The North West Company Inc. (the "Company" or "North West") today

reported its unaudited financial results for the third quarter

ended October 31, 2024. It also announced that the Board of

Directors has declared a quarterly dividend of $0.40 to

shareholders of record on December 31, 2024, to be paid on

January 15, 2025.

“Our Canadian and International Operations

delivered solid same-store sales growth and an increase in EBITDA

this quarter. However, we saw a decline in net earnings compared to

last year’s impressive results, primarily due to higher expenses

and increased income taxes,” stated President & CEO Dan

McConnell. “We are encouraged by the advancements in our Next 100

operational excellence work, including the planned refinement of

our merchandise assortments, which we believe will help mitigate

the challenging economic conditions impacting our International

Operations.”

Financial

Highlights

Sales

Third quarter consolidated sales increased 3.3% to $637.5 million

compared to $616.9 million last year driven by same store sales

gains and the impact of new stores. These factors were partially

offset by lower wholesale sales and airline revenues compared to

last year. Excluding the foreign exchange impact, consolidated

sales increased 3.4%, with food sales increasing 3.3% and general

merchandise and other sales increasing 3.6% compared to last year.

On a same store basis, sales increased 4.0%1 compared to the third

quarter last year led by a 4.9% increase in same store sales in

Canadian Operations and a 2.7%1 increase in same store sales in

International Operations.

Gross

Profit Gross profit increased 4.3% to

$214.1 million compared to $205.4 million last year due to sales

gains and a 30 basis point increase in gross profit rate compared

to last year. The increase in gross profit rate was largely due to

changes in sales blend, including a lower blend of wholesale food

sales.

Selling, Operating and

Administrative Expenses Selling, operating

and administrative expenses ("Expenses") increased $10.4 million or

7.0% compared to last year and were up 86 basis points as a

percentage to sales. The increase in Expenses is largely due to

higher staff costs related to inflationary and minimum wage

increases and additional staff resources required to execute our

Next 100 operational excellence work. The investment in additional

resources is required to unlock the future growth and incremental

earnings expected from the Next 100 initiatives. An increase in

depreciation, the impact of new stores and higher share-based

compensation costs primarily due to adjustments from changes in the

Company's share price were also factors.

Earnings From

Operations Earnings from operations

("EBIT") decreased 2.9% to $54.1 million compared to very strong

earnings gains last year which were up 24.0% to $55.7 million, as

an increase in EBIT in Canadian Operations was more than offset by

lower EBIT in International Operations. Earnings before interest,

income taxes, depreciation and amortization ("EBITDA2") increased

0.6% to $83.4 million on top of an 18.8% increase in EBITDA2 to

$83.0 million last year due to the sales, gross profit and Expense

factors previously noted. Adjusted EBITDA2, which excludes the

impact of share-based compensation costs, increased 1.4% to $88.4

million compared to $87.2 million last year and as a percentage to

sales was 13.9% compared to 14.1% last year.

Income Tax

Expense Income tax expense increased to

$12.8 million compared to $12.7 million last year as the impact of

lower earnings was more than offset by an increase in the effective

tax rate to 26.0% compared to 25.0% last year. The increase in the

effective tax rate is substantially due to the impact of The Global

Minimum Tax Act ("GMTA") – Pillar Two legislation included in Bill

C-69 that was enacted in Canada on June 20, 2024. This legislation

implements the Pillar Two global minimum tax regime developed by

the Organisation for Economic Co-operation and Development ("OECD")

which applies a minimum effective tax rate of 15% on income earned

in each jurisdiction in which the Company operates. The Company

operates retail stores in the Cayman Islands, Barbados and British

Virgin Islands jurisdictions which are impacted by the GMTA -

Pillar Two legislation.

