Guardian Capital Group Limited Completes Acquisition of Emerging Markets Equity Firm, Zephyr Management U.K. Limited

14 April 2014 - 10:30PM

Marketwired Canada

Guardian Capital Group Limited ("Guardian") (TSX:GCG)(TSX:GCG.A) announced today

that it has completed the acquisition of London, UK-based Zephyr Management U.K.

Limited ("Zephyr"). The acquisition adds emerging markets equity investment

capabilities and provides Guardian an international platform in a key global

financial centre to expand its asset management business.

The Zephyr investment team combined has over 60 years of emerging markets equity

experience and will continue to be led by Steve Bates, who has been appointed

Managing Director, Head of Emerging Markets Equity.

George Mavroudis, President and CEO of Guardian said: "Despite the recent

economic challenges in developing markets, we believe emerging market equities

are a core component for investors' strategic asset allocation decisions. The

overall investment thesis in emerging equity markets is more compelling now than

at any point in the last number of years due to the recent multi-year low

valuations for several quality companies operating in those markets. With the

addition of Steve and his team, Guardian can offer its clients an opportunity to

participate in the long-term dynamic and diversified developing economies, by

investing in a high-quality strategy with a long proven track record of

success."

The integration of the Zephyr emerging market strategies will add approximately

$100 million to the assets under management of Guardian's investment management

subsidiaries. Guardian is acquiring Zephyr Management U.K. Limited from its

parent company, Zephyr Management, L.P., a global investment management firm

headquartered in New York, which focuses on emerging market private equity

investments, as well as wealth management.

About Guardian Capital Group Limited

Guardian Capital Group Limited is a diversified financial services company

founded in 1962. Guardian provides investment management services to

institutional and high net worth clients; provides financial services to

international investors; and provides services to financial advisors in its

national mutual fund dealer, securities dealer, and insurance distribution

network. Its Common and Class A shares are listed on the Toronto Stock Exchange.

As at December 31, 2013, Guardian had assets under management of $22.2 billion

and assets under administration were $11.6 billion.

FOR FURTHER INFORMATION PLEASE CONTACT:

Guardian Capital Group Limited

George Mavroudis

President & Chief Executive Officer

(416) 364-8341

Guardian Capital Group Limited

Vern Christensen

Senior Vice-President and Secretary

(416) 947-4093

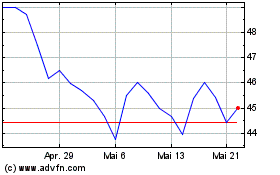

Guardian Capital (TSX:GCG.A)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

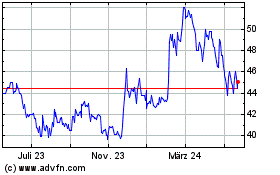

Guardian Capital (TSX:GCG.A)

Historical Stock Chart

Von Jun 2023 bis Jun 2024