Positive Metallurgical and Drilling Results at Bombore

10 Juli 2014 - 11:17PM

Marketwired Canada

Orezone Gold Corporation (TSX:ORE) is pleased to announce an update of the

ongoing feasibility work and 21,000 m drill program at its 100%-owned Bombore

Gold Project in Burkina Faso.

Scrubbed Ore Column Test Results

Final results for the initial coarse ore column test of the scrubbed saprolite

ore have now been issued by Kappes, Cassiday & Associates (KCA) in Reno, Nevada.

Overall gold recovery has been calculated at 88%, with all size fractions

showing excellent percolation rates and gold extraction in the 80 and 90 percent

range. The leach curve follows the signature 'fast leach kinetics' of the gold

content typical of Bombore ore, with the majority of gold extraction taking

place within the first few days of solution application. Screen analysis on the

heads and tails indicate very little, if any, degradation of the size fractions.

Testwork on a second column containing scrubbed coarse ore is nearing completion

and exhibits the same excellent leach characteristics, with estimated recovery

to be in the high 80 to low 90 percent gold extraction range. The column will be

rinsed and sent for assays in the coming days with final results expected in

August.

A second round of metallurgical tests using 2.2 tonnes of oxide core is being

initiated this month at KCA. The work is designed to emulate the modified

flowsheet that combines heap leaching (HL) with agitated leach tanks (CIL). The

results are expected to confirm or improve upon the already excellent leaching

properties of the Bombore oxide ores. Tests will include further scrubbing of

the ore for coarse column leach tests on the +0.212 mm fractions and CIL tests

on the -0.212 mm fractions. Rheological and physical characteristic tests will

also be performed to assist with the sizing and design of the equipment for the

combined HL/CIL plant.

Heap Leach Pad Over Liner

Test results on the scrubbed crushed ore continue to show that it is acceptable

for use as over liner material (drainage material on top of the liner) on the

leach pad, thereby significantly reducing the capital cost of crushing and

screening gravel from local quarries. The February 2014 Bombore Preliminary

Economic Assessment includes approximately $20M of total capital expenditures

for gravel as over liner material. In addition to the positive compaction and

percolation tests performed earlier on the coarse ore, recent abrasion tests

also indicate that the material will meet the required over liner

specifications. Further tests will be completed as part of the final program of

metallurgical and geotechnical studies underway with KCA and Golder.

Scrubber Tests

KCA also analyzed the material specifications and process parameters of the

oxide ore scrubbed for the coarse column test work with positive results.

Scrubbing efficiency of greater than 90% is realized within 3 to 5 minutes. This

coincides with earlier tests carried out by Met Solve on saprolitic ores which

indicated approximately 3 minutes scrubber residence time after crushing to less

than 75 mm. The two separate tests indicate that scrubbing is most effective in

water at 50% solids. Both tests also indicated that the coarse/fine split

(+0.212 mm/-0.212 mm) is approximately 35%/65% on the saprolitic ores with less

than 10% of the fine fraction remaining in the coarse split after scrubbing is

complete.

21,000 m Drilling Program

Since April 2014, 17,000 m of RC and 1,100 m of core drilling has been

completed. The program is focused on infilling and upgrading of the oxide

resource in the northern half of the deposit. The remaining 3,000 m of RC should

be completed by the end of the month. Results have been received for only 130

holes or 8,600 m. An additional 29,000 m of drill results from last year's drill

program have not been included in the 2013 resource estimation. Highlights of

all the results not included in the latest (2013) resource estimation are as

follows:

-- Core holes - 1.37 g/t is the weighted average grade of the mineralized

intervals from the core holes excluded from the 2013 resource, above a

lower cut-off of 0.5 g/t, with all assays cut to 5 g/t.

-- RC holes - 1.08 g/t is the weighted average grade of the mineralized

intervals from the RC holes excluded from the 2013 resources, above a

lower cut-off of 0.5 g/t, with all assays cut to 5 g/t.

-- A total of 607 RC holes (33,265 m) have now been reported since the 2013

resource, representing an increase of 13% with respect to the meterage

included within the 2013 resource.

-- The next resource update is planned for Q1 2015 which will include the

50,000 m of drill results.

