Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF)

(“Orezone” or “Company”) is pleased to report the results of its

Phase II Expansion and Updated Life-of-Mine Feasibility Study

(“2023 Study”) for its 90%-owned Bomboré Gold Mine, located in

central Burkina Faso.

Bomboré achieved commercial production of its

Phase I oxide plant in December 2022, which has operated

successfully above nameplate to produce 76,783oz of gold at an

All-In Sustaining Cost1 (“AISC”) of $1,006/oz sold in H1-2023. The

planned expansion at Bomboré from a processing rate of 5.9 million

tonnes per annum (“Mtpa”) to 10.3Mtpa will deliver a significant

increase in gold production at a low incremental capital cost.

Construction of the new standalone 4.4Mtpa hard rock processing

facility will enable Bomboré to produce an average of 209,000oz/yr

at an AISC of $1,121/oz. First gold from the hard rock plant is

scheduled for Q3-2025.

Bomboré 2023 Study Highlights

(at Base Case gold price of $1,750/oz)

-

After-tax NPV5% of $635.9M with rapid payback

-

Mine-life of 11.3 years with gold production totalling 2.11Moz

-

Conventional open pit mining at a low strip ratio of less than

2:1

-

Phase II hard rock plant capital costs of $167.5M

-

Average annual gold production of 231,000oz in the first three full

years after expansion at an AISC of $1,081/oz

Patrick Downey, President and CEO, commented:

“The Bomboré 2023 Expansion and Updated Life-of-Mine feasibility

study marks a major milestone in the growth of Orezone. The updated

study highlights a material step-change in the mine’s future

production profile, while maintaining a low overall cost structure.

Furthermore, based on ongoing drilling results, we see excellent

opportunities to continue to add higher grade resources and

reserves that should enhance the production profile in future

years.

With the continued support of our senior lender,

Coris Bank International, the Company expects to finance the

construction of the hard rock plant using a combination of debt and

free cash flow from current operations.

Following the commissioning of the oxide plant

in December 2022, on-time and under budget, and providing strong

operational results through its first operating year, Orezone

remains well positioned to deliver this next stage of brownfield

growth at Bomboré. The parallel hard rock plant will be constructed

at a modest capital cost as compared to a greenfield project as it

will utilize many of the existing systems and infrastructure

already in place including connection to the national electrical

grid by the end of 2023.

Mining will continue as conventional open pit

with a low overall strip ratio. We will use our operational and

management experience in working with local mining contractors over

the past two years to further enhance optimization in this

area.

We now have firm bids and delivery times for

several long lead pieces of equipment including the SAG mill and we

intend to conclude evaluation and place orders for this equipment

in Q4-2023. Full construction is expected to commence in Q1-2024

subject to financing and board approval.

The Phase II Expansion will create several

hundred new employment opportunities during construction on top of

the 2,400 direct local jobs that currently support existing

operations. Once complete, the expansion will also create further

long-term local employment and promote further investment in

community programs and livelihood restoration projects that aim to

improve the lives of local residents while providing a larger

source of tax and royalty revenue for Burkina Faso.”

Idrissa Nassa, CEO of Coris Bank International,

commented: “We congratulate Orezone on the release of a robust

expansion study, and look forward to maintaining our close

partnership with the Company and supporting the next stage of

growth at Bomboré.”

Lycopodium Minerals Canada Ltd. ("Lycopodium")

of Toronto, Canada was the lead 2023 Study consultant (Process

Engineering and Overall Study Manager), supported by P&E Mining

Consultants Inc. (Mineral Resource Estimates), Knight Piésold Pty

Limited of Perth, Australia (Tailings and Water Management), AMC

Mining Consultants (Canada) Ltd. ("AMC") of Vancouver, Canada

(Mineral Reserves and Mining), and Africa Label Group Inc. (Social

& Environmental).

CONFERENCE

CALL AND

WEBCAST

The Company will host a conference call and

webcast to further discuss the Bomboré 2023 Study results. To

participate, please use the following dial-in phone numbers or join

the webcast using the link below:

Webcast

|

Date: |

Thursday, October 12th |

|

Time: |

7:00 am Pacific Time (10:00 am Eastern time) |

|

|

|

Please register for the webcast here: Orezone

2023 Study Conference Call and Webcast

Conference Call

|

Toll-free in U.S. and Canada: |

1-800-715-9871 |

|

International callers: |

+646-307-1963 |

|

Event ID: |

4944136 |

|

|

|

A copy of the presentation will be available on

the Company’s website.

