Paramount Resources Ltd. (TSX:POU)

FIRST QUARTER OVERVIEW

Oil and Gas Operations

-- Average sales volumes increased 44 percent to 18,813 Boe/d in the first

quarter of 2012 from 13,097 Boe/d in the same period of 2011, with NGLs

volumes increasing by 71 percent.

-- The Company's sales volumes increased to approximately 23,000 Boe/d in

April; including 13,500 Boe/d in the Kaybob COU following the successful

re-commissioning of the 45 MMcf/d Musreau processing facility and 4,500

Boe/d in the Grande Prairie COU.

-- In the Kaybob COU, work continued on the 200 MMcf/d deep cut expansion

of the Musreau facility. Site construction is scheduled to commence in

the second half of the year.

-- Advance drilling to feed the deep cut facilities expansions at Musreau

and Smoky continued. The Company currently has an inventory of 18 net

wells with estimated first month deliverability of 26,400 Boe/d and

first year deliverability of 13,700 Boe/d.

-- In the Grande Prairie COU, construction of the Valhalla compression and

gathering system expansion to 28 MMcf/d was completed in May and

commissioning is underway.

-- The Company's first quarter netback was $22.5 million, as the 44 percent

increase in sales volumes was offset by the impact of low natural gas

prices.

-- In April, Paramount's wholly-owned subsidiary, Summit Resources, Inc.,

entered into an agreement to sell a portion of its producing properties

in North Dakota and Montana for cash proceeds of approximately US$70

million. The transaction is scheduled to close in late-May.

-- The Southern COU closed the previously announced sales of non-core

properties in Southern Alberta and Saskatchewan for total proceeds of

$49.2 million.

Strategic Investments

-- In January, the Company closed the sale of 5.0 million of its Trilogy

shares for net proceeds of $181.7 million.

-- The Company began drilling a vertical shale gas evaluation well at a

winter access location at Dunedin in Northeast British Columbia.

-- Cavalier Energy Inc. continued to focus on finalizing its regulatory

application for development of the Hoole property.

-- Fox Drilling Inc. continued the construction of two new triple-sized

walking drilling rigs, which are expected to be operational in late-

2012.

Corporate

-- Upon closing the United States property disposition in May 2012,

Paramount will have raised over $500 million since October 2011 through

equity issuances and the sale of investments and properties. Combined

with funds flow from operations, the Company has more than sufficient

capacity to fund its 2012 capital program.

-- The Company has commenced its annual credit facility renewal process and

anticipates that its current $300 million credit limit will be increased

due to reserves growth and increased asset coverage.

-- General and administrative costs per Boe decreased 34 percent in the

first quarter of 2012 to $1.77 per Boe from $2.68 in 2011.

FINANCIAL AND OPERATING HIGHLIGHTS(1)

($ millions, except as noted)

Three months ended March 31 2012 2011 % Change

----------------------------------------------------------------------------

Financial

Petroleum and natural gas sales 54.7 46.8 17

Funds flow from operations 12.8 13.9 (8)

Per share - diluted ($/share) 0.15 0.19 (21)

Net income (loss) 124.5 (11.9) 1,146

Per share - basic ($/share) 1.46 (0.16) 1,013

Per share - diluted ($/share) 1.42 (0.16) 988

Exploration and development expenditures 142.2 160.2 (11)

Investments in other entities - market

value(2) 675.6 717.6 (6)

Total assets 1,810.9 1,590.9 14

Net debt(3) 474.0 432.3 10

Common shares outstanding (thousands) 85,569 75,397 13

Operating

Sales Volumes:

Natural gas (MMcf/d) 88.6 58.7 51

NGLs (Bbl/d) 1,652 968 71

Oil (Bbl/d) 2,386 2,353 1

Total (Boe/d) 18,813 13,097 44

Average realized price:

Natural gas ($/Mcf) 2.77 4.15 (33)

NGLs ($/Bbl) 78.57 75.56 4

Oil ($/Bbl) 89.21 81.40 10

Total ($/Boe) 31.95 39.67 (19)

Net wells drilled (excluding oil sands

evaluation) 11 12 (8)

Net oil sands evaluation wells drilled 1 26 (96)

----------------------------------------------------------------------------

(1) Readers are referred to the advisories concerning non-GAAP measures and

oil and gas definitions in the "Advisories" section of this document.

