Paramount Resources Ltd. Announces Upsizing and Pricing of Previously Announced Senior Notes Offering

04 Dezember 2013 - 11:06PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

The previously announced offering of Paramount's 7.625% senior unsecured notes

due 2019 (the "Senior Notes") has been upsized from $100 million to $150 million

and priced at a premium price of $1,007.50 per $1,000 principal amount. The

offering is expected to close on December 11, 2013.

The Senior Notes have not been and will not be registered under any federal or

state securities laws of the United States. Accordingly, the Senior Notes may

not be offered or sold within the United States, except in transactions exempt

from the registration requirements of the federal and applicable state

securities laws of the United States. This news release shall not constitute an

offer to sell or the solicitation of an offer to buy the Senior Notes in any

jurisdiction.

Paramount is a Canadian oil and natural gas exploration, development and

production company with operations focused in Western Canada. Paramount's Class

A Common Shares are listed on the Toronto Stock Exchange under the symbol "POU".

FOR FURTHER INFORMATION PLEASE CONTACT:

Paramount Resources Ltd.

J.H.T. (Jim) Riddell, President and Chief Operating Officer

B.K. (Bernie) Lee, Chief Financial Officer

Phone: (403) 290-3600

(403) 262-7994 (FAX)

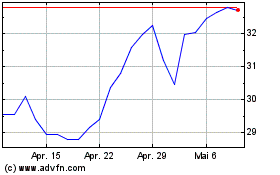

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024