2023 Study Summary

Table 1 – Summary of 2023 Study Results

(starting Q2-2023)

|

Description |

Unit |

Value |

|

Base Case Gold Price |

US$/oz |

1,750 |

|

Mine Life |

yr |

11.3 |

|

Total Ore Tonnes Mined |

Mt |

95.7 |

|

Total Waste Tonnes Mined |

Mt |

187.6 |

|

Strip Ratio |

Waste:Ore |

1.96 |

|

Consolidated Mill Throughput |

Mtpa |

10.3 |

|

Oxide Plant Throughput |

Mtpa |

5.9 |

|

Hard Rock Plant Throughput |

Mtpa |

4.4 |

|

LOM Gold Production |

Moz |

2.11 |

|

LOM Average Gold Production |

oz/yr |

186,000 |

|

Phase II first 3 years |

oz/yr |

231,000 |

|

Unit Operating Costs |

$/t processed |

19.60 |

|

Cash Costs |

$/oz |

1,070 |

|

LOM AISC |

$/oz |

1,122 |

|

Phase II first 3 years |

$/oz |

1,081 |

|

Sustaining capex |

$M |

101.0 |

|

Growth capex |

$M |

57.7 |

|

Phase II Hard Rock Expansion capex |

$M |

167.5 |

|

Pre-tax NPV (5%) |

$M |

844.2 |

|

After-tax NPV (5%) |

$M |

635.9 |

|

|

|

|

|

Note: 9M-2023 based on average gold price of $1,900/oz |

|

|

Figure 1 – Bomboré 2023 LOM Production

and Cost Profile (starting Q2-2023)

Figure 2 – Bomboré Mine Layout and

Infrastructure

Comparison of 2023 Study to 2019

Feasibility Study

The results of the 2023 Study supersede the 2019

Feasibility Study (“2019 FS”). The 2023 Study incorporates the

following main scope changes from the 2019 FS:

-

Increased Resource Cut-off Grades: The applied

cut-off grades utilized for the primary oxide and fresh rock units

in the 2023 Mineral Resource calculation have increased a

respective 25% and 18% relative to that utilized in the 2019 FS, as

a result of global inflation and realized costs achieved

to-date.

-

Expanded Mineral Reserve Base: Total gold content

of Proven and Probable mineral reserves now stand at 2.4Moz, which

factoring for mine depletion to the end of Q1-2023, marks a 37%

increase relative to the 1.8Moz outlined in the 2019 FS. The

increase in mineral reserves is supported by over 100,000m of

additional drilling.

-

Increased Mill Throughput: The 2019 FS was based

on an initial oxide mill design throughput of 5.2Mtpa, reducing to

3.0Mtpa upon the commissioning of a partially integrated 2.2Mtpa

hard rock mill in Year 3. In contrast, the 2023 Study maintains the

current 5.9Mtpa oxide mill throughput but envisions the

commissioning of an independent and upsized 4.4Mtpa hard rock plant

in Year 3 (2025).Overall, expanded mill throughput of 10.3Mtpa

under the 2023 Study is 98% higher than the 5.2Mtpa throughput

outlined in the 2019 FS.

-

Reduced Hard Rock Leach Time: Additional

metallurgical test work conducted in 2023 confirmed a 24hr leach

time versus the 48hr leach time utilized in the 2019 FS. The faster

leach kinetics contributes to lower capital and operating costs,

and further de-risks project execution as the hard rock

Carbon-in-Leach (“CIL”) circuit will duplicate the existing oxide

CIL circuit.

-

Expanded Production Profile: The expanded mineral

reserve base and increased annual mill throughput have led to

higher LOM and annual gold production. At the full processing rate

of 10.3Mtpa, the 2023 Study outlines an average production profile

of 209,000oz/yr over the first 8 years, a 70% increase relative to

the 123,00oz/yr in the 2019 FS.

MINERAL RESOURCE AND MINERAL

RESERVE

Gold mineralization on the Property is

predominantly hosted in the Bomboré Shear Zone, a major structure

within a 50km long northeast-southwest trending greenstone belt.

The updated mineral resource estimate has an effective date of

March 28, 2023 and was completed by P&E Mining Consultants Inc.

The updated mineral resource is based on a total of 601,795m of

drilling, and excludes material mined up to the effective date, as

well as excluding stockpiles.

