Tidewater Midstream and Infrastructure Ltd.

("

Tidewater" or the

"

Corporation") (TSX:TWM) is pleased to announce

that it: has entered into an agreement to acquire from Pipestone

Energy Corp. ("

Pipestone Energy"), a 100% working

interest in a strategic 30 MMcf/d raw gas compression, 5,400 bbls/d

condensate handling and associated water disposal battery

(“

Pipestone East Battery”) for total consideration

of up to $30 million in cash (the "

Acquisition");

plans to invest $25 million in additional liquids handling

infrastructure at its Pipestone Gas Plant ("

Pipestone Plant

1") and extended a take or pay agreement with Pipestone

Energy. Tidewater is also pleased to announce that it has

entered into a $75 million bought deal offering of convertible

debentures with a syndicate of underwriters.

Pipestone East Battery

Acquisition

Tidewater is pleased to announce that it has

entered into an agreement with Pipestone Energy to acquire a 100%

working interest in the Pipestone East Battery (the

“Acquisition Agreement”) which will be located

approximately 24km directly east of Pipestone Plant 1 and will be a

physical extension of existing Tidewater infrastructure that

services Pipestone Energy. The total cash consideration

payable under the Acquisition Agreement is up to $30 million

consisting of an initial cash payment by Tidewater of approximately

$14 million to purchase existing compression, power generation,

water handling infrastructure and facility equipment, with a

commitment to fund up to $16 million to finalize the design,

construction and commissioning of the Pipestone East Battery, which

is expected to be completed over the next 12 to 18 months.

Concurrently upon signing the Acquisition

Agreement, Pipestone Energy has elected to not exercise its option

to acquire a 20% working interest in the Pipestone Plant 1 and has

entered into certain other commitment agreements with Tidewater for

Tidewater’s current and future projects in the Pipestone area,

including:

- a 10-year take-or-pay agreement for

compression, separation and liquids handling at the Pipestone East

Battery;

- an extension of Pipestone Energy’s

current 30 MMcf/day take-or-pay commitment at the Pipestone Plant 1

from a 5-year term to a 10-year term;

- a 10-year, 20 MMcf/d take-or-pay

commitment for Tidewater’s proposed Pipestone Plant 2 project

(defined below), subject to the project receiving final investment

decision by Tidewater on or before year-end 2019 and the proposed

Pipestone Plant 2 being commissioned by Tidewater on or before the

end of the second quarter of 2022; and

- a 10-year dedication of an existing

Pipestone Energy facility to Tidewater’s liquids handling expansion

project.

Once the Pipestone East Battery is complete, it

is expected to improve the strategic position that Tidewater has in

the Pipestone area, provide additional EBITDA to Tidewater of

approximately $4 million per year and further increase the average

contract life of Tidewater’s infrastructure assets in the greater

Pipestone area.

Pipestone Plant Update

At Pipestone Plant 1, Tidewater has received all

the required regulatory approvals, including with respect to the

acid gas injection well, and has commenced commissioning

operations. The project remains on budget with an expected

in-service date in the third quarter of 2019.

Tidewater plans to invest an incremental $25

million in liquids handling equipment (“Pipestone Liquids

Handling”) in order to increase truck-in, stabilization,

treating and storage capacity at the Pipestone Plant 1 due to

increased demand in the area. The investment in additional liquids

handling equipment is expected to generate an EBITDA multiple of

approximately 6.0x once complete.

Tidewater continues to obtain significant

commercial support for its proposed Pipestone Plant 1 expansion

(“Pipestone Plant 2”) where the economics of this

second plant are expected to be equivalent to Pipestone Plant 1.

The Corporation has received significant interest from

multiple parties to finance the project on an attractive basis to

Tidewater. Tidewater expects to reach a final investment

decision on Pipestone Plant 2 in the next 90 days.

Convertible Debenture

Financing

In connection with the Acquisition and liquids

handling expansion, Tidewater is pleased to announce that it has

entered into a $75 million bought-deal financing (the

"Convertible Debenture Financing") of five-year

convertible unsecured subordinated debentures (the

"Debentures") with a syndicate of underwriters

(the "Underwriters") co-led by CIBC Capital

Markets and National Bank Financial Inc. The Debentures will have a

coupon of 5.5 percent per annum, and a conversion price of $1.86

per Tidewater common share ("Common Share").

The Corporation has granted the Underwriters an over-allotment

option to purchase up to an additional $11.25 million aggregate

principal amount of the Debentures, on the same terms, exercisable

in whole or in part at any time up to the 30th day following

initial closing of the Convertible Debenture Financing.

