Real Matters Inc. (TSX: REAL) (“Real Matters” or the “Company”), a

leading network management services platform for the mortgage and

insurance industries, today announced its financial results for the

fourth quarter and fiscal year ended September 30, 2024.

“Consolidated revenue increased 8% year-over-year to $45.6

million in the fourth quarter, and we posted positive Adjusted

EBITDA(A) of $0.6 million. U.S. Title Net Revenue(A) increased 30%

sequentially on stronger market volumes and market share increases.

This growth in Net Revenue(A) coupled with disciplined cost

management allowed us to convert 100% of the increase to Adjusted

EBITDA(A),” said Real Matters Chief Executive Officer Brian Lang.

“We launched six lenders in the fourth quarter, three of which were

new U.S. Title clients, including one Tier 2 lender. Increases in

our market share with our clients continue to underpin our

performance, offsetting some of the impact of variable mortgage

market conditions.”

“Looking back at our fiscal 2024 performance, we delivered

Adjusted EBITDA(A) of $1.9 million – a significant improvement from

a loss of $2.4 million in fiscal 2023, as we continued to prudently

manage our cost base throughout the year in line with the

variability in mortgage origination volumes. We grew our market

share with our clients across all three segments, launched a total

of 16 clients and four new channels during the year, delivering

consolidated revenue growth of 5% in a record-low market. Net

Revenue(A) was up 8% from fiscal 2023 and we improved Net

Revenue(A) margins in all three segments,” added Lang.

“Heading into fiscal 2025, we are optimistic about the potential

for growth as pent-up demand continues to build. Today, there are

eight million outstanding mortgages with interest rates above 6%

which represents a significant pool of potential refinance

candidates. According to our Future Plans of Homeowners Survey, 40%

of future buyers plan to buy a primary home when rates decline.

These tailwinds, coupled with our market leadership in appraisal

and the significant potential for expanding our U.S. Title

business, position us well for growth. We continue to maintain a

readiness posture to flex the business based on market dynamics and

lender positioning. As we drive more transaction volumes on our

platform, we expect to expand our margins and profitability in line

with our long-term operating model,” concluded Lang.

Q4 2024 Highlights

- Consolidated revenues of $45.6

million, up 8% year-over-year

- Consolidated Adjusted EBITDA(A) of

$0.6 million and net loss of $0.2 million

- Year-over-year market share gains

with 3 of our top U.S. Appraisal clients

- Year-over-year market share gains

with Tier 1 lender and launched 3 new clients in U.S. Title

- Launched 3 new clients in Canada

and one new channel

Fiscal 2024 Highlights

- Consolidated revenues of $172.7

million, up 5% year-over-year

- U.S. Appraisal Net Revenue(A)

