Paramount Resources Ltd.: Financial and Operating Results for the Three and Six Months Ended June 30, 2008

08 August 2008 - 2:33AM

Marketwired Canada

Paramount Resources Ltd. (TSX:POU) ("Paramount" or the "Company") announces its

financial and operating results for the three and six months ended June 30,

2008.

FINANCIAL AND OPERATING HIGHLIGHTS (1)

($ millions, except as noted)

Three Months Ended Six Months Ended

June 30 March 31 June 30 June 30

2008 2008 Change% 2008 2007 Change%

----------------------------------------------------------------------------

Financial

Petroleum and

natural gas sales 102.9 77.0 34 179.9 159.7 13

Funds flow from

operations (2) 46.3 24.2 91 70.5 56.0 26

Per share -

diluted ($/share) 0.68 0.36 89 1.04 0.78 33

Net earnings

(loss) (31.9) (38.0) 16 (69.9) 654.9 (111)

Per share -

diluted ($/share) (0.47) (0.56) 16 (1.03) 9.15 (111)

Capital

expenditures(3) 10.5 64.1 (84) 74.6 165.4 (55)

Investments (4) 467.7 387.3 21 467.7 355.3 32

Total assets 1,193.6 1,217.0 (2) 1,193.6 1,897.6 (37)

Net debt (5) 48.0 75.9 37 48.0 (145.4) 133

Common shares

outstanding

(thousands) 67,739 67,693 - 67,739 70,937 (5)

----------------------------------------------------------------------------

Operating

Sales volumes:

Natural gas

(MMcf/d) 67.7 65.8 3 66.7 87.3 (24)

Oil and NGLs

(Bbl/d) 3,611 3,811 (5) 3,711 3,598 2

Total (Boe/d) 14,895 14,775 1 14,835 18,129 (18)

Gas weighting 76% 74% - 75% 80% -

Total wells

drilled (gross) 8 28 (71) 36 105 (66)

----------------------------------------------------------------------------

(1) Readers are referred to the advisories concerning non-GAAP measures and

barrels of oil equivalent conversions under the heading "Advisories" in

this document.

(2) The six months ended June 30, 2007 have been reclassified by $4.9

million for a foreign exchange collar settlement to conform to the

current year presentation.

(3) Exploration and development capital expenditures only.

(4) Based on the period-end closing prices of publicly traded enterprises

and book value of the remaining investments.

(5) Net debt, a non-GAAP measure, excludes risk management assets and

liabilities and stock-based compensation liabilities. Prior period

comparative amounts have been restated to conform to the current year

presentation.

Second Quarter Overview

- Funds flow from operations increased by 91 percent to $46.3 million in the

second quarter from $24.2 million in the first quarter due to higher realized

commodity prices offset by higher payments on commodity contract settlements.

- The Company reported a net loss of $31.9 million in the second quarter of 2008

compared to net loss of $38.9 million for the first quarter. Current quarter

pre-tax earnings included $66.7 million of mark-to-market losses on commodity

contracts and stock based compensation charges.

Principal Properties

- Second quarter netback increased by $33.0 million from the first quarter to

$67.8 million, largely due to higher realized commodity prices and lower

operating expenses.

- Received regulatory approval to drill up to 4 wells per section on 62 sections

of land in Kaybob and added approximately $20 million to Kaybob's 2008 capital

budget to drill an additional 11 (6.1 net) wells.

- Initiated a process to explore the sale of properties in the Cameron Hills,

Bistcho Lake, Negus, and Larne areas in Alberta and the Northwest Territories.

On July 29, 2008, the initial bidding process closed, the Company is presently

evaluating the bidding results.

- Continued to dispose of non-core assets and evaluate the potential sale of

other non-core properties.

Strategic Investments

- Purchased $5.1 million of additional lands.

- Continued participation in Trilogy's dividend reinvestment plan increasing

ownership to 21.4 percent as of June 30, 2008.

- During July 2008, commenced construction of a third drilling rig expected to

be in service in 2009.

- In July 2008, invested $12.3 million in 22.4 million common shares of MGM

Energy, pursuant to MGM Energy's public offering. Paramount maintained a 16.7

percent equity ownership following the transaction.

Corporate

- Interest and financing charges for the six months ended June 30, 2008

decreased to $5.1 million from $25.9 million for the prior year comparable

period on lower average debt levels.

OUTLOOK UPDATE

Paramount's annual production guidance will be updated pending resolution of the

process to explore the sale of certain properties in Northern and confirmation

of sustained incremental production rates from Southern's North Dakota drilling

program.

Paramount's 2008 exploration and development capital budget has been increased

by $20 million to drill and equip an additional 11 (6.1 net) wells in Kaybob. As

a result, 2008 exploration and development capital spending is expected to be

$150 million (excluding land).

ADDITIONAL INFORMATION

A copy of Paramount's complete results for the three and six months ended June

30, 2008, including Management's Discussion and Analysis and Unaudited Interim

Consolidated Financial Statements can be obtained at

http://media3.marketwire.com/docs/807pouq2.pdf. This report will also be made

available through Paramount's website at www.paramountres.com and SEDAR at

www.sedar.com .

ABOUT PARAMOUNT

Paramount is a Canadian oil and natural gas exploration, development and

production company with operations focused in Western Canada. Paramount's common

shares are listed on the Toronto Stock Exchange under the symbol "POU".

ADVISORIES

NON-GAAP MEASURES

In this document, Paramount uses the term "funds flow from operations", "funds

flow from operations per share - diluted" and "net debt", collectively the

"Non-GAAP measures", as indicators of Paramount's financial performance. The

Non-GAAP measures do not have standardized meanings prescribed by GAAP and,

therefore, are unlikely to be comparable to similar measures presented by other

issuers. "Funds flow from operations" is commonly used in the oil and gas

industry to assist management and investors in measuring the Company's ability

to finance capital programs and meet financial obligations, and refers to cash

flows from operating activities before net changes in operating working capital.