(2) Based on the period-end closing prices of publicly traded enterprises

and the book value of the remaining investments.

(3) Net debt is a non-GAAP measure, it is calculated and defined in the

Liquidity and Capital Resources section of Management's Discussion and

Analysis.

----------------------------------------------------------------------------

REVIEW OF OPERATIONS

----------------------------------------------------------------------------

First Quarter Fourth Quarter

2012 2011 % Change

----------------------------------------------------------------------------

Sales Volumes

Natural Gas (MMcf/d) 88.6 91.5 (3)

NGLs (Bbl/d) 1,652 1,620 2

Oil (Bbl/d) 2,386 2,356 1

--------------------------------

Total (Boe/d) 18,813 19,223 (2)

--------------------------------

Average realized price

Natural gas ($/Mcf) 2.77 3.62 (23)

NGLs ($/Bbl) 78.57 78.08 1

Oil ($/Bbl) 89.21 93.25 (4)

--------------------------------

Total ($/Boe) 31.95 35.80 (11)

--------------------------------

% Change

Netbacks ($ millions) ($/Boe) ($/Boe) in $/Boe

Petroleum and natural gas sales 54.7 31.95 63.3 35.80 (11)

Royalties (5.3) (3.09) (5.5) (3.13) (1)

Operating expense and production

tax (21.3) (12.45) (21.2) (11.98) 4

Transportation (5.6) (3.29) (5.1) (2.88) 14

--------------------------------

Netback 22.5 13.12 31.5 17.81 (26)

Financial commodity contract

settlements (1.4) (0.84) 0.3 0.17 (594)

--------------------------------

Netback including financial

commodity contract settlements 21.1 12.28 31.8 17.98 (32)

----------------------------------------------------------------------------

Paramount's sales volumes averaged 18,813 Boe/d in the first quarter of 2012

compared to 19,223 Boe/d in the fourth quarter of 2011, primarily as a result of

the annual Bistcho plant turnaround in the Northern COU and third party

processing facility constraints at Valhalla in the Grande Prairie COU. Average

sales volumes increased to approximately 23,000 Boe/d in April as the 45 MMcf/d

Musreau plant was re-commissioned. Following start-up of the Valhalla gathering

and processing expansion and the addition of other new well production in the

second quarter, sales volumes for the remainder of the year are expected to

range between 26,000 and 28,000 Boe/d, before accounting for the impact of the

United States property disposition.

Petroleum and natural gas sales decreased by $8.6 million compared to the fourth

quarter of 2011, mainly due to a 23 percent decline in realized natural gas

prices. Operating costs per Boe increased four percent in the first quarter as

the Company incurred seasonal scheduled maintenance costs in the Northern COU

and other winter access locations. Operating costs per Boe are expected to

decrease throughout the remainder of 2012 as fixed costs are spread over higher

production volumes.

The Company is continuing to proceed with its previously announced liquids-rich

natural gas developments despite current low natural gas prices, as associated

NGLs revenues continue to support the economics of these projects. The Company

monitors the contribution from all of its properties and evaluates alternatives

to mitigate the impact of low natural gas prices.

KAYBOB

----------------

First Quarter Fourth Quarter

2012 2011 % Change

----------------------------------------------------------------------------

Sales Volumes

Natural Gas (MMcf/d) 52.7 50.8 4

NGLs (Bbl/d) 821 901 (9)

Oil (Bbl/d) 65 62 5

--------------------------------

Total (Boe/d) 9,675 9,437 3

--------------------------------

Exploration and Development

Expenditures ($ millions)

Exploration, drilling,

completions and tie-ins 40.4 69.5 (42)

Facilities and gathering 31.1 37.4 (17)

--------------------------------

71.5 106.9 (33)

--------------------------------

Gross Net Gross Net

--------------------------------

Wells drilled 6 4.5 19 12.5

----------------------------------------------------------------------------

First quarter sales volumes in the Kaybob COU averaged 9,675 Boe/d. The 45

MMcf/d processing facility at Musreau was successfully re-commissioned in

mid-March and was operating at design capacity by the end of the month. Average

sales volumes increased to approximately 13,500 Boe/d in April 2012. Sales

volumes are expected to remain near this level until the phase two deep cut

expansion of the Musreau facility is commissioned in the second half of 2013.