Net

Earnings Net earnings decreased 4.3%

to $36.4 million compared to a 26.1% increase in net earnings to

$38.0 million last year. Net earnings attributable to shareholders

were $35.4 million and diluted earnings per share were $0.72 per

share compared to $0.77 per share last year. Adjusted net

earnings2, which excludes the after-tax impact of share-based

compensation, decreased 3.1% to $40.1 million compared

to $41.4 million last year due to the sales, gross profit, Expense

and GMTA - Pillar Two income tax expense factors previously

noted.

Non-GAAP Financial

Measures

The Company uses the following non-GAAP

financial measures: earnings before interest, income taxes,

depreciation and amortization ("EBITDA"), adjusted EBITDA and

adjusted net earnings. The Company believes these non-GAAP

financial measures provide useful information to both management

and investors in measuring the financial performance and financial

condition of the Company for the reasons outlined below.

Earnings Before Interest, Income

Taxes, Depreciation and Amortization (EBITDA) is

not a recognized measure under IFRS. Management believes that in

addition to net earnings, EBITDA is a useful supplemental measure

as it provides investors with an indication of the Company's

operational performance before allocating the cost of interest,

income taxes and capital investments. Investors should be cautioned

however, that EBITDA should not be construed as an alternative to

net earnings determined in accordance with IFRS as an indicator of

the Company's performance. The Company's method of calculating

EBITDA may differ from other companies and may not be comparable to

measures used by other companies.

Adjusted EBITDA and Adjusted Net

Earnings are not recognized measures under IFRS.

Management uses these non-GAAP financial measures to exclude the

impact of certain income and expenses that must be recognized under

IFRS. The excluded amounts are either subject to volatility in the

Company's share price or may not necessarily be reflective of the

Company's underlying operating performance. These factors can make

comparisons of the Company's financial performance between periods

more difficult. The Company may exclude additional items if it

believes that doing so will result in a more effective analysis and

explanation of the underlying financial performance. The exclusion

of these items does not imply that they are non-recurring.

These measures do not have a standardized

meaning prescribed by GAAP and therefore they may not be comparable

to similarly titled measures presented by other publicly traded

companies and should not be construed as an alternative to the

other financial measures determined in accordance with IFRS.

Reconciliation of consolidated

earnings from operations (EBIT) to EBITDA and adjusted

EBITDA:

|

|

|

| |

Third Quarter |

| ($ in

thousands) |

|

2024 |

|

|

2023 |

|

|

|

|

|

| Earnings from operations

(EBIT) |

$ |

54,102 |

|

$ |

55,746 |

| Add:

Amortization |

|

29,343 |

|

|

27,231 |

|

EBITDA |

$ |

83,445 |

|

$ |

82,977 |

| Adjusted for: |

|

|

|

|

Share-based compensation expense |

|

4,974 |

|

|

4,246 |

|

Adjusted EBITDA |

$ |

88,419 |

|

$ |

87,223 |

Reconciliation of consolidated

net earnings to adjusted net earnings:

|

|

|

| |

Third Quarter |

|

($ in thousands) |

|

2024 |

|

|

2023 |

|

|

|

|

|

| Net earnings |

$ |

36,395 |

|

$ |

38,038 |

| Adjusted for: |

|

|

|

|

Share-based compensation expense, net of tax |

|

3,705 |

|

|

3,353 |

|

Adjusted net earnings |

$ |

40,100 |

|

$ |

41,391 |

Certain share-based compensation costs are

presented as liabilities on the Company's consolidated balance

sheets. The Company is exposed to market price fluctuations in its

share price through these share-based compensation costs. These

liabilities are recorded at fair value at each reporting date based

on the market price of the Company's shares at the end of each

reporting period with the changes in fair value recorded in

selling, operating and administrative expenses.

Further information on the financial results is

available in the Company's 2024 third quarter Report to

Shareholders, Management's Discussion and Analysis and unaudited

interim period condensed consolidated financial statements which

can be found in the investor section of the Company's website at

www.northwest.ca.