"Funds flow from operations" includes distributions and dividends received on

securities held by Paramount. The most directly comparable measure to "funds

flow from operations" calculated in accordance with GAAP is cash flows from

operating activities. "Funds flow from operations" can be reconciled to cash

flows from operating activities by adding (deducting) the net change in

operating working capital as shown in the consolidated statements of cash flows.

Refer to the calculation of net debt in the Liquidity and Capital Resources

section of Management's Discussion and Analysis. The calculation of net debt has

been changed to exclude risk management assets and liabilities and stock based

compensation liabilities because both are highly volatile and are settled in

future periods. Management of Paramount believes that the Non-GAAP measures

provide useful information to investors as indicative measures of performance.

Investors are cautioned that the Non-GAAP Measures should not be considered in

isolation or construed as alternatives to their most directly comparable measure

calculated in accordance with GAAP, as set forth above, or other measures of

financial performance calculated in accordance with GAAP.

FORWARD-LOOKING INFORMATION

Certain statements included in this document constitute forward-looking

statements or information under applicable securities legislation.

Forward-looking statements or information typically contain statements with

words such as "anticipate", "believe", "expect", "plan", "intend", "estimate",

"propose", or similar words suggesting future outcomes or statements regarding

an outlook. Forward-looking statements or information in this document include,

but are not limited to: business strategies and objectives, capital

expenditures, reserve quantities and the undiscounted and discounted present

value of future net revenues from such reserves, anticipated tax liabilities,

future production levels, exploration and development plans and the timing

thereof, abandonment and reclamation plans and costs, acquisition and

disposition plans, operating and other costs and royalty rates.

Such forward-looking statements or information are based on a number of

assumptions which may prove to be incorrect. The following assumptions have been

made, in addition to any other assumptions identified in this document:

- the ability of Paramount to obtain required capital to finance its

exploration, development and operations;

- the ability of Paramount to obtain equipment, services and supplies in a

timely manner to carry out its activities;

- the ability of Paramount to market its oil and natural gas successfully to

current and new customers;

- the timing and costs of pipeline and storage facility construction and

expansion and the ability of Paramount to secure adequate product

transportation;

- the ability of Paramount and its industry partners to obtain drilling success

consistent with expectations;

- the timely receipt of required regulatory approvals;

- currency, exchange and interest rates; and

- future oil and gas prices.

Although Paramount believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue reliance should

not be placed on forward-looking statements because Paramount can give no

assurance that such expectations will prove to be correct. Forward-looking

statements or information are based on current expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Paramount and

described in the forward-looking statements or information. These risks and

uncertainties include but are not limited to:

- the ability of Paramount's management to execute its business plan;

- the risks of the oil and gas industry, such as operational risks in exploring

for, developing and producing crude oil and natural gas and market demand for

oil and gas;

- the ability of Paramount to obtain required capital to finance its

exploration, development and operations and the adequacy and costs of such

capital;

- fluctuations in oil and gas prices, foreign currency exchange rates and

interest rates;

- risks and uncertainties involving the geology of oil and gas deposits;

- risks inherent in Paramount's marketing operations, including credit risk;

- the uncertainty of reserves estimates and reserves life;

- the value and liquidity of Paramount's investments in other entities and the

returns on such investments;

- the uncertainty of estimates and projections relating to exploration and

development costs and expenses;

- the uncertainty of estimates and projections relating to future production and

the results of exploration, development and drilling;

- potential delays or changes in plans with respect to exploration or

development projects or capital expenditures;

- the availability of future growth prospects and Paramount's expected financial

requirements;

- Paramount's ability to obtain equipment, services, supplies and personnel in a

timely manner to carry out its activities;

- Paramount's ability to enter into or continue leases;

- health, safety and environmental risks;

- Paramount's ability to secure adequate product transportation and storage;

- imprecision in estimates of product sales and the anticipated revenues from

such sales;

- the ability of Paramount to add production and reserves through development

and exploration activities;

- weather conditions;

- the possibility that government laws, regulations or policies may change or

governmental approvals may be delayed or withheld;

- uncertainty in amounts and timing of royalty payments and changes to royalty

regimes and government regulations regarding royalty payments;

- changes in taxation laws and regulations and the interpretation thereof;

- changes in environmental laws and regulations and the interpretation thereof;

- the cost of future abandonment activities and site restoration;

- the ability to obtain necessary regulatory approvals;

- risks associated with existing and potential future law suits and regulatory

actions against Paramount;

- uncertainty regarding aboriginal land claims and co-existing with local

populations;

- loss of the services of any of Paramount's executive officers or key employees;

- the impact of market competition;

- general economic and business conditions; and

- other risks and uncertainties described elsewhere in this document or in

Paramount's other filings with Canadian securities authorities and the United

States Securities and Exchange Commission.

The forward-looking statements or information contained in this news release are

made as of the date hereof and Paramount undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, unless so required by

applicable securities laws.

OIL AND GAS ADVISORY

This news release contains disclosure expressed as "Boe" and "Boe/d" All oil and

natural gas equivalency volumes have been derived using the ratio of six

thousand cubic feet of natural gas to one barrel of oil. Equivalency measures

may be misleading, particularly if used in isolation. A conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the well head.

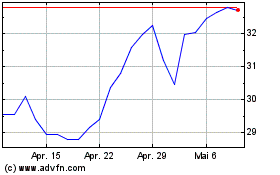

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024