The Company is actively investigating opportunities to access additional

processing capacity in the region to increase production in the interim.

Phase two of the Musreau facility will be a wholly-owned incremental 200 MMcf/d

deep cut liquids extraction facility. Most of the facility's capacity will be

used to process Paramount's natural gas production and partner volumes from

joint ownership wells for a fee. The majority of the design work and procurement

of long lead-time equipment have been completed and construction is scheduled to

begin this fall upon receipt of regulatory approvals. The facility is expected

to be commissioned in the second half of 2013 at an estimated total cost of $180

million. The incremental investment in deep cut facilities will add significant

value to Paramount's natural gas production due to the price premium realized

from the sale of additional NGLs volumes that would otherwise be sold as higher

heat content natural gas.

At Smoky, Paramount is participating in the expansion of a non-operated

processing facility, increasing the Company's 10 percent share of the existing

100 MMcf/d facility to a 20 percent share of the expanded 200 MMcf/d facility,

which is being upgraded to operate as a deep cut liquids extraction facility.

The Company will have an option to participate in a further expansion of the

plant to 300 MMcf/d in the future with the addition of an incremental 100 MMcf/d

of compression.

The Kaybob COU continued its drilling program during the first quarter, with

four rigs working in Musreau and Resthaven, drilling two (1.5 net) Falher

formation wells, two (1.0 net) Dunvegan formation wells and two (2.0 net)

Montney formation wells. Results from the wells have been consistent with

expectations and further confirm well performance profiles. These wells will be

included in inventory as the Company builds production capability in advance of

completing the expansions of processing facilities. The following table

summarizes the current status of Kaybob Deep Basin wells awaiting production,

estimated additional costs to complete and anticipated production and sales

volumes:

Total

Additional

Capital Net Raw Gas Net Sales

Wells (net) Production Volumes(1)

---------------------------------------------------------------

First First First First

Month Year Month Year

---------------------------------------------------

Gross Net ($ millions) (MMcf/d) (MMcf/d) (Boe/d) (Boe/d)

Tied-in,

capable of

producing 6 3 - 18 9 4,000 2,000

Completed,

awaiting

tie-in 7 5 3 33 18 8,900 4,800

Drilled,

awaiting

completion 11 10 44 56 28 13,500 6,900

----------------------------------------------------------------------------

24 18 47 107 55 26,400 13,700

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Based on processing through a deep cut facility

The Company plans to drill up to an additional 20 wells for the remainder of

2012 with additional wells to be drilled throughout 2013 to continue to build

Paramount's well inventory ahead of the deep cut facilities expansions. The

Company continues to utilize its own facilities and third party processing

capacity to maximize production while the expansions are being constructed. In

the interim, behind pipe wells will be produced where capacity is available.

GRANDE PRAIRIE

--------------

Fourth

First Quarter Quarter

2012 2011 % Change

----------------------------------------------------------------------------

Sales Volumes

Natural Gas (MMcf/d) 16.8 19.4 (13)

NGLs (Bbl/d) 596 480 24

Oil (Bbl/d) 391 333 17

------------------------

Total (Boe/d) 3,792 4,048 (6)

------------------------

Exploration and Development Expenditures

($ millions)

Exploration, drilling, completions and

tie-ins 31.4 21.2 48

Facilities and gathering 12.5 11.2 12

------------------------

43.9 32.4 35

------------------------

Gross Net Gross Net

----------------------------------

Wells drilled 5 3.4 4 3.6

----------------------------------------------------------------------------

First quarter sales volumes in the Grande Prairie COU averaged 3,792 Boe/d

compared to 4,048 Boe/d in the fourth quarter of 2011, primarily because of

capacity restrictions at a non-operated processing facility at Valhalla. During

March, the Company re-routed its Valhalla production to a different non-operated

processing facility and sales volumes increased by approximately 9 MMcf/d. On

May 1, 2012, a disruption at a downstream third party ethane extraction facility

resulted in a partial shut-in of Paramount's production at Valhalla. This

disruption is expected to last for up to six weeks. Paramount has re-routed some

of its production to alternate facilities.

