SmartCentres Releases 2023 ESG Report

29 August 2024 - 9:01PM

SmartCentres Real Estate Investment Trust (“SmartCentres” or

the “Trust”) (TSX:SRU.UN) announced today the release of its 2023

ESG Report. This year’s report highlights SmartCentres key ESG

initiatives and accomplishments along with forward-looking

commitments for how it will continue to embed ESG strategy into its

business.

“SmartCentres is committed to integrating ESG considerations

across our organization to enhance value to all stakeholders and to

the communities in which we operate. We accomplish this by working

closely with our tenants and other partners in how we manage our

existing portfolio, as well as how we plan our developments for

future generations,” says Mitchell Goldhar, Executive Chairman and

CEO, SmartCentres.

2023 highlights of SmartCentres ESG journey include:

- Completed over 3,000 homes, with another 1,000 residential

units in its development pipeline;

- Improved Global Real Estate Sustainability Benchmark score by

25 points over the previous year’s submission;

- Continued progress on LED conversion at our retail portfolio

sites, which led to a 15% reduction of landlord control electricity

consumption at retrofitted properties;

- Achieved BOMA Best Gold certification for 90% of SmartCentres’

retail properties;

- Maintained strong commitment to governance and oversight with

the establishment of an ESG Sub-Committee with responsibility for

ESG matters;

- Exceeded Board diversity target with women representing 38% of

the Trustees, and independent trustees representing 75% of the

Board;

- Improved cybersecurity practices and upgraded enterprise risk

management systems to ensure effective risk monitoring; and

- Trained all people managers in fair selection processes and

identifying unconscious bias in the workplace.

SmartCentres third annual ESG Report can be found on its website

at ESG Report - SmartCentres.

About SmartCentres REIT

SmartCentres is one of Canada’s largest fully integrated REITs,

with a best-in-class and growing mixed-use portfolio featuring 195

strategically located properties in communities across the country.

SmartCentres has approximately $12.0 billion in assets and owns

35.2 million square feet of income producing value-oriented retail

and first-class office properties with 98.2% in place and committed

occupancy, on 3,500 acres of owned land across Canada.

SmartCentres was started over thirty years ago because we

believed that Canadians deserved products they could afford, at

convenient times, in stores that were close to home. By fulfilling

those needs, SmartCentres has grown and expanded into communities

across every province across Canada.

Today, Canadians need transit-connected rental apartments,

condos, townhomes and seniors’ residences with access to retail,

offices and storage facilities — as well as open, green spaces and

places to gather. So, SmartCentres is evolving, and SmartLiving has

emerged, with a $15.2B plan to transform our properties from

shopping centres to city centres.

We plan, develop, build and manage holistic communities

coast-to-coast. SmartCentres has 3,500 acres of land across 185

prime locations where we’ve consistently provided a best-in-class

retail experience. Now, because we’ve always respected Canadians'

needs, we’re creating communities that Canadians can be proud to

call home. Visit smartcentres.com for more information.

For more information, please visit www.smartcentres.com or

contact:

Contact

For information, visit www.smartcentres.com or please

contact:

Mitchell Goldhar

Executive Chairman and CEO

(905) 326-6400 ext. 7674

mgoldhar@smartcentres.com

Rudy GobinEVP Portfolio Management &

Inv.(905) 326-6400 ext. 7684rgobin@smartcentres.com

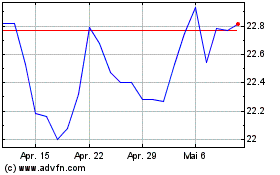

SmartCentres Real Estate... (TSX:SRU.UN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

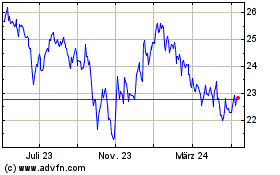

SmartCentres Real Estate... (TSX:SRU.UN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025