Third Quarter Conference

Call

North West will host a conference call for its

third quarter results on December 10, 2024 at 8:00 a.m. (Central

Time). To access the call, please dial 416-340-2217 or

1-800-898-3989 with a pass code of 7763559#. The conference call

will be archived and can be accessed by dialing 905-694-9451 or

1-800-408-3053 with a pass code of 4329009# on or before January

10, 2025.

Notice to

Readers

Certain forward-looking statements are made in

this news release, within the meaning of applicable securities

laws. These statements reflect North West's current expectations

and are based on information currently available to management.

Forward-looking statements about the Company, including its

business operations, strategy and expected financial performance

and condition. Forward-looking statements include statements that

are predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects”, “anticipates”,

“plans”, “believes”, “estimates”, “intends”, “targets”, “projects”,

“forecasts” or negative versions thereof and other similar

expressions, or future or conditional future financial performance

(including sales, earnings, growth rates, capital expenditures,

dividends, debt levels, financial capacity, access to capital, and

liquidity), ongoing business strategies or prospects, the Company's

intentions regarding a normal course issuer bid and the number of

shares purchased, the potential impact of a pandemic on the

Company's operations, supply chain and the Company's related

business continuity plans, the realization of cost savings from

cost reduction plans, the anticipated impact of The Next 100

strategic priorities and possible future action by the Company.

Forward-looking statements are based on current

expectations and projections about future events and are inherently

subject to, among other things, risks, uncertainties and

assumptions about the Company, economic factors and the retail

industry in general. They are not guarantees of future performance,

and actual events and results could differ materially from those

expressed or implied by forward-looking statements made by the

Company due to changes in economic conditions, political and market

factors in North America and internationally. These factors

include, but are not limited to, changes in inflation, interest and

foreign exchange rates, the Company's ability to maintain an

effective supply chain, changes in accounting policies and methods

used to report financial condition, uncertainties associated with

critical accounting assumptions and estimates, including estimates

of contingent consideration, the effect of applying future

accounting changes, business competition, technological change,

changes in government regulations and legislation, changes in tax

laws, unexpected judicial or regulatory proceedings, catastrophic

events, the Company's ability to complete and realize benefits from

capital projects, E-Commerce investments, strategic transactions

and the integration of acquisitions, the Company's ability to

realize benefits from investments in information technology ("IT")

and systems, including IT system implementations, or unanticipated

results from these initiatives and the Company's success in

anticipating and managing the foregoing risks.

The reader is cautioned that the foregoing list

of important factors is not exhaustive. Other risks are outlined in

the Risk Management section of the 2023 Annual Report and in the

Risk Factors sections of the Annual Information Form and Management

Information Circular, material change reports and news releases.

The reader is also cautioned to consider these and other factors

carefully and not place undue reliance on forward-looking

statements. Other than as specifically required by applicable law,

the Company does not intend to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Additional information on the Company, including

our Annual Information Form, can be found on SEDAR+ at

www.sedarplus.com or on the Company's website at

www.northwest.ca.

Company

Profile

The North West Company Inc., through its

subsidiaries, is a leading retailer of food and everyday products

and services to rural communities and urban neighbourhoods in

Canada, Alaska, the South Pacific and the Caribbean. North West

operates 230 stores under the trading names Northern, NorthMart,

Giant Tiger, Alaska Commercial Company, Cost-U-Less and RiteWay

Food Markets and has annualized sales of approximately CDN$2.5

billion.

The common shares of North West

trade on the Toronto Stock Exchange under the symbol

NWC.

For more information

contact:

Dan McConnell, President and Chief Executive

Officer, The North West Company Inc. Phone 204-934-1482; fax

204-934-1317; email dmcconnell@northwest.ca

John King, Executive Vice-President and Chief

Financial Officer, The North West Company Inc. Phone 204-934-1397;

fax 204-934-1317; email jking@northwest.ca

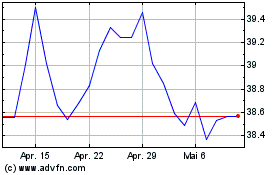

The North West (TSX:NWC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

The North West (TSX:NWC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024