The Company was active at Valhalla during the first quarter, drilling four (2.4

net) wells, completing the construction of its compression and gathering

facilities expansion and re-routing the gathering system to an alternate

processing facility. Three (2.5 net) wells previously drilled were brought on

production late in the quarter. The Company is currently commissioning the

expansion of its gathering and compression facilities at Valhalla and will have

total raw gas capacity of 28 MMcf/d fully operational in the second quarter,

once the third party ethane extraction facility disruption has been resolved.

With the additional wells drilled to date, the Company has sufficient production

behind pipe to operate the expanded gathering system at capacity. No further

drilling is planned for the remainder of 2012.

At Karr/Gold Creek, one (1.0 net) well was drilled in the quarter, and one (1.0

net) well drilled in 2011 was brought on production. Surface equipment that had

been ordered as part of a well performance enhancement program was delivered and

installed on two (2.0 net) wells that had previously been completed but not

placed on production. The wells were brought on in April and the Company will

evaluate the results over the coming months.

SOUTHERN

------------------

First Quarter Fourth Quarter

2012 2011 % Change

----------------------------------------------------------------------------

Sales Volumes

Natural Gas (MMcf/d) 11.0 11.4 (4)

NGLs (Bbl/d) 217 216 -

Oil (Bbl/d) 1,663 1,551 7

----------------------------------

Total (Boe/d) 3,718 3,670 1

----------------------------------

Exploration and Development

Expenditures ($ millions)

Exploration, drilling,

completions and tie-ins 4.4 2.8 57

Facilities and gathering 1.4 1.3 8

----------------------------------

5.8 4.1 41

----------------------------------

Gross Net Gross Net

----------------------------------

Wells drilled 1 0.5 5 2.6

----------------------------------------------------------------------------

First quarter sales volumes in the Southern COU were consistent with the fourth

quarter of 2011. First quarter capital expenditures primarily related to an oil

well drilled and tied-in at Harmattan in Southern Alberta.

CANADA

In the first quarter, Paramount closed the previously announced dispositions of

non-core properties at West Pembina, Alberta and Kindersley, Saskatchewan for

total proceeds of $49.2 million. These properties did not have significant

production volumes.

At Chain, three (2.4 net) natural gas wells were brought on production in the

first quarter of 2012 to replace natural declines. The Company does not plan to

carry out any more drilling activities at Chain for the remainder of the year

due to the current low natural gas price environment.

The Southern COU plans to drill up to eight (7.0 net) wells in Harmattan,

Ricinis and Pembina for the remainder of 2012 targeting oil and liquids-rich

natural gas prospects.

UNITED STATES

In April 2012, Paramount's wholly-owned subsidiary, Summit Resources, Inc.

("Summit"), entered into an agreement to sell a portion of its producing

properties in North Dakota and Montana for cash proceeds of approximately US$70

million, subject to customary closing adjustments. The properties had

approximately 900 Boe/d of production in the first quarter, and include

approximately 38,000 (27,000 net) acres of land. The transaction is scheduled to

close in late-May.

The transaction does not include approximately 58,000 (41,000 net) acres of

Summit's Bakken / Three Forks lands in North Dakota with first quarter

production of approximately 200 Boe/d. Paramount and Summit are continuing the

sales process for these properties.