Table 2 – Bomboré Mineral Resource

Estimate as of March 28, 2023

|

|

Measured |

Indicated |

Measured and Indicated |

Inferred |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

Mt |

Au g/t |

Au koz |

Mt |

Au g/t |

Au koz |

Mt |

Au g/t |

Au koz |

Mt |

Au g/t |

Au koz |

|

Oxide |

16.4 |

0.59 |

312 |

72.9 |

0.56 |

1,311 |

89.3 |

0.57 |

1,623 |

3.3 |

0.57 |

60 |

|

Hard Rock |

11.1 |

1.09 |

389 |

78.8 |

0.99 |

2,503 |

89.9 |

1.00 |

2,892 |

16.7 |

1.02 |

549 |

|

Total |

27.5 |

0.79 |

701 |

151.7 |

0.78 |

3,814 |

179.3 |

0.78 |

4,515 |

20.0 |

0.95 |

610 |

|

|

|

See the end of news release for associated footnotes for the above

table. |

|

|

The updated mineral reserve estimate was

completed by AMC with an effective date of March 28, 2023. Orezone

developed new re-blocked mine models for each of the resource block

models accounting for internal dilution and mining recoveries. AMC

applied appropriate modifying factors for conversion of mineral

resources to mineral reserves. Those factors include amongst

others, weathering profiles, operating costs, and pit slope angles.

Cut-off grade determinations for block assignments (ore versus

waste) were based on a gold price of $1,500/oz. Mine planning

included standard procedures of optimization, design and

scheduling.

Table 3 – Bomboré Mineral Reserve

Estimate as of March 28, 2023

|

|

Proven |

Probable |

Proven & Probable |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

|

|

Mt |

Au g/t |

Au koz |

Mt |

Au g/t |

Au koz |

Mt |

Au g/t |

Au koz |

|

Oxide |

6.2 |

0.62 |

124 |

50.5 |

0.55 |

897 |

56.7 |

0.56 |

1,020 |

|

Hard Rock |

3.3 |

1.29 |

137 |

35.6 |

1.00 |

1,144 |

38.9 |

1.02 |

1,281 |

|

Oxide Stockpiles |

- |

- |

- |

7.9 |

0.40 |

102 |

7.9 |

0.40 |

102 |

|

Total |

9.5 |

0.86 |

261 |

94.0 |

0.71 |

2,143 |

103.5 |

0.72 |

2,403 |

|

|

|

See the end of news release for associated footnotes for the above

table. |

|

|

MINE PLAN AND PRODUCTION

SUMMARY

The 2023 Study is based on an annual ore feed

rate of 10.3Mtpa with delivery of higher-grade ore in the earlier

years. The open pit operation will continue with mining contractors

utilizing backhoe excavators and rear-dump haul trucks. The pit

design is based on 6m benches in oxide ore to be mined in two 3m

flitches with berm widths varied according to the recommended

geotechnical parameters. In hard rock ore, mining will take place

on 3m flitches stacked to 12m in the final pit walls. The oxide

material is soft and free digging with minimal blasting while the

hard rock material will be mined using conventional drill and blast

mining methods. Mining rate will peak at 30Mt per year.

Multiple open pits will be mined over a strike

of 14km which provides flexibility in ore scheduling. The mine plan

was developed to satisfy physical and practical constraints

including consideration for access to new mining areas, a

sustainable production profile, limits on vertical advance rates

and practical use of low-grade ore stockpiling. The high-grade P17S

pits have been prioritized and will be mined from 2025 to 2028. The

LOM strip ratio is 1.96:1 with waste placed either in dumps or used

in tailings facility construction.

Figure 3 – Mining Schedule (starting

Q2-2023)

MINERAL PROCESSING

The Bomboré oxide plant is currently processing

material at a rate of 5.9Mtpa which is 0.7Mtpa above nameplate

design. From the truck dump hopper, the soft oxide and upper

transition ore is introduced into a mineral sizer via an inclined

apron feeder and then fed by conveyor into a single stage 3.2MW

ball mill in closed circuit with hydrocyclones to produce a grind

size of 80% passing 125µm. The CIL leach residence time is 21

hours. Gold recovery is 92% for oxide ore and 89% for upper

transition ore.

The new 4.4Mtpa hard rock plant is designed to

process fresh and lower transition material to achieve a grind size

of 80% passing 75µm. Metallurgical test work conducted in 2023 has

concluded that the optimal grind size is 80% passing 75µm and that

gold recovery is independent of head grade. With oxygen addition, a

24-hour leach time is sufficient. Gold recovery is 86% for lower

transition ore, 95% for P17S ore, 84% for P8P9 fresh ore, and 82%

for all other fresh ore.

The new comminution circuit will include a

primary jaw crusher, a 24-hour crushed ore stockpile, a single

stage 18MW twin pinion SAG mill, hydrocyclones for product size

classification and space for a potential future pebble crusher.