margin of 27.6% - in our target operating model range

- Positive consolidated Adjusted

EBITDA of $1.9 million up from $(2.4) million in fiscal 2023

- Positive consolidated net income in

fiscal 2024, up from a loss of $6.2 million in fiscal 2023

- Year-over-year market share gains

in all three segments

- Launched 2 new lenders, 1 new

channel in U.S. Appraisal

- Launched 7 new lenders and 1 new

channel in U.S. Title

- Launched 7 new clients in Canada

and 2 new channels in Canada

- Cash and cash equivalents of $49.1

million and no outstanding debt

Financial and Operational

Summary

|

|

|

Quarter ended |

|

|

|

|

|

Year ended |

|

|

% |

|

|

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

% Change1 |

|

|

|

2024 |

|

|

2023 |

|

|

Change1 |

|

|

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Quarter over Quarter |

|

Year over Year |

|

|

September 30 |

|

September 30 |

|

|

Year over Year |

|

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

45.6 |

|

$ |

49.5 |

|

$ |

42.2 |

|

$ |

35.4 |

|

$ |

42.2 |

|

|

-8 |

% |

8 |

% |

|

$ |

172.7 |

|

$ |

163.9 |

|

|

5 |

% |

| Net Revenue(A) |

$ |

12.0 |

|

$ |

13.1 |

|

$ |

11.5 |

|

$ |

9.7 |

|

$ |

11.2 |

|

|

-9 |

% |

8 |

% |

|

$ |

46.4 |

|

$ |

43.0 |

|

|

8 |

% |

| Adjusted EBITDA(A) |

$ |

0.6 |

|

$ |

1.7 |

|

$ |

0.7 |

|

$ |

(1.1 |

) |

$ |

0.6 |

|

|

-66 |

% |

-6 |

% |

|

$ |

1.9 |

|

$ |

(2.4 |

) |

|

178 |

% |

| Net (loss) income |

$ |

(0.2 |

) |

$ |

1.7 |

|

$ |

2.1 |

|

$ |

(3.6 |

) |

$ |

1.6 |

|

|

-109 |

% |

-110 |

% |

|

$ |

- |

|

$ |

(6.2 |

) |

|

100 |

% |

| Net income (loss) per diluted

share |

$ |

0.00 |

|

$ |

0.02 |

|

$ |

0.03 |

|

$ |

(0.05 |

) |

$ |

0.02 |

|

|

-100 |

% |

-100 |

% |

|

$ |

0.00 |

|

$ |

(0.08 |

) |

|

100 |

% |

| Adjusted Net income

(loss)(A) |

$ |

0.9 |

|

$ |

1.7 |

|

$ |

1.3 |

|

$ |

(1.2 |

) |

$ |

0.8 |

|

|

-45 |

% |

13 |

% |

|

$ |

2.7 |

|

$ |

(2.2 |

) |

|

223 |

% |

| Adjusted Net income (loss)(A)