To view a map of the properties, please visit the following link:

http://media3.marketwire.com/docs/508pou1.pdf

NORTHERN

----------------

First Quarter Fourth Quarter

2012 2011 % Change

----------------------------------------------------------------------------

Sales Volumes

Natural Gas (MMcf/d) 8.1 9.9 (18)

NGLs (Bbl/d) 18 23 (22)

Oil (Bbl/d) 267 410 (35)

--------------------------------

Total (Boe/d) 1,628 2,068 (21)

--------------------------------

Exploration and Development

Expenditures ($ millions)

Exploration, drilling,

completions and tie-ins 18.5 3.9 374

Facilities and gathering 2.3 0.1 2,200

--------------------------------

20.8 4.0 420

--------------------------------

Gross Net Gross Net

--------------------------------

Wells drilled 2 2.0 - -

----------------------------------------------------------------------------

First quarter sales volumes in the Northern COU decreased by 21 percent in the

first quarter of 2012, primarily as a result of the annual Bistcho plant

turnaround.

The Company's first well at Birch was completed in the third quarter of 2011 and

brought on production in April 2012. Two (2.0 net) additional wells were drilled

and completed at Birch in the first quarter of 2012 and will be brought-on after

break-up. Production results from these wells will be evaluated over the coming

months.

STRATEGIC INVESTMENTS

Cavalier Energy Inc. ("Cavalier Energy") continued to build its management team

during the first quarter of 2012 with the addition of key technical personnel.

The team's efforts are focused on finalizing the regulatory application for

development of the Hoole property, which is expected to be submitted in the

fourth quarter of 2012, and developing detailed project plans for the

construction of a thermal in-situ project. Also during the quarter, Cavalier

Energy acquired 9,200 hectares of oil sands rights at a cost of $7.0 million.

SHALE GAS

The Company began drilling a vertical evaluation well at a winter access

location at Dunedin in Northeast British Columbia during the first quarter. The

targeted depth was not achieved before breakup and drilling operations have been

suspended due to warm weather. The Company will evaluate further plans prior to

the 2013 winter drilling season. The Company is taking a cautious approach to

de-risking its shale gas holdings in the current low natural gas price

environment while taking steps to maintain its mineral rights.

OUTLOOK

Paramount's annual 2012 capital spending budget, excluding land, acquisitions

and capitalized interest, is $535 million, with $475 million allocated to

exploration and development spending in the Company's core producing areas and

$60 million allocated to Strategic Investment spending. The Company has more

than sufficient capacity to fund its 2012 capital program and retains

flexibility within its current capital plan to vary spending depending upon

future economic conditions, among other factors.

First quarter 2012 exploration and development spending totaled approximately

$140 million. Planned spending of $335 million for the remainder of the year

will be focused in the Kaybob Deep Basin development, where $130 million will be

invested in the Musreau and Smoky deep cut facility expansions and $150 million

will be invested in drilling and completion activities to build an inventory of

wells to feed the new 200 MMcf/d Musreau deep cut facility. By year-end 2012,

Paramount expects to have an inventory of approximately 32 wells awaiting the

commissioning of the deep cut facilities expansions.

Strategic Investment spending for the remainder of the year will be directed to

completing the construction of two walking drilling rigs.

Following start-up of the Valhalla gathering and processing expansion and the

addition of other new well production in the second quarter, sales volumes for

the remainder of the year are expected to range between 26,000 and 28,000 Boe/d,

before accounting for the impact of the United States property disposition. The

Company's sales volumes will continue to be in this range until the deep cut

facility expansion at Musreau is fully commissioned in the second half of 2013.

Sales volumes are expected to more than double once the expansions of the

Company's Deep Basin facilities are fully operational in 2014.

ADDITIONAL INFORMATION

A copy of Paramount's complete results for the three months ended March 31,

2012, including Management's Discussion and Analysis and the unaudited Interim

Condensed Consolidated Financial Statements for the three months ended March 31,

2012 can be found at http://file.marketwire.com/release/508pou.pdf. This

information will also be made available through Paramount's website at

www.paramountres.com and SEDAR at www.sedar.com.

ABOUT PARAMOUNT

Paramount Resources Ltd. is a Canadian oil and natural gas exploration,

development and production company with operations focused in Western Canada.