Cyclone overflow will report to trash removal screens and then into

a 29m diameter thickener. The slurry will be thickened to 45%

solids and pumped to the CIL circuit. The new CIL circuit will be

identical to the existing CIL circuit and will include an oxygen

plant. Carbon will be processed in a new 12-tonne carbon elution

circuit and the existing carbon kiln will be utilized for carbon

regeneration. Two new electrowinning cells will be installed and

the existing gold room and refinery will be used to produce gold

doré bars.

Extensive metallurgical test work has been

completed on Bomboré ore to confirm plant design parameters. The

most recent testing of fresh ore characterization and gold recovery

was completed by Maelgwyn Mineral Services Africa in Q1-2023.

Comminution test work data has been compiled from a total of 42 Axb

tests and 43 BWi tests and Orway Mineral Consultants have provided

recommendations on the design of the grinding circuit.

Figure 4 – Processing Schedule (starting

Q2-2023)

Figure 5 – Existing 5.9Mtpa Oxide Plant

and New 4.4Mtpa Hard Rock Plant Layout

Figure 6 – 4.4Mtpa Hard Rock Plant

Flowsheet

PROJECT INFRASTRUCTURE

The Bomboré Mine benefits from a strong mining

culture and excellent local infrastructure. Burkina Faso also has

an expanding pool of available mining contractors, suppliers, and

skilled labour. In addition, the mine is favourably situated only

85km from the capital city of Ouagadougou, accessed by a 5km

all-weather road connecting to the main sealed highway (RN4) that

runs between the capital and the coast. In addition, construction

of the neighbouring Kiaka Mine is underway and Bomboré is expected

to benefit from synergies including the use of common

contractors.

Resettlement Action Plan

("RAP")

RAP Phases II and III follows the successful

completion of Phase I RAP and involves the construction of three

new resettlement villages (MV3, MV2, and BV2). Phase II is

well-advanced with the construction of MV3 sequenced as the first

village to construct in order to gain access to mining areas that

are currently contemplated in the 2024 mine plan. MV3 is the

largest of the resettlement villages and requires the erection of

over 1,200 private homes and public structures.

A RAP Phase IV is planned to accommodate an

increased footprint to the mining lease and includes the

resettlement of approximately 330 households. This resettlement

will be performed progressively over 2024 through to 2027.

Tailings Storage Facility

The existing tailings storage facility is fully

lined with a pump out decant system. The facility is designed to be

raised in stages over the mine life with downstream embankment

construction techniques using run-of-mine waste rock. The capacity

of the tailings storage facility will be expanded from 70Mt to

128Mt, which is sufficient for the current mineral reserves plus

future potential.

Power Supply

The project to connect Bomboré to Burkina Faso’s

national grid is progressing well and remains on schedule for

completion before the end of 2023. ECG Engineering Pty Ltd. (“ECG”)

is managing the design, construction, and commissioning of the new

high voltage transmission line and dedicated substations, and has

been working closely with SONABEL, Burkina Faso’s state-owned

electricity company, to ensure timely deliverables and adherence to

schedule. ECG is a specialized engineering firm that has

successfully delivered on similar projects in West Africa,

including Burkina Faso. All major equipment and materials have

shipped, and installations are progressing on schedule.

Water Supply

Raw water is currently sourced from the seasonal

Nobsin River and diverted by a weir into an existing 5.2Mm3

off-channel reservoir (“OCR”). A pit in the P8P9 orebody has been

selected for early excavation to serve as a second 1.8Mm3 reservoir

which will store sufficient water for the expanded plant

throughput.

PROJECT ECONOMICS

Operating Costs

The life of mine AISC is estimated at $1,122/oz

using a base case gold price of $1,750/oz and a USD to XOF exchange

rate of 600. Electrical grid power is projected to reduce energy

costs to $0.21/kWh from the current $0.62/kWh which is based on

diesel generation. Contract mining has been selected as the basis

for open pit mining activities, to be managed by the Bomboré

operation team, and costs are based on contractor proposals.

Processing cost estimates are life of mine averages and include

various annual blends of oxide, transition and fresh ores as mill

feed, incorporating the associated reagent consumptions, work

indices, abrasion indices, and power requirements.