Approximately 600 m of drilling was focused on new near-surface higher grade

sulphide target (P17S) located along the main shear zone trend, 2 km south of

Bombore. This zone was discovered in a previous program but required further

drilling to confirm its significance and geometry. Results from 32 core and RC

holes indicate a deformed and shallowly dipping granodiorite unit that averages

7.1 m in thickness (true width is approximately 85%) with an average uncut grade

of 2.65 g/t (using a 0.35 g/t cutoff). The drilling extends over an area of

about 1 hectare with an average depth to the mineralized unit of only 28 m; the

deepest intersection is 55 m. Projecting the geology to a depth of 100 m could

double the prospective area. All assays were performed using a 1kg bottle roll

technique (identical to the other Bombore samples) with indicative cyanide

soluble recoveries over 95%. Although these results are interesting with grades

more than double the average grade of the Bombore resource, further drilling is

not likely to occur until after the Bombore oxide deposit is developed.

Click here for a complete list of drill results and analytical procedures

referred to in this release.

About Orezone Gold Corporation

Orezone is a Canadian company with a gold discovery track record of +12 Moz and

recent mine development experience in Burkina Faso, West Africa. The Company

owns a 100% interest in Bombore, the largest undeveloped oxide gold deposit in

West Africa which is situated 85 km east of the capital city, adjacent to an

international highway. The Company is continuing with various technical studies

in order to be in a position to complete a full feasibility study and an

application for a mining permit before year-end.

Carl Defilippi of Kappes Cassiday & Associates; and Tim Miller, COO, Pascal

Marquis, SVP Exploration and Ron Little, CEO of Orezone, are Qualified Persons

under National Instrument 43-101 and have reviewed the information in this

release. Pascal Marquis is the Qualified Person in charge of the drilling

program and related analysis.

FORWARD-LOOKING STATEMENTS AND FORWARD-LOOKING INFORMATION: This news release

contains certain "forward-looking statements" within the meaning of applicable

Canadian securities laws. Forward-looking statements and forward-looking

information are frequently characterized by words such as "plan", "expect",

"project", "intend", "believe", "anticipate", "estimate", "potential",

"possible" and other similar words, or statements that certain events or

conditions "may", "will", "could", or "should" occur. Forward-looking statements

in this release include statements regarding, among others; completing various

technical studies for Bombore in 2014 and their potential impact on the economic

returns on the project, completing the FS and applying for a mining permit by

year-end 2014, updating the resource model and mine plan in Q1 2015, and

becoming a mid-tier gold producer.

FORWARD-LOOKING STATEMENTS are based on certain assumptions, the opinions and

estimates of management at the date the statements are made, and are subject to

a variety of risks and uncertainties and other factors that could cause actual

events or results to differ materially from those projected in the

forward-looking statements. These factors include the inherent risks involved in

the exploration and development of mineral properties, the uncertainties

involved in interpreting drilling results and other geological and geotechnical

data, fluctuating metal prices, the possibility of project cost overruns or

unanticipated costs and expenses, the ability of contracted parties (including

laboratories and drill companies to provide services as contracted);

uncertainties relating to the availability and costs of financing needed in the

future and other factors. The Company undertakes no obligation to update

forward-looking statements if circumstances or management's estimates or

opinions should change. The reader is cautioned not to place undue reliance on

forward-looking statements. Comparisons between any resource model and estimates

with the subsequent drill results are preliminary in nature and should not be

relied upon as potential qualified changes to any future resource updates or

estimates.

Readers are advised that National Instrument 43-101 of the Canadian Securities

Administrators requires that each category of mineral reserves and mineral

resources be reported separately. Readers should refer to the annual information

form of Orezone for the year ended December 31, 2013 and other continuous

disclosure documents filed by Orezone since January 1, 2014 available at

www.sedar.com, for this detailed information, which is subject to the

qualifications and notes set forth therein.

FOR FURTHER INFORMATION PLEASE CONTACT:

Orezone

(613) 241-3699

Toll Free: (888) 673-0663

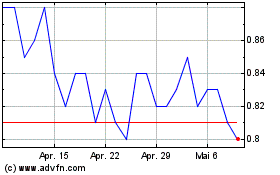

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

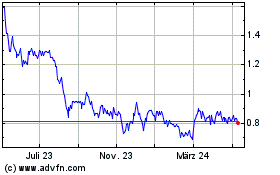

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024