High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its third quarter results today.

Mike Maguire, CEO of High Arctic, commented:

“Papua New Guinea is key to High Arctic’s

long-term business strategy. There have been significant LNG

commitments in PNG made by large oil and gas companies and High

Arctic is positioned well to support our customers’ future

investments. Over fifteen years High Arctic has developed the

logistics expertise and trained local workforce required to operate

the heli-portable drilling rigs in otherwise inaccessible PNG

locations.

"As our long-term investors know, PNG is a

market where we have developed a strong position with potential for

higher profits and free cash flow. In the past this has funded

corporate growth and shareholder returns.

"The divestment of our Canadian Production

Services segment this quarter allows us to focus on putting rigs

back to work in PNG. We are currently providing services to both

our principal customer and the PNG-LNG operator, and we are looking

forward to returning to consistent drilling operations following an

exceptional period of Covid driven activity suspension.

"The Corporation continues to look at the

capital allocation decision in relation to its current and expected

significant cash balances. This may include a return of capital to

shareholders or reinvestment in the business.”

Highlights

The following highlights the Corporations results for Q3-2022

and YTD-2022:

- During the Quarter, High Arctic

made a strategic shift to capitalize on opportunities and focus on

developments in its core market of Papua New Guinea while resetting

its long-standing energy service presence in Canada.

- Disposed of Canadian well servicing

business for cash consideration, originally acquired in 2016

- Consolidated snubbing industry in

Canada through disposal of snubbing business for an equity interest

and note receivable in acquiring company

- Renewed a key drilling services

contract in PNG as the country begins early-stage reactivation of

upstream activity in its largest commodity export, liquified

natural gas

- Carried forward in Canada with

active Rental and Nitrogen Services businesses

- Built upon its record of

shareholder returns with dividend payments of $731, and

- Delivered safety excellence and ESG

alignment with a customer portfolio of high-quality operators.

- Preparations to return to drilling

in PNG with Rig 103 progressed, adding an upgrade of the topdrive,

enhancing the rigs drilling capability. Rig 103 is expected to

commence drilling operations by the end of the first quarter of

2023.

- High Arctic maintained a strong

financial position, with working capital of $65,434 including

$23,386 cash, $12,101 accounts receivable, $28,000 asset sale

receivable (due in January 2023), and total debt of $7,860 as at

September 30, 2022.

Outlook

High Arctic has taken transformative actions

this quarter which will allow the Corporation to focus on the

emerging opportunities to deploy drilling assets in Papua New

Guinea, while maintaining exposure to the Canadian Energy Services

market. High Arctic believes that the fundamentals for sustained

high LNG demand, particularly in Asia, positions PNG for

substantive LNG export growth, and the drilling required to realize

this has the potential to exceed our past activity peaks.

On August 1, 2022 High Arctic entered into a

three-year contract renewal covering customer owned Heli-portable

Rig 103 and High Arctic’s services related to the supply of

personnel, camp accommodation and rental equipment to support the

drilling operations in PNG.

Work is currently underway to prepare Rig 103,

including an upgrade of its topdrive, for recommencement of

drilling early in 2023. High Arctic anticipates Rig 103 will

operate consistently through the term of the contract. This

cornerstone contract is flexible and scalable to align with

activity, which positions High Arctic to respond quickly to future

incremental drilling opportunities associated with LNG expansion.

While the contract for customer owned Rig 104 was not renewed at

that time, High Arctic is optimistic for future contracts with

third-party customers in the coming activity cycle.

High Arctic maintains active dialogue with the

management of all the active energy companies in PNG, towards

understanding their project timeframes and plans for drilling

activity utilizing High Arctic’s owned rigs. The Corporation

expects an additional drilling rig deployment in the 1st half of

2023 and is optimistic about further activity increases by the end

of next year.

The advancement of the TotalEnergies led

Papua-LNG project’s front-end-engineering-and-design continues to

progress and has recently included public forums outlining plans

for early-works and overall project timelines around a final

investment decision on the two-train Papua-LNG project in the 2nd

half of 2023. Earlier this year ExxonMobil, operator of the PNG-LNG

joint venture, announced the signing of a gas agreement for the

development of the P’nyang gas field in the Western Province of

PNG, which is anticipated to result in the addition of another

train to the world class PNG-LNG export facility. These

developments underpin our optimism of an expanding PNG energy

sector and increasing future demand for our people, equipment and

expertise.

