Velan Inc. (TSX: VLN) (“Velan” or the “Company”), a world-leading

manufacturer of industrial valves, announced today financial

results for its third quarter ended November 30, 2024. All amounts

are expressed in U.S. dollars unless indicated otherwise.

On January 14, 2025, the Company announced that

it has entered into an agreement (the “Asbestos Divestiture

Agreement”) with an affiliate of Global Risk Capital (the “Buyer”)

to permanently divest its asbestos-related liabilities (the

“Asbestos Divestiture Transaction”). Global Risk Capital is a

long-term liability management company specializing in the

acquisition and management of legacy corporate liabilities. The

Asbestos Divestiture Transaction will be achieved by Velan Inc.

transferring its assets and liabilities into a new subsidiary and

selling its existing U.S. subsidiary, Velan Valve Corp, which will

have been capitalized with $143 million (subject to certain

adjustments) from Velan Inc. and $7 million from the Buyer. The

Asbestos Divestiture Transaction will permanently remove all

asbestos-related liabilities and obligations from Velan Inc.’s

balance sheet and will indemnify Velan for all legacy asbestos

liabilities.

The Company also announced that its wholly-owned

subsidiary, Velan UK, has entered into a memorandum of

understanding (the “Memorandum of Understanding”) relating to the

sale of 100% of the share capital and voting rights of its French

subsidiaries, Segault SAS (“Segault”) and Velan SAS (“Velan

France”), to Framatome SAS (“Framatome”), a world leader in nuclear

energy, for a total consideration of US$198.4 million (€192.5

million) (the “France Transaction”).

The sale of the French businesses met the

criteria, at November 30, 2024 of assets held for sale and

discontinued operations. As a result, the consolidated balance

sheet as at November 30, 2024 has been adjusted to present the

disposal group as asset held for sale, and the consolidated income

statement and cash flows have been retrospectively adjusted to

present only the results from continuing operations.

THIRD-QUARTER HIGHLIGHTS FROM CONTINUING

OPERATIONSNON-IFRS AND SUPPLEMENTARY FINANCIAL

MEASURES

- Solid order

backlog2 of $298.7 million, up $15.0 million or 5.3% since the

beginning of the year.

- Bookings2 of

$59.1 million, versus $60.1 million last year, representing a

book-to-bill ratio2 of 0.81.

- Adjusted net

income from continuing operations of $8.5 million, versus an

adjusted net loss of $7.0 million in the corresponding quarter,

mainly due to higher sales and gross profit.

- Adjusted net

income per share from continuing operations of $0.39, compared to

an adjusted net loss per share of $0.32 last year.

- Adjusted EBITDA

from continuing operations of $14.3 million, compared to negative

$4.1 million last year. The increase is mainly attributable to

higher sales and gross profit.

IFRS MEASURES CONSIDERING SIGNIFICANT

TRANSACTIONS

- Sales of $73.4

million, up $11.2 million or 18.1% compared to the same quarter

last year.

- Gross profit of

$28.3 million or 38.6% of sales, up significantly from $8.2

million, or 13.1% of sales, last year.

- Net

loss2 from continuing operations of $47.8 million, versus a

net loss of $9.5 million last year reflecting restructuring costs

of $74.5 million before income taxes.

- Net loss per

share from continuing operations of $2.22, compared to a net loss

per share of $0.44 last year.

- Cash flows from

operating activities was breakeven, versus $0.1 million last

year.

- Net cash of

$32.1 million at the end of the quarter, versus $36.4 million at

the beginning of the fiscal year.

