Paramount Resources Ltd. (TSX:POU) ("Paramount" or the "Company") announces its

financial and operating results for the three and six months ended June 30,

2011: Second quarter 2011 average sales volumes increase 30 percent to 16,572

Boe/d.

FINANCIAL AND OPERATING HIGHLIGHTS(1)

($ millions, except as noted)

Three months ended Six months ended

June 30 June 30

2011 2010 Change% 2011 2010 Change%

----------------------------------------------------------------------------

Financial(2)

Petroleum and natural gas

sales 61.1 44.6 37 107.9 93.5 15

Funds flow from

operations(3) 23.4 25.2 (7) 37.3 48.7 (23)

Per share - diluted

($/share) 0.29 0.35 (17) 0.48 0.67 (28)

Net income (loss) 12.2 (17.5) 170 0.3 9.4 (97)

Per share - basic

($/share) 0.16 (0.24) 167 - 0.13 (100)

Per share - diluted

($/share) (0.02) (0.24) 92 (0.06) 0.13 (146)

Exploration and development

expenditures 54.5 17.9 204 214.6 84.7 153

Investments in other

entities - market value(4) 783.1 354.8 121

Total assets 1,714.5 1,145.6 50

Net debt(5) 514.1 184.9 178

Common shares outstanding

(thousands) 79,051 72,434 9

Operating

Sales volumes:

Natural gas (MMcf/d) 77.7 57.0 36 68.3 53.6 27

NGLs (Bbl/d) 1,504 821 83 1,237 798 55

Oil (Bbl/d) 2,110 2,466 (14) 2,231 2,602 (14)

Total (Boe/d) 16,572 12,787 30 14,844 12,333 20

Average realized price:

Natural gas ($/Mcf) 4.43 4.49 (1) 4.36 5.00 (13)

NGLs ($/Bbl) 83.17 77.26 8 81.66 74.82 9

Oil ($/Bbl) 95.64 69.34 38 88.44 72.57 22

Net wells drilled

(excluding oil sands

evaluation) 8 2 300 20 24 (17)

Net oil sands evaluation

wells drilled 1 - - 27 45 (40)

----------------------------------------------------------------------------

1. Readers are referred to the advisories concerning non-GAAP measures and

oil and gas definitions in the "Advisories" section of this document.

2. Paramount adopted International Financial Reporting Standards ("IFRS")

effective for fiscal years beginning on or after January 1, 2011 and the

Company has applied IFRS as of January 1, 2010 (the "Transition Date")

for comparative purposes. Certain prior period amounts have been

adjusted to reflect the changes in the Company's accounting policies.

3. The Company has adjusted its funds flow from operations measure for all

periods presented. Refer to the advisories concerning non-GAAP measures

in the "Advisories" section of this document.

4. Based on the period-end closing prices of publicly traded enterprises

and the book value of the remaining investments.

5. Net debt is a non-GAAP measure, it is calculated and defined in the

Liquidity and Capital Resources section of Management's Discussion and

Analysis.

SECOND QUARTER OVERVIEW

Funds Flow From Operations

-- Second quarter 2011 funds flow from operations was $23.4 million, $1.8

million lower than the second quarter of 2010, as the impact of higher

production and a higher netback was more than offset by higher interest,

cash payments on financial commodity contracts and other corporate

costs.

Principal Properties

-- Average sales volumes in the second quarter of 2011 increased 30 percent

to 16,572 Boe/d compared to 12,787 Boe/d in the second quarter of 2010.

Paramount's average daily sales volumes for the last two weeks of June

exceeded 20,000 Boe/d.

-- Netback increased 49 percent in the second quarter of 2011 to $34.9

million from $23.4 million in the second quarter of 2010.

-- The Kaybob corporate operating unit ("COU") increased sales volumes to

over 10,000 Boe/d in the last two weeks of June.

-- Construction of the 45 MMcf/d processing plant at Musreau is progressing

on budget with an expected start-up in October. Design work has

commenced to expand the new facility, once operational, into a 190

MMcf/d (160 MMcf/d sales gas capacity) deep cut liquids extraction plant

with an expected start-up in the second quarter of 2013.

