NOT FOR DISTRIBUTION TO U.S. NEWS SERVICES OR

DISSEMINATION IN THE UNITED STATES

Premium Brands Holdings Corporation (TSX:PBH), a leading producer,

marketer and distributor of branded specialty food products,

announced today that it has signed a definitive agreement to

purchase substantially all of the assets and operating divisions of

Seattle based Oberto Sausage Company.

Oberto is one of North America’s leading

manufacturers of beef jerky and other protein based snack foods,

which it sells under its Oberto, Pacific Gold, Pacific Gold Reserve

and Cattleman’s Cut brands. The company was founded in 1918

by Mr. Constantino Oberto and later led by Constantino’s son Mr.

Art Oberto who, along with other family members, still own it

today.

The transaction is expected to close within the

next four to six weeks and is subject to customary closing

conditions including regulatory approvals such as expiration or

termination of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act.

“We are very pleased to be welcoming the Oberto

organization into our group. Its values, culture, loyal

employees and talented management team are an ideal fit for

us. Furthermore, we are very excited about being entrusted

with the iconic Oberto brand, which we have followed and admired

for many years,” said Mr. George Paleologou, President and CEO of

Premium Brands.

“This transaction will create a leading North

American platform in the rapidly growing meat snacks product

category and will feature Canada’s top meat snack brands, including

McSweeney’s, Grimm’s, Freybe, Piller’s and Harvest, as well as

Oberto’s iconic family of brands and our fast emerging, U.S. based

Hempler’s brand. I have no doubt that both Oberto and our

legacy businesses will benefit from each other’s respective

strengths.

“Oberto will be our third major investment in

Washington State. Our two prior ones: sandwich maker SK Food

Group and premium processed meats producer Hempler Foods Group,

have both prospered under the Premium Brands umbrella with their

combined sales growing from under US$130 million in 2011 to over

US$560 million last year. We fully expect Oberto to replicate

this type of success by combining its current strengths with access

to our various resources,” added Mr. Paleologou.

“We are very excited to be joining the Premium

Brands group. Its entrepreneurial culture and respect for the

uniqueness of its individual businesses, combined with its focus on

quality, innovation and long term decision making makes Premium

Brands a perfect fit for our business,” said Mr. Tom Hernquist, CEO

of Oberto. “Furthermore, we are also very excited about

accelerating the growth of our business by accessing the resources

and abilities of Premium Brands, including its Canadian

distribution channels, product development expertise and supply

chain infrastructure,” added Mr. Hernquist.

“We are very proud of what we have achieved over

the past 100 years as a family owned and operated business and it

was an extremely difficult decision to make as to what would be the

best next step in the evolution of Oberto. We wanted to

ensure that we found a partner that would not only honor the

traditions, values and most importantly, the people, that are at

the heart of Oberto’s success; but also one that shared our vision

for its future,” said Mr. Art Oberto. “My family and I have

been very impressed with how Hempler’s and SK Food Group have

thrived under the Premium Brands umbrella and do not doubt that

they are the right partner to take us forward.”

“We are also pleased to announce that we

increased our investment in Vancouver based McLean Meats Inc. to

66.2% percent from the previous 36.2%,” said Mr. Paleologou.

“McLean is a niche marketer and supplier of branded, high quality,

preservative free and organic processed meats to foodservice and

retail customers across Canada,” added Mr. Paleologou.

The combined purchase price for the Company’s

investments in Oberto and McLean is approximately $237 million

while the combined revenues of the two businesses are approximately

$246 million. These transactions are expected to be

immediately accretive to both Premium Brands’ earnings per share

and free cash flow per share for 2018.

Cody Peak Advisors acted as financial advisor to

Oberto.

Equity Financing

Concurrent with the Oberto acquisition, Premium

Brands entered into an agreement with a syndicate of underwriters

co-led by CIBC Capital Markets, Scotiabank, BMO Capital Markets and

Cormark Securities Inc. (collectively, the "Underwriters"),

pursuant to which the Company will issue on a "bought-deal"

basis, 1,280,000 subscription receipts (the “Subscription

Receipts”) at a price of $117.35, (the “Offering”), for gross

proceeds of approximately $150 million. The Company has also

granted the Underwriters an over-allotment option to purchase up to

an additional 192,000 Subscription Receipts (or, in certain

circumstances, common shares), on the same terms, exercisable in

whole or in part at any time for a period of up to 30 days

following closing of the Offering, to cover over-allotments, if

any. The net proceeds of the Offering will be used to partially

finance the acquisition of Oberto.

Each Subscription Receipt represents the right

of the holder to receive, upon closing of the Oberto acquisition,

without payment of additional consideration, one common share of

Premium Brands plus an amount per common share equal to the amount

per common share of Premium Brands of any dividends for which

record dates have occurred during the period from the closing date

of the Offering to the date immediately preceding the closing date

of the Oberto acquisition, less withholding taxes, if any. Closing

of the Offering is expected to occur on or about May 2, 2018. The

Offering is subject to normal regulatory approvals, including

approval of the Toronto Stock Exchange.