Table 4 – Operating Costs Summary (Oxide

& Hard Rock)

|

Description |

Total Costs ($M) |

$/tonne milled |

$/ounce |

|

Mining |

840.2 |

8.12 |

398 |

|

Processing |

945.6 |

9.13 |

448 |

|

Site G&A |

242.9 |

2.35 |

115 |

|

Refining and transport |

5.8 |

0.06 |

3 |

|

Government royalties |

222.3 |

2.15 |

105 |

|

Total Cash Costs |

2,256.7 |

21.80 |

1,070 |

|

Sustaining capital |

101.0 |

0.98 |

48 |

|

Rehabilitation and closure |

19.1 |

0.18 |

9 |

|

Salvage Value |

(9.9) |

(0.10) |

(5) |

|

All-in Sustaining Cost |

2,367.0 |

22.87 |

1,122 |

|

|

|

|

|

Hard Rock Expansion Project Capital

Costs

The capital cost of the Phase II Expansion

Project is estimated at $167.5M. The capital cost estimate was

compiled by Lycopodium and is based on Q3-2023 pricing. The

estimate is deemed to have an accuracy of ±15%.

Table 5 – Hard Rock Plant Expansion

Capital

|

Description |

Total Costs ($M) |

|

Process Plant |

81.0 |

|

Infrastructure |

13.2 |

|

Construction Indirects |

14.5 |

|

Owner’s Cost (including EPCM) |

47.7 |

|

Subtotal |

156.5 |

|

Contingency |

11.0 |

|

Total Expansion Capital Costs |

167.5 |

|

|

|

Sustaining Capital Costs

Sustaining capital costs include ongoing

tailings storage facility raises, haul road extensions, grade

control drills, and mine dewatering and surface water management

equipment.

Closure cost includes the remediation work

required to return the site to meet all conditions of the

Environmental and Social Impact Assessment.

Table 6 – Sustaining Capital &

Closure Costs (Oxide & Hard Rock)

|

Description |

Total Costs ($M) |

|

Plant |

2.1 |

|

Infrastructure |

87.0 |

|

Mining |

8.4 |

|

General & Administration |

3.6 |

|

Total Sustaining Capital Costs |

101.0 |

|

Reclamation and Closure |

19.1 |

|

Salvage Value |

(9.9) |

|

Total Sustaining Capital and Closure Costs |

110.3 |

|

|

|

Growth Capital Costs

Growth capital includes the grid power

connection project that will be completed in Q4-2023, RAP Phases II

& III, that are currently underway and will be completed in

2024, and RAP Phase IV that will be performed progressively over

2024 through to 2027.

Table 7 – Growth Capital

|

Description |

Total Costs ($M) |

|

Grid Power |

16.3 |

|

RAP Phases II & III (underway) |

23.0 |

|

RAP Phase IV |

18.4 |

|

Total Growth Capital Costs |

57.7 |

|

|

|

Economic Analysis

Table 8 – Simplified Financial Model

(Base Case Gold Price of US$1,750/oz, 100% basis)

|

Description |

9M-2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

|

Oxide |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mill Throughput (Mt) |

4.3 |

5.9 |

5.9 |

5.9 |

5.9 |

5.9 |

5.9 |

5.9 |

5.9 |

5.9 |

5.9 |

1.3 |

|

Gold Grade (g/t) |

0.78 |

0.74 |

0.71 |

0.53 |

0.46 |

0.45 |

0.47 |

0.44 |

0.51 |

0.47 |

0.49 |

0.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hard Rock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mill Throughput (Mt) |

|

|

1.1 |

4.4 |

4.4 |

4.4 |

4.4 |

4.4 |

4.4 |

4.4 |

4.4 |

2.6 |

|

Gold Grade (g/t) |

|

|

1.21 |

1.33 |

1.14 |

1.12 |

1.02 |

1.08 |

1.08 |

0.95 |

0.70 |

0.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxide + Hard Rock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold Production (koz) |

98 |

128 |

161 |

257 |

219 |

216 |

201 |

202 |

215 |

194 |

167 |

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financials |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue ($M) |