In Canada, the post-closing transitional

activities have progressed smoothly with the buyers of Concord Well

Servicing and High Arctic’s snubbing division. The consolidated

Team Snubbing Services has already increased market share, with

deployed services exiting Q3-2022 exceeding the sum of the two

parts in 2021. Team’s dominant market position and service quality

has immediately driven pricing improvements and margin growth.

Streamlining of the management support structure

of High Arctic’s remaining Canadian business is well underway and

has been consolidated for efficient operation of our pressure

control focused HAES Rentals and Nitrogen pumping services.

Management remains attentive to opportunities to best realize a

return on the investments in these Canadian service lines, and the

dormant snubbing assets in the USA. Commensurate with these efforts

is an exploration of growth financing options levered off the

Corporations assets in PNG.

Strategy

Strategic priorities build on High Arctic’s core

values, code of business conduct and fiscal discipline,

including:

- Safety excellence and quality

service delivery,

- Actions aimed at generating free

cash flow including:

- Increased utilization of the

Corporation’s world-class fleet of equipment,

- Improved efficiency and work force

productivity, and

- Operating cost control.

- Development of new and existing

employees to grow our workforce to meet demand,

- Pursuit of opportunities that

secure the Corporation’s future as a lower emissions energy

services provider,

- Pursuit of opportunities for growth

and corporate transactions in well understood markets that enhance

shareholder value, and

- Disciplined capital stewardship to

improve returns for shareholders including divestitures, dividends

and common share buybacks.

Noteworthy performance during the third quarter

included:

- Activity in PNG maintained a

personnel count of about 200 employees deployed, reaching key

safety milestones of 6 years and 3 million work hours recordable

incident free.

- As previously announced, renewed a

three-year contract for drilling services with its principal

customer in PNG, and made progress towards commencing active

drilling operations with Rig 103 in Q1-2023.

- On July 27, 2022, the Corporation

sold its Canadian well servicing business for an aggregate purchase

price of $38,200, and sold its Canadian snubbing business for 42%

equity ownership of Team, the acquiring company, and a note

receivable of $3,365 (the “Sale Transactions”).

- During the Quarter, High Arctic

generated $942 (YTD-2022 $ $7,362) in cash flow from operations and

spent $660 ($3,976) on equipment capital expenditures for positive

net cash generation of $282 (YTD-2022 $3,386).

- Paid shareholders dividends of $731

(YTD $$1,218) and after Quarter-end began to buy back shares, in

nominal quantities, pursuant to its Normal Course Issuer Bid

expiring in early December 2022.

Canadian Production Services Segment

Divestments

As reported last quarter, On July 27, 2022, High

Arctic executed two separate asset sales transactions resulting in

the effective divestment of the Corporation’s Production Services

segment.

The Canadian well servicing business was sold

for an aggregate purchase price of $38,200 payable in cash. The

Well Servicing Transaction involved the sale of well servicing

rigs, associated rental equipment, and real estate used in the

support of these operations along with the transfer of field

personnel and a large majority of the office support personnel.

Cash payment of $10,200 was received on first closing in July 2022.

The second and final closing of the Well Servicing Transaction will

occur in January 2023, with the remaining $28,000 cash payment and

transfer of real estate titles to the purchaser. The Corporation

will repay $3,565 of mortgage principal related to the real estate

properties at second closing.

As at Q2-2022, an estimated impairment of $8,236

was charged relating to the difference in carrying value of the

assets and total consideration of the Well Servicing transaction.

An additional impairment of $646 was identified in Q3-2022,

resulting in a total impairment of $8,882 relating to this

transaction. By comparison, the well servicing business was

purchased in August 2016 for $42,800 with a non-cash $12,700 gain

on the acquisition booked to PP&E.

The Canadian Snubbing business was sold to Team

Snubbing Services Inc. for consideration consisting of 42%

ownership in the post-closing outstanding shares (420,000 common

voting shares) in Team, valued at $7,738, and a convertible

promissory note of $3,365. The note has a five-year term, with

interest accruing at 4.5% from January 1, 2023, and principal

repayments commencing July of 2024. Investment in the share capital

of Team represents a joint arrangement whereby High Arctic has

significant influence of the operations and rights to the net

assets of Team. This transaction involved both the sale of High

Arctic’s Canadian snubbing assets and the transfer of field

personnel.