per diluted share |

$ |

0.01 |

|

$ |

0.02 |

|

$ |

0.02 |

|

$ |

(0.02 |

) |

$ |

0.01 |

|

|

-50 |

% |

0 |

% |

|

$ |

0.04 |

|

$ |

(0.03 |

) |

|

233 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Appraisal

segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

33.8 |

|

$ |

37.5 |

|

$ |

32.6 |

|

$ |

26.8 |

|

$ |

31.2 |

|

|

-10 |

% |

8 |

% |

|

$ |

130.7 |

|

$ |

120.8 |

|

|

8 |

% |

| Net Revenue(A) |

$ |

9.0 |

|

$ |

10.3 |

|

$ |

9.2 |

|

$ |

7.5 |

|

$ |

8.6 |

|

|

-13 |

% |

6 |

% |

|

$ |

36.1 |

|

$ |

33.1 |

|

|

9 |

% |

| Net Revenue(A) margin |

|

26.7 |

% |

|

27.6 |

% |

|

28.3 |

% |

|

27.9 |

% |

|

27.5 |

% |

|

|

|

|

|

27.6 |

% |

|

27.4 |

% |

|

|

| Adjusted EBITDA(A) |

$ |

4.1 |

|

$ |

5.5 |

|

$ |

4.4 |

|

$ |

2.7 |

|

$ |

3.9 |

|

|

-26 |

% |

4 |

% |

|

$ |

16.7 |

|

$ |

14.1 |

|

|

18 |

% |

| Adjusted EBITDA(A) margin |

|

45.2 |

% |

|

53.2 |

% |

|

47.9 |

% |

|

35.8 |

% |

|

46.0 |

% |

|

|

|

|

|

46.2 |

% |

|

42.8 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Title

segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

2.4 |

|

$ |

2.1 |

|

$ |

2.0 |

|

$ |

2.0 |

|

$ |

2.3 |

|

|

14 |

% |

4 |

% |

|

$ |

8.6 |

|

$ |

9.6 |

|

|

-9 |

% |

| Net Revenue(A) |

$ |

1.2 |

|

$ |

0.9 |

|

$ |

0.9 |

|

$ |

1.0 |

|

$ |

1.0 |

|

|

30 |

% |

15 |

% |

|

$ |

4.0 |

|

$ |

3.9 |

|

|

3 |

% |

| Net Revenue(A) margin |

|

49.8 |

% |

|

43.6 |

% |

|

44.0 |

% |

|

47.3 |

% |

|

45.0 |

% |

|

|

|

|

|

46.3 |

% |

|

40.6 |

% |

|

|

| Adjusted EBITDA(A) |

$ |

(1.6 |

) |

$ |

(1.9 |

) |

$ |

(1.7 |

) |

$ |

(1.6 |

) |

$ |

(1.6 |

) |

|

18 |

% |

-1 |

% |

|

$ |

(6.8 |

) |

$ |

(8.3 |

) |

|

18 |

% |

| Adjusted EBITDA(A) margin |

|

-131.4 |

% |

|

-209.8 |

% |

|

-184.8 |

% |

|

-167.9 |

% |

|

-150.4 |

% |

|

|

|

|

|

-170.4 |

% |

|

-215.6 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canadian

segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

9.4 |

|

$ |

9.9 |

|

$ |

7.6 |

|

$ |

6.6 |

|

$ |

8.7 |

|

|

-5 |

% |

8 |

% |

|

$ |

33.4 |

|

$ |

33.5 |

|

|

0 |

% |

| Net Revenue(A) |

$ |

1.8 |

|

$ |

1.9 |

|

$ |

1.4 |

|

$ |

1.2 |

|

$ |

1.6 |

|

|

-5 |

% |

14 |

% |

|

$ |

6.3 |

|

$ |

6.0 |

|

|

5 |

% |

| Net Revenue(A) margin |

|

18.9 |

% |

|

19.0 |

% |

|

18.9 |

% |

|

18.8 |

% |

|

17.9 |

% |

|

|

|

|

|

18.9 |

% |

|

18.0 |

% |

|

|

| Adjusted EBITDA(A) |

$ |

1.2 |

|

$ |

1.3 |

|

$ |

0.9 |

|

$ |

0.7 |

|

$ |

1.2 |

|

|

-7 |

% |

6 |

% |

|

$ |

4.1 |

|

$ |

4.2 |

|

|

-4 |

% |

| Adjusted EBITDA(A) margin |

|

67.7 |

% |

|

69.3 |

% |

|

62.3 |

% |

|

56.8 |

% |

|

72.9 |

% |

|

|

|

|

|

64.8 |

% |

|

70.5 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate

segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA(A) |

$ |

(3.1 |

) |

$ |

(3.2 |

) |

$ |

(2.9 |

) |

$ |

(2.9 |

) |

$ |

(2.9 |

) |

|

2 |

% |

-8 |

% |

|

$ |

(12.1 |

) |

$ |

(12.4 |

) |

|

3 |

% |

Note 1 – Percentage change is calculated based

on figures disclosed in our MD&A which are rounded to the

nearest thousands of dollars.

Conference Call and Webcast A conference call

to review the results will take place at 10:00 a.m. (ET) on

Thursday, November 21, 2024, hosted by Chief Executive Officer

Brian Lang and Chief Financial Officer Rodrigo Pinto. An

accompanying slide presentation will be posted to the Investor

section of our website shortly before the call.

To access the call:

- Participant Local (Toronto): (416) 764-8624

- Participant Toll Free Dial-In Number: (888) 259-6580

- Conference ID: 77493257

To listen to the live webcast of the call:

- Go to:

https://events.q4inc.com/attendee/195642986

The webcast will be archived and a transcript of the call will

be available in the Investor section of our website following the

call.

(A) Non-GAAP MeasuresThe

non-GAAP measures used in this news release, including Net Revenue,

Adjusted EBITDA and Adjusted Net Income do not have a standardized

meaning prescribed by International Financial Reporting Standards

and are therefore unlikely to be comparable to similar measures

presented by other issuers. These non-GAAP measures are more fully

defined and discussed in the Company’s MD&A for the three

months and year ended September 30, 2024 under the heading

“Non-GAAP measures”, which is incorporated by reference in this

Press Release and available on SEDAR+ at www.sedarplus.ca.

Real Matters financial results for the three months and year

ended September 30, 2024 are included in the annual audited

consolidated financial statements and the accompanying MD&A,

each of which are available on SEDAR+ at www.sedarplus.ca. In

addition, supplemental information is available on our website at

www.realmatters.com.

Net Revenue represents the difference between revenues and

transaction costs. Net Revenue margin is calculated as Net Revenue

divided by Revenues. The reconciling items between net income or

loss and Net Revenue were as follows:

