Sangoma Technologies Corporation (TSX:STC), a trusted leader in

delivering cloud-based Communications as a Service solutions for

companies of all sizes, today announced highlights of its unaudited

results for the first quarter of fiscal year 2022 ended September

30, 2021.

Sales for the first quarter of fiscal 2022 were

a record $52.48 million, twice that of the same quarter last year

and 5% higher than in the last quarter of fiscal 2021. Please note

that these results are being presented in United States dollars for

the first time, and so all comparable numbers have been converted

to US dollars.

|

|

|

|

|

|

|

|

|

|

|

US $M |

Q1 FY2022 |

Q1 FY2021 |

Change |

Q4 FY2021 |

Change |

|

Sales |

$52.48 |

|

m |

$26.22 |

|

m |

100% |

$50.12 |

|

m |

5% |

| Gross

profit |

$37.85 |

|

m |

$17.31 |

|

m |

119% |

$35.89 |

|

m |

5% |

| Operating

expense |

$38.71 |

|

m |

$14.77 |

|

m |

162% |

$37.78 |

|

m |

2% |

| Adjusted

operating Income1 (loss) |

($0.85) |

|

m |

$2.55 |

|

m |

|

($1.89) |

|

m |

|

| Net

income (loss) |

($2.30) |

|

m |

$1.58 |

|

m |

|

($1.29) |

|

m |

|

| Net

earnings/(loss) per share (fully diluted) |

$(0.073) |

|

|

$0.109 |

|

|

|

$(0.041) |

|

|

|

| Adjusted

EBITDA1 |

$10.09 |

|

m |

$4.95 |

|

m |

104% |

$9.62 |

|

m |

5% |

|

|

|

|

|

|

|

|

|

|

|

The Company undertook a seven for one share

consolidation on November 2, 2021, so please note that in this

press release, as well as the accompanying interim financial

statements and MD&A (all of which have been filed on SEDAR),

the share count, option count, exercise prices, and earnings per

share reflect this share consolidation for all periods

reported.

“I am very pleased with our performance in the

first quarter,” said Bill Wignall, President and CEO of Sangoma.

“Financially, both revenue and adjusted EBITDA were double that of

the first quarter in fiscal 21, a testament to the ongoing growth

and compounding of our services business. And from a strategic

perspective, this was also the quarter in which we completed much

of the integration of the Sangoma and Star2Star teams, along with

the product portfolios, so that customers can choose from the

combined suite of Sangoma offerings. As we have previously

indicated, we expect spending as a percentage of revenue, to remain

relatively consistent, as we reinvest the synergistic savings from

the acquisition to help drive growth. Overall, I see this

quarter as a very sound start to the year, one capped off by our

up-listing from the Venture exchange to the TSX after

quarter-end.”

Gross profit for the first quarter of fiscal

2022 was $37.85 million, delivering gross margin of 72% of sales,

up by 6 points over the 66% in the same quarter last year.

Operating expenses were $38.71 million for the

first fiscal quarter of 2022, up 2% sequentially over the most

recent fourth quarter of fiscal 2021. When compared to last year,

operating expenses are materially higher primarily because of the

addition of the Star2Star teams and the non-cash intangible asset

amortization arising from the acquisition.

Adjusted EBITDA1 was $10.09 million in the first

quarter, more than twice that of last year, and at about 19% of

revenue, is consistent with expectations for this point in the

fiscal year.

Net loss for the first quarter ended September

30, 2021 was $2.30 million, which includes the additional non-cash

intangible asset amortization, together with $0.84 million of

one-time integration expense which is expected to cover all such

costs associated with the Star2Star acquisition.

Sangoma continues to maintain a healthy balance

sheet, finishing the quarter with a cash balance of $19.13 million

on September 30, 2021 and remains comfortably within its debt

covenants. Adjusted Cash Flow from operations during the first

quarter was $5.16 million, compared to $3.01 million in the same

quarter of fiscal 2021.

Outlook for fiscal year 2022

Based upon these results for the first quarter,

Sangoma continues to expect revenue of between $209 and $213

million, and Adjusted EBITDA in a range of $41 to $43 million, for

fiscal 22. The company is not changing its fiscal 2022

guidance.

The above outlook is based on the Company’s assessment of many

material assumptions, including:

- The continuing recovery of the

global economy from the effects of COVID-19

- The successful integration of the

Star2Star business

- There is continuing growth in the

global UCaaS and cloud communications markets more generally

- Demand and subscriber growth

continues for the Company’s cloud offerings

- Changes in global exchange rates do

not disrupt demand for the Company’s Products and Services

- The ability of the Company’s

customers to continue their business operations without any

material impact on their requirements for the Company’s Products

and Services

- The Company’s forecasted revenue

from its internal sales teams and via channel partners meets

expectations

- There is no material further

increase to the Company’s cost of goods sold

- The Company’s manufacturers and

supply chain deliver ongoing quantities of finished products on

schedule

- That the Company can continue to

secure electronic components and parts to support a largely

uninterrupted supply chain

- That the Company is able to attract

and keep the employees needed to maintain the current momentum

- The continued ability for the

Company’s operations employees to work at the Company’s internal

and outsourced facilities

- Other employees are able to work

from home as required without any material impact on

productivity

Full first quarter results and

conference callSangoma will host a conference call on

Friday, November 12, 2021 at 7.45 am EST to discuss these results.