-- At Karr-Gold Creek in the Grande Prairie COU, a 22 day shut-down of a

third-party midstream processing facility that affected approximately

1,700 Boe/d of the Company's production was resolved during May 2011 and

the Company is working to restore production from the shut-in wells.

-- Construction of the 10 MMcf/d compression and gathering system at

Valhalla was completed in June 2011 and the facility commenced

operations in July 2011.

-- In May 2011, Paramount closed the acquisition of ProspEx Resources Ltd.

("ProspEx").

Strategic Investments

-- The market value of Paramount's portfolio of investments in other oil

and gas entities increased nine percent during the second quarter of

2011 to $783.1 million.

-- In July 2011, the Company received an updated independent evaluation of

its bitumen resources within the Grand Rapids formation at the Hoole oil

sands property in which estimated economic contingent bitumen resources

increased 20 percent to 763 million barrels (Best Estimate (P50)). The

before-tax net present value of future net revenue of such economic

contingent resources, discounted at ten percent (Best Estimate (P50)),

increased 49 percent to $2.8 billion.

-- Between April 2011 and July 2011 Paramount sold its investments in the

shares of NuLoch Resources Inc. ("NuLoch") and Magnum Hunter Resources

Corporation ("Magnum Hunter") for aggregate proceeds of $15.8 million.

Corporate

-- In April 2011, Paramount closed offerings of an aggregate 1.7 million

Common Shares for gross proceeds of $54.2 million.

-- In June 2011, Paramount renewed and expanded its bank credit facility,

increasing the total credit limit to $300 million from $160 million.

REVIEW OF OPERATIONS

----------------

Three months ended June 30, 2011 March 31, 2011 Change%

----------------------------------------------------------------------------

SALES VOLUMES

Natural gas (MMcf/d) 77.7 58.7 32

NGLs (Bbl/d) 1,504 968 55

Oil (Bbl/d) 2,110 2,353 (10)

Total (Boe/d) 16,572 13,097 27

NETBACK ($/Boe)

Petroleum and natural gas sales 40.52 39.67 2

Royalties (3.46) (4.01) (14)

Operating expense and production

tax (10.40) (13.20) (21)

Transportation (3.52) (3.47) 1

-----------------------------------------

Netback 23.14 18.99 22

Financial commodity contract

settlements (0.47) (0.23) 104

-----------------------------------------

Netback including financial

commodity contract settlements 22.67 18.76 21

----------------------------------------------------------------------------

Paramount's average sales volumes increased 27 percent to 16,572 Boe/d in the

second quarter of 2011 compared to 13,097 Boe/d in the previous quarter,

primarily as a result of production increases in the Kaybob COU and the impact

of the ProspEx acquisition (June - 2,850 Boe/d, second quarter - 950 Boe/d).

Sales volumes were affected by operational disruptions in the Grande Prairie COU

where a third-party processing facility shut-in Karr-Gold Creek production for

22 days and in the Northern COU where a third-party pipeline failure affected

liquids sales volumes during the quarter. Paramount's average sales volumes

exceeded 20,000 Boe/d during the last two weeks of June.

The second quarter netback per Boe increased 21 percent compared to the previous

quarter, primarily because of lower per unit operating costs. The Company's

operating costs are normally higher in the first quarter as a result of annual

scheduled repair and maintenance programs at winter access locations in the

Northern COU.

ProspEx Acquisition

On May 31, 2011, Paramount completed the acquisition of ProspEx; paying $64.8

million in cash and issuing two million Paramount Common Shares.

Through the acquisition, Paramount added a suite of high impact liquids-rich

natural gas assets with multi-zone and horizontal drilling potential in several

zones, including the prolific Falher C zone in the Kakwa area. These assets

increase Paramount's Deep Basin land holdings in the Kakwa, Elmworth and Wapiti

areas of Alberta. The acquisition also included assets in the Pembina and

Brazeau areas and numerous drilling locations in the Birch area of north eastern

British Columbia, a liquids-rich Montney gas opportunity. In addition, the

acquisition included reserves and production from the Ricinus and Harmattan

areas of Alberta.

The following map shows Paramount's Deep Basin lands and the Deep Basin lands

added through the acquisition of ProspEx.

