Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF)

(the “Company” or “Orezone”) is pleased to report further assay

results from the maiden grade control (“GC”) reverse circulation

(“RC”) drill program at the Bomboré Gold Project, located in

Burkina Faso. GC drilling to-date is focused on near-surface oxide

mineralization within the starter pits located in the northern

portion of the mining lease. These starter pits will be the source

of higher-grade oxide mill feed for the first year of production

and are denoted as A1, A2, A3, H1, H2, and H3 (see Figure 1 below).

GC results for Pit A2 are now available and similar to Pit A1 (see

news release dated April 7, 2022 for A1 Pit GC results), are very

encouraging.

Results have returned several significant

thicker high-grade intervals where localized zones of higher grades

were intersected in several holes which collared or ended in

mineralization. Some of these zones reported remain open in several

areas (see Figures 2 and 3).

Drilling Highlights

- 4.00 m of

22.42 g/t Au from 27.00 m

- 31.00 m of

2.30 g/t Au from 0.00 m

- 31.00 m of

2.17 g/t Au from 0.00 m

- 20.00 m of

2.43 g/t Au from 11.00 m

- 18.00 m of

2.61 g/t Au from 13.00 m

- 26.00 m of

1.79 g/t Au from 5.00 m

- 31.00 m of

1.49 g/t Au from 0.00 m

- 31.00 m of

1.48 g/t Au from 0.00 m

- 31.00 m of

1.47 g/t Au from 0.00 m

- 27.00 m of

1.68 g/t Au from 0.00 m

- 2.00 m of

21.98 g/t Au from 10.00 m

- 24.00 m of

1.83 g/t Au from 0.00 m

- 25.00 m of

1.74 g/t Au from 6.00 m

- 11.00 m of

3.79 g/t Au from 17.00 m

- 24.00 m of

1.61 g/t Au from 7.00 m

- 28.00 m of

1.37 g/t Au from 3.00 m

- 18.00 m of

2.08 g/t Au from 13.00 m

- 20.00 m of

1.77 g/t Au from 0.00 m

- 7.00 m of

4.76 g/t Au from 5.00 m

- 17.00 m of

1.92 g/t Au from 0.00 m

- 17.00 m of

1.84 g/t Au from 13.00 m

- 18.00 m of

1.68 g/t Au from 8.00 m

- 18.00 m of

1.63 g/t Au from 13.00 m

- 11.00 m of

2.67 g/t Au from 7.00 m

- 9.00 m of

3.22 g/t Au from 14.00 m

- 18.00 m of

1.53 g/t Au from 3.00 m

- 9.00 m of

2.90 g/t Au from 19.00 m

- 15.00 m of

1.74 g/t Au from 10.00 m

- 10.00 m of

2.56 g/t Au from 21.00 m

- 12.00 m of

2.07 g/t Au from 4.00 m

- 12.00 m of

2.05 g/t Au from 9.00 m

- 10.00 m of

2.40 g/t Au from 21.00 m

- 5.00 m of

4.73 g/t Au from 6.00 m

- 7.00 m of

3.19 g/t Au from 8.00 m

- 5.00 m of

3.60 g/t Au from 0.00 m

- 9.00 m of

1.92 g/t Au from 22.00 m

- 11.00 m of

1.52 g/t Au from 0.00 m

- 6.00 m of

2.73 g/t Au from 5.00 m

- 4.00 m of

3.51 g/t Au from 0.00 m

Patrick Downey, President and CEO stated, “The

GC drilling results at the A2 starter pit are extremely robust and

have not only confirmed but extended the higher-grade zones within

our resource and reserve models for Bomboré. These higher-grade

zones are up to 60 m thick with average widths of 15 m to 30 m with

ore starting right at surface with several holes ending in

mineralization. These zones continue up to the A3 pit and beyond

towards the northeast, and we will now expand the GC program to

incorporate this additional area. We expect to outline an enlarged

higher-grade starter pit that will encompass all of the A1, A2, and

A3 pits. The GC program is also continuing at the H1 and H2

higher-grade starter pits in the P8/P9 area located in close

proximity to the process plant. Mining from all of these pits will

provide better grade oxide ore feed for the first 12 to 15 months

of operations. We remain on-time and on-budget for first gold in Q3

of this year and look forward to delivering strong early gold

production as supported by these impressive recent and on-going GC

results.”