The dial-in number for the call is 1-800-319-4610 (International

1-604-638-5340). Investors are requested to dial in 5 to 10 minutes

before the scheduled start time and ask to join the Sangoma

call.

1 Adjusted Operating Income, Adjusted EBITDA and

Adjusted Cash Flow from Operations are metrics used by the Company

to monitor its performance and definitions of these terms, as well

as other important information on these results, may be found in

the accompanying MD&A posted today at www.sedar.com.

About Sangoma Technologies

CorporationSangoma Technologies is a trusted leader in

delivering value-based Communications as a Service (CaaS) solutions

for businesses of all sizes. Sangoma’s cloud-based Services include

Unified Communication (UCaaS) business communications, Contact

Center as a Service (CCaaS), Video Meetings as a Service (MaaS),

Collaboration as a Service (Collab aaS), Communications Platform as

a Service (CPaaS), Trunking as a Service (TaaS), Fax as a Service

(FaaS), Device as a Service (DaaS), and Access Control as a Service

(ACaaS). In addition, Sangoma offers a full line of communications

Products, including premise-based UC systems, a full line of desk

phones and headsets, and a complete connectivity suite

(gateways/SBCs/telephony cards). Sangoma’s products and services

are used in leading UC, PBX, IVR, contact center, carrier networks,

office productivity, and data communication applications worldwide.

Sangoma is also the primary developer and sponsor of Asterisk and

FreePBX, the world’s two most widely used open source communication

software projects.

Sangoma Technologies Corporation is publicly

traded on the Toronto Stock Exchange (TSX: STC). Additional

information on Sangoma can be found at: www.sangoma.com.

Cautionary Statement Regarding Forward

Looking StatementsThis press release contains

forward-looking statements, including statements regarding the

future success of our business, development strategies and future

opportunities.

Forward-looking statements include, but are not

limited to, statements concerning estimates of expected

expenditures (including in respect of IT and security enhancements

being implemented in response to the cyber attack), statements

relating to expected future production and cash flows, statements

relating to the ongoing investigation into and actions being

undertaken in response to the cyber attack and the anticipated

impact on our business, and other statements which are not

historical facts. When used in this document, the words such as

"could", "plan", "estimate", "expect", "intend", "may",

"potential", "should" and similar expressions indicate

forward-looking statements.

Although Sangoma believes that its expectations

reflected in these forward-looking statements are reasonable, such

statements involve risks and uncertainties and no assurance can be

given that actual results will be consistent with these

forward-looking statements. Forward-looking statements are based on

the opinions and estimates of management at the date that the

statements are made, and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in

forward-looking statements. Such risks and uncertainties include,

but are not limited to, the outcome of our ongoing investigation

into the cyber attack, costs related to our investigation and any

resulting liabilities, our ability to recover any proceeds under

our insurance policies, and costs related to and the effectiveness

of our mitigation and remediation efforts. Sangoma undertakes no

obligation to update forward-looking statements if circumstances or

management's estimates or opinions should change except as required

by law.

Readers are cautioned not to place undue

reliance on forward-looking statements, as there can be no

assurance that the plans, intentions or expectations upon which

they are based will occur. By their nature, forward-looking

statements involve numerous assumptions, known and unknown risks

and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections and

other events contemplated by the forward-looking statements will

not occur. Although Sangoma believes that the expectations

represented by such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be

correct as these expectations are inherently subject to business,

economic and competitive uncertainties and contingencies. Some of

the risks and other factors which could cause results to differ

materially from those expressed in the forward-looking statements

contained in its management's discussion and analysis, annual

information form and management information circular relating the

special meeting to approve the acquisition of StarBlue Inc. (each

available on www.sedar.com) include, but are not limited to risks

and uncertainties associated with the COVID-19 pandemic, changes in

exchange rate between the United States dollar and other

currencies, changes in technology, changes in the business climate,

changes in the regulatory environment, the decline in the

importance of the PSTN and new competitive pressures. The

forward-looking statements contained in this press release are

expressly qualified by this cautionary statement.

Neither the TSX nor its Regulation Services

Provider (as that term is defined in policies of the TSX Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Sangoma Technologies Corporation

David Moore

Chief Financial Officer

(905) 474-1990 Ext. 4107

dsmoore@sangoma.com

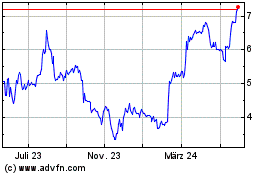

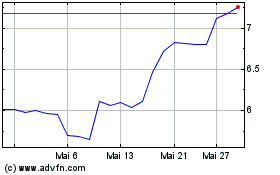

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024