Net proceeds from the Offering will initially be

used to complete the Acquisition and repay Tidewater’s credit

facility, which is then expected to be utilized to expand Pipestone

Liquids Handling, and for general corporate purposes.

The Debentures will be offered in all provinces

of Canada, by way of short form prospectus and in certain other

jurisdictions as may be agreed by the Underwriters and

Tidewater.

The Debentures offered, and the Common Shares

issuable on conversion or redemption thereof, have not and will not

be registered under the U.S. Securities Act of 1933, as amended

(the “Act”), and may not be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements under the Act. This press

release does not constitute an offer to sell or a solicitation of

any offer to buy the common shares in the United States.

Closing of the Offering is expected to occur on

or about, August 8, 2019 and is subject to customary conditions and

regulatory approvals, including the approval of the Toronto Stock

Exchange.

Chief Executive Officer’s Intent to

Acquire Additional Tidewater Shares

Mr. MacLeod has entered into a term sheet with

an arm’s length loan provider to facilitate, inter alia, the

acquisition of additional Tidewater Common Shares. Mr.

MacLeod feels that Tidewater Common Shares continue to be

undervalued. The term sheet includes a pledge of

approximately 5.5 million shares of Tidewater (the

“Collateral”) as security in connection with a

loan. The loan has a term of three years and upon repayment

Mr. MacLeod is entitled to 100% of the appreciation or increase in

the value of the Collateral.

Second Quarter, 2019 Earnings

Call

In conjunction with Tidewater’s second quarter

2019 earnings release, investors will have the opportunity to

listen to Tidewater senior management review its second quarter

results of fiscal 2019 via conference call on Tuesday, August 13th

at 11:00 am MDT.

To access the conference call by telephone, dial

647-427-7450 (local / international participant dial in) or

1-888-231-8191 (North American toll free participant dial in).

A question and answer session for analysts will follow

management's presentation.

A live audio webcast of the conference call will

be available by following this link:

https://event.on24.com/wcc/r/2054100/9C564F679042E1460EE659317D970AC1

and will also be archived there for 90 days.

For those accessing the call via Cision’s

investor website, we suggest logging in at least 15 minutes prior

to the start of the live event. For those dialing in, participants

should ask to be joined into the Tidewater Midstream and

Infrastructure Ltd. earnings call.

About Tidewater

Tidewater is traded on the TSX under the symbol

“TWM”. Tidewater’s business objective is to build a diversified

midstream and infrastructure company in the North American natural

gas, natural gas liquids (“NGL”) and crude oil space. Its strategy

is to profitably grow and create shareholder value through the

acquisition and development of oil and gas infrastructure.

Tidewater plans to achieve its business objective by providing

customers with a full service, vertically integrated value chain

through the acquisition and development of oil and gas

infrastructure including: gas plants, pipelines, railcars, trucks,

export terminals and storage facilities.

Advisory Regarding Forward-Looking Statements

In the interest of providing Tidewater's

shareholders and potential investors with information regarding

Tidewater, including management's assessment of Tidewater's future

plans and operations, certain statements in this press release are

"forward-looking information" within the meaning of applicable

Canadian securities legislation ("forward-looking statements"). In

some cases, forward-looking statements can be identified by

terminology such as "anticipate", "believe", "continue", "could",

"estimate", "expect", "forecast", "intend", "may", "objective",

"ongoing", "outlook", "potential", "project", "plan", "should",

"target", "would", "will" or similar words suggesting future

outcomes, events or performance. The forward-looking statements

contained in this press release speak only as of the date thereof

and are expressly qualified by this cautionary statement.

Specifically, this news release contains

forward-looking statements relating to but not limited to: the

Offering and its use of Proceeds; an acquisition by Tidewater of a

100% working interest in the Pipestone East Battery, projected

completion of the Pipestone East Battery and timing thereof and

projections of anticipated EBITDA to Tidewater resulting from this

project; plans to invest capital in liquids handling at the

Pipestone Plant 1; anticipated in-service date of the Pipestone

Phase 1 plant; plans with respect to a proposed Pipestone Phase 2

plant, the anticipated economics of such plant and expectations to

reach final investment decision.