As at Q2-2022, an estimated impairment of $443

was charged relating to the difference in carrying value of the

Canadian snubbing assets of $11,546 and estimated fair value less

cost to sell of $11,103. An additional impairment of $233 was

identified in Q3-2022, resulting in a total impairment of $676

relating to the Snubbing Transaction.

High Arctic retains its Ancillary Services

Segment in Canada comprised of the Nitrogen Pumping business and a

Rentals business focused on pressure control equipment. High Arctic

also retains its snubbing assets in the USA, which along with the

hydraulic workover rig (Rig 102) in PNG remain idle and will be

reported under Ancillary Services.

As a result of the Sale Transactions, the

Corporation has a significantly reduced Canadian business and has

written down the deferred tax assets of $7,743 while retaining in

excess of $130,000 of operating tax loss carry-forward in Canada.

Additionally, the Corporation cancelled its revolving bank loan

credit facility effective July 27, 2022.

The unaudited interim consolidated financial

statements, management discussion & analysis (“MD&A”), for

the quarter ended September 30, 2022 will be available on SEDAR at

www.sedar.com, and on High Arctic’s website at www.haes.ca. Within

this news release, the three-months ended September 30, 2022 may be

referred to as the “Quarter” or “Q3-2022”, and similarly the nine

months ended September 30, 2022 may be referred to as “YTD-2022”.

The comparative three-months ended September 30, 2021 may be

referred to as “Q3-2021”, and similarly the nine months ended

September 30, 2021 may be referred to as “YTD-2021”. References to

other quarters may be presented as “QX-20XX” with “X” being the

quarter/year to which the commentary relates. All amounts are

expressed in thousands of Canadian dollars, unless otherwise

noted.

RESULTS OVERVIEW

The following is a summary of select financial

information of the Corporation ($ thousands, except per share

amounts):

|

|

For the three months ended September

30 |

For the nine months ended September

30 |

|

($ thousands, except per share amounts) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Revenue |

12,519 |

|

18,654 |

|

66,921 |

|

52,798 |

|

| Net loss |

(4,546) |

|

(4,784) |

|

(27,480) |

|

(13,999) |

|

|

Per share (basic and diluted) |

(0.09) |

|

(0.10) |

|

(0.56) |

|

(0.29) |

|

| Oilfield services operating

margin |

3,088 |

|

3,886 |

|

14,334 |

|

10,516 |

|

| Oilfield services operating

margin as a % of revenue |

24.7% |

|

20.8% |

|

21.4% |

|

19.9% |

|

| EBITDA |

(297) |

|

1,294 |

|

(3,130) |

|

3,254 |

|

| Adjusted EBITDA |

572 |

|

1,412 |

|

6,556 |

|

3,082 |

|

| Adjusted EBITDA as % of

revenue |

4.6% |

|

7.6% |

|

9.8% |

|

5.8% |

|

| Operating loss |

(2,759) |

|

(4,597) |

|

(8,688) |

|

(14,848) |

|

| Cash flow from operating

activities |

942 |

|

737 |

|

7,362 |

|

1,675 |

|

|

Per share (basic and diluted) |

0.02 |

|

0.02 |

|

0.15 |

|

0.03 |

|

| Funds flow from operating

activities |

196 |

|

1,077 |

|

5,059 |

|

2,307 |

|

|

Per share (basic and diluted) |

- |

|

0.02 |

|

0.10 |

|

0.05 |

|

| Dividend payments |

731 |

|

- |

|

1,218 |

|

- |

|

|

Per share (basic and diluted) |

0.015 |

|

- |

|

0.025 |

|

- |

|

| Capital expenditures |

660 |

|

2,658 |

|

3,976 |

|

4,108 |

|

|

|

|

As at |

| ($

thousands, except share amounts) |

|

|

September 30, 2022 |

December 31, 2021 |

| Working

capital |

|

|

65,434 |

29,724 |

| Cash and cash

equivalents, end of period |

|

|

23,386 |

12,037 |

| Total assets |

|

|

149,662 |

185,452 |

| Long-term

debt |

|

|

3,971 |

7,779 |

| Long-term

financial liabilities, excluding long-term debt |

|

|

6,062 |

13,414 |

| Shareholders’

equity |

|

|

125,652 |

148,851 |

| Common

shares outstanding, thousands |

|

|

48,733,145 |

48,733,145 |

Three-Months Period Ended September 30, 2022

Summary:

- High Arctic continues to see

improved activity levels in PNG, driving a net increase in Drilling

Services and Ancillary Service revenues to $4,870 and $2,905,

respectively (Q3-2021 revenues: $2,718 and $3,280,

respectively).