|

|

|

|

|

|

|

|

|

Quarter ended |

|

|

Year ended |

|

|

|

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q1 2024 |

|

|

Q4 2023 |

|

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(0.2 |

) |

$ |

1.7 |

|

$ |

2.1 |

|

$ |

(3.6 |

) |

$ |

1.6 |

|

|

$ |

- |

|

$ |

(6.2 |

) |

| Operating expenses |

|

12.6 |

|

|

11.8 |

|

|

11.2 |

|

|

11.6 |

|

|

10.9 |

|

|

|

47.3 |

|

|

46.8 |

|

| Amortization |

|

0.8 |

|

|

0.8 |

|

|

0.8 |

|

|

0.8 |

|

|

0.9 |

|

|

|

3.2 |

|

|

3.9 |

|

| Restructuring expenses |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

- |

|

|

1.7 |

|

| Interest expense |

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

|

0.3 |

|

|

0.3 |

|

| Interest income |

|

(0.5 |

) |

|

(0.5 |

) |

|

(0.4 |

) |

|

(0.4 |

) |

|

(0.3 |

) |

|

|

(1.8 |

) |

|

(0.8 |

) |

| Net foreign exchange loss

(gain) |

|

1.3 |

|

|

(0.9 |

) |

|

(2.2 |

) |

|

2.0 |

|

|

(1.8 |

) |

|

|

0.2 |

|

|

1.0 |

|

| (Gain) loss on fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| of derivatives |

|

(1.9 |

) |

|

(0.1 |

) |

|

0.1 |

|

|

(0.2 |

) |

|

(0.1 |

) |

|

|

(2.0 |

) |

|

(0.8 |

) |

| Income

tax (recovery) expense |

|

(0.2 |

) |

|

0.2 |

|

|

(0.2 |

) |

|

(0.6 |

) |

|

(0.1 |

) |

|

|

(0.8 |

) |

|

(2.9 |

) |

|

Net Revenue |

$ |

12.0 |

|

$ |

13.1 |

|

$ |

11.5 |

|

$ |

9.7 |

|

$ |

11.2 |

|

|

$ |

46.4 |

|

$ |

43.0 |

|

Adjusted EBITDA represents net income or loss before stock-based

compensation expense, amortization, restructuring expenses,

interest expense, interest income, net foreign exchange gain or

loss, gain or loss on fair value of derivatives and income tax

expense or recovery. Adjusted EBITDA margin is calculated as

Adjusted EBITDA divided by Net Revenue. The reconciling items

between net income or loss and Adjusted EBITDA were as follows:

|

|

|

|

|

|

|

|

|

Quarter ended |

|

|

Year ended |

|

|

|

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q1 2024 |

|

|

Q4 2023 |

|

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(0.2 |

) |

$ |

1.7 |

|

$ |

2.1 |

|

$ |

(3.6 |

) |

$ |

1.6 |

|

|

$ |

- |

|

$ |

(6.2 |

) |

| Stock-based compensation

expense |

|

1.2 |

|

|

0.4 |

|

|

0.4 |

|

|

0.8 |

|

|

0.3 |

|

|

|

2.8 |

|

|

1.4 |

|

| Amortization |

|

0.8 |

|

|

0.8 |

|

|

0.8 |

|

|

0.8 |

|

|

0.9 |

|

|

|

3.2 |

|

|

3.9 |

|

| Restructuring expenses |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

- |

|

|

1.7 |

|

| Interest expense |

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

|

0.3 |

|

|

0.3 |

|

| Interest income |

|

(0.5 |

) |

|

(0.5 |

) |

|

(0.4 |

) |

|

(0.4 |

) |

|

(0.3 |

) |

|

|

(1.8 |

) |

|

(0.8 |

) |

| Net foreign exchange loss

(gain) |

|

1.3 |

|

|

(0.9 |

) |

|

(2.2 |

) |

|

2.0 |

|

|

(1.8 |

) |

|

|

0.2 |

|

|

1.0 |

|

| (Gain) loss on fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| of derivatives |

|

(1.9 |

) |

|

(0.1 |

) |

|

0.1 |

|

|

(0.2 |

) |

|

(0.1 |

) |

|

|

(2.0 |

) |

|

(0.8 |

) |

| Income

tax (recovery) expense |

|

(0.2 |

) |

|

0.2 |

|

|

(0.2 |

) |

|

(0.6 |

) |

|

(0.1 |

) |

|

|

(0.8 |

) |

|

(2.9 |

) |

|

Adjusted EBITDA |

$ |

0.6 |

|

$ |

1.7 |

|

$ |

0.7 |

|

$ |

(1.1 |

) |

$ |

0.6 |

|

|

$ |

1.9 |

|

$ |

(2.4 |

) |

The reconciling items between net income or loss

and Adjusted Net Income or Loss were as follows:

