Osisko Mining Inc. (TSX:OSK) (the "

Corporation" or

"

Osisko") today announces that the Toronto Stock

Exchange (the “

TSX”) has approved the

Corporation’s notice of intention to make a normal course issuer

bid (the “

NCIB Program”). Under the terms of the

NCIB Program, Osisko may acquire up to 36,465,404 of its common

shares (“

Common Shares”) from time to time in

accordance with the normal course issuer bid procedures of the TSX.

The normal course issuer bid will be conducted

through the facilities of the TSX or alternative trading systems,

if eligible, and will conform to their regulations. Purchases under

the normal course issuer bid will be made by means of open market

transactions or such other means as a securities regulatory

authority may permit, including pre-arranged crosses, exempt offers

and private agreements under an issuer bid exemption order issued

by a securities regulatory authority.

Repurchases under the NCIB Program may commence

on January 2, 2024 and will terminate on January 1, 2025 or on such

earlier date as the NCIB Program is complete. Daily purchases will

be limited to 191,304 Common Shares, other than block purchase

exemptions, representing 25% of the average daily trading volume of

the Common Shares on the TSX for the six-month period ending

November 30, 2023, being 765,219 Common Shares.

The price that the Corporation may pay for any

Common Shares purchased in the open market under the NCIB Program

will be the prevailing market price at the time of purchase (plus

any brokerage fees) and any Common Shares purchased by the

Corporation will be cancelled. In the event that the Corporation

purchases Common Shares by pre-arranged crosses, exempt offers,

block purchases or private agreements, the purchase price of the

Common Shares may be, and will be in the case of purchases by

private agreements, as may be permitted by the securities

regulatory authority, at a discount to the market price of the

Common Shares at the time of acquisition.

The board of directors of Osisko believes that

the underlying value of the Corporation may not be reflected in the

market price of the Common Shares from time to time and that,

accordingly, the purchase of Common Shares will increase the

proportionate interest in the Corporation of, and be advantageous

to, all remaining shareholders of the Corporation.

As of December 19, 2023, there were 370,797,070

Common Shares issued and outstanding. The 36,465,404 Common Shares

that may be repurchased under the NCIB Program represent

approximately 10% of the public float of the Corporation as of

December 19, 2023, being 364,654,047 Common Shares.

During the prior NCIB Program of the

Corporation, which will end on January 1, 2024, the Corporation

obtained approval to purchase 29,053,640 Common Shares, and

actually purchased 13,992,324 Common Shares at a weighted average

price of approximately $2.93 per Common Share through the

facilities of the TSX and alternative trading systems in

Canada.

Osisko has appointed Canaccord Genuity Corp. to

make any purchases under the NCIB Program on its behalf.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused

on the acquisition, exploration, and development of precious metal

resource properties in Canada. Osisko holds a 50% interest in the

high-grade Windfall gold deposit located between Val-d'Or and

Chibougamau in Québec and holds a 50% interest in a large area of

claims in the surrounding Urban Barry area and nearby Quévillon

area (over 2,300 square kilometres).

Cautionary Note Regarding Forward-Looking

Information

This news release contains forward-looking

statements. These forward-looking statements, by their nature,

require the Corporation to make certain assumptions and necessarily

involve known and unknown risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in these forward-looking statements. Words such as "may", "will",

"would", "could", "expect", "believe", "plan", "anticipate",

"intend", "estimate", "continue", or the negative or comparable

terminology, as well as terms usually used in the future and the

conditional, are intended to identify forward-looking statements

including the fact that the Corporation "expects", "plans",

"anticipates", "believes", "intends", "estimates", "projects",

"potential", "scheduled" and similar expressions or variations

(including negative variations), or that events or conditions

"will", "would", "may", "could" or "should" occur including,

without limitation, statements about the board of directors of

Osisko's belief that the NCIB Program is advantageous to

shareholders and that underlying value of the Corporation may not

be reflected in the market price of the Common Shares, the

Corporation's intentions regarding the NCIB Program and whether the

Corporation will receive the requisite acceptance of the TSX in

respect of the NCIB Program. Although Osisko believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements involve known and

unknown risks, uncertainties and other factors and are not

guarantees of future performance and actual results may accordingly

differ materially from those in forward looking statements. Factors

that could cause the actual results to differ materially from those

in forward-looking statements include, without limitation:

fluctuations in the prices of the commodities; fluctuations in the

value of the Canadian dollar relative to the U.S. dollar;

regulatory changes by national and local government, including

corporate law, permitting and licensing regimes and taxation

policies; continued availability of capital and financing and

general economic, market or business conditions; business

opportunities that become available to, or are pursued by Osisko;

other uninsured risks. The forward looking statements contained in

this news release are based upon assumptions management believes to

be reasonable, including, without limitation: the ability of

exploration activities (including drill results) to accurately

predict mineralization; errors in management's geological

modelling; the ability of Osisko to complete further exploration

activities, including drilling; property interests in the Windfall

gold project; the ability of the Corporation to obtain required

approvals and complete transactions on terms announced; the results

of exploration activities; risks relating to mining activities; the

global economic climate; metal prices; dilution; environmental

risks; and community and non-governmental actions. Although the

forward-looking information contained in this news release is based

upon what management believes, or believed at the time, to be

reasonable assumptions. Osisko cannot assure shareholders and

prospective purchasers of securities of the Corporation that actual

results will be consistent with such forward-looking information,

as there may be other factors that cause results not to be as

anticipated, estimated or intended, and neither Osisko nor any

other person assumes responsibility for the accuracy and

completeness of any such forward-looking information, Osisko does

not undertake, and assumes no obligation, to update or revise any

such forward-looking statements or forward-looking information

contained herein to reflect new events or circumstances, except as

may be required by law.

For further information on Osisko please contact:

John BurzynskiChief Executive OfficerTelephone:

(416) 363-8653

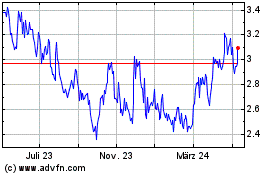

Osisko Mining (TSX:OSK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

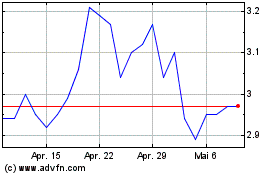

Osisko Mining (TSX:OSK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024