- PNG activity drove consolidated

oilfield services operating margin as a percentage of revenue up to

24.7% from 20.8% in Q3-2021. Improved profitability in the Quarter

relative to Q3-2021 was without Canadian emergency wage subsidies

(“CEWS”) and Canadian emergency rent subsidies

(“CERS”) in 2022 (Q3-2021 $865 of CEWS & CERS received).

- High Arctic continued work

preparing customer owned Drilling Rig 103, which now includes an

equipment upgrade of the top drive, for active well site operations

pursuant to its new contract renewal expiring in 2025.

- The Corporation’s Production

Service segment realized revenue of $4,959 and an operating margin

of 9.9% in the month of July before the close of the Sale

Transactions.

Year to Date September 30, 2022

Summary:

- The recommencement of drilling

services activity in PNG has resulted in YTD-2022 Drilling Services

segment revenue of $20,545 compared to $4,362 YTD-2021 and through

associated rentals increased the Ancillary Services segment revenue

to $11,878 YTD-2022 compared with $8,049 YTD-2021.

- High Arctic’s owned Rig 115

successfully completed abandonment of a customer’s legacy

exploration well and the rig was moved offsite during the second

quarter of 2022.

- Primarily due to the receipt of

first closing payment of $10,200 associated with the Well Servicing

Transaction in Canada, the cash balance on hand increased by

$11,349 YTD-2022 to $23,386.

- YTD-2022 the Corporation has paid

out $1,218 of dividends since recommencing monthly dividend

distribution in Q2-2022.

- The Corporation received payment

for services performed for the acquisition and deliver of equipment

to be utilized on Drilling Rig 103. At September 30, 2022 the

equipment was not yet received in PNG and the $4,287 cash received

has been classified as deferred revenue and the related $4,115 cost

of the equipment is reflected in inventory.

Drilling Services Segment

|

|

Three months endedSeptember

30 |

Nine months endedSeptember

30 |

|

($ thousands, unless otherwise noted) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Revenue |

4,870 |

|

2,718 |

|

20,545 |

|

4,362 |

|

|

Oilfield services expense |

3,718 |

|

2,430 |

|

15,832 |

|

4,159 |

|

|

Oilfield services operating margin |

1,152 |

|

288 |

|

4,713 |

|

203 |

|

|

Operating margin (%) |

23.7% |

|

10.6% |

|

22.9% |

|

4.7% |

|

Production Services Segment

|

|

Three months endedSeptember

30 |

Nine months endedSeptember

30 |

|

($ thousands, unless otherwise noted) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Revenue |

4,959 |

|

13,100 |

|

36,099 |

|

41,802 |

|

|

Oilfield services expense |

4,469 |

|

11,140 |

|

33,219 |

|

35,236 |

|

|

Oilfield services operating margin |

490 |

|

1,960 |

|

2,880 |

|

6,566 |

|

|

Operating margin (%) |

9.9% |

|

15.0% |

|

8.0% |

|

15.7% |

|

Ancillary Services Segment

|

|

Three months endedSeptember

30 |

Nine months endedSeptember

30 |

|

($ thousands, unless otherwise noted) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Revenue |

2,905 |

|

3,280 |

|

11,878 |

|

8,049 |

|

|

Oilfield services expense |

1,458 |

|

1,642 |

|

5,137 |

|

4,302 |

|

|

Oilfield services operating margin |

1,447 |

|

1,638 |

|

6,741 |

|

3,747 |

|

|

Operating margin (%) |

49.8% |

|

49.9% |

|

56.7% |

|

46.5% |

|

Liquidity and Capital

Resources

|

|

Three months endedSeptember

30 |

Nine months endedSeptember

30 |

|

($ thousands) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Cash provided by (used in): |