| NON-IFRS

AND SUPPLEMENTARY FINANCIAL MEASURES (From

continuing operation, in ‘000s of U.S. dollars, excluding per share

amounts) |

Three-month periods ended |

Nine-month periods ended |

|

November 30, 2024 |

|

November 30, 2023 |

|

November 30, 2024 |

|

November 30, 2023 |

|

|

Adjusted EBITDA1 |

$14,260 |

|

($4,148) |

|

$24,337 |

|

($5,824) |

|

| Adjusted net income1

(loss) |

$8,502 |

|

($7,011) |

|

$11,857 |

|

($14,728) |

|

|

per share - basic and diluted |

$0.39 |

|

($0.32) |

|

$0.55 |

|

($0.68) |

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL

RESULTS(From continuing operation, in ‘000s of

U.S. dollars, excluding per share amounts) |

Three-month periods ended |

Nine-month periods ended |

|

November 30,2024 |

|

November 30, 2023 |

|

November 30, 2024 |

|

November 30, 2023 |

|

| Sales |

$73,404 |

|

$62,160 |

|

$211,998 |

|

$177,458 |

|

| Gross profit |

$28,305 |

|

$8,165 |

|

$65,087 |

|

$31,871 |

|

| Gross margin |

38.6% |

|

13.1% |

|

30.7% |

|

18.0% |

|

| Restructuring expenses |

74,468 |

|

2,274 |

|

81,301 |

|

6,846 |

|

| Net income (loss) |

$(47,835) |

|

($9,461) |

|

$(50,632) |

|

($22,366) |

|

|

per share - basic and diluted |

$(2.22) |

|

($0.44) |

|

$(2.35) |

|

($1.04) |

|

|

Weighted average share outstanding (‘000s) |

21,586 |

|

21,586 |

|

21,586 |

|

21,586 |

|

“Velan’s strong operating performance in the

third quarter produced sales growth of 18% and a significant

improvement in profitability,” said James A. Mannebach, Chairman of

the Board and CEO of Velan. “Driven by its strong brand,

high-quality products and proven expertise in delivering solutions

for critical applications, Velan is well-positioned to benefit from

robust momentum in the clean energy sector. We are particularly

excited with opportunities in the global nuclear market, which is

undergoing a multi-year growth cycle. Recent alliances with leading

players for our proprietary products at small modular reactors bode

well for the long term, while our large installed base at existing

reactors holds solid potential from life-extension projects and

maintenance. Given current dynamics, we expect nuclear activities

to generate new orders in the near future. Looking ahead, we are

confident to conclude fiscal 2025 with sales growth year over

year.

I am happy to announce that we have entered into

an agreement with an affiliate of Global Risk Capital, a long-term

liability management company specializing in the acquisition and

management of legacy corporate liabilities, for the divestiture of

our asbestos-related liabilities. The transaction will eliminate

the Company’s asbestos-related liabilities.

We have also entered into a memorandum of

understanding (MoU) with Framatome, an international leader in

nuclear energy, for the sale of our French subsidiaries — Segault

and Velan France — for a purchase price of US$175.2 million (€170

million), with the benefit of the transfer of an intercompany loan

of US$23.2 million (€22.5 million), for total consideration to the

Company of US$198.4 million (€192.5 million). In accordance

with French laws, Segault, Velan France, and Framatome must inform

and consult their employee representative bodies before any

definitive agreement is entered into between the parties. Once a

definitive agreement has been signed, a meeting of Velan’s

shareholders will be called to approve the transaction. Our

controlling shareholder, Velan Holding, has already pledged its

support in favour of the transaction. The Company continues to

review options to maximize value for our shareholders.”

“Solid execution and higher business volume has

yielded robust profit margins so far this year, while a strong

operating cash flow enabled us to further reduce our long-term

debt,” added Rishi Sharma, Chief Financial and Administrative

Officer of Velan. “A strong financial position offers Velan the

flexibility to invest in growth opportunities to leverage its brand

and know-how. We remain firmly committed to deliver sustained

profitable growth and to create lasting value for all shareholders.

These transactions would meet two key financial objectives, namely

the reduction of risk and resolution of our asbestos-related

liabilities through the divestiture transaction and the

strengthening of our balance sheet.”

|

BACKLOG(‘000s of U.S.

dollars) |

|

|

|

|

As at |

|

|

|

|

|

|

November 30, 2024 |

|

February 29, 2024 |

|

Backlog |

|

|

|

|

$298,685 |

|

$283,647 |

|

|

for delivery within the next 12 months |

|

|

|

|

$249,144 |

|

$259,662 |

|

| |

|

|

|

|

|

|

|

|

| BOOKINGS

(‘000s of U.S. dollars, excluding ratios) |

Three-month periods ended |

Nine-month periods ended |

|

|

November 30, 2024 |

|

November 30, 2023 |

|

November 30, 2024 |

|

November 30, 2023 |

| Bookings |

$59,096 |

|

$60,076 |

|

$230,474 |

|

$177,054 |

|

|

Book-to-bill ratio |

0.81 |

|

0.97 |

|

1.09 |

|

1.00 |

|

As at November 30, 2024, the backlog from

continuing operations stood at $298.7 million, up $15.0 million, or

5.3%, since the beginning of the fiscal year due to bookings

exceeding shipments in the first nine months of fiscal 2025. As at

November 30, 2024, 83.4% of the backlog, representing orders of

$249.1 million, is deliverable in the next 12 months. Currency

movements had a $2.5 million negative effect on the value of the

backlog for the first nine months of fiscal 2025 mainly due to the

weakening of the euro versus the U.S. dollar.