Figure 1: North Pits Plan

View is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/4db5a20f-4286-4103-b69b-0e670a851168

Figure 2: Maga Area Resources and

Reserve Drilling Plan View is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/383a65d2-4fc1-49cd-b029-b1b241a2d53c

Figure 3: Maga Area Grade Control

Drilling Plan View is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/f28b5aae-e3da-43a0-a3ea-60cc06a76ee5

Figure 4: A2 Pit Resources and Reserve

Drilling Plan View is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/b3999818-f7d5-4407-9301-c0e6f2927d0e

Figure 5: A2 Pit Grade Control

Drilling Plan View is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/57ad2499-088f-45d8-bdb1-f55b7ffa651b

Table 1: A2 Starter Pit Drilling

Highlights

|

Hole# |

From(m) |

To(m) |

Length(m)* |

Grade(g/t gold) |

|

MAGA-GCA2-0337 |

27.00 |

31.00 |

4.00 |

22.42 |

|

MAGA-GCA2-0254 |

0.00 |

31.00 |

31.00 |

2.30 |

|

MAGA-GCA2-0146 |

0.00 |

31.00 |

31.00 |

2.17 |

|

MAGA-GCA2-0060 |

11.00 |

31.00 |

20.00 |

2.43 |

|

MAGA-GCA2-0132 |

13.00 |

31.00 |

18.00 |

2.61 |

|

MAGA-GCA2-0204 |

5.00 |

31.00 |

26.00 |

1.79 |

|

MAGA-GCA2-0215 |

0.00 |

31.00 |

31.00 |

1.49 |

|

MAGA-GCA2-0236 |

0.00 |

31.00 |

31.00 |

1.48 |

|

MAGA-GCA2-0247 |

0.00 |

31.00 |

31.00 |

1.47 |

|

MAGA-GCA2-0253 |

0.00 |

27.00 |

27.00 |

1.68 |

|

MAGA-GCA2-0343 |

10.00 |

12.00 |

2.00 |

21.98 |

|

MAGA-GCA2-0059 |

0.00 |

24.00 |

24.00 |

1.83 |

|

MAGA-GCA2-0216 |

6.00 |

31.00 |

25.00 |

1.74 |

|

MAGA-GCA2-0328 |

17.00 |

28.00 |

11.00 |

3.79 |

|

MAGA-GCA2-0271 |

7.00 |

31.00 |

24.00 |

1.61 |

|

MAGA-GCA2-0263 |

3.00 |

31.00 |

28.00 |

1.37 |

|

MAGA-GCA2-0163 |

13.00 |

31.00 |

18.00 |

2.08 |

|

MAGA-GCA2-0145 |

0.00 |

20.00 |

20.00 |

1.77 |

|

MAGA-GCA2-0255 |

0.00 |

31.00 |

31.00 |

1.14 |

|

MAGA-GCA2-0094 |

5.00 |

12.00 |

7.00 |

4.76 |

|

MAGA-GCA2-0270 |

0.00 |

17.00 |

17.00 |

1.92 |

|

MAGA-GCA2-0235 |

0.00 |

24.00 |

24.00 |

1.36 |

|

MAGA-GCA2-0027 |

13.00 |

30.00 |

17.00 |

1.84 |

|

MAGA-GCA2-0124 |

0.00 |

21.00 |

21.00 |

1.49 |

|

MAGA-GCA2-0077 |

0.00 |

21.00 |

21.00 |

1.48 |

|

MAGA-GCA2-0033 |

8.00 |

26.00 |

18.00 |

1.68 |

|

MAGA-GCA2-0272 |

13.00 |

31.00 |

18.00 |

1.63 |

|

MAGA-GCA2-0213 |

7.00 |

18.00 |

11.00 |

2.67 |

|

MAGA-GCA2-0095 |

14.00 |

23.00 |

9.00 |

3.22 |

|

MAGA-GCA2-0120 |

3.00 |

21.00 |

18.00 |

1.53 |

|

MAGA-GCA2-0331 |

19.00 |

28.00 |

9.00 |

2.90 |

|

MAGA-GCA2-0286 |

10.00 |

25.00 |

15.00 |

1.74 |

|

MAGA-GCA2-0045 |

21.00 |

31.00 |

10.00 |

2.56 |

|

MAGA-GCA2-0157 |

0.00 |

17.00 |

17.00 |

1.50 |

|

MAGA-GCA2-0137 |

1.00 |

