Mulvihill Capital Management Inc. Announces Ratios for Class A Share Consolidation and Preferred Share Exchange

17 Juni 2024 - 11:12PM

(TSX: WFS) Mulvihill Capital

Management Inc., the manager of World Financial Split Corp. (the

“

Fund”) announced that, in connection with the

Fund’s previously announced proposal (the

“

Proposal”) to reposition and recapitalize the

Fund, as a result of the special retraction right to be provided to

holders of Class A Shares and Preferred Shares who do not wish to

continue their investment in the Fund should the Proposal be

approved by shareholders, the Class A Shares will be consolidated

on a 1:4 basis, such that each holder of a Class A Share will

receive approximately 0.25 Class A Shares for each Class A Share

held (the “

Consolidation”) and the existing

Preferred Shares will be exchanged into approximately 0.68

Preferred Shares and 0.40 Class A Shares, such that a holder of 100

Preferred Shares of the Fund will receive approximately 68

Preferred Shares and 40 Class A Shares for each Preferred Share

held (the “

Exchange”).

The Consolidation will result in the Fund’s NAV

per Class A Share being reset to an initial approximately $8.00 per

Class A Share and enable the Fund to reinstate the distribution on

the Class A Shares. The Exchange will increase coverage levels for

the Preferred Shares, provide potential for capital appreciation

and increase overall yield for the holders of such shares as well

as establish more appropriate leverage levels for the Class A

Shares. Any fractional Shares to be issued on the Consolidation or

the Exchange will be rounded down to the nearest whole number of

shares.

A special meeting of the Shareholders has been

called and will be held on June 21, 2024. The Meeting is scheduled

to be held as a virtual-only meeting conducted via live audio

webcast online on June 21, 2024 at 10:00 a.m. (Eastern time).

The Fund’s management information circular (the

“Circular”) prepared in connection with the

Meeting was mailed to shareholders in compliance with applicable

laws, and is available under the Fund’s profile on SEDAR+ at

www.sedarplus.com. The Circular provides important information on

the Proposal and related matters, including the voting procedures

and how to virtually attend the Meeting. Shareholders are urged to

read the Circular and its schedules carefully and in their

entirety.

For further information, please contact Investor

Relations at 416.681.3966, toll free at 1-800-725-7172 or visit

www.mulvihill.com.

|

John Germain, Senior Vice-President & CFO |

Mulvihill Capital

Management Inc.121 King Street

West Suite 2600Toronto, Ontario, M5H 3T9 416.681.3966;

1.800.725.7172www.mulvihill.com info@mulvihill.com |

|

|

|

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the Fund on the TSX. If

the shares are purchased or sold on the TSX, investors may pay more

than the current net asset value when buying and may receive less

than current net asset value when selling them. There are ongoing

fees and expenses associated with owning shares of the Fund. An

investment fund must prepare disclosure documents that contain key

information about the Fund. You can find more detailed information

about the Fund in these documents. Investment funds are not

guaranteed, their values change frequently and past performance may

not be repeated.

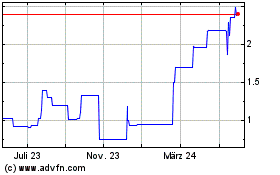

World Financial Split (TSX:WFS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

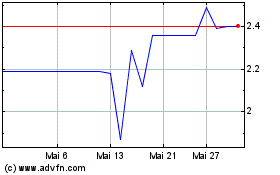

World Financial Split (TSX:WFS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024