Bookings from continuing operations for the

third quarter of fiscal 2025 were $59.1 million, versus $60.1

million for the same period last year. This slight decrease

reflects the timing of orders following strong bookings in the

first half of fiscal 2025 and delays in certain targeted projects

in Italy. These factors were partially offset by higher MRO

bookings in North America and higher bookings in Germany for oil

refinery projects. Currency movements had a $0.6 million negative

effect on the value of bookings for the quarter.

For the first nine months of fiscal 2025,

bookings from continuing operations totaled $230.5 million, up from

$177.1 million in fiscal 2024. The increase reflects higher

bookings in North America and Germany, partially offset by lower

bookings in Italy. Currency movements had a $1.7 million negative

effect on the value of bookings for the period.

As sales outpaced bookings, the book-to-bill

ratio was 0.81 for the quarter ended November 30, 2024, while the

ratio for the nine-month period ended November 30, 2024, was 1.09

as bookings, driven mainly by nuclear activities in North America,

outpaced sales.

THIRD QUARTER RESULTS

Sales from continuing operations reached $73.4

million, up $11.2 million or 18.1% from the same period last year.

The increase mainly reflects higher shipments from Italian

operations for the oil and gas market and from China for the

petrochemical sector. These factors were partially offset by lower

sales in other international markets, while sales from North

American operations remained relatively stable. Currency movements

had a $0.5 million positive effect on sales for the

quarter.

Gross profit from continuing operations totaled

$28.3 million, up from $8.2 million last year. The increase is

attributable to higher sales, which positively impacted the

absorption of fixed production overhead costs, a more favorable

product mix, reduced exposure to an onerous contract and efficiency

gains. Currency movements had a $0.2 million positive effect

on gross profit for the quarter compared to the same period last

year. As a percentage of sales, gross profit was 38.6%, compared to

13.1% last year.

Administration costs from continuing operations

totaled $17.0 million, or 23.2% of sales, compared to $15.5

million, or 24.9% of sales a year ago. The year-over-year increase

is mainly attributable to higher sales commissions due to higher

business volume, higher freight costs and the impact of a

significant increase in the market value of the Company’s shares on

its long-term incentive plan.

For the three-month period ended November 30,

2024, the Company incurred restructuring expenses of $74.5 million

consisting of asbestos-related costs of $69.1 million and

transaction-related costs of $5.4 million. In the three-month

period ended November 30, 2023, restructuring expenses were $2.3

million in connection with asbestos-related costs.

EBITDA from continuing operations for the third

quarter of fiscal 2025 amounted to negative $60.2 million, compared

to negative $6.7 million last year. Excluding asbestos-related

costs and transaction-related costs, this year’s third quarter

adjusted EBITDA from continuing operations was $14.3 million, while

last year’s adjusted EBITDA was negative $4.1 million. The

year-over-year increase is due to higher sales and gross profit,

partially offset by higher administration costs.

The net loss from continuing operations was

$47.8 million, or $2.22 per share, compared to a net loss of $9.5

million, or $0.44 per share last year. Adjusted net income from

continuing operations was $8.5 million, or $0.39 per share, versus

an adjusted net loss of $7.0 million, or $0.32 per share, last

year. The variation is primarily attributable to higher adjusted

EBITDA.

Net loss from discontinued operations amounted

to $14.3 million, or $0.66 per share, versus net income from

discontinued operations of $2.2 million, or $0.10 per share, last

year. As a result, the net loss was $62.1 million, or $2.88 per

share, versus a net loss of $7.3 million, or $0.34 per share, last

year.

NINE-MONTH RESULTS

Sales from continuing operations totaled $212.0

million, compared to $177.5 million for the same period last year.

Gross profit from continuing operations reached $65.1 million,

compared to $31.9 million a year ago. As a percentage of sales,

gross profit was 30.7%, compared to 18.0% last year. Excluding the

effect of non-recurring revenue in the second quarter for which no

gross profit was recognized, this year’s gross profit as a

percentage of sales was 31.5%.

EBITDA from continuing operations was negative

$56.9 million, compared to negative $13.8 million last year, while

adjusted EBITDA from continuing operations stood at $24.3 million,

up from negative $5.9 million in the first nine months of fiscal

2024.

The net loss from continuing operations was

$50.6 million, or $2.35 per share, compared to a net loss of $22.4

million or $1.04 per share last year. Adjusted net income from

continuing operations was $11.9 million, or $0.55 per share, versus

an adjusted net loss of $14.7 million, or $0.68 per share, last

year. Net loss from discontinued operations amounted to $12.4

million, or $0.57 per share, versus net income from discontinued

operations of $4.7 million, or $0.22 per share, last year. As a

result, the net loss was $63.1 million, or $2.92 per share, versus

a net loss of $17.7 million, or $0.82 per share, last year.

