NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

Paramount Resources Ltd. ("Paramount" or the "Company") (TSX:POU) is pleased to

announce:

-- Commissioning of the Company's wholly-owned 200 MMcf/d Musreau Deep Cut

Facility is complete. The facility has been handed over to Paramount's

operations team and final start-up activities are underway to begin

delivering sales volumes.

-- The Company is expanding the development of its liquids-rich Montney

lands in the Kaybob area. To provide incremental natural gas processing

capacity, Paramount has sanctioned the construction of two new wholly-

owned 100 MMcf/d refrigeration plants. The first new plant is scheduled

to be on-stream in the second half of 2016 and the second plant

approximately six months later.

-- Paramount's sales volumes are projected to surpass 100,000 Boe/d by the

end of 2016 and 125,000 Boe/d in 2017 once both new plants are on-

stream.

-- Fox Drilling has commenced the construction of two new walking rigs to

support the Company's expanded drilling program.

-- Paramount has drilled its first horizontal Duvernay well in the

Willesden Green area of Alberta. The Company has also entered into a

joint venture agreement that will increase its Willesden Green Duvernay

land position to 86 (43 net) sections.

-- Cavalier Energy Inc. has received regulatory approval for the initial

10,000 Bbl/d phase of its Hoole Grand Rapids development.

-- Paramount's 2014 capital budget has been increased by $150 million to

$800 million.

-- In the second quarter, the Company received approximately $90 million

cash from the sale of a 50 percent interest in its Birch property.

-- Based on the results of Paramount's Deep Basin development programs, the

Company's bank credit facility was increased from $600 million to $700

million following a scheduled mid-year review.

-- The Company has entered into an agreement with a syndicate of

underwriters for a bought deal offering of 4,600,000 Class A Common

Shares at a price of $60.00 per share and a guaranteed agency offering

of 900,000 Class A Common Shares to be issued on a flow-through basis at

a price of $74.40 per share and also intends to issue an additional

100,000 Class A Common Shares on a flow-through basis pursuant to a

concurrent private placement.

MUSREAU DEEP CUT FACILITY

Paramount is pleased to announce that commissioning of its wholly-owned 200

MMcf/d Musreau Deep Cut Facility is complete and the facility has been handed

over to the Company's operations team for start-up. The Company is in the final

stages of purging the facilities with nitrogen and pressuring the system up to

operating levels so that raw gas can be introduced into the plant and first

sales can begin. This deep cut processing plant allows Paramount to ramp-up

production from its behind-pipe wells in the Musreau area.

The Company expects to more than double its sales volumes to reach approximately

50,000 Boe/d later in 2014 and more than triple its sales volumes to

approximately 70,000 Boe/d in 2015 as third-party downstream NGLs facilities

expansions are completed and new wells are brought-on production. Over the same

period, Paramount's production mix is anticipated to increase from approximately

15% liquids / 85% natural gas to approximately 45% liquids / 55% natural gas.

EXPANSION OF KAYBOB AREA DEVELOPMENT

The Company is expanding the development of its liquids-rich Montney lands in

the Kaybob area. To provide incremental natural gas processing capacity,

Paramount has sanctioned the construction of two new wholly-owned 100 MMcf/d

refrigeration plants. The first new plant is scheduled to be on-stream in the

second half of 2016 to align with the anticipated completion of expansions to

third-party transportation and fractionation facilities in which Paramount has

secured long-term firm capacity. The second new plant is scheduled to be

on-stream approximately six months later. Paramount's total sales volumes are

projected to surpass 100,000 Boe/d by the end of 2016 and 125,000 Boe/d in 2017

once the second new plant is on-stream.

To view the figure associated with this press release, please visit the

following link: http://media3.marketwire.com/docs/POU_image.jpg.

The new facilities will utilize a refrigeration process to extract propane,

butane and heavier hydrocarbons, with ethane remaining in the gas stream and

being sold as higher heat content natural gas. The plants are expected to cost

approximately $180 million each, and will include an oversized condensate

stabilization system, on-site natural gas power generation and an amine

processing train. Each of the new plants is being designed to allow for future

expansions to double capacity to 200 MMcf/d. Front-end engineering and design

for the new facilities is currently being finalized, and the Company plans to

place orders for long-lead-time items in the near future. Pending regulatory

approvals, site work is targeted to commence in the fall of 2014 with

construction to begin in the first half of 2015. To ensure access to downstream

transportation and fractionation, Paramount has secured additional long-term

firm service capacity for the transportation of natural gas, NGLs and condensate

to be delivered from the new plants, as well as C3+ fractionation capacity at

Fort Saskatchewan.

Paramount's wholly-owned drilling subsidiary, Fox Drilling, has commenced the

construction of two new triple-sized built-for-purpose walking rigs to support

the expanded Kaybob drilling program. The new rigs are expected to cost

approximately $25 million each and enter service in the second half of 2015.