|

|

|

|

|

Operating activities |

942 |

|

737 |

|

7,362 |

|

1,675 |

|

|

Investing activities |

8,670 |

|

(2,191) |

|

6,713 |

|

(2,850) |

|

|

Financing activities |

(905) |

|

(509) |

|

(2,214) |

|

(11,301) |

|

|

Effect of exchange rate changes on cash |

(419) |

|

445 |

|

(512) |

|

88 |

|

|

Increase (decrease) in cash |

8,288 |

|

(1,518) |

|

11,349 |

|

(12,388) |

|

The Bank of PNG continues to encourage the use

of the local market currency, Kina or PGK. Due to High Arctic’s

requirement to transact with international suppliers and customers,

High Arctic has received approval from the Bank of PNG to maintain

its USD account within the conditions of the Bank of PNG currency

regulations. The Corporation continues to use PGK for local

transactions when practical. Included in the Bank of PNG’s

conditions is for PNG drilling contracts to be settled in PGK,

unless otherwise approved by the Bank of PNG for the contracts to

be settled in USD. The Corporation has historically received such

approval for its contracts with its key customers in PNG. The

Corporation will continue to seek Bank of PNG approval for future

customer contracts to be settled in USD on a contract-by-contract

basis, however, there is no assurance the Bank of PNG will continue

to grant these approvals.

If such approvals are not received, the

Corporation’s PNG drilling contracts will be settled in PGK which

would expose the Corporation to exchange rate fluctuations related

to the PGK. In addition, this may delay the Corporation’s ability

to receive USD which may impact the Corporation’s ability to settle

USD denominated liabilities and repatriate funds from PNG on a

timely basis. The Corporation also requires the approval from

the PNG Internal Revenue Commission (“IRC”) to

repatriate funds from PNG and make payments to non-resident PNG

suppliers and service providers. While delays can be experienced

for the IRC approvals, such approvals have been received in the

past.

Operating ActivitiesQ3-2022

funds flow from operating activities was $942 (Q3-2021: $737), of

which $196 are funds generated by operations (Q3-2021: $1,077 funds

flow from operations), see “Non-IFRS Measures” on page 18, and $746

cash inflow from working capital changes (Q3-2021: $340 outflow)

mainly due to decrease in trade accounts receivable during the

Quarter.

YTD-2022 cash generated from operating

activities was $7,362 (YTD-2021: $1,675), of which $5,059 are funds

flow from operations (YTD-2021: $2,307), see “Non-IFRS Measures” on

page 18, and $2,303 cash inflow from working capital changes

(YTD-2021: $632 outflow) mainly due to decrease in accounts

receivable during the period.

Investing Activities

Q3-2022 the Corporation’s cash from investing

activities was $8,670 (Q3-2021: $2,191 cash used in investing

activities). Proceeds on disposal of property and equipment mainly

related to the Well Servicing transaction was $10,254 (Q3-2021:

$152), partially offset by capital expenditures of $660 (Q3-2021:

$2,658), and $924 cash outflow relating to working capital balance

changes for capital items (Q3-2021: $315 inflow).

YTD-2022 the Corporation’s cash from investing

activities was $6,713 (YTD-2021: $2,850 used). Proceeds on disposal

of property and equipment was $11,365 (YTD-2021: $983), partially

offset by capital expenditures of $3,976 (YTD-2021: $4,108), and

$676 cash outflow relating to working capital balance changes for

capital items (YTD-2021: $275 inflow).

Financing Activities

Q3-2022, the Corporation’s cash used in

financing activities was $905 (Q2-2021: $509). During the quarter

the Corporation made dividend payments of $731, lease payments of

$94 (Q2-2021: $407) and mortgage principal repayments of $80, see

“Mortgage Financing below”.

YTD-2022, the Corporation’s cash used in

financing activities was $2,214 (YTD-2021: $11,301). During the

period the Corporation made lease payments of $1,025 (YTD 2021:

$1,199), dividend payments of $1,218 and principal payments on

mortgage financings of $215, see “Mortgage Financing below”

(YTD-2021: $10,000 loan payment on Credit Facility).

Mortgage Financing

|

|

As at |

As at |

|

|

|

|

September 30, 2022 |

December 31, 2021 |

|

Current |

|

|

|

3,889 |

296 |

|

Non-current |

|

|

|

3,971 |

7,779 |

|

Total |

|

|

|

7,860 |

8,075 |

In December 2021, High Arctic entered a mortgage

arrangement with the Business Development Bank of Canada (BDC) for

$8,100, secured by lands and buildings owned and occupied by High

Arctic within Alberta. The mortgage financing provides the

Corporation with long term liquidity and adds to existing cash

balances. The mortgage has an initial term of 5 years with a fixed

interest rate of 4.30% and an amortization period of 25 years with

payments occurring monthly. In January 2023, the High Arctic will

transfer title to certain owned real estate locations to the

purchaser of the well servicing business and will be required to

repay mortgage principal of $3,565 related to these properties.