185.6 |

224.1 |

281.5 |

449.7 |

382.9 |

377.4 |

352.1 |

352.7 |

375.7 |

339.9 |

292.2 |

90.7 |

|

Operating Costs ($M) |

103.3 |

105.3 |

147.9 |

234.2 |

248.2 |

230.9 |

216.0 |

218.8 |

215.8 |

218.9 |

220.7 |

96.6 |

|

Sustaining Capital ($M) |

8.0 |

7.0 |

15.9 |

18.0 |

7.7 |

8.8 |

7.5 |

7.7 |

8.4 |

8.9 |

3.1 |

0.0 |

|

Growth Capital ($M) |

26.7 |

22.8 |

3.6 |

4.7 |

|

|

|

|

|

|

|

|

|

Hard Rock Exp. Capital ($M) |

|

83.6 |

83.9 |

|

|

|

|

|

|

|

|

|

|

Pre-tax Cash Flow ($M) |

23.9 |

(21.8) |

11.2 |

214.1 |

136.9 |

147.9 |

120.4 |

122.0 |

160.5 |

114.4 |

94.5 |

10.1 |

|

After-tax Cash Flow ($M) |

5.4 |

(48.7) |

(18.1) |

168.8 |

114.1 |

122.2 |

97.9 |

100.7 |

132.6 |

98.3 |

92.6 |

10.1 |

|

|

|

Note: The cash flow totals do not add as changes in working

capital (including ore stockpiles), closure costs (net of salvage

values), and corporates taxes are not shown in the above

table. |

|

|

Project Sensitivities

Table 9: After-tax

NPV5% Sensitivity to Gold

Price

|

Gold Price ($/oz) |

After-tax NPV5% ($M) |

|

1,550 |

421.8 |

|

1,650 |

529.4 |

|

1,750 (Base Case) |

635.9 |

|

1,850 |

741.0 |

|

1,950 |

846.0 |

|

|

HARD ROCK EXPANSION

SCHEDULE

The Phase II Expansion is being managed by the

same team who successfully delivered the Phase I plant on time and

under budget. The overall schedule is 24 months with the critical

path being the delivery and installation of the SAG mill. The

Company expects to place the order for the SAG mill in Q4-2023 with

early works on site expected to commence in Q1-2024.

Figure 7 – Bomboré Projects and Hard

Rock Expansion Schedule

ENHANCEMENT OPPORTUNITIES

Bomboré hosts multiple opportunities to further

expand the mine’s production profile and lower the life of mine

AISC, including:

-

Significant Exploration Upside: To date, the

primary 13km long Bomboré Shear Zone has only been drilled to an

average depth of approximately 200m. Additional drilling at depth

has the potential to materially expand the mine’s mineral resource

and reserve base which is supported by the low overall strip

ratio.In addition to multiple regional targets open to further

delineation, the emerging sub-parallel P17 Trend is a priority

target. To date, this higher-grade zone of mineralization has been

broadly traced over a strike length that exceeds 1.5km, and remains

open along strike and down-plunge. The discovery of additional

higher-grade near-surface ounces along the P17 Trend presents the

opportunity to re-sequence higher margin ounces earlier, further

improving the mine’s robust economics.

-

Reserve Expansion: The 2023 Study is based on a

project scope that focused on margin, rapid payback and an

expansion capex that was financeable. As such, mineral reserves

were calculated using a conservative gold price of $1,500/oz, which

provided the tonnage profile to support a 4.4Mtpa hard rock plant

and 11.3-year mine life. A future opportunity exists to lower the

cut-off grades using a higher gold price to expand mineral

reserves.

-

Phase III Mill Expansion: The current 4.4Mtpa hard

rock plant design allows for the future addition of a ball mill, a

pebble crusher, and an additional CIL tank. The installation of

these components, at a modest additional cost, will allow an

increase to the hard rock plant throughput to 6.0Mtpa.

-

Hydraulic Stockpile Movement: Internal testing and

studies provide preliminary support for hydraulic transport of low

and medium grade oxide stockpiles. This material could potentially

be pumped to the process plant at significantly lower cost than

conventional truck hauling.

NOTES FOR MINERAL RESOURCE ESTIMATE ON

BOMBORÉ DEPOSIT

- “Oxide” includes Regolith, Oxide

and Transitional Upper units reported at a cut-off of 0.25g/t

Au.

- “Hard Rock” includes Transitional

Lower and Fresh units reported at a cut-off of 0.45g/t Au.

- Mineral resources, which are not

mineral reserves, do not have demonstrated economic viability. The

estimate of mineral resources may be materially affected by

environmental, permitting, legal, marketing, or other relevant

issues.

- Mineral resources were estimated

using the Canadian Institute of Mining, Metallurgy and Petroleum

(CIM), CIM Standards on Mineral Resources and Reserves, Definitions

(2014) and Best Practices Guidelines (2019) prepared by the CIM

Standing Committee on Reserve Definitions and adopted by CIM

Council.

- The inferred mineral resource in

this estimate has a lower level of confidence than that applied to

an indicated mineral resource and must not be converted to a

mineral reserve. It is reasonably expected that the majority of the

inferred mineral resource could be upgraded to an indicated mineral

resource with continued exploration.

- Totals may differ due to

rounding.

- Mineral resources are reported

within an optimized pit shell at a gold price of $1,700/troy

oz.

- Mineral resources are inclusive of

mineral reserves, however, exclude ore stockpiles.

- The mineral resource estimates

include oxide grade reduction factors applied by Orezone based on

recent mine to mill reconciliation data.