FINANCIAL POSITION

As at November 30, 2024, the Company held cash

and cash equivalents of $35.1 million and short-term investments of

$0.4 million. Bank indebtedness stood at $3.0 million, while

long-term debt, including the current portion, amounted to $19.5

million.

OUTLOOK

As at November 30, 2024, orders amounting to

$249.1 million, representing 83.4% of a total backlog of $298.7

million, are expected to be delivered in the next 12 months. Given

current orders, the Company anticipates concluding fiscal 2025 with

a growth year over year in sales from continuing operations.

DIVIDEND

The Board of Directors of Velan has declared a

dividend of CA$0.03 per common share payable on February 28, 2025,

to shareholders of record as at February 14, 2025. Given the

improved financial performance of the Company, the Board believes

it is appropriate to reinstate the dividend payment. The Board will

revisit its dividend policy following the closing of the above

noted transactions.

CONFERENCE CALL NOTICE

Financial analysts, shareholders, and other

interested individuals are invited to attend the third quarter

conference call to be held on Wednesday, January 15, 2025, at 8:00

a.m. (EST). The toll-free call-in number is 1-888-510-2154 or by

RapidConnect URL: https://emportal.ink/3B0rDEL. The material that

will be referenced during the conference call will be made

available shortly before the event on the company’s website

under the Investor Relations section

(https://www.velan.com/en/company/investor_relations). A recording

of this conference call will be available for seven days at

1-289-819-1450 or 1-888-660-6345, access code 76543.

ABOUT VELAN

Founded in Montreal in 1950, Velan Inc.

(www.velan.com) is one of the world’s leading manufacturers of

industrial valves, with sales of US$346.8 million in its last

reported fiscal year. The Company employs 1,617 people and has

manufacturing plants in 9 countries. Velan Inc. is a public company

with its shares listed on the Toronto Stock Exchange under the

symbol VLN.

SAFE HARBOUR STATEMENT

This news release may include forward-looking

statements, which generally contain words like “should”, “believe”,

“anticipate”, “plan”, “may”, “will”, “expect”, “intend”, “continue”

or “estimate” or the negatives of these terms or variations of them

or similar expressions, all of which are subject to risks and

uncertainties, which are disclosed in the Company’s filings with

the appropriate securities commissions. While these statements are

based on management’s assumptions regarding historical trends,

current conditions and expected future developments, as well as

other factors that it believes are reasonable and appropriate in

the circumstances, no forward-looking statement can be guaranteed

and actual future results may differ materially from those

expressed herein. The Company disclaims any intention or obligation

to update or revise any forward-looking statements contained herein

whether as a result of new information, future events or otherwise,

except as required by the applicable securities laws. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

NON-IFRS AND SUPPLEMENTARY FINANCIAL

MEASURES

In this press release, the Company has presented

measures of performance or financial condition which are not

defined under IFRS (“non-IFRS measures”) and are, therefore,

unlikely to be comparable to similar measures presented by other

companies. These measures are used by management in assessing the

operating results and financial condition of the Company and are

reconciled with the performance measures defined under IFRS. The

Company has also presented supplementary financial measures which

are defined at the end of this report. Reconciliation and

definition can be found below.

Adjusted net income (loss), Adjusted net

income (loss) per share, Earnings before interest, taxes,

depreciation and amortization ("EBITDA") and Adjusted

EBITDA

The term “Adjusted net income (loss)” is defined

as net income or loss attributable to Subordinate and Multiple

Voting Shares plus adjustment, net of income taxes, for costs

related to restructuring and to the proposed transaction. The terms

“Adjusted net income (loss) per share” is obtained by dividing

Adjusted net income (loss) by the total amount of subordinate and

multiple voting shares. The forward-looking statements contained in

this press release are expressly qualified by this cautionary

statement.

The term “EBITDA” is defined as adjusted net

income plus depreciation of property, plant & equipment, plus

amortization of intangible assets, plus net finance costs, plus

income tax provision. The term “Adjusted EBITDA” is defined as

EBITDA plus adjustment for costs related to restructuring and to

the proposed transaction. The forward-looking statements contained

in this press release are expressly qualified by this cautionary

statement.

Definitions of supplementary financial

measures

The term “Net new orders” or “bookings” is

defined as firm orders, net of cancellations, recorded by the

Company during a period. Bookings are impacted by the fluctuation

of foreign exchange rates for a given period. The measure provides

an indication of the Company’s sales operation performance for a

given period as well as well as an expectation of future sales and

cash flows to be achieved on these orders.