19.00 |

18.00 |

1.39 |

|

MAGA-GCA2-0203 |

4.00 |

16.00 |

12.00 |

2.07 |

|

MAGA-GCA2-0044 |

9.00 |

21.00 |

12.00 |

2.05 |

|

MAGA-GCA2-0288 |

11.00 |

31.00 |

20.00 |

1.21 |

|

MAGA-GCA2-0167 |

10.00 |

28.00 |

18.00 |

1.33 |

|

MAGA-GCA2-0214 |

21.00 |

31.00 |

10.00 |

2.40 |

|

MAGA-GCA2-0055 |

13.00 |

31.00 |

18.00 |

1.32 |

|

MAGA-GCA2-0340 |

6.00 |

11.00 |

5.00 |

4.73 |

|

MAGA-GCA2-0227 |

0.00 |

21.00 |

21.00 |

1.11 |

|

MAGA-GCA2-0102 |

8.00 |

26.00 |

18.00 |

1.29 |

|

MAGA-GCA2-0152 |

13.00 |

25.00 |

12.00 |

1.86 |

|

MAGA-GCA2-0205 |

8.00 |

15.00 |

7.00 |

3.19 |

|

MAGA-GCA2-0070 |

0.00 |

20.00 |

20.00 |

1.10 |

|

MAGA-GCA2-0144 |

0.00 |

18.00 |

18.00 |

1.20 |

|

MAGA-GCA2-0112 |

6.00 |

21.00 |

15.00 |

1.34 |

|

MAGA-GCA2-0237 |

18.00 |

31.00 |

13.00 |

1.54 |

|

MAGA-GCA2-0327 |

3.00 |

16.00 |

13.00 |

1.53 |

|

MAGA-GCA2-0294 |

0.00 |

11.00 |

11.00 |

1.74 |

|

MAGA-GCA2-0066 |

14.00 |

29.00 |

15.00 |

1.26 |

|

MAGA-GCA2-0280 |

17.00 |

26.00 |

9.00 |

2.08 |

|

MAGA-GCA2-0273 |

11.00 |

29.00 |

18.00 |

1.03 |

|

MAGA-GCA2-0166 |

0.00 |

11.00 |

11.00 |

1.66 |

|

MAGA-GCA2-0162 |

0.00 |

10.00 |

10.00 |

1.81 |

|

MAGA-GCA2-0249 |

0.00 |

5.00 |

5.00 |

3.60 |

|

MAGA-GCA2-0117 |

13.00 |

24.00 |

11.00 |

1.64 |

|

MAGA-GCA2-0308 |

8.00 |

16.00 |

8.00 |

2.24 |

|

MAGA-GCA2-0179 |

9.00 |

31.00 |

22.00 |

0.81 |

|

MAGA-GCA2-0226 |

0.00 |

14.00 |

14.00 |

1.26 |

|

MAGA-GCA2-0088 |

0.00 |

9.00 |

9.00 |

1.93 |

|

MAGA-GCA2-0138 |

6.00 |

19.00 |

13.00 |

1.34 |

|

MAGA-GCA2-0282 |

8.00 |

23.00 |

15.00 |

1.16 |

|

MAGA-GCA2-0336 |

12.00 |

19.00 |

7.00 |

2.47 |

|

MAGA-GCA2-0256 |

22.00 |

31.00 |

9.00 |

1.92 |

|

MAGA-GCA2-0285 |

0.00 |

11.00 |

11.00 |

1.52 |

|

MAGA-GCA2-0323 |

5.00 |

11.00 |

6.00 |

2.73 |

|

MAGA-GCA2-0147 |

17.00 |

28.00 |

11.00 |

1.46 |

|

MAGA-GCA2-0226 |

20.00 |

27.00 |

7.00 |

2.29 |

|

MAGA-GCA2-0156 |

6.00 |

19.00 |

13.00 |

1.23 |

|

MAGA-GCA2-0081 |

26.00 |

31.00 |

5.00 |

3.17 |

|

MAGA-GCA2-0208 |

8.00 |

21.00 |

13.00 |

1.21 |

|

MAGA-GCA2-0138 |

23.00 |

31.00 |

8.00 |

1.96 |

|

MAGA-GCA2-0078 |

21.00 |

30.00 |

9.00 |

1.74 |

|

MAGA-GCA2-0172 |

12.00 |

26.00 |

14.00 |

1.10 |

|

MAGA-GCA2-0281 |

15.00 |

31.00 |

16.00 |

0.96 |

|

MAGA-GCA2-0187 |

13.00 |

27.00 |

14.00 |

1.08 |

|

MAGA-GCA2-0234 |

14.00 |

20.00 |

6.00 |

2.52 |

|

MAGA-GCA2-0292 |

0.00 |

12.00 |

12.00 |

1.26 |

|

MAGA-GCA2-0040 |

0.00 |

16.00 |

16.00 |

0.94 |

|

MAGA-GCA2-0103 |

21.00 |

31.00 |

10.00 |

1.49 |

|

MAGA-GCA2-0200 |

18.00 |

31.00 |

13.00 |

1.10 |

|