The Corporation capitalized $25 in financing

fees incurred to set up the loan in 2021 and applied this to the

long-term debt liability. Financing fees will be amortized over the

expected life of the mortgage financing.

NON - IFRS MEASURES

This news release contains references to certain

financial measures that do not have a standardized meaning

prescribed by International Financial Reporting Standards (“IFRS”)

and may not be comparable to the same or similar measures used by

other companies. High Arctic uses these financial measures to

assess performance and believes these measures provide useful

supplemental information to shareholders and investors. These

financial measures are computed on a consistent basis for each

reporting period and include EBITDA, Adjusted EBITDA, EBITDA for

purposes of long-term debt covenants, Oilfield services operating

margin, Percent of revenue, Funds provided from operations, Working

capital, Total long-term financial liabilities, excluding long-term

debt, and Net cash, none of which have standardized meanings

prescribed under IFRS.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at www.sedar.com

and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the Corporation’s actual

results, performance or achievements to vary from those described

in this news release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this news release include, among

others, statements pertaining to the following: potential for

higher profits and free cash flow; returning to consistent drilling

operations following an exceptional period of Covid driven activity

suspension; a return of capital to shareholders or reinvestment in

the business; impact of commodity prices on demand for and market

prices for the Corporation’s services; continued impact of

Covid-19; emerging opportunities to deploy drilling assets in Papua

New Guinea; expansion of the PNG energy sector; expected drilling

commencement dates for rigs in PNG; additional drilling rig

deployment in the first-half of 2023; sustained high LNG demand

particularly in Asia; substantive LNG export growth in PNG;

anticipation Rig 103 will operate consistently through the term of

the contract; incremental drilling opportunities associated with

LNG expansion; future contracts for Rig 104 with third-party

customers; climate and weather predictions and their effect on

energy demand; the Corporation’s ability to maintain a USD bank

account and conduct its business in USD in PNG; market fluctuations

in interest rates, commodity prices, and foreign currency exchange

rates; restrictions to repatriate funds held in PGK; factors upon

which the Corporation will decide whether or not to undertake a

specific course of operational action or expansion; the

Corporation’s ongoing relationship with key customers; treatment

under governmental regulatory regimes and political uncertainty and

civil unrest; developments in Ukraine; effect of economic and trade

sanctions on Russia; OPEC’s ability and desire to change future

production; development of additional pathways to market in Canada,

and a shift in political focus from energy transition to energy

security; and estimated credit risks and tax losses.

With respect to forward-looking statements

contained in this news release, the Corporation has made

assumptions regarding, among other things, its ability to: obtain

equity and debt financing on satisfactory terms; market

successfully to current and new customers; the general continuance

of current or, where applicable, assumed industry conditions;

activity and pricing; assumptions regarding commodity prices, in

particular oil and gas; the Corporation’s primary objectives, and

the methods of achieving those objectives; obtain equipment from

suppliers; construct property and equipment according to

anticipated schedules and budgets; remain competitive in all of its

operations; and attract and retain skilled employees.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this news release, along with the risk factors set out

in the most recent Annual Information Form filed on SEDAR at

www.sedar.com.

The forward-looking statements contained in this

news release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this news release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy Services

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

nitrogen services and pressure control equipment on a rental basis

to a number of exploration and production companies.

For further information contact:

Lance Mierendorf, Chief Financial

Officer P:

+1 (587) 318 2218P: +1 (800) 688

7143 High

Arctic Energy Services Inc.Suite 2350, 330 – 5th Ave SWCalgary,

Alberta, Canada T2P 0L4

website: www.haes.caEmail: info@haes.ca

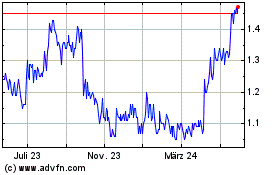

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

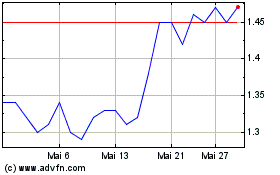

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025