Upon completion of the Company's new plants, Paramount's net owned and firm

service gas processing capacity in the Kaybob area will increase to over 500

MMcf/d, providing potential sales volumes of over 135,000 Boe/d, depending on

the liquids content of the natural gas processed. This capacity will be used to

process Paramount's production as well as unavoidably commingled third-party

volumes for a fee. The Company's natural gas processing capacity and capacity

under construction in the Kaybob area is shown below:

Gross Net Paramount Potential

Raw Gas Raw Gas Sales

Capacity Capacity Volumes(1)

----------------------------------------------------------------------------

(MMcf/d) (MMcf/d) (Boe/d)

Processing Capacity

Musreau Deep-Cut Facility 200 200 50,000

Musreau Refrig Facility 45 45 8,500

Smoky Facility 100 10 2,500

Other Musreau area capacity 70 24 4,500

----------------------------------------------------------------------------

Subtotal 415 279 65,500

----------------------------------------------------------------------------

Capacity Under Construction

Musreau Condensate Stabilizer

Expansion - - 15,000

Smoky Deep-Cut Facility 200 30 7,500

6-18 Plant 100 100 25,000(2)

3-15 Plant 100 100 25,000(2)

----------------------------------------------------------------------------

Subtotal 400 230 72,500

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Projected Total 815 509 138,000

----------------------------------------------------------------------------

(1) Refer to the heading "Potential Sales Volumes" in the Advisories

section for further information.

(2) These volumes exclude approximately 5,000 Bbl/d of potential sales

volumes that could be produced from each of the 6-18 Plant and the 3-15

Plant through their condensate stabilization systems which, once

constructed, will have oversized capacity to provide operational

flexibility to accommodate potential higher condensate yields and

stabilization capacity for potential future expansions.

WILLESDEN GREEN DUVERNAY

During the first half of 2014, Paramount drilled its first exploratory Duvernay

well in the Willesden Green area of Alberta. The well was initially drilled to a

vertical depth of 3,200 meters, cored and logged. Based on the encouraging

results, a 2,400 meter horizontal leg was drilled and the Company plans to

complete and tie-in the well in the second half of 2014.

Paramount also entered into a joint venture agreement in the second quarter that

will increase its Willesden Green Duvernay land position to 86 (43 net)

sections, after the completion of earning obligations.

By the end of 2014, Paramount expects that it will have drilled and completed

two horizontal Duvernay wells and spud a third horizontal Duvernay well in the

Willesden Green area. The Company intends to invest an incremental $50 million

in the Willesden Green area in 2014 relative to its original 2014 budget.

CAVALIER ENERGY

Cavalier Energy Inc. ("Cavalier"), Paramount's wholly-owned subsidiary, has

received regulatory approval for the initial 10,000 Bbl/d phase of its Hoole

Grand Rapids project. Development of this phase is dependent upon Cavalier

securing financing and sanctioning by Cavalier's Board of Directors. Cavalier is

continuing to evaluate funding alternatives. Its current activities are being

funded with drawings on its $40 million bank credit facility.

2014 CAPITAL BUDGET

Paramount's 2014 capital budget for exploration and development and strategic

investments, excluding land acquisitions and capitalized interest, has been

increased by $150 million to $800 million. The updated capital budget includes

incremental spending of approximately $70 million for the two new refrigeration

plants, $50 million for Willesden Green Duvernay activities and $20 million to

commence construction of the two new walking drilling rigs.

BIRCH

In the second quarter, Paramount received approximately $90 million cash for the

sale of a 50 percent interest in approximately 65 sections of land and three

producing wells at Birch in northeast British Columbia. Paramount plans to drill

4 (2.0 net) wells at Birch in the second half of 2014.

CREDIT FACILITY INCREASE

Based on the results of Paramount's Deep Basin development programs, the

Company's bank credit facility (the "Facility") was increased from $600 million

to $700 million following a scheduled mid-year review. The credit limit of

Tranche A of the Facility was increased by $100 million to $600 million and the

credit limit of Tranche B of the Facility remains at $100 million. All other

terms of the Facility remain unchanged.

EQUITY OFFERINGS

Paramount has entered into an agreement with a syndicate of underwriters led by

BMO Capital Markets to sell: (i) on a bought deal basis, 4,600,000 Class A

Common Shares of Paramount (the "Common Shares") to be issued at a price of

$60.00 per share for gross proceeds of $276,000,000; and (ii) on a guaranteed

agency basis, 900,000 Class A Common Shares of Paramount to be issued on a

"flow-through" basis in respect of Canadian exploration expenses (the

"Flow-Through Shares") at a price of $74.40 per share for gross proceeds of

$66,960,000. Both the Common Shares and the Flow-Through Shares will be offered

for sale by the underwriters in each of the provinces of Canada other than

Quebec by a prospectus supplement to Paramount's short form base shelf

prospectus dated November 14, 2012, as amended. Closing of this offering is

expected to occur on or about July 9, 2014.