To view the map, please follow the link provided:

http://media3.marketwire.com/docs/802pou_map.jpg

KAYBOB

---------------

Three months ended June 30, 2011 March 31, 2011 Change%

----------------------------------------------------------------------------

Sales Volumes

Natural gas (MMcf/d) 43.5 27.7 57

NGLs (Bbl/d) 847 535 58

Oil (Bbl/d) 102 95 7

Total (Boe/d) 8,204 5,246 56

Exploration and Development

Expenditures(1) ($ millions)

Exploration, drilling, completions

and tie-ins 14.0 45.1 (69)

Facilities and gathering 4.4 34.2 (87)

---------------------------------------

18.4 79.3 (77)

Gross Net Gross Net

-------------------------------

Wells drilled 5 3 10 6

Wells placed on production - - 11 7

----------------------------------------------------------------------------

1. Before deduction of Alberta Drilling Royalty credits

Average daily sales volumes in the Kaybob COU in the second quarter of 2011

increased 56 percent to 8,204 Boe/d compared to the prior quarter, and exceeded

10,000 Boe/d in the last two weeks of June 2011. The increase in sales volumes

was primarily the result of production from new wells brought on production and

incremental production from wells added through the ProspEx acquisition.

Performance of the 11 (7.0 net) wells brought on production during 2011 has been

consistent with, or exceeded expectations.

Subsequent to quarter end, one (0.5 net) new Montney formation well was

completed and brought on production, and Paramount currently has an additional

11 (7.3 net) Dunvegan, Falher and Montney wells awaiting completion and tie-in.

The Company expects that by August 2011 it will be operating four drilling rigs

on its Deep Basin properties, drilling up to 11 (7.4 net) more wells this year,

including three (3.0 net) Montney wells. Regulatory approvals to drill up to

eight wells per section have been obtained for a total of 19 sections and

additional applications will be submitted as the development of the Company's

properties progresses.

The Company is continuing its plans to expand processing capacity in the Deep

Basin as current production levels are nearing the limit of the Company's owned

and third-party firm service processing capacity. Construction of the new 45

MMcf/d processing plant at Musreau is progressing on-budget and is now expected

to start-up in October 2011 as construction activities have been impacted by wet

weather conditions. With its continued positive drilling results, the Company

has initiated design work to expand the total capacity of the new plant, once

operational, to 190 MMcf/d (160 MMcf/d sales gas capacity) and convert it into a

deep cut liquids extraction plant. It is anticipated that this expansion will be

completed during the second quarter of 2013. The planned expansion of the

third-party processing plant at Smoky, for which Paramount has nominated for an

incremental 50 MMcf/d of processing capacity, is currently in the engineering

and design phase and is expected to be completed in mid-2013.

Paramount anticipates that by the end of 2011 it will have 55 MMcf/d of

Company-owned and firm-service third-party processing capacity at Musreau and

approximately 20 MMcf/d of Company-owned processing capacity in the

Resthaven/Smoky area. The Company will continue to utilize available excess

capacity at facilities where Paramount has ownership and utilize interruptible

capacity in third-party facilities to maximize production while additional

Company-owned capacity is being constructed.

GRANDE PRAIRIE

--------------

Three months ended June 30, 2011 March 31, 2011 Change%

----------------------------------------------------------------------------

Sales Volumes

Natural gas (MMcf/d) 12.6 13.0 (3)

NGLs (Bbl/d) 560 367 53

Oil (Bbl/d) 448 426 5

Total (Boe/d) 3,108 2,954 5

Exploration and Development

Expenditures(1) ($ millions)

Exploration, drilling, completions and

tie-ins 19.0 39.6 (52)

Facilities and gathering 9.9 20.8 (52)

-------------------------------------

28.9 60.4 (52)

Gross Net Gross Net

-----------------------------

Wells drilled 3 3 7 4

Wells placed on production 3 3 7 4

----------------------------------------------------------------------------

1. Before deduction of Alberta Drilling Royalty credits

Average sales volumes in the Grande Prairie COU increased five percent in the

second quarter of 2011 to 3,108 Boe/d compared to 2,954 Boe/d in the first

quarter of the year, despite a processing disruption at a third-party processing

facility and continued wet weather conditions.

KARR-GOLD CREEK

Sales volumes at Karr-Gold Creek were impacted by processing interruptions at a

third-party midstream facility which shut-in approximately 1,700 Boe/d of

production for 22 days during the quarter. The facility resumed service in

mid-May and production volumes are expected to increase during the remainder of

2011 as production from shut-in wells is restored and new wells are brought on

production.