MAGA-GCA2-0335 |

0.00 |

4.00 |

4.00 |

3.51 |

|

MAGA-GCA2-0309 |

21.00 |

30.00 |

9.00 |

1.55 |

|

MAGA-GCA2-0234 |

0.00 |

9.00 |

9.00 |

1.51 |

|

MAGA-GCA2-0313 |

9.00 |

17.00 |

8.00 |

1.68 |

|

MAGA-GCA2-0217 |

20.00 |

31.00 |

11.00 |

1.22 |

|

MAGA-GCA2-0318 |

6.00 |

14.00 |

8.00 |

1.67 |

|

MAGA-GCA2-0316 |

0.00 |

5.00 |

5.00 |

2.65 |

|

MAGA-GCA2-0113 |

26.00 |

31.00 |

5.00 |

2.62 |

|

MAGA-GCA2-0189 |

17.00 |

31.00 |

14.00 |

0.94 |

|

MAGA-GCA2-0279 |

0.00 |

7.00 |

7.00 |

1.79 |

|

MAGA-GCA2-0008 |

0.00 |

7.00 |

7.00 |

1.79 |

|

MAGA-GCA2-0186 |

2.00 |

16.00 |

14.00 |

0.89 |

|

MAGA-GCA2-0109 |

12.00 |

18.00 |

6.00 |

2.06 |

|

MAGA-GCA2-0076 |

0.00 |

9.00 |

9.00 |

1.37 |

|

MAGA-GCA2-0214 |

0.00 |

14.00 |

14.00 |

0.87 |

|

MAGA-GCA2-0287 |

14.00 |

21.00 |

7.00 |

1.75 |

|

MAGA-GCA2-0120 |

26.00 |

31.00 |

5.00 |

2.40 |

|

MAGA-GCA2-0145 |

22.00 |

31.00 |

9.00 |

1.27 |

|

MAGA-GCA2-0101 |

1.00 |

10.00 |

9.00 |

1.25 |

|

MAGA-GCA2-0305 |

9.00 |

18.00 |

9.00 |

1.25 |

|

MAGA-GCA2-0139 |

22.00 |

31.00 |

9.00 |

1.22 |

|

MAGA-GCA2-0089 |

23.00 |

28.00 |

5.00 |

2.16 |

|

MAGA-GCA2-0274 |

5.00 |

12.00 |

7.00 |

1.54 |

|

MAGA-GCA2-0125 |

16.00 |

24.00 |

8.00 |

1.33 |

|

MAGA-GCA2-0063 |

0.00 |

9.00 |

9.00 |

1.17 |

|

MAGA-GCA2-0298 |

0.00 |

14.00 |

14.00 |

0.74 |

|

MAGA-GCA2-0074 |

0.00 |

6.00 |

6.00 |

1.67 |

* True widths

for A2 grade control drilling are approximately 85% of drilled

lengths

Grade Control Drilling

Program

Drilling was completed on a 12.5 m by 12.5 m

pattern over the A2 starter pit to bench elevation 255 m. The GC

program has confirmed the widths of the high-grade gold ore zones,

generally 15 m to 30 m wide and in some places, up to 60 m wide

within the A2 starter pit. The majority of cross-sections have

returned significant zones of thick high-grade oxide gold results

with several collaring and/or ending in mineralization. The oxide

starter pit at A2 is expected to have an average depth of 30 m to

35 m along the main mineralized zone.

These results provide further confidence in both

the widths and tenors of mineralization present at A2 prior to the

commencement of scheduled mining and processing.

Drilling on-site continues with the RC drill rig

now operating at the H1 and H2 open pit areas. Upon completion, the

rig will return to expand the GC program from A2 towards the A3 pit

to the northeast and towards the A1 pit to the southwest.

A summary plan map of the resource drilling

results in the A2 pit prior to the GC drilling is presented in

Figure 4 while Figure 5 shows the same area updated with the

successful GC drilling results.