The term “backlog” is defined as the buildup of

all outstanding bookings to be delivered by the Company. The

Company’s backlog is impacted by the fluctuation of foreign

exchange rates for a given period. The measure provides an

indication of the future operational challenges of the Company as

well as an expectation of future sales and cash flows to be

achieved on these orders.

The term “book-to-bill” is obtained by dividing

bookings by sales. The measure provides an indication of the

Company’s performance and outlook for a given period.

The forward-looking statements contained in this

press release are expressly qualified by this cautionary

statement.

|

Contact: |

|

| Rishi Sharma, Chief Financial

and Administrative Officer |

Martin Goulet, M.Sc., CFA |

| Velan Inc. |

MBC Capital Markets

Advisors |

| Tel: (438) 817-4430 |

Tel.: (514) 731-0000, ext.

229 |

1 Non-IFRS and supplementary financial measure.

Refer to the Non-IFRS and Supplementary Financial Measures section

for definitions and reconciliations.2 Net income or loss refer to

net income or loss attributable to Subordinate and Multiple Voting

Shares.

|

Consolidated Statements of Financial Position |

|

|

|

|

|

(in thousands of U.S. dollars) |

|

|

|

|

|

|

|

|

As at |

|

|

|

|

November 30, |

February 29, |

|

|

|

|

2024 |

2024 |

|

|

|

|

$ |

$ |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

35,051 |

36,445 |

|

|

Short-term investments |

|

370 |

5,271 |

|

|

Accounts receivable |

|

65,623 |

119,914 |

|

|

Income taxes recoverable |

|

5,964 |

6,132 |

|

|

Inventories |

|

153,987 |

208,702 |

|

|

Deposits and prepaid expenses |

|

3,845 |

10,421 |

|

|

Derivative assets |

|

413 |

125 |

|

|

Assets held for sale |

|

139,390 |

- |

|

|

|

|

404,643 |

387,010 |

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

Property, plant and equipment |

|

57,933 |

69,918 |

|

|

Intangible assets and goodwill |

|

7,651 |

16,543 |

|

|

Deferred income taxes |

|

22,448 |

5,193 |

|

|

Other assets |

|

726 |

729 |

|

|

Assets held for sale |

|

16,985 |

- |

|

|

|

|

|

|

|

|

|

|

105,743 |

92,383 |

|

|

|

|

|

|

|

|

Total assets |

|

510,386 |

479,393 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Bank indebtedness |

|

2,990 |

- |

|

|

Accounts payable and accrued liabilities |

|

77,641 |

88,230 |

|

|

Income taxes payable |

|

1,307 |

1,568 |

|

|

Customer deposits |

|

24,604 |

30,396 |

|

|

Provisions |

|

150,378 |

14,129 |

|

|

Derivative liabilities |

|

517 |

26 |

|

|

Current portion of long-term lease liabilities |

|

1,371 |

1,607 |

|

|

Current portion of long-term debt |

|

3,150 |

24,431 |

|

|

Liabilities held for sale |

|

39,729 |

- |

|

|

|

|

301,687 |

160,387 |

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

Long-term lease liabilities |

|

4,558 |

11,036 |

|

|

Long-term debt |

|

16,318 |

4,346 |

|

|

Income taxes payable |

|

419 |

2,325 |

|

|

Deferred income taxes |

|

954 |

3,462 |

|

|

Customer deposits |

|

3,903 |

35,082 |

|

|

Asbestos provision |

|

- |

74,058 |

|

|

Other liabilities |

|

5,158 |

5,438 |

|

|

Liabilities held for sale |

|

60,593 |

- |

|

|

|

|

|

|

|

|

|

|

91,903 |

135,747 |

|

|

|

|

|

|

|

|

Total liabilities |

|

393,590 |

296,134 |

|

|

|

|

|

|

|

|

Total equity |

|

116,796 |

183,259 |

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

510,386 |

479,393 |

|

|

|

|

|

|

|

|

Consolidated Statements of Income (loss) |

|

|

|

|

|

(in thousands of U.S. dollars, excluding number of shares and per

share amounts) |