Second quarter activities at Karr-Gold Creek included the drilling of one (1.0

net) well and the tie-in of two (2.0 net) wells previously drilled. The

completion of an additional three (3.0 net) wells was deferred until the third

quarter due to an extended spring break-up and wet weather that impacted

construction activities.

Construction of the second phase of the compression/dehydration facility at

Karr-Gold Creek has been completed, which brings total dehydration and

compression capacity to 40 MMcf/d of sour gas and 8 MMcf/d of sweet gas.

VALHALLA

Two (1.5 net) wells were drilled at Valhalla in the second quarter and

construction of the initial 10 MMcf/d phase of a gas gathering and compression

system was completed. The start-up of the system was deferred until July as a

result of delays in receiving third-party approvals. The Company plans to expand

the system to 20 MMcf/d by the end of 2011.

ANTE CREEK

Paramount has drilled two (1.5 net) wells to date at Ante Creek targeting oil

from the Montney formation. The first well is producing at approximately 200

Bbl/d (100 Bbl/d net), the maximum currently permitted. The second well is

planned to be completed and tied-in during the third quarter. Applications will

be made for Good Production Practice to permit wells in Ante Creek to be

produced at unrestricted rates. A third Montney oil well is expected to be

drilled later in 2011.

SOUTHERN

--------------

Three months ended June 30, 2011 March 31, 2011 Change%

----------------------------------------------------------------------------

Sales Volumes

Natural gas (MMcf/d) 10.6 8.7 22

NGLs (Bbl/d) 90 51 76

Oil (Bbl/d) 1,477 1,435 3

Total (Boe/d) 3,333 2,939 13

Exploration and Development

Expenditures(1) ($ millions)

Exploration, drilling, completions and

tie-ins 1.8 3.0 (40)

Facilities and gathering 0.5 1.8 (72)

-------------------------------------

2.3 4.8 (52)

Gross Net Gross Net

-----------------------------

Wells drilled 5 2 3 1

Wells placed on production 2 2 15 12

----------------------------------------------------------------------------

1. Before deduction of Alberta Drilling Royalty credits

Southern COU average sales volumes increased by 13 percent in the second quarter

of 2011 to 3,333 Boe/d compared to 2,939 Boe/d in the prior quarter as a result

of production additions from the ProspEx acquisition and new wells in Chain.

Second quarter 2011 activities in southern Alberta included the tie-in of two

(2.0 net) Chain area coal bed methane wells. At Enchant, the drilling of three

oil wells planned for the second quarter was deferred to the third quarter due

to rig availability.

In southern Saskatchewan, Paramount's joint development partner brought its

initial three Viking light oil wells on production. Paramount will have a

post-payout interest of 45 percent in these wells. An additional 4 (1.8 net)

wells were drilled in the second quarter and will be completed later in 2011.

In May 2011, drilling of a fourth well began under the North Dakota joint

development project.

NORTHERN

--------------

Three months ended June 30, 2011 March 31, 2011 Change%

----------------------------------------------------------------------------

Sales Volumes

Natural gas (MMcf/d) 11.0 9.3 18

NGLs (Bbl/d) 7 15 (53)

Oil (Bbl/d) 83 397 (79)

Total (Boe/d) 1,927 1,958 (2)

Exploration and Development

Expenditures(1)($ millions)

Exploration, drilling, completions and

tie-ins 2.4 9.9 76

Facilities and gathering 0.1 2.9 97

---------------------------------------------------------------------------

2.5 12.8 80

Gross Net Gross Net

-----------------------------

Wells drilled - - 2 2

Wells placed on production - - 2 2

----------------------------------------------------------------------------

1. Before deduction of Alberta Drilling Royalty credits

Average sales volumes in the Northern COU during the second quarter of 2011 were

unchanged from the first quarter of the year, as decreases in sales volumes

resulting from natural declines and a third-party pipeline failure were offset

by new production from wells brought on during the first quarter. The

third-party pipeline was shut-down at the end of April, and has not yet received

regulatory approval to resume service.