In conjunction with this offering, Paramount also intends to issue, through a

non-brokered private placement, to Clayton H. Riddell and/or companies

controlled by Mr. Riddell, Paramount's Chairman and Chief Executive Officer,

100,000 Class A Common Shares of Paramount to be issued on a flow-through basis

in respect of Canadian exploration expenses at the same price per share as the

Flow-Through Shares for gross proceeds of $74.40. This private placement is

expected to occur on or before the closing date of the public offering.

The net proceeds from the offering of Common Shares will be applied to

Paramount's exploration and development activities which are primarily focused

on its Kaybob Deep Basin lands, including its expanded drilling program and the

construction of the two new wholly-owned 100 MMcf/d refrigeration gas processing

plants, and for general corporate purposes. The gross proceeds from the offering

of Flow-Through Shares and the private placement will be used by Paramount to

incur eligible Canadian exploration expenses. The completion of the offerings

will be subject to Paramount receiving all necessary regulatory approvals.

Paramount will initially use the net proceeds from the offerings to temporarily

reduce indebtedness under the Company's revolving bank credit facility.

The securities offered have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold in the United

States absent registration or applicable exemption from the registration

requirements. This news release does not constitute an offer to sell or the

solicitation of any offer to buy nor will there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any

such state or jurisdiction.

ABOUT PARAMOUNT

Paramount is an independent, publicly traded, Canadian corporation that explores

for and develops conventional petroleum and natural gas prospects, pursues

longer-term non-conventional exploration and pre-development projects and holds

investments in other entities. The Company's principal properties are primarily

located in Alberta and British Columbia. Paramount's Class A Common Shares are

listed on the Toronto Stock Exchange under the symbol "POU".

ADVISORIES

FORWARD-LOOKING INFORMATION

Certain statements in this document constitute forward-looking information under

applicable securities legislation. Forward-looking information typically

contains statements with words such as "anticipate", "believe", "estimate",

"will", "expect", "plan", "schedule", "intend", "propose", or similar words

suggesting future outcomes or an outlook. Forward-looking information in this

document includes, but is not limited to:

-- projected production and sales volumes and growth and the timing thereof

(including the liquids component of such volumes);

-- forecast capital expenditures;

-- exploration, development, and associated operational plans and

strategies and the anticipated timing and costs of such activities;

-- projected timelines for, and anticipated costs of, constructing,

commissioning and/or starting-up new and expanded natural gas processing

and associated facilities, and the Kaybob area processing capacity and

potential sales volumes following the completion of such facilities;

-- projected timelines for, and the anticipated costs of, constructing new

drilling rigs;

-- the projected availability of third party processing, transportation,

fractionation, de-ethanization and other facilities;

-- closing of the offerings of Common Shares and Flow-Through Shares and

the expected timing thereof and the use of proceeds therefrom; and

-- business strategies and objectives.

Such forward-looking information is based on a number of assumptions which may

prove to be incorrect. Assumptions have been made with respect to the following

matters, in addition to any other assumptions identified in this document:

-- future oil, bitumen, natural gas, NGLs and other commodity prices;

-- royalty rates, taxes and capital, operating, general & administrative

and other costs;

-- foreign currency exchange rates and interest rates;

-- general economic and business conditions;

-- the ability of Paramount to obtain the required capital to finance its

exploration, development and other operations;

-- the ability of Paramount to obtain equipment, services, supplies and

personnel in a timely manner and at an acceptable cost to carry out its

activities;

-- the production mix of new and existing wells and related sustained

production volumes therefrom;

-- the ability of Paramount to secure adequate product processing,

transportation, fractionation, de-ethanization and storage capacity on

acceptable terms;

-- the ability of Paramount to market its oil, bitumen, natural gas and

NGLs successfully to current and new customers;

-- the ability of Paramount and its industry partners to obtain drilling

success (including in respect of anticipated production volumes,

reserves additions and NGLs yields) and operational improvements,

efficiencies and results consistent with expectations;

-- the timely completion of third-party downstream NGLs facilities

expansions;

-- the timely receipt of required governmental and regulatory approvals;

and

-- anticipated timelines and budgets being met in respect of drilling

programs and other operations (including well completions and tie-ins,

drilling rigs and the construction, commissioning and start-up of new

and expanded facilities).