|

|

|

|

|

Three-month periods ended |

|

|

Six-month periods ended |

|

|

|

November 30, |

|

November 30, |

|

|

November 30, |

|

November 30, |

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

Sales |

73,404 |

|

62,160 |

|

|

211,998 |

|

177,458 |

|

|

|

|

|

|

|

|

|

Cost of sales |

45,099 |

|

53,995 |

|

|

146,911 |

|

145,587 |

|

|

|

|

|

|

|

|

|

Gross profit |

28,305 |

|

8,165 |

|

|

65,087 |

|

31,871 |

|

|

|

|

|

|

|

|

|

Administration costs |

17,003 |

|

15,476 |

|

|

48,348 |

|

46,504 |

|

|

Other expense (income) |

(782 |

) |

(542 |

) |

|

(876 |

) |

(949 |

) |

|

Restructuring expenses |

74,468 |

|

2,274 |

|

|

81,301 |

|

6,846 |

|

|

|

|

|

|

|

|

|

Operating loss |

(62,384 |

) |

(9,043 |

) |

|

(63,686 |

) |

(20,529 |

) |

|

|

|

|

|

|

|

|

Finance income |

41 |

|

65 |

|

|

245 |

|

130 |

|

|

Finance costs |

(483 |

) |

(456 |

) |

|

(1,336 |

) |

(1,194 |

) |

|

|

|

|

|

|

|

|

Finance costs – net |

(442 |

) |

(391 |

) |

|

(1,091 |

) |

(1,064 |

) |

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

(62,826 |

) |

(9,434 |

) |

|

(64,777 |

) |

(21,593 |

) |

|

|

|

|

|

|

|

|

Income tax expense (recovery) |

(14,930 |

) |

77 |

|

|

(13,993 |

) |

832 |

|

|

|

|

|

|

|

|

|

Net Income (loss) for the period from continuing operation |

(47,896 |

) |

(9,511 |

) |

|

(50,784 |

) |

(22,425 |

) |

|

Results from discontinued operations |

(14,262 |

) |

2,211 |

|

|

(12,449 |

) |

4,712 |

|

|

|

(62,158 |

) |

(7,300 |

) |

|

(63,233 |

) |

(17,713 |

) |

|

Net Income (loss) attributable to: |

|

|

|

|

|

|

Subordinate Voting Shares and Multiple Voting

Shares |

(62,097 |

) |

(7,250 |

) |

|

(63,081 |

) |

(17,654 |

) |

|

Non-controlling interest |

(61 |

) |

(50 |

) |

|

(152 |

) |

(59 |

) |

|

|

|

|

|

|

|

|

Net Income (loss) attributable to Shareholders for the

period |

(62,158 |

) |

(7,300 |

) |

|

(63,233 |

) |

(17,713 |

) |

|

Net Income (loss) per Subordinate and Multiple Voting

Share |

|

|

|

|

|

|

Basic and diluted from continuing operation |

(2.22 |

) |

(0.44 |

) |

|

(2.35 |

) |

(1.04 |

) |

|

Basic and diluted from discontinued operations |

(0.66 |

) |

0.10 |

|

|

(0.57 |

) |

0.22 |

|

|

Basic and diluted from all operations |

(2.88 |

) |

(0.34 |

) |

|

(2.92 |

) |

(0.82 |

) |

|

|

|

|

|

|

|

|

Dividends declared per Subordinate and

Multiple |

0.02 |

|

- |

|

|

- |

|

0.02 |

|

|

Voting Share |

(CA$0.03) |

|

(CA$ -) |

|

|

(CA$ -) |

|

(CA$0.03) |

|

|

|

|

|

|

|

|

|

Total weighted average number of Subordinate

and |

|

|

|

|

|

|

Multiple Voting Shares |

|

|

|

|

|

|

Basic and diluted common number of shares |

21,585,635 |

|

21,585,635 |

|

|

21,585,635 |

|

21,585,635 |

|

|

Net Income (loss) attributable to Shareholders: |

|

|

|

|

|

|

Continuing operations |

(47,896 |

) |

(9,511 |

) |

|

(50,784 |

) |

(22,425 |

) |

|

Discontinued operations |

(14,262 |

) |

2,211 |

|

|

(12,449 |

) |

4,712 |

|

|

Net Income (loss) for the period |

(62,158 |

) |

(7,300 |

) |

|

(63,233 |

) |

(17,713 |

) |

|

|

|

|

|

|

|

|

Consolidated Statements of Comprehensive Loss |

|

|

|

|

(in thousands of U.S. dollars) |

|

|

|

|

|

|

|

Three-month periods ended |

|

|

Six-month periods ended |

|

|

|

November 30, |

|

November 30, |

|

|

November 30, |

|

November 30, |

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive Income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (loss) for the period |