As part of the ProspEx acquisition, the Company added approximately 22,500 net

acres of undeveloped land in the Birch area of north east British Columbia,

which is prospective for a liquids-rich Montney natural gas play. In the third

quarter of 2011, Paramount expects to complete a horizontal exploratory well

that had been drilled by ProspEx.

STRATEGIC INVESTMENTS

In July 2011, Paramount received an updated independent evaluation of its

bitumen resources within the Grand Rapids formation at the Hoole oil sands

property from the Company's independent reserves evaluator, McDaniel &

Associates Consultants Ltd. ("McDaniel"), who had previously evaluated the Hoole

oil sands property effective April 30, 2010. This update was undertaken to

include the results of Paramount's 15 well 2010/2011 winter delineation drilling

program, which increased the mapped thickness of the reservoir in some areas,

confirmed the continuous nature of the reservoir and extended the boundaries of

the exploitable reservoir.

The tables below summarize McDaniel's updated evaluation of the estimated

volumes and net present values attributable to Paramount's 100 percent interest

in the economic contingent bitumen resources in the Grand Rapids formation at

Hoole as of April 30, 2011, and current estimates of initial and fully developed

production from such interests. Economic contingent bitumen resources in the

Grand Rapids formation and the associated net present values were determined

assuming a conventional Steam-Assisted Gravity Drainage development scenario.

Potentially exploitable bitumen accumulations within other prospective

formations in the Hoole oil sands properties were not included in McDaniel's

evaluation.

Economic

Contingent Fully

Resources Initial Developed

Category / Level of DEBIP(1) (2)(3) Production Production

Certainty (6) (MBbl)(4) (MBbl)(4) (Bbl/d)(5) (Bbl/d)(5)

----------------------------------------------------------------------------

High Estimate 1,821,614 952,544 27,000 105,000

Best Estimate 1,631,742 762,661 26,000 80,000

Low Estimate 1,320,406 552,094 25,000 60,000

----------------------------------------------------------------------------

1. DEBIP means Discovered Exploitable Bitumen In-Place. Discovered

Exploitable Bitumen In-Place is the estimated volume of bitumen, as of a

given date, which is contained in a subsurface stratigraphic interval of

a known accumulation that meets or exceeds certain reservoir

characteristics, such as minimum continuous net pay, porosity, and mass

bitumen content, considered necessary for the commercial application of

known recovery technologies. There is no certainty that it will be

commercially viable to produce any portion of the resources.

2. Represents the Company's share of recoverable volumes before deduction

of royalties. In the assessment of contingent resources within the Hoole

oil sands properties, McDaniel used a minimum net pay cut-off of 10

meters in the best estimate case.

3. Refer to the advisories section at the end of this document for further

information concerning contingent resources, including economic

contingent resources.

4. MBbl means thousands of barrels.

5. Bbl/d means barrels per day. Initial production means the average daily

production rate during the first year of production. Estimates of

production rates assume that production will commence in 2015 and fully

developed production will be reached in 2016 for the low estimate, 2017

for the best estimate and 2018 for the high estimate.

6. Refer to the advisories section at the end of this document for a

description of such categories.

NPV(1)of Future Net Revenue ($MM)(2)

Discounted At NPV(1)

--------------------------------------- Discounted

Category / Level of at 10%

Certainty (4) 0% 5% 8% 10% ($/Bbl)(3)

----------------------------------------------------------------------------

High Estimate 22,884 9,452 5,862 4,336 4.55

Best Estimate 16,522 6,549 3,935 2,834 3.72

Low Estimate 10,454 4,026 2,321 1,602 2.90

----------------------------------------------------------------------------

1. NPV means net present value and represents the Company's share of future

net revenue, before the deduction of income tax from the economic

contingent bitumen resources in the Grand Rapids formation within the

Hoole oil sands properties. The calculation considers such items as

revenues, royalties, operating costs, abandonment costs and capital

expenditures. Royalties have been calculated based on Alberta's Royalty

Framework applicable to oil sands projects in Alberta. The calculation

does not consider financing costs and general and administrative costs.

All NPVs are calculated assuming natural gas is used as a fuel for steam

generation. Revenues and expenditures were calculated based on

McDaniel's forecast prices and costs as of April 1, 2011.

2. $MM means millions of Canadian dollars.

3. $/Bbl means Canadian dollars per barrel.