NOTES FOR MINERAL RESERVE ESTIMATE ON

BOMBORÉ DEPOSIT

- CIM Definition Standards for

mineral resources and mineral reserves (CIM, 2014) were used for

reporting of mineral reserves.

- Mineral reserves are estimated

using a long-term gold price of $1,500 per troy oz for all mining

areas.

- Mineral reserves are stated in

terms of delivered tonnes and grade before process recovery.

- “Oxide” includes Regolith, Oxide,

and Upper Transition material. Hard Rock includes Lower Transition

and Fresh material.

- Mineral reserves are based on

modified re-blocked mine models with variable internal dilution and

mining recoveries.

- Mineral reserves for Block 1

(Maga), Block 2 (CFU and P8P9), Block 3 (P11), and Block 4 (Siga)

are based on marginal cut-off grades that range from 0.252 to

0.270g/t Au for Oxides, and 0.464 to 0.516g/t Au for Hard

Rock.

- Mineral reserves for mining blocks

Block 5 (P16) and Block 6 (P17S) are based on polygons developed by

Orezone delimiting oxide material averaging above 0.30g/t Au and

fresh rock above 0.50g/t Au.

- The mineral reserve estimates

include oxide grade reduction factors applied by Orezone based on

recent mine to mill reconciliation data.

- Tonnage and grade measurements are

in metric units. Contained Au is reported as troy ounces.

- Processing recovery varies by

weathering unit and location.

- Mineral resources, which are not

mineral reserves, do not have demonstrated economic viability.

- Mineral reserves are reported

effective March 28, 2023.

- Rounding of some figures might lead

to minor discrepancies in totals.

TECHNICAL

REPORT FILING

The National Instrument 43-101 Technical Report

supporting the Bomboré 2023 Study will be filed on SEDAR+ within 45

days of this news release.

QUALIFIED

PERSONS

The 2023 Study was prepared for Orezone Gold

Corporation by personnel from Lycopodium Mineral Canada Ltd. and

other industry consultants, each of whom is a "qualified person"

within the meaning of NI 43-101 and considered to be "independent"

of the Company under Section 1.5 of NI 43-101. Each Qualified

Person has reviewed and confirmed that the scientific and technical

information in this news release accurately reflects the summaries

or extracts of the NI 43-101 Technical Report for which they are

responsible.

- Lycopodium Mineral Canada Ltd.: Georgi

Doundarov, P. Eng.; and Olav Mejia, P. Eng.

- P&E Mining Consultants Inc.:

Eugene Puritch, P. Eng.; William Stone, Ph.D., P. Geo.; Jarita

Barry, P. Geo.; and Fred Brown, P. Geo.

- AMC Mining Consultants (Canada) Ltd.:

David Warren, P. Eng.

- Knight Piésold Pty. Ltd.: David

Morgan, M.Sc., MAusIMM, MIEAust

- Africa Label Group Inc.: Bright Oppong

Afum, Ph.D., M.Sc., P.Eng., MAusIMM(CP)

Pascal Marquis, Geo., Ph.D., SVP; Dale Tweed, P.

Eng., VP Engineering; and Rob Henderson, P. Eng., VP Technical

Services of Orezone, are Qualified Persons under NI 43-101 and have

reviewed and approved other scientific and technical information

contained in this news release for which the independent Qualified

Persons who prepared the NI 43-101 Technical Report are not

responsible. Messrs. Marquis, Tweed, and Henderson are not

independent within the meaning of NI 43-101.

CONTACT INFORMATION

Patrick DowneyPresident and Chief Executive

Officer

Vanessa PickeringManager, Investor Relations

Tel: 1 778 945 8977 / Toll Free: 1 888 673

0663info@orezone.com / www.orezone.com

FORWARD-LOOKING INFORMATION AND

FORWARD-LOOKING STATEMENTS:

This news release contains certain

“forward-looking information” within the meaning of applicable

Canadian securities laws. Forward-looking information and

forward-looking statements (together, “forward-looking statements”)

are frequently characterized by words such as “plan”, “expect”,

“project”, “intend”, “believe”, “anticipate”, “estimate”,

“potential”, “possible” and other similar words, or statements that

certain events or conditions “may”, “will”, “could”, or “should”

occur.

