/ or contact:

Wallbridge Mining Company

Limited

Brian Penny, CPA, CMACEOTel: (416)

716-8346Email: bpenny@wallbridgemining.comM: +1 416 716 8346

Tania Barreto, CPIRDirector, Investor

RelationsEmail: tbarreto@wallbridgemining.comM: +1 289 819 3012

Cautionary Note Regarding

Forward-Looking Information

The information in this document may contain

forward-looking statements or information (collectively,

“FLI”) within the meaning of applicable Canadian

securities legislation. FLI is based on expectations, estimates,

projections, and interpretations as at the date of this

document.

All statements, other than statements of

historical fact, included herein are FLI that involve various

risks, assumptions, estimates and uncertainties. Generally, FLI can

be identified by the use of statements that include, but are not

limited to, words such as “seeks”, “believes”, “anticipates”,

“plans”, “continues”, “budget”, “scheduled”, “estimates”,

“expects”, “forecasts”, “intends”, “projects”, “predicts”,

“proposes”, "potential", “targets” and variations of such words and

phrases, or by statements that certain actions, events or results

“may”, “will”, “could”, “would”, “should” or “might”, “be taken”,

“occur” or “be achieved.”

FLI in this document may include, but is not

limited to: statements regarding the use of proceeds of the Private

Placements; the Company’s exploration plans, the tax treatment of

the securities issued under the FT Share Private Placement under

the Income Tax Act (Canada); the timing to renounce all qualifying

expenditures in favour of the subscribers (if at all); the future

prospects of Wallbridge; statements regarding the results of the

PEA; future drill results; the Company’s ability to convert

inferred resources into measured and indicated resources;

environmental matters; stakeholder engagement and relationships;

parameters and methods used to estimate the MRE’s at the Fenelon

and Martiniere properties (collectively the

“Deposits”); the prospects, if

any, of the Deposits; future drilling at the Deposits; and the

significance of historic exploration activities and results.

FLI is designed to help you understand

management’s current views of its near- and longer-term prospects,

and it may not be appropriate for other purposes. FLI by

their nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance, or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such FLI. Although the FLI

contained in this document is based upon what management believes,

or believed at the time, to be reasonable assumptions, the Company

cannot assure shareholders and prospective purchasers of securities

of the Company that actual results will be consistent with such

FLI, as there may be other factors that cause results not to be as

anticipated, estimated or intended, and neither the Company nor any

other person assumes responsibility for the accuracy and

completeness of any such FLI. Except as required by law, the

Company does not undertake, and assumes no obligation, to update or

revise any such FLI contained in this document to reflect new

events or circumstances. Unless otherwise noted, this document has

been prepared based on information available as of the date of this

document. Accordingly, you should not place undue reliance on the

FLI, or information contained herein.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in FLI.

Assumptions upon which FLI is based, without

limitation, include: the results of exploration activities, the

Company’s financial position and general economic conditions; the

ability of exploration activities to accurately predict

mineralization; the accuracy of geological modelling; the ability

of the Company to complete further exploration activities; the

legitimacy of title and property interests in the Deposits; the

accuracy of key assumptions, parameters or methods used to estimate

the MREs and in the PEA; the ability of the Company to obtain

required approvals; geological, mining and exploration technical

problems; and failure of equipment or processes to operate as

anticipated; the evolution of the global economic climate; metal

prices; foreign exchange rates; environmental expectations;

community and non-governmental actions; and, the Company’s ability

to secure required funding. Risks and uncertainties about

Wallbridge's business are discussed in the disclosure materials

filed with the securities regulatory authorities in Canada, which

are available at www.sedarplus.ca.

Cautionary Notes to United States

Investors

Wallbridge prepares its disclosure in accordance

with NI 43-101 which differs from the requirements of the U.S.

Securities and Exchange Commission (the

"SEC"). Terms relating to mineral

properties, mineralization and estimates of mineral reserves and

mineral resources and economic studies used herein are defined in

accordance with NI 43-101 under the guidelines set out in CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the Canadian Institute of Mining, Metallurgy and

Petroleum Council on May 19, 2014, as amended. NI 43-101 differs

significantly from the disclosure requirements of the SEC generally

applicable to US companies. As such, the information presented

herein concerning mineral properties, mineralization and estimates

of mineral reserves and mineral resources may not be comparable to

similar information made public by U.S. companies subject to the

reporting and disclosure requirements under the U.S. federal

securities laws and the rules and regulations thereunder.

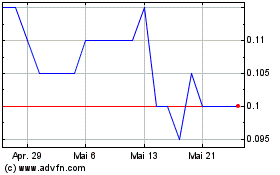

Wallbridge Mining (TSX:WM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Wallbridge Mining (TSX:WM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025