4. Refer to the advisories section at the end of this document for a

description of such categories.

During the remainder of 2011, the Company expects to finalize its plans for the

initial development of the Hoole oil sands properties, complete the engineering

design and environmental impact analysis for the project and submit a regulatory

application for commercial development of the resource. The Company has

continued to analyze and interpret the data collected in the first quarter

drilling and delineation program, including performing a steam coreflood in

order to confirm the quality and characteristics of the reservoir.

Paramount continues to interpret the results of its winter drilling program at

Saleski, with an emphasis on the analysis of the recovered cores. Paramount has

commissioned an independent evaluation of the Saleski property, which is

expected to be received in the fourth quarter of 2011.

Paramount is developing plans to begin drilling operations on its shale gas

properties in the 2011/2012 winter drilling season, with the first well being

planned for the Dunedin area of north east British Columbia. The Company

purchased seismic data in the first quarter of 2011 covering a substantial

portion of its shale gas acreage which will be incorporated in further studies

and planning for future projects.

OUTLOOK

Paramount's 2011 annual capital spending budget (excluding land and

acquisitions) remains at $450 million, with $425 million allocated to

exploration and development spending in the Company's core producing areas and

$25 million allocated to the Hoole oil sands and Saleski carbonate bitumen

areas. The Company has flexibility within its current capital plan to increase

or decrease spending depending upon future economic conditions, among other

factors.

Average sales volumes for the last two weeks of June 2011 increased to over

20,000 Boe/d and further increases in sales volumes are expected throughout the

second half of the year as additional wells and facilities are brought on

production. A wet spring and summer, combined with disruptions at third-party

facilities, have impacted the timing of some of the Company's planned field

activities and subsequent expected production additions. The Company continues

to forecast a 2011 exit rate of approximately 28,000 Boe/d.

ADDITIONAL INFORMATION

A copy of Paramount's complete results for the three and six months ended June

30, 2011, including Management's Discussion and Analysis and the Unaudited

Interim Consolidated Financial Statements can be obtained at

http://media3.marketwire.com/docs/802pou.pdf. These documents will also be made

available through Paramount's website at www.paramountres.com and SEDAR at

www.sedar.com.

ABOUT PARAMOUNT

Paramount is a Canadian oil and natural gas exploration, development and

production company with operations focused in Western Canada. Paramount's common

shares are listed on the Toronto Stock Exchange under the symbol "POU".

ADVISORIES

Forward-looking Information

Certain statements in this document constitute forward-looking information under

applicable securities legislation. Forward-looking information typically

contains statements with words such as "anticipate", "believe", "estimate",

"expect", "plan", "intend", "propose", or similar words suggesting future

outcomes or an outlook. Forward looking information in this document includes,

but is not limited to:

-- expected production volumes and the timing thereof;

-- planned exploration and development expenditures, and the timing

thereof;

-- development plans for Paramount's oil sands leases and the projected

timeline for finalizing such plans;

-- exploration and development plans and strategies;

-- budget allocations and capital spending flexibility;

-- adequacy of facilities to process natural gas production;

-- estimated resources and the undiscounted and discounted net present

value of future net revenues from such resources (including the forecast

prices and costs and the timing of expected production volumes and

future development capital);

-- estimated initial and fully developed production from the oil sands

leases and the timing thereof;

-- timing of regulatory applications;

-- ability to fulfill future pipeline transportation commitments;

-- undeveloped land lease expiries;

-- timing and cost of future abandonment and reclamation;

-- business strategies and objectives;

-- sources of and plans for financing;

-- acquisition and disposition plans;

-- operating and other costs and royalty rates;

-- expected drilling programs, well tie-ins, facility construction and

expansions, completions and the timing thereof; and

-- the outcome of any legal claims, audits, assessments or other regulatory

matters or proceedings.

Such forward-looking information is based on a number of assumptions which may

prove to be incorrect. The following assumptions have been made, in addition to

any other assumptions identified in this document:

-- future crude oil, bitumen and natural gas prices and general economic

and business conditions;

-- the ability of Paramount to obtain required capital to finance its

exploration, development and operations;

-- the ability of Paramount to obtain equipment, services, supplies and

personnel in a timely manner to carry out its activities;

-- the ability of Paramount to market its oil and natural gas successfully

to current and new customers;

-- estimates of input and labour costs for an oil sands project;

-- the ability of Paramount to secure adequate product transportation and

storage;

-- the ability of Paramount and its industry partners to obtain drilling

success consistent with expectations;

-- the timely receipt of required regulatory approvals;

-- estimated timelines being met in respect of the development of the Hoole

oil sands properties;

-- access to capital markets and other sources of funding; and

-- currency exchange and interest rates.