This news release contains forward-looking

statements in respect of the Bomboré Mine and the Phase II

Expansion and Updated Life-of-Mine. These include statements

regarding, among others:

- After-tax NPV5% of $635.9M with

rapid payback

- Mine-life of 11.3 years with gold

production totalling 2.11Moz

- Conventional open pit mining at a

low strip ratio of less than 2:1

- Phase II hard rock plant capital

costs of $167.5M

- Average annual gold production of

231,000oz in the first three full years after expansion at an AISC

of $1,081/oz

- Bomboré 2023 LOM Production and

Cost Profile

- Bomboré Mine Project Layout and

Infrastructure

- Project Economics, including

Operating Costs Summary, Hard Rock Plant Expansion Capital, Growth

Capital, Sustaining Capital, and Closure Costs

- Project Analysis, including the

Simplified Financial Model and Project Sensitivities

- Opportunities to continue to add to

higher grade mineral resources and reserves based on results from

the 2022 drilling program

Furthermore, statements regarding mine plan and

production; mineral processing; project infrastructure; project

economics; initial project capital costs; development and timeline

timetables; and enhancement opportunities are forward-looking

statements.

All such forward-looking statements are based on

certain assumptions and analysis made by management and qualified

persons in light of their experience and perception of historical

trends, current conditions and expected future developments, as

well as other factors management and the qualified persons believe

are appropriate in the circumstances. The forward- looking

information and statements are also based on metal price

assumptions, exchange rate assumptions, cash flow forecasts, and

other assumptions used in the 2023 Study. Readers are cautioned

that actual results may vary from those presented.

In addition, all forward-looking information and

statements are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements

including, but not limited to, use of assumptions that may not

prove to be correct, unexpected changes in laws, rules or

regulations, or their enforcement by applicable authorities; the

failure of parties to contracts to perform as agreed; social or

labour unrest; changes in commodity prices; unexpected failure or

inadequacy of infrastructure, the possibility of project cost

overruns or unanticipated costs and expenses, accidents and

equipment breakdowns, political risk (including but not limited the

possibility of one or more coup d’état), unanticipated changes in

key management personnel and general economic, market or business

conditions, the failure of exploration programs, including drilling

programs, to deliver anticipated results and the failure of ongoing

and uncertainties relating to the availability and costs of

financing needed in the future, and other factors described in the

Company’s most recent annual information form and management

discussion and analysis filed on SEDAR+. Readers are cautioned not

to place undue reliance on forward-looking information or

statements.

This news release also contains references to

estimates of mineral resources and mineral reserves. The estimation

of mineral resources is inherently uncertain and involves

subjective judgments about many relevant factors. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. The accuracy of any such estimates is a function of the

quantity and quality of available data, and of the assumptions made

and judgments used in engineering and geological interpretation,

which may prove to be unreliable and depend, to a certain extent,

upon the analysis of drilling results and statistical inferences

that may ultimately prove to be inaccurate. Mineral resource

estimates may require re-estimation based on, among other things:

(i) fluctuations in the price of gold; (ii) results of drilling;

(iii) results of metallurgical testing, process and other studies;

(iv) changes to proposed mine plans; (v) the evaluation of mine

plans subsequent to the date of any estimates; and (vi) the

possible failure to receive required permits, approvals and

licenses.

Although the forward-looking statements

contained in this news release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this news release.

The National Instrument 43-101 technical report

supporting the Bomboré 2023 Study will be filed on SEDAR+ within

the next 45 days of the date of this news release. Reference should

be made to the full text of the technical report for the

assumptions, qualifications and limitations relating thereto.

1 AISC includes operating costs, royalties,

sustaining capital, and closure costs (net of salvage values) but

excludes the costs of the Phase II hard rock plant expansion,

growth capital, and corporate G&A.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/f6fe2b21-6057-4452-b58e-e646a7e6c52ahttps://www.globenewswire.com/NewsRoom/AttachmentNg/2db95121-1dcc-432e-a4d2-45c25dc9533fhttps://www.globenewswire.com/NewsRoom/AttachmentNg/78c733c2-7587-46a3-898d-674203f155fahttps://www.globenewswire.com/NewsRoom/AttachmentNg/18653930-b3a0-43e5-95e8-9c322568210bhttps://www.globenewswire.com/NewsRoom/AttachmentNg/fd998e3a-d365-4518-b818-378641a14ae9https://www.globenewswire.com/NewsRoom/AttachmentNg/2dd162a6-bb89-47eb-b557-7748c8730239https://www.globenewswire.com/NewsRoom/AttachmentNg/9dbd9ed7-e3ca-43c7-a060-dfdb41092d24

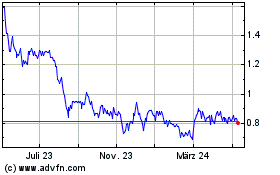

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

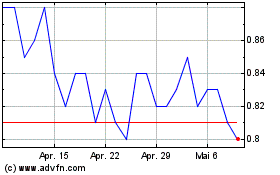

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025