Theratechnologies Announces Proposed Public Offering of Common Shares and Concurrent Private Placement

25 Oktober 2023 - 10:13PM

Theratechnologies Inc. (“Theratechnologies” or the “Company”)

(Nasdaq: THTX; TSX: TH), a biopharmaceutical company focused on the

development and commercialization of innovative therapies, today

announced the launch of a marketed public offering (the “Public

Offering”) of common shares of the Company (the “Common Shares”).

The Company intends to grant the underwriter a 30-day option to

purchase up to an additional 15% of the number of Common Shares to

be sold pursuant to the Public Offering (the “Option”).

In connection with the Public Offering, the

Company intends to enter into a subscription agreement with

Investissement Québec for a concurrent private placement of Common

Shares (and Common Share equivalents in the form of pre-funded,

non-voting subscription receipts, exchangeable into Common Shares

on a one-for-one basis (the “Exchangeable Subscription Receipts”)

in lieu of Common Shares), for up to US$12.5 million aggregate

gross proceeds (the “Concurrent Private Placement”). As part of the

Concurrent Private Placement, it is expected that Investissement

Québec will be granted rights to nominate one director to the

Company’s board of directors. The consummation of the Concurrent

Private Placement will be contingent upon the closing of the Public

Offering.

Cantor Fitzgerald & Co. is acting as

the underwriter for the Public Offering.

A preliminary prospectus supplement (the

“Prospectus Supplement”) to the Company’s short form base shelf

prospectus dated December 14, 2021 (the “Base Shelf Prospectus”)

was filed with the securities regulatory authorities in each of the

provinces of Canada as well as with the U.S. Securities and

Exchange Commission (the “SEC”) as part of its registration

statement on Form F-10 (the “Registration Statement”) under

the U.S.-Canada multijurisdictional disclosure system (“MJDS”). The

Public Offering will be made in Canada only pursuant to the

Prospectus Supplement and Base Shelf Prospectus and in the United

States only pursuant to the Registration Statement, containing the

Prospectus Supplement and the Base Shelf Prospectus, filed with the

SEC under the MJDS. Copies of the Prospectus Supplement and the

Base Shelf Prospectus are available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov, and a copy of

the Registration Statement is available on EDGAR at www.sec.gov.

Copies may also be obtained from Cantor Fitzgerald & Co.,

Attention: Capital Markets, 110 East 59th Street, 6th

Floor, New York, New York 10022, or by e-mail

at prospectus@cantor.com.

Completion of the Public Offering and Concurrent

Private Placement will be subject to customary closing conditions,

including the listing of the Common Shares and the Common Shares

underlying the Exchangeable Subscription Receipts on the Toronto

Stock Exchange and the submission of notice to the Nasdaq Global

Market.

Prospective investors should read the Prospectus

Supplement, Base Shelf Prospectus and Registration Statement before

making an investment decision.

No securities regulatory authority has either

approved or disapproved the contents of this news release. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any province, state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

province, state or jurisdiction.

About Theratechnologies

Theratechnologies (Nasdaq: THTX) (TSX: TH) is a biopharmaceutical

company focused on the development and commercialization of

innovative therapies addressing unmet medical needs. Further

information about Theratechnologies is available on the Company's

website at www.theratech.com, on SEDAR+ at www.sedarplus.ca and on

EDGAR at www.sec.gov.

Forward-Looking InformationThis

press release contains forward-looking statements and

forward-looking information (collectively, the “Forward-Looking

Statements”) within the meaning of applicable securities laws, that

are based on management’s beliefs and assumptions and on

information currently available to it. You can identify

forward-looking statements by terms such as “may”, “will”,

“should”, “could”, “promising”, “would”, “outlook”, “believe”,

“plan”, “envisage”, “anticipate”, “expect” and “estimate”, or the

negatives of these terms, or variations of them. The

Forward-Looking Statements contained in this press release include,

but are not limited to, statements regarding the sale of Common

Shares and the Exchangeable Subscription Receipts; the Public

Offering, including its size, price and the closing thereof; the

underwriting agreement; the granting to the underwriter of the

Option; the Concurrent Private Placement, including its size, price

and the closing thereof; and the subscription agreement.

Although the Forward-Looking Statements

contained in this press release are based upon what the Company

believes are reasonable assumptions in light of the information

currently available, investors are cautioned against placing undue

reliance on these statements since actual results may vary from the

Forward-Looking Statements. Forward-Looking Statements assumptions

are subject to a number of risks and uncertainties, many of which

are beyond the Company’s control, that could cause actual results

to differ materially from those that are disclosed in or implied by

such Forward-Looking Statements. These, as well as other, risks and

uncertainties are described more fully in the section titled “Risk

Factors” of the preliminary Prospectus Supplement and of the Base

Shelf Prospectus in connection with the Public Offering as well as

other public filings made by the Company available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. The reader is

cautioned to consider these and other risks and uncertainties

carefully and not to put undue reliance on Forward-Looking

Statements.

Forward-Looking Statements reflect current

expectations regarding future events and speak only as of the date

of this press release and represent the Company’s expectations as

of that date. The Company undertakes no obligation to update or

revise the information contained in this press release, whether as

a result of new information, future events or circumstances or

otherwise, except as may be required by applicable law.

Contacts:

Investor inquiries:Philippe DubucSenior Vice

President and Chief Financial

Officerpdubuc@theratech.com1-438-315-6608

Media inquiries:Julie SchneidermanSenior

Director, Communications & Corporate

Affairscommunications@theratech.com 1-514-336-7800

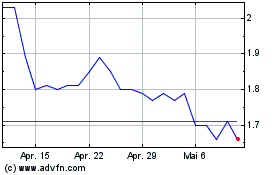

Theratechnologies (TSX:TH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Theratechnologies (TSX:TH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024