Although Paramount believes that the expectations reflected in such forward

looking information is reasonable, undue reliance should not be placed on it as

Paramount can give no assurance that such expectations will prove to be correct.

Forward-looking information is based on current expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Paramount and

described in the forward looking information. These risks and uncertainties

include, but are not limited to:

-- fluctuations in crude oil, bitumen, natural gas and NGLs prices, foreign

currency exchange rates and interest rates;

-- the uncertainty of estimates and projections relating to future revenue,

future production, costs and expenses and the timing thereof;

-- the ability to secure adequate product processing, transportation and

storage;

-- the uncertainty of exploration, development and drilling;

-- operational risks in exploring for, developing and producing crude oil

and natural gas, and the timing thereof;

-- the ability to obtain equipment, services, supplies and personnel in a

timely manner;

-- potential disruption or unexpected technical difficulties in designing,

developing or operating new or existing facilities;

-- risks and uncertainties involving the geology of oil and gas deposits;

-- the uncertainty of reserves and resource estimates;

-- the ability to generate sufficient cash flow from operations and other

sources of financing at an acceptable cost to meet current and future

obligations, including costs of anticipated projects;

-- changes to the status or interpretation of laws, regulations or

policies;

-- changes in environmental laws including emission reduction obligations;

-- the receipt and timing of governmental or regulatory approvals;

-- changes in general business and economic conditions;

-- uncertainty regarding aboriginal land claims and co-existing with local

populations;

-- the effects of weather;

-- the ability to fund exploration, development and operational activities

and meet current and future obligations;

-- the timing and cost of future abandonment and reclamation activities;

-- cleanup costs or business interruptions due environmental damage and

contamination;

-- the ability to enter into or continue leases;

-- existing and potential lawsuits and regulatory actions; and

-- other risks and uncertainties described elsewhere in this document and

in Paramount's other filings with Canadian securities authorities,

including its Annual Information Form.

The foregoing list of risks is not exhaustive. Additional information concerning

these and other factors which could impact Paramount are included in Paramount's

most recent Annual Information Form. The forward-looking information contained

in this document is made as of the date hereof and, except as required by

applicable securities law, Paramount undertakes no obligation to update publicly

or revise any forward-looking statements or information, whether as a result of

new information, future events or otherwise.

Non-GAAP Measures

In this document "Funds flow from operations", "Funds flow from operations per

share - diluted", "Netback", "Netback including financial commodity contract

settlements", "Net Debt", "Exploration and development expenditures" and

"Investments in other entities - market value", collectively the "Non-GAAP

measures", are used and do not have any standardized meanings as prescribed by

Canadian Generally Accepted Accounting Principles ("GAAP").

The Company has adjusted its funds flow from operations measure for all periods

subsequent to the Transition Date to exclude asset retirement obligation

settlements, cash outflows related to the purchase of Paramount's Common Shares

under the Company's stock incentive plan and the effect of changes in foreign

exchange rates in respect of foreign currency cash and cash equivalent balances.

Funds flow from operations refers to cash from operating activities before net

changes in operating working capital, geological and geophysical expenses and

asset retirement obligation settlements. Funds flow from operations is commonly

used in the oil and gas industry to assist management and investors in measuring

the Company's ability to finance capital programs and meet financial

obligations.

Netback equals petroleum and natural gas sales less royalties, operating costs,

production taxes and transportation costs. Netback is commonly used by

management and investors to compare the results of the Company's oil and gas

operations between periods. Net Debt is a measure of the Company's overall debt

position after adjusting for certain working capital amounts and is used by

management to assess the Company's overall leverage position. Refer to the

calculation of Net Debt in the liquidity and capital resources section of

Management's Discussion and Analysis. Exploration and development expenditures

refers to capital expenditures incurred by the Company's COUs (excluding land

and property acquisitions). The exploration and development expenditure measure

provides management and investors with information regarding the Company's

Principal Property spending on drilling and infrastructure projects, separate

from land and property acquisition activity.