(62,158 |

) |

(7,300 |

) |

|

(63,233 |

) |

(17,713 |

) |

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

Foreign currency translation of foreign subsidiaries |

1,188 |

|

(189 |

) |

|

(740 |

) |

471 |

|

|

Foreign currency translation of foreign subsidiaries from

discontinued operations |

(4,297 |

) |

320 |

|

|

(2,123 |

) |

2,764 |

|

|

|

|

|

|

|

|

|

Comprehensive Income (loss) |

(65,267 |

) |

(7,169 |

) |

|

(66,096 |

) |

(14,478 |

) |

|

|

|

|

|

|

|

|

Comprehensive Income (loss) attributable to: |

|

|

|

|

|

|

Subordinate Voting Shares and Multiple Voting Shares |

(65,206 |

) |

(7,119 |

) |

|

(65,944 |

) |

(14,419 |

) |

|

Non-controlling interest |

(61 |

) |

(50 |

) |

|

(152 |

) |

(59 |

) |

|

|

|

|

|

|

|

|

Comprehensive Income (loss) |

(65,267 |

) |

(7,169 |

) |

|

(66,096 |

) |

(14,478 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss is composed solely of items that may be

reclassified subsequently to the consolidated statement of

loss. |

|

|

|

|

|

|

|

|

Consolidated Statements of Changes in Equity |

|

|

|

|

|

|

(in thousands of U.S. dollars, excluding number of shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to the Subordinate and Multiple Voting