Such forward-looking statements of information

are based on a number of assumptions which may prove to be

incorrect. Tidewater has made assumptions regarding, among

other things: the timing of closing and regulatory and third party

approvals for the Offering and the satisfaction of the conditions

to closing the Offering, including, if required, the consent of the

Toronto Stock Exchange and, if required, the consent of Tidewater’s

lenders under its credit facility; general economic and industry

trends; the Corporation’s ability to secure natural gas supplies;

anticipated timelines and budgets being met in respect of the

Corporation’s projects and operations, including specifically with

respect to the Pipestone Gas Plant and any expansions thereof;

receipt of regulatory approvals for the Corporation’s capital

projects; that counterparties will comply with contracts in a

timely manner; that there are no unforeseen material costs relating

to the facilities which are not recoverable from customers;

customer demand for processing at the Pipestone Gas Plant and

expansions thereof; future capital expenditures to be made by the

Corporation; the ability to obtain additional financing on

satisfactory terms; the ability of Tidewater to successfully market

its products; the Corporation's future debt levels and the ability

of the Corporation to repay its debt when due; that any third-party

projects relating to the Corporation’s growth projects will be

sanctioned and completed as expected; that transactions will close

as expected; and, the Corporation's ability to obtain and retain

qualified staff and equipment in a timely and cost-effective

manner.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors including but not

limited to: general economic, political, market and business

conditions, including fluctuations in interest rates, foreign

exchange rates and stock market volatility; regulatory approvals of

the Corporation’s capital projects; activities of producers and

customers, procurement of natural gas supplies; the regulatory

environment and decisions and First Nations and landowner

consultation requirements; operational matters, including potential

hazards inherent in the Corporation's operations and the

effectiveness of health, safety, environmental and integrity

programs; transportation of hazardous materials; fluctuations in

commodity prices, inventory levels and supply/demand trends;

actions by governmental authorities, including changes in

government regulation including environmental, tariffs and

taxation; changes in operating and capital costs, including

fluctuations in input costs; competition for, among other things,

business, capital, acquisition opportunities, requests for

proposals, materials, equipment, labour and skilled personnel;

environmental risks and hazards, including risks inherent in the

transportation of NGLs which may create liabilities to the

Corporation in excess of the Corporation's insurance coverage, if

any; non-performance or default by counterparties to agreements

which the Corporation has entered into in respect of its business;

construction and engineering variables associated with capital

projects, including the availability of contractors, engineering

and construction services, accuracy of estimates and schedules, and

the performance of contractors; the availability of capital on

acceptable terms; changes in the credit-worthiness of

counterparties; effects of weather conditions; reliance on key

personnel; technology and security risks; technical and processing

problems; changes in gas composition; and failure to realize the

anticipated benefits of recently completed acquisitions.

The foregoing lists are not exhaustive.

Additional information on these and other factors which could

affect the Corporation’s operations or financial results are

included in the Corporation’s most recent Annual Information Form

and in other documents on file with the Canadian Securities

regulatory authorities.

The above summary of assumptions and risks

related to forward-looking statements in this news release is

intended to provide shareholders and potential investors with a

more complete perspective on Tidewater's current and future

operations and such information may not be appropriate for other

purposes. There is no representation by Tidewater that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Tidewater does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

Non-GAAP Measures

This news release refers to “EBITDA” which does

not have any standardized meaning prescribed by generally accepted

accounting principles in Canada (“GAAP”). EBITDA is

calculated as income or loss before interest, taxes, depreciation

and amortization.

Tidewater Management believes that EBITDA

provides useful information to investors as it provides an

indication of results generated from the Corporation’s operating

activities prior to financing, taxation and depreciation and

amortization expenses. Management utilizes EBITDA to set

objectives and as a key performance indicator of the Corporation’s

success. In addition to its use by Management, Tidewater also

believes EBITDA is a measure widely used by security analysts,

investors and others to evaluate the financial performance of the

Corporation and other companies in the midstream industry.

Investors should be cautioned that EBITDA should not be construed

as alternatives to earnings, cash flow from operating activities or

other measures of financial results determined in accordance with

GAAP as an indicator of the Corporation’s performance and may not

be comparable to companies with similar calculations.

For more information with respect to financial

measures which have not been defined by GAAP, including

reconciliations to the closest comparable GAAP measure, see the

“Non-GAAP Measures” section of Tidewater’s most recent MD&A

which is available on SEDAR.

Neither the Toronto Stock Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the Toronto Stock Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact Information

Tidewater Midstream & Infrastructure Ltd. Joel MacLeod,

Chairman, President and CEO 587.475.0210

jmacleod@tidewatermidstream.com

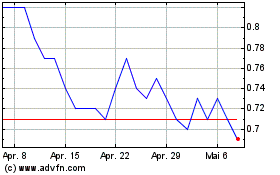

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

Von Feb 2024 bis Feb 2025