Investments in other entities - market value reflects the Company's investments

in enterprises whose securities trade on a public stock exchange at their period

end closing price (e.g. Trilogy Energy Corp., MEG Energy Corp., MGM Energy Corp.

and others), and all other investments in other entities at book value.

Paramount provides this information in its MD&A because the market values of

equity-accounted investments, which are significant assets of the Company, are

often materially different than their carrying values.

Non-GAAP measures should not be considered in isolation or construed as

alternatives to their most directly comparable measure calculated in accordance

with GAAP, or other measures of financial performance calculated in accordance

with GAAP. The Non-GAAP measures are unlikely to be comparable to similar

measures presented by other issuers.

Oil and Gas Measures and Definitions

This document contains disclosure expressed as "Boe" and "Boe/d". All oil and

natural gas equivalency volumes have been derived using the ratio of six

thousand cubic feet of natural gas to one barrel of oil. Equivalency measures

may be misleading, particularly if used in isolation. A conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the well head.

This document contains disclosure of certain results of an updated independent

evaluation of the Company's contingent bitumen resources from the Grand Rapids

formation within the Company's Hoole oil sands property as of April 30, 2011 by

McDaniel (the "McDaniel Evaluation"). "Contingent resources" are those

quantities of bitumen resources estimated, as of a given date, to be potentially

recoverable from known accumulations using established technology or technology

under development, but are classified as a resource rather than a reserve due to

one or more contingencies, such as the absence of regulatory approvals, detailed

design estimates or near term development plans. There is no certainty that it

will be commercially viable to produce any portion of the contingent resources.

For Paramount, contingencies which must be overcome to enable the

reclassification of bitumen contingent resources as reserves include

finalization of plans for the initial development of the Hoole oil sands

properties, regulatory application submission with no major issues raised,

access to capital markets and other sources of funding, and intent to proceed by

Paramount evidenced by a development plan with major capital expenditures.

"Economic contingent resources" are those contingent bitumen resources that are

currently economically recoverable based on specific forecasts of commodity

prices and costs. There is no certainty that it will be commercially viable to

produce any portion of the economic contingent resources. "Best estimate" is

considered to be the best estimate of the quantity of resources that will

actually be recovered. It is equally likely that the actual remaining quantities

recovered will be greater or less than the best estimate. Those resources that

fall within the best estimate have a 50 percent confidence level that the actual

quantities recovered will equal or exceed the estimate. "Low estimate" is

considered to be a conservative estimate of the quantity of resources that will

actually be recovered. It is likely that the actual remaining quantities

recovered will exceed the low estimate. Those resources at the low end of the

estimate range have the highest degree of certainty - a 90 percent confidence

level - that the actual quantities recovered will equal or exceed the estimate.

"High estimate" is considered to be an optimistic estimate of the quantity of

resources that will actually be recovered. It is unlikely that the actual

remaining quantities of resources recovered will meet or exceed the high

estimate. Those resources at the high end of the estimate range have a lower

degree of certainty - a 10 percent confidence level - that the actual quantities

recovered will equal or exceed the estimate. The volume of economic contingent

resources disclosed represents the Company's share of recoverable volumes before

the deduction of royalties.

This document contains certain disclosures of net present values ("NPV") from

the McDaniel Evaluation. The NPVs disclosed represent the Company's share of

future net revenue, before the deduction of income tax from the economic

contingent bitumen resources in the Grand Rapids formation within the Hoole oil

sands properties. The calculation considers such items as revenues, royalties,

operating costs, abandonment costs and capital expenditures. Royalties were

calculated based on Alberta's Royalty Framework applicable to oil sands projects

in Alberta. The calculation does not consider financing costs and general and

administrative costs. The NPVs were calculated assuming natural gas is used as a

fuel for steam generation. Revenues and expenditures were calculated based on

McDaniel's forecast prices and costs as of April 1, 2011. The estimated net

present value of economic contingent resources disclosed does not represent fair

market value.

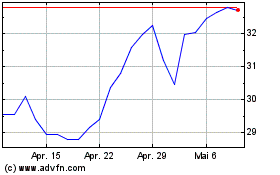

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024