High Arctic Declares Special One-Time Dividend

21 Oktober 2021 - 3:10AM

High Arctic Energy Services Inc. (TSX: HWO) (“High Arctic” or the

“Corporation”) is pleased to announce that its Board of Directors

has approved a special one-time dividend payment of $0.20 per share

to holders of common shares. The dividend is payable on November 5,

2021 to holders of High Arctic common shares of record at the close

of business on October 27, 2021. The ex-dividend date is October

26, 2021. The dividend is designated as an "eligible dividend" for

Canadian Income Tax purposes.

With the first quarter 2020 declaration of the

Covid-19 Pandemic and emergence of an oil price crisis, the Board

of Directors (the “Board”) suspended regular dividends, halted

share repurchases and borrowed $10 million on its revolving loan

facility to preserve financial strength. Since this time, the Board

and management has continuously monitored business conditions and

the financial assets of the Corporation. This included workforce

and asset preservation while streamlining business processes within

a global leadership structure. Improvement led the Corporation to

repay the $10 million dollars drawn from the revolving loan

facility during the first quarter of 2021. Continuing improvement

during 2021 positioned the Corporation to consider the best use of

surplus cash carried since 2019.

Currently, positive developments position High

Arctic to pay a special one-time dividend while preserving a strong

capital structure. Notwithstanding continuing Covid-19 Pandemic

challenges, these developments include: economic recovery in the

Canadian and global economy, a recovery in global demand for

energy, sustained high energy prices for oil and natural gas, the

annual Canadian “breakup” seasonal activity low having passed, a

resurgence in demand for energy services in Canada and High

Arctic’s revenue generating activity in Papua New Guinea

recommencing.

Mike Maguire, Chief Executive Officer, stated:

“Having considered other investment options available to us, it is

our view that the most appropriate action right now is to return

surplus cash to shareholders by way of special dividend. Post

dividend the Corporation will still have a substantive cash

balance, an undrawn loan facility and with improving EBITDA

increasing access to funds under our $45 million loan facility to

fund growth initiatives.

We continue to prudently explore opportunities

to use our assets to increase shareholder value. This is evidenced

by our Q3 2021 investment in modern hydraulic catwalks in our

Canadian business and an available Normal Course Issuer Bid to

repurchase common shares of the Corporation. We will continue to

monitor market conditions, the outlook for our business activities,

access to funds and the financial assets of the Corporation with a

view to optimising the returns to shareholders including

consideration of the timing and amount of any prospective return to

regular dividend payments.”

About High Arctic

High Arctic’s principal focus is to provide

drilling and specialized well completion services, equipment

rentals and other services to the oil and gas industry. High Arctic

is a market leader providing drilling and specialized well

completion services and supplies rig matting, camps, and drilling

support equipment on a rental basis in Papua New Guinea. The

western Canadian operation provides well servicing, well

abandonment, snubbing and nitrogen services and equipment on a

rental basis to exploration and production companies.

For further information, please contact:

Lance MierendorfChief Financial

Officer1.587.318.22181.800.668.7143High

Arctic Energy Services Inc.Suite 500, 700 – 2nd

Street S.W.Calgary, Alberta, Canada T2P

2W1website:

www.haes.caEmail:

info@haes.ca

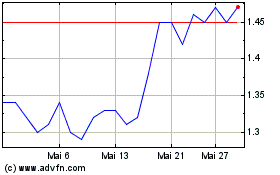

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

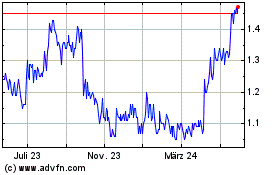

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Apr 2024 bis Apr 2025