Orezone Shifts Focus of Bombore Study to Heap Leach Scenario

20 Juni 2013 - 12:49AM

Marketwired

Orezone Gold Corporation (TSX:ORE) announces that it intends to

shift the focus of the Bombore Feasibility Study in order to review

and reassess the lower capital cost heap leach (HL) scenario

outlined in the August 2011 Preliminary Economic Assessment (PEA).

The ongoing feasibility work for an oxide-only Carbon in Leach

(CIL) circuit with a capacity of 8 Mt/yr for ten years has included

and largely completed the geotechnical and metallurgical studies,

tailings design, mine planning and environmental assessment and

could be compiled into a finalized prefeasibility or full

feasibility document at anytime if warranted. The study work to

date indicates that the initial capital required to build the CIL

scenario is similar to that outlined in the PEA. Although this

could be a very robust project for a producing company, the

required financing is not practical for Orezone given the current

condition of the capital markets. The heap leach scenario, as per

the PEA, is expected to have a substantially lower initial capex

and benefit from the significantly larger oxide resource which is

now double that used in the PEA.

"There are several undeveloped large-scale oxide-gold projects

world-wide that are comparable to Bombore in terms of size, grades

and heap leaching kinetics," said Ron Little, CEO for Orezone. "By

updating the economics of the heap leach scenario using the

reserves, study work and results of the current CIL scenario, we

hope to obtain a timely value re-rating in keeping with those other

projects." The company plans to update the PEA heap leach scenario

as soon as possible and continue towards a full feasibility subject

to positive results.

All drill programs have been completed for the season and the

company is focusing on core activities related to the feasibility

study resulting in lower expenditures.

The Company would also like to draw attention to an announcement

made on Friday June 14th, 2013 that it will be deleted from the

Junior Gold Miners ETF (GDXJ) Friday June 21, 2013. The Company

dropped below the required minimum market capitalization of

$75M.

About Orezone Gold Corporation

Orezone is a Canadian company with a gold discovery track record

of +12 Moz and recent mine development experience in Burkina Faso,

West Africa. The company owns a 100% interest in Bombore which is

situated 85 km east of the capital city, adjacent to an

international highway. Mineral resources are constrained within

optimized open pit shells that span 11 km, and include 4.13 Moz of

measured and indicated (125 Mt @ 1.03 g/t) and 1.03 Moz of inferred

resources (35 Mt @ 1.00 g/t) with an average depth of drilling to

only 120 meters. The Company is completing a Feasibility Study

("FS") at Bombore for a phase one oxide-only scenario in order to

become a mid-tier gold producer.

Pascal Marquis, SVP Exploration and Ron Little, CEO are

Qualified Persons under National Instrument 43-101 have reviewed

the information in this release.

FORWARD-LOOKING STATEMENTS AND FORWARD-LOOKING INFORMATION: This

news release contains certain "forward-looking statements" within

the meaning of applicable Canadian securities laws. Forward-looking

statements and forward-looking information are frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate", "potential",

"possible" and other similar words, or statements that certain

events or conditions "may", "will", "could", or "should" occur.

Forward-looking statements in this release include statements

regarding, among others; similar initial capital requirement (CIL)

to the PEA, (HL) substantially lower initial capex, timely value

re-rating, updating the PEA for the HL scenario, completing a FS at

Bombore, and becoming a mid-tier gold producer.

FORWARD-LOOKING STATEMENTS are based on certain assumptions, the

opinions and estimates of management at the date the statements are

made, and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements.

These factors include the inherent risks involved in the

exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological and geotechnical data, fluctuating metal prices, the

possibility of project cost overruns or unanticipated costs and

expenses, the ability of contracted parties (including laboratories

and drill companies to provide services as contracted);

uncertainties relating to the availability and costs of financing

needed in the future and other factors. The Company undertakes no

obligation to update forward-looking statements if circumstances or

management's estimates or opinions should change. The reader is

cautioned not to place undue reliance on forward-looking

statements. Comparisons between any resource model or estimates

with the subsequent drill results are preliminary in nature and

should not be relied upon as potential qualified changes to any

future resource updates or estimates.

Readers are advised that National Instrument 43-101 of the

Canadian Securities Administrators requires that each category of

mineral reserves and mineral resources be reported separately.

Readers should refer to the annual information form of Orezone for

the year ended December 31, 2012 and other continuous disclosure

documents filed by Orezone since January 1, 2013 available at

www.sedar.com, for this detailed information, which is subject to

the qualifications and notes set forth therein.

Contacts: Orezone Gold Corporation Ron Little CEO (613) 241-3699

or Toll Free: (888) 673-0663rlittle@orezone.com Orezone Gold

Corporation Pascal Marquis SVP Exploration (613) 241-3699 or Toll

Free: (888) 673-0663pmarquis@orezone.com www.orezone.com

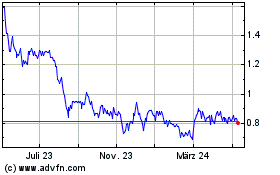

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

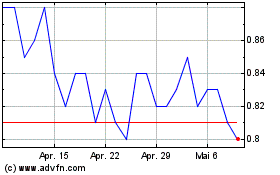

Orezone Gold (TSX:ORE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025