shareholders |

|

|

|

|

Share capital |

Contributed surplus |

Accumulated other comprehensive loss |

|

Retained earnings |

|

Total |

|

Non-controlling interest |

|

Total equity |

|

|

|

|

|

|

|

|

|

|

|

Balance - February 28, 2023 |

72,695 |

6,260 |

(41,208 |

) |

162,142 |

|

199,889 |

|

946 |

|

200,835 |

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period |

- |

- |

- |

|

(17,654 |

) |

(17,654 |

) |

(59 |

) |

(17,713 |

) |

|

Other comprehensive income |

- |

- |

3,235 |

|

- |

|

3,235 |

|

- |

|

3,235 |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

- |

- |

3,235 |

|

(17,654 |

) |

(14,419 |

) |

(59 |

) |

(14,478 |

) |

|

|

|

|

|

|

|

|

|

|

Acquisition of non-controlling interests |

- |

- |

- |

|

- |

|

- |

|

200 |

|

200 |

|

|

Dividends |

|

|

|

|

|

|

|

|

Multiple Voting Shares |

- |

- |

- |

|

(354 |

) |

(354 |

) |

- |

|

(354 |

) |

|

Subordinate Voting Shares |

- |

- |

- |

|

(137 |

) |

(137 |

) |

- |

|

(137 |

) |

|

|

|

|

|

|

|

|

|

|

Balance - November 30, 2023 |

72,695 |

6,260 |

(37,973 |

) |

143,997 |

|

184,979 |

|

1,087 |

|

186,066 |

|

|

|

|

|

|

|

|

|

|

|

Balance - February 29, 2024 |

72,695 |

6,260 |

(38,692 |

) |

141,914 |

|

182,177 |

|

1,082 |

|

183,259 |

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period |

- |

- |

- |

|

(63,081 |

) |

(63,081 |

) |

(152 |

) |

(63,233 |

) |

|

Other comprehensive income |

- |

- |

(2,863 |

) |

- |

|

(2,863 |

) |

- |

|

(2,863 |

) |

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

- |

- |

(2,863 |

) |

(63,081 |

) |

(65,944 |

) |

(152 |

) |

(66,096 |

) |

|

|

|

|

|

|

|

|

|

|

Other |

- |

95 |

- |

|

- |

|

95 |

|

- |

|

95 |

|

|

Dividends |

|

|

|

|

|

|

|

|

Multiple Voting Shares |

- |

- |

- |

|

(333 |

) |

(333 |

) |

- |

|

(333 |

) |

|

Subordinate Voting Shares |

- |

- |

- |

|

(129 |

) |

(129 |

) |

- |

|

(129 |

) |

|

Non-controlling interest |

- |

- |

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

Balance - November 30, 2024 |

72,695 |

6,355 |

(41,555 |

) |

78,371 |

|

115,866 |

|

930 |

|

116,796 |

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flow |

|

|

|

|

|

|

(in thousands of U.S. dollars) |

|

|

|

|

|

|

|

Three-month periods ended |

|

|

Six-month periods ended |

|

|

|

November 30, |

|

November 30, |

|

|

November 30, |

|

November 30, |

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

Cash flows from |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities |

|

|

|

|

|

|

Net income (loss) for the period |

(62,158 |

) |

(7,300 |

) |

|

(63,233 |

) |

(17,713 |

) |

|

Results from discontinued operations |

(14,262 |

) |

2,211 |

|

|

(12,449 |

) |

4,712 |

|

|

Net Income (loss) for the period for continued operations |

(47,896 |

) |

(9,511 |

) |

|

(50,784 |

) |

(22,425 |

) |

|

Adjustments to reconcile net Income (loss) to cash provided by

operating activities |

45,240 |

|

1,010 |

|

|

54,424 |

|

(194 |

) |

|

Changes in non-cash working capital items |

2,647 |

|

8,563 |

|

|

16,243 |

|

15,025 |

|

|

Cash provided by operating activities from continued

operations |

(9 |

) |

61 |

|

|

19,883 |

|

(7,594 |

) |

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

Short-term investments |

(193 |

) |

2 |

|

|

472 |

|

22 |

|

|

Additions to property, plant and equipment |

(4,039 |

) |

(1,670 |

) |

|

(7,860 |

) |

(5,257 |

) |

|

Additions to intangible assets |

(981 |

) |

(443 |

) |

|

(1,083 |

) |

(1,320 |

) |

|

Proceeds on disposal of property, plant and equipment, and

intangible assets |

31 |

|

29 |

|

|

177 |

|

82 |

|

|

Net change in other assets |

258 |

|

304 |

|

|

(190 |

) |

(52 |

) |

|

Cash provided (used) by investing activities from continued

operations |

(4,923 |

) |

(1,778 |

) |

|

(8,484 |

) |

(6,525 |

) |

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

Dividends paid to Subordinate and Multiple Voting shareholders |

- |

|

- |

|

|

- |

|

(491 |

) |

|

Acquisition of non-controlling interests |

- |

|

200 |

|

|

- |

|

200 |

|

|

Increase in long-term debt |

506 |

|

- |

|

|

1,090 |

|

5,000 |

|

|

Repayment of long-term debt |

(242 |

) |

(5,728 |

) |

|

(6,753 |

) |

(6,768 |

) |

|

Repayment of long-term lease liabilities |

0 |

|

(615 |

) |

|

(425 |

) |

(1,260 |

) |

|

Cash used by financing activities from continued

operations |

264 |

|

(6,143 |

) |

|

(6,088 |

) |

(3,320 |

) |

|

|

|

|

|

|

|

|

Effect of exchange rate differences on cash and cash

equivalents |

(315 |

) |

(178 |

) |

|

(533 |

) |

210 |

|

|

|

|

|

|

|

|

|

Net change in cash during the period from continuated

operations |

(4,984 |

) |

(8,038 |

) |

|

4,778 |

|

(17,229 |

) |

|

Net change in cash during the period from discontinuing

operations |

10,301 |

|

(4,972 |

) |

|

6,146 |

|

(6,662 |

) |

|

Net change in cash and cash equivalents during the

period |

5,317 |

|

(13,010 |

) |

|

10,925 |

|

(23,891 |

) |

|

|

|

|

|

|

|

|

Net cash – Beginning of the period |

37,045 |

|

31,414 |

|

|

27,283 |

|

40,605 |

|

|

|

|

|

|

|

|

|

Net cash – End of the period |

32,061 |

|

23,376 |

|

|

32,061 |

|

23,376 |

|

|

|

|

|

|

|

|

|

Net cash is composed of: |

|

|

|

|

|

|

Cash and cash equivalents |

35,051 |

|

25,063 |

|

|

35,051 |

|

25,063 |

|

|

Bank indebtedness |

(2,990 |

) |

(1,687 |

) |

|

(2,990 |

) |

(1,687 |

) |

|

|

|

|

|

|

|

|

Net cash – End of the period |

32,061 |

|

23,376 |

|

|

32,061 |

|

23,376 |

|

|

|

|

|

|

|

|

|

Supplementary information |

|

|

|

|

|

|

Interest paid |

(206 |

) |

(419 |

) |

|

(623 |

) |

(861 |

) |

|

Income taxes paid |

(3,618 |

) |

(1,657 |

) |

|

(8,389 |

) |

(6,110 |

) |

|

|

|

|

|

|

|

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/294a7bfb-66bd-402f-9e67-1c6b854d896b

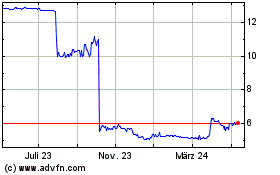

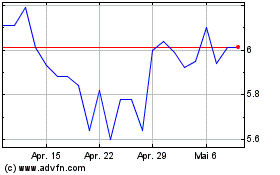

Velan (TSX:VLN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Velan (TSX:VLN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025