|

|

|

|

|

|

|

Quarter ended |

|

|

Year ended |

|

|

|

|

Q4 2024 |

|

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q1 2024 |

|

|

Q4 2023 |

|

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(0.2 |

) |

$ |

1.7 |

|

$ |

2.1 |

|

$ |

(3.6 |

) |

$ |

1.6 |

|

|

$ |

- |

|

$ |

(6.2 |

) |

| Stock-based compensation

expense |

|

1.2 |

|

|

0.4 |

|

|

0.4 |

|

|

0.8 |

|

|

0.3 |

|

|

|

2.8 |

|

|

1.4 |

|

| Amortization of

intangibles |

|

0.5 |

|

|

0.4 |

|

|

0.4 |

|

|

0.4 |

|

|

0.4 |

|

|

|

1.6 |

|

|

1.6 |

|

| Restructuring expenses |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

- |

|

|

1.7 |

|

| Net foreign exchange loss

(gain) |

|

1.3 |

|

|

(0.9 |

) |

|

(2.2 |

) |

|

2.0 |

|

|

(1.8 |

) |

|

|

0.2 |

|

|

1.0 |

|

| (Gain) loss on fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| of derivatives |

|

(1.9 |

) |

|

(0.1 |

) |

|

0.1 |

|

|

(0.2 |

) |

|

(0.1 |

) |

|

|

(2.0 |

) |

|

(0.8 |

) |

| Related tax effects |

|

- |

|

|

0.2 |

|

|

0.5 |

|

|

(0.6 |

) |

|

0.4 |

|

|

|

0.1 |

|

|

(0.9 |

) |

|

Adjusted Net Income |

$ |

0.9 |

|

$ |

1.7 |

|

$ |

1.3 |

|

$ |

(1.2 |

) |

$ |

0.8 |

|

|

$ |

2.7 |

|

$ |

(2.2 |

) |

Forward-Looking InformationThis Press Release

contains “forward-looking information” within the meaning of

applicable Canadian securities laws. Words such as “could”,

“forecast”, “target”, “may”, “will”, “would”, “expect”,

“anticipate”, “estimate”, “intend”, “plan”, “seek”, “believe”,

“likely” and “predict” and variations of such words and similar

expressions are intended to identify such forward-looking

information, although not all forward-looking information contains

these identifying words.

The forward-looking information in this Press Release includes

statements which reflect the current expectations of management

with respect to our business and the industry in which we operate

and is based on management’s experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors that management believes

appropriate and reasonable in the circumstances. The

forward-looking information reflects management’s beliefs based on

information currently available to management, including

information obtained from third party sources, and should not be

read as a guarantee of the occurrence or timing of any future

events, performance or results.

The forward-looking information in this Press Release is subject

to risks, uncertainties and other factors that are difficult to

predict and that could cause actual results to differ materially

from historical results or results anticipated by the

forward-looking information. A comprehensive discussion of the

factors which could cause results or events to differ from current

expectations can be found in the “Risk Factors” section of our

Annual Information Form for the year ended September 30, 2023,

which is available on SEDAR+ at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on the

forward-looking information, which reflect our expectations only as

of the date of this Press Release. Except as required by law, we do

not undertake to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise.

About Real MattersReal Matters is a leading

network management services provider for the mortgage lending and

insurance industries. Real Matters’ platform combines its

proprietary technology and network management capabilities with

tens of thousands of independent qualified field professionals to

create an efficient marketplace for the provision of mortgage

lending and insurance industry services. Our clients include top

100 mortgage lenders in the U.S. and some of the largest banks and

insurance companies in Canada. We are a leading independent

provider of residential real estate appraisals to the mortgage

market and a leading independent provider of title services in the

U.S. Headquartered in Markham (ON), Real Matters has principal

offices in Buffalo (NY) and Middletown (RI). Real Matters is listed

on the Toronto Stock Exchange under the symbol REAL. For more

information, visit www.realmatters.com.

For more information:Lyne

Beauregard Vice President, Investor Relations and Corporate

CommunicationsReal Matterslbeauregard@realmatters.com

416.994.5930

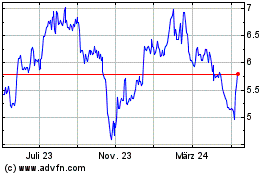

Real Matters (TSX:REAL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

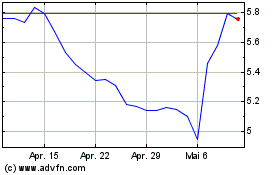

Real Matters (TSX:REAL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024