Although Paramount believes that the expectations reflected in such

forward-looking information is reasonable, undue reliance should not be placed

on it as Paramount can give no assurance that such expectations will prove to be

correct. Forward-looking information is based on expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Paramount and

described in the forward-looking information. The material risks and

uncertainties include, but are not limited to:

-- fluctuations in oil, bitumen, natural gas, NGLs and other commodity

prices;

-- changes in foreign currency exchange rates and interest rates;

-- changes in costs for third party services related to the Company's

planned facilities and drilling rigs;

-- the uncertainty of estimates and projections relating to future revenue,

future production, NGLs yields, royalty rates, taxes and costs and

expenses;

-- the ability to secure adequate product processing, transportation,

fractionation, de-ethanization and storage capacity on acceptable terms;

-- operational risks in exploring for, developing and producing crude oil,

bitumen, natural gas and NGLs;

-- the ability to obtain equipment, services, supplies and personnel in a

timely manner and at an acceptable cost;

-- potential disruptions or unexpected technical or other difficulties in

designing, developing, expanding or operating new, expanded or existing

facilities (including third party facilities);

-- industry wide processing, pipeline, de-ethanization, and fractionation

infrastructure outages, disruptions and constraints;

-- risks and uncertainties involving the geology of oil and gas deposits;

-- the uncertainty of reserves and resources estimates;

-- general business, economic and market conditions;

-- the ability to generate sufficient cash flow from operations and obtain

financing at an acceptable cost to fund planned exploration, development

and operational activities and meet current and future obligations

(including costs of anticipated new and expanded facilities and other

projects and product processing, transportation, de-ethanization,

fractionation and similar commitments);

-- changes in, or in the interpretation of, laws, regulations or policies

(including environmental laws);

-- the ability to obtain required governmental or regulatory approvals in a

timely manner, and to enter into and maintain leases and licenses;

-- the effects of weather;

-- the timing and cost of future abandonment and reclamation obligations

and potential liabilities for environmental damage and contamination;

-- uncertainties regarding aboriginal claims and in maintaining

relationships with local populations and other stakeholders;

-- the outcome of existing and potential lawsuits, regulatory actions,

audits and assessments; and

-- other risks and uncertainties described elsewhere in this document and

in Paramount's other filings with Canadian securities authorities.

The foregoing list of risks is not exhaustive. For more information relating to

risks, see the section titled "RISK FACTORS" in Paramount's current annual

information form. The forward-looking information contained in this document is

made as of the date hereof and, except as required by applicable securities law,

Paramount undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise.

OIL AND GAS MEASURES AND DEFINITIONS

Equivalency Measures

This document contains disclosures expressed as "Boe/d". All oil and natural gas

equivalency volumes have been derived using the ratio of six thousand cubic feet

of natural gas to one barrel of oil. Equivalency measures may be misleading,

particularly if used in isolation. A conversion ratio of six thousand cubic feet

of natural gas to one barrel of oil is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a value

equivalency at the well head. The term "liquids" is used to represent oil and

natural gas liquids.

During the first quarter of 2014, the value ratio between crude oil and natural

gas was approximately 16:1. This value ratio is significantly different from the

energy equivalency ratio of 6:1. Using a 6:1 ratio would be misleading as an

indication of value.

Potential Sales Volumes at Kaybob

"Potential Sales Volumes" means the potential volumes of saleable natural gas

and NGLs (expressed on a combined basis in Boe/d) that could result from

processing the associated quantities of raw natural gas set out in the "Net

Paramount Raw Gas Capacity" column. These potential sales volumes should not be

construed as a projection of Paramount's Kaybob area production at or by any

particular date, as they will include some unavoidably commingled third-party

production, and are subject to a number of factors and contingencies including

the following: (a) production volumes sufficient to fill Paramount's processing

capacity will not be available in all periods and under certain conditions; (b)

during maintenance periods and at other times, the processing facilities will

not operate at design capacity; and (c) NGLs sales volumes will vary depending

on the liquids content of individual wells and the manner in which the

facilities are operated.

The potential sales volumes for each facility, other than the 6-18 Plant and

3-15 Plant (the "New Plants"), have been estimated assuming that natural gas

processing and condensate stabilization capacity is fully utilized. The

potential sales volumes for the New Plants have been estimated assuming that

natural gas processing and condensate stabilization capacity is fully utilized,

except for approximately 5,000 Bbl/d of potential sales volumes for each New

Plant related to oversized condensate stabilization capacity.

FOR FURTHER INFORMATION PLEASE CONTACT:

Paramount Resources Ltd.

J.H.T. (Jim) Riddell, President and Chief Operating Officer

B.K. (Bernie) Lee, Chief Financial Officer

(403) 290-3600

(403) 262-7994 (FAX)

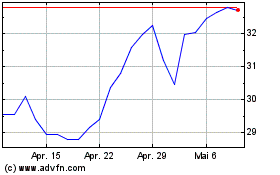

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024