Paramount's common shares are listed on the Toronto Stock Exchange under the

symbol "POU".

ADVISORIES

FORWARD-LOOKING INFORMATION

Certain statements in this document constitute forward-looking information under

applicable securities legislation. Forward-looking information typically

contains statements with words such as "anticipate", "believe", "estimate",

"expect", "plan", "intend", "propose", or similar words suggesting future

outcomes or an outlook. Forward looking information in this document includes,

but is not limited to:

-- expected production and sales volumes and the timing thereof;

-- planned exploration and development expenditures and the timing thereof;

-- exploration and development potential, plans and strategies and the

anticipated costs, timing and results thereof;

-- budget allocations and capital spending flexibility;

-- availability of facilities to process and transport natural gas

production;

-- the scope and timing of proposed new facilities and expansions to

existing facilities and the expected capacity and utilization of such

facilities;

-- the timing of the anticipated development of Paramount's oil sands,

carbonate bitumen and shale gas assets;

-- ability to fulfill future pipeline transportation commitments;

-- the anticipated costs and completion date of the two new triple-sized

walking drilling rigs;

-- ability to fulfill future pipeline transportation commitments;

-- business strategies and objectives;

-- sources of and plans for financing;

-- acquisition and disposition plans;

-- operating and other costs;

-- regulatory applications and the anticipated scope, timing and results

thereof;

-- expected drilling programs, completions, well tie-ins, facilities

construction and expansions and the timing thereof;

-- the outcome of any legal claims, audits, assessments or other regulatory

matters or proceedings;

-- the expected closing of property sales and the proceeds and timing

thereof;

-- the anticipated renewal of the Company's credit facility and the size

and timing thereof; and

-- the expected duration of the third party ethane extraction facility

disruption

Such forward-looking information is based on a number of assumptions which may

prove to be incorrect. The following assumptions have been made, in addition to

any other assumptions identified in this document:

-- future crude oil, bitumen, natural gas and NGLs prices and general

economic, business and market conditions;

-- the ability of Paramount to obtain required capital to finance its

exploration and development activities;

-- the ability of Paramount to obtain equipment, services, supplies and

personnel in a timely manner and at an acceptable cost to carry out its

activities;

-- the ability of Paramount to market its oil and natural gas successfully

to current and new customers;

-- the ability of Paramount to close expected property sales and the timing

thereof;

-- the ability of Paramount to secure adequate product processing,

transportation and storage;

-- the ability of Paramount and its industry partners to obtain drilling

success consistent with expectations, including liquids yields;

-- the timely receipt of required regulatory approvals;

-- expected timelines being met in respect of facility development and

construction projects;

-- access to capital markets and other sources of funding;

-- well economics relative to other projects; and

-- currency exchange and interest rates.

Although Paramount believes that the expectations reflected in such forward

looking information is reasonable, undue reliance should not be placed on it as

Paramount can give no assurance that such expectations will prove to be correct.

Forward-looking information is based on current expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Paramount and

described in the forward looking information. These risks and uncertainties

include, but are not limited to:

-- fluctuations in crude oil, bitumen, natural gas and NGLs prices, foreign

currency exchange rates and interest rates;

-- the uncertainty of estimates and projections relating to future revenue,

future production, liquids yields, costs and expenses and the timing

thereof;

-- the ability to secure adequate product processing, transportation and

storage;

-- the uncertainty of exploration, development and drilling activities;

-- operational risks in exploring for, developing and producing crude oil

and natural gas, and the timing thereof;

-- the ability to obtain equipment, services, supplies and personnel in a

timely manner and at an acceptable cost;

-- potential disruptions or unexpected technical difficulties in designing,

developing or operating new, expanded or existing facilities including

third party facilities;

-- risks and uncertainties involving the geology of oil and gas deposits;

-- the uncertainty of reserves and resource estimates;

-- the ability to generate sufficient cash flow from operations and other

sources of financing at an acceptable cost to meet current and future

obligations, including costs of anticipated projects;

-- changes to the status or interpretation of laws, regulations or

policies;