The Subscription Receipts will be offered in

each of the provinces and territories of Canada by way of a short

form prospectus, and by way of private placement in the United

States to "qualified institutional buyers" pursuant to Rule 144A or

in such a manner as to not require registration under the United

States Securities Act of 1933, as amended.

About Premium Brands

Premium Brands owns a broad range of leading

specialty food manufacturing and differentiated food distribution

businesses with operations in British Columbia, Alberta,

Saskatchewan, Manitoba, Ontario, Quebec, Nova Scotia, California,

Nevada, Ohio, Arizona, Minnesota, Mississippi and Washington

State. The Company services a diverse base of customers

located across North America and its family of brands and

businesses include Grimm’s, Harvest, McSweeney’s, Piller’s, Freybe,

SJ Fine Foods, McLean Meats, Expresco, Belmont Meats, Leadbetter,

Skilcor, The Meat Factory, Hempler’s, Isernio’s, Fletcher’s U.S.,

Direct Plus, Country Prime Meats, Audrey’s, SK Food Group,

OvenPride, Bread Garden Go, Hygaard, Quality Fast Foods, Deli Chef,

Buddy’s Kitchen, Raybern’s, Creekside Bakehouse, Stuyver’s

Bakestudio, Island City Baking, Shaw Bakers, Partners Crackers,

Conte Foods, Larosa Foods, Gourmet Chef, Duso’s, Centennial

Foodservice, B&C Food Distributors, Shahir, Wescadia, Harlan

Fairbanks, Maximum Seafood, Ocean Miracle, Hub City Fisheries,

Diana’s Seafood, C&C Packing, Premier Meats, Interprovincial

Meat Sales and Frandon Seafoods.

For further information, please contact George

Paleologou, President and CEO or Will Kalutycz, CFO at (604)

656-3100.

www.premiumbrandsholdings.com

The securities to be offered have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or under any state securities laws, and may not be

offered, sold, directly or indirectly, or delivered within the

United States of America and its territories and possessions or to,

or for the account or benefit of, United States persons except in

certain transactions exempt from the registration requirements of

such Act. This release does not constitute an offer to sell or a

solicitation to buy such securities in the United States, Canada or

in any other jurisdiction where such offer is unlawful.

Forward Looking Statements

This press release contains forward looking

statements with respect to the Company, including its business

operations, strategy and financial performance and condition. These

statements generally can be identified by the use of forward

looking words such as "may", "could", "should", "would", "will",

"expect", "intend", "plan", "estimate", "project", "anticipate",

"believe" or "continue", or the negative thereof or similar

variations.

Although management believes that the

expectations reflected in such forward looking statements are

reasonable and represent the Company's internal expectations and

belief as of April 12, 2018, such statements involve unknown risks

and uncertainties beyond the Company's control which may cause its

actual performance and results in future periods to differ

materially from any estimates or projections of future performance

or results expressed or implied by such forward looking

statements.

Some of the factors that could affect future

results and could cause results to differ materially from those

expressed in the forward-looking statements contained herein

include: (i) changes in the cost of raw materials used in the

production of the Company’s products; (ii) seasonal and/or weather

related fluctuations in the Company’s sales; (iii) changes in

consumer discretionary spending resulting from changes in economic

conditions and/or general consumer confidence levels; (iv) changes

in the cost of finished products sourced from third party

manufacturers; (v) changes in the Company’s relationships with its

larger customers; (vi) access to commodity raw materials; (vii)

potential liabilities and expenses resulting from defects in the

Company’s products; (viii) changes in consumer food product

preferences; (ix) competition from other food manufacturers and

distributors; (x) execution risk associated with the Company’s

growth and business restructuring initiatives; (xi) risks

associated with the Company’s business acquisition strategies;

(xii) changes in the value of the Canadian dollar relative to the

U.S. dollar; (xiii) new government regulations affecting the

Company’s business and operations; (xiv) the Company’s ability to

raise the capital needed to fund its growth initiatives; (xv) labor

related issues including potential disputes with employees

represented by labor unions and labor shortages; (xvi) the loss

and/or inability to attract key senior personnel; (xvii)

fluctuations in the interest rates associated with the Company’s

funded debt; (xviii) failure or breach of the Company’s information

systems; (xix) financial exposure resulting from credit extended to

the Company’s customers; (xx) the malfunction of critical equipment

used in the Company’s operations; (xxi) livestock health issues;

(xxii) international trade issues; and (xxiii) changes in

environmental, health and safety standards. Details on these risk

factors as well as other factors can be found in the Company's 2017

MD&A, which is filed electronically through SEDAR and is

available online at www.sedar.com.

Unless otherwise indicated, the forward looking

statements in this document are made as of April 12, 2018 and,

except as required by applicable law, will not be publicly updated

or revised. This cautionary statement expressly qualifies the

forward looking statements in this press release.

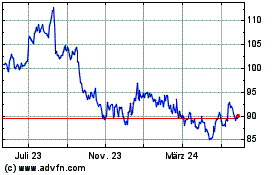

Premium Brands (TSX:PBH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

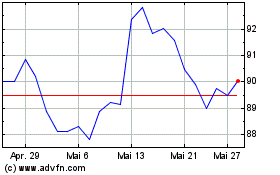

Premium Brands (TSX:PBH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024