About Orezone Gold

Corporation

Orezone Gold Corporation (TSX: ORE OTCQX: ORZCF)

is a Canadian development company which owns a 90% interest in

Bomboré, one of the largest undeveloped gold deposits in Burkina

Faso.

The 2019 feasibility study highlights Bomboré as

an attractive shovel-ready gold project with forecasted annual gold

production of 118,000 ounces over a 13+ year mine life at an All-In

Sustaining Cost of US$730/ounce with an after-tax payback period of

2.5 years at an assumed gold price of US$1,300/ounce. Bomboré is

underpinned by a mineral resource base in excess of 5 million gold

ounces and possesses significant expansion potential. Orezone is

fully funded to bring Bomboré into production with the first gold

pour scheduled for Q3-2022.

Patrick DowneyPresident and Chief Executive

Officer

Vanessa PickeringManager, Investor Relations

Tel: 1 778 945 8977 / Toll Free: 1 888 673

0663info@orezone.com / www.orezone.com

Qualified Person

Dr. Pascal Marquis, Geo., Senior VP Exploration

is the Qualified Person who has approved the scientific and

technical information in this news release.

QA/QC

The grade control program mineralized intervals

are based on a lower cut-off grade of 0.28 g/t Au, a minimal width

of 4.00 m and up to a maximum of 3.0 m of dilution being included.

The true width of the mineralization is approximately 85% of the

drilled length. The A2 Pit grade control samples were collected by

employees of Orezone Bomboré SA (“OBSA”), Orezone’s 90% owned

subsidiary that owns the Project, using the Orezone Reverse

Circulation (RC) rig equipped with a Metzke automatic sampler. The

average weight of the samples collected was 2.1 kg. All samples

from this program were dried and pulverized at the OBSA sample

preparation site facility operated by SGS Burkina Faso SA. A 1 kg

aliquot was analyzed for leachable gold by bottle-roll cyanidation

using a LeachWell TM catalyst at BIGS Global Burkina Sarl in

Ouagadougou .

Orezone employs a rigorous Quality Control

Program including a minimum of 10% standards, blanks, and

duplicates.

For further information please contact

Orezone at +1 (778) 945-8977 or visit the Company’s

website at

www.orezone.com.

The Toronto Stock Exchange neither approves nor

disapproves the information contained in this news release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain information

that may constitute “forward-looking information” within the

meaning of applicable Canadian Securities laws and “forward-looking

statements” within the meaning of applicable U.S. securities laws

(together, “forward-looking statements”). Forward-looking

statements are frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate",

"potential", "possible" and other similar words, or statements that

certain events or conditions "may", "will", "could", or "should"

occur. Forward-looking statements in this press release include,

but are not limited to, statements with respect to future grade

control drilling, Bomboré project being fully funded to production

and projected first gold by Q3-2022.

All such forward-looking statements are based on

certain assumptions and analyses made by management in light of

their experience and perception of historical trends, current

conditions and expected future developments, as well as other

factors management and the qualified persons believe are

appropriate in the circumstances.

All forward-looking statements are subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements including, but not

limited to, delays caused by the COVID-19 pandemic, terrorist or

other violent attacks, the failure of parties to contracts to

honour contractual commitments, unexpected changes in laws, rules

or regulations, or their enforcement by applicable authorities; the

failure of parties to contracts to perform as agreed; social or

labour unrest; changes in commodity prices; unexpected failure or

inadequacy of infrastructure, the possibility of project cost

overruns or unanticipated costs and expenses, accidents and

equipment breakdowns, political risk, unanticipated changes in key

management personnel and general economic, market or business

conditions, the failure of exploration programs, including drilling

programs, to deliver anticipated results and the failure of ongoing

and uncertainties relating to the availability and costs of

financing needed in the future, and other factors described in the

Company's most recent annual information form and management

discussion and analysis filed on SEDAR on www.sedar.com. Readers

are cautioned not to place undue reliance on forward-looking

statements.

Although the forward-looking statements

contained in this press release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this press release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this press release.

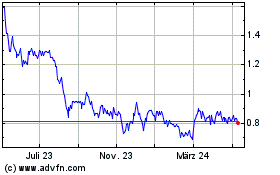

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

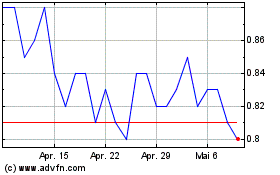

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025