-- changes in environmental laws including emission reduction obligations;

-- the receipt, timing, and scope of governmental or regulatory approvals;

-- changes in economic, business and market conditions;

-- uncertainty regarding aboriginal land claims and co-existing with local

populations;

-- the effects of weather;

-- the ability to fund exploration, development and operational activities

and meet current and future obligations;

-- the timing and cost of future abandonment and reclamation activities;

-- cleanup costs or business interruptions due to environmental damage and

contamination;

-- the ability to enter into or continue leases;

-- existing and potential lawsuits and regulatory actions; and

-- other risks and uncertainties described elsewhere in this document and

in Paramount's other filings with Canadian securities authorities,

including its Annual Information Form.

The foregoing list of risks is not exhaustive. Additional information concerning

these and other factors which could impact Paramount are included in Paramount's

most recent Annual Information Form. The forward-looking information contained

in this document is made as of the date hereof and, except as required by

applicable securities law, Paramount undertakes no obligation to update publicly

or revise any forward-looking statements or information, whether as a result of

new information, future events or otherwise.

NON-GAAP MEASURES

In this document "Funds flow from operations", "Funds flow from operations - per

Boe", "Funds flow from operations per share - diluted", "Netback", "Netback

including commodity contract settlements", "Net Debt", "Exploration and

development expenditures" and "Investments in other entities - market value",

collectively the "Non-GAAP measures", are used and do not have any standardized

meanings as prescribed by Generally Accepted Accounting Principles in Canada

("GAAP").

Funds flow from operations refers to cash from operating activities before net

changes in operating non-cash working capital, geological and geophysical

expenses and asset retirement obligation settlements. Funds flow from operations

is commonly used in the oil and gas industry to assist management and investors

in measuring the Company's ability to fund capital programs and meet financial

obligations.

Netback equals petroleum and natural gas sales less royalties, operating costs,

production taxes and transportation costs. Netback is commonly used by

management and investors to compare the results of the Company's oil and gas

operations between periods. Net Debt is a measure of the Company's overall debt

position after adjusting for certain working capital amounts and is used by

management to assess the Company's overall leverage position. Refer to the

calculation of Net Debt in the liquidity and capital resources section of

Management's Discussion and Analysis. Exploration and development expenditures

refer to capital expenditures and geological and geophysical costs incurred by

the Company's COUs (excluding land and acquisitions). The exploration and

development expenditure measure provides management and investors with

information regarding the Company's Principal Property spending on drilling and

infrastructure projects, separate from land acquisition activity.

Investments in other entities - market value reflects the Company's investments

in enterprises whose securities trade on a public stock exchange at their period

end closing price (e.g. Trilogy, MEG Energy, MGM Energy and others), and

investments in all other entities at book value. Paramount provides this

information because the market values of equity-accounted investments, which are

significant assets of the Company, are often materially different than their

carrying values.

Non-GAAP measures should not be considered in isolation or construed as

alternatives to their most directly comparable measure calculated in accordance

with GAAP, or other measures of financial performance calculated in accordance

with GAAP. The Non-GAAP measures are unlikely to be comparable to similar

measures presented by other issuers.

OIL AND GAS MEASURES AND DEFINITIONS

This document contains disclosures expressed as "Boe" and "Boe/d". All oil and

natural gas equivalency volumes have been derived using the ratio of six

thousand cubic feet of natural gas to one barrel of oil. Equivalency measures

may be misleading, particularly if used in isolation. A conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the well head. The term "liquids" is used

to represent oil, natural gas liquids ("NGLs") and condensate. The term

"liquids-rich" is used to represent natural gas streams with associated liquids

volumes.

During the first quarter of 2012, the value ratio between crude oil and natural

gas was approximately 32:1. This value ratio is significantly different from the

energy equivalency ratio of 6:1. Using a 6:1 ratio would be misleading as an

indication of value.

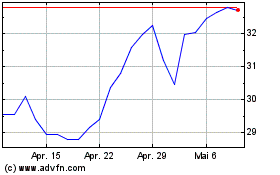

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024