Forsys Files Updated NI 43-101 Technical Report on Norasa Uranium Project

27 März 2014 - 12:41PM

Marketwired Canada

Forsys Metals Corp. (TSX:FSY)(FRANKFURT:F2T)(NAMIBIAN:FSY) ("Forsys" or the

"Company") is pleased to announce today that subsequent to its news release

dated February 11, 2014, it has filed an updated National Instrument 43-101

Technical Report ("NI 43-101") on SEDAR (www.sedar.com) for its 100% owned

Norasa Uranium Project ("Norasa") located in Namibia.

This NI 43-101 Technical Report describes the Mineral Resource and Reserve

estimation and economic analyses to a pre-feasibility level for Norasa. Norasa

consists of the Valencia (Mining Licence, ML 149) ("Valencia") and Namibplaas

(Exclusive Prospecting Licence, EPL 3638) ("Namibplaas") Uranium Projects.

The Mineral Resources are reported above cut-off grades of 100ppm and 160ppm

U3O8 for Valencia and Namibplaas respectively, and areas have been classified as

Measured, Indicated and Inferred Resources in accordance with the guidelines of

the NI 43-101 as listed in Table 1. Estimated Measured and Indicated Mineral

Resource for Norasa is 237Mt at a grade of 197ppm U3O8, which equates to 103Mlbs

of U3O8. The estimated Inferred Mineral Resource is 50Mt at a grade of 198ppm

U3O8 for 22Mlbs of U3O8

The Mineral Reserve estimate is summarised in Table 2. The total Proven and

Probable Norasa Ore Reserve is 177Mt at a grade of 202ppm, which equates to

79Mlbs of U3O8. Resources are reported inclusive of Reserves. Mineral Resources

that are not Reserves either haven't demonstrated economic viability or don't

meet the cut-off grade criteria.

Table 1. Norasa Mineral Resource (October 2013)

----------------------------------------------------------------------------

Category Cut-Off Grades Tonnes (M) U3O8(ppm) U3O8(Mlbs)

----------------------------------------------------------------------------

Measured

Val 60ppm: Nam 100ppm 27 153 9

Val 100ppm: Nam 160ppm 17 202 7

Val 140ppm: Nam 200ppm 10 253 6

----------------------------------------------------------------------------

Indicated

Val 60ppm: Nam 100ppm 419 153 141

Val 100ppm: Nam 160ppm 221 197 96

Val 140ppm: Nam 200ppm 114 248 62

----------------------------------------------------------------------------

Measured +

Indicated

Val 60ppm: Nam 100ppm 447 153 150

Val 100ppm: Nam 160ppm 237 197 103

Val 140ppm: Nam 200ppm 125 248 68

----------------------------------------------------------------------------

Inferred

Val 60ppm: Nam 100ppm 105 156 36

Val 100ppm: Nam 160ppm 50 198 22

Val 140ppm: Nam 200ppm 18 269 10

----------------------------------------------------------------------------

Resources are reported inclusive of Reserves.

Table 2. Norasa Mineral Reserve Estimate (February 2014)

----------------------------------------------------------------------------

Classification Tonnes (M) U3O8(ppm) U3O8(Mlbs)

----------------------------------------------------------------------------

Proven 16 203 7.3

Probable 161 202 71.7

Total Reserve 177 202 79.0

----------------------------------------------------------------------------

Cut-off grades of 100ppm for Valencia and 160ppm Namibplaas

The Reserves come from three deposits, resulting in 3 distinct pits; the

Valencia pit, a small satellite pit just 500m away from Valencia, and the

Namibplaas pit.

"This Technical Report has confirmed the strengthening economics of our Norasa

Uranium Project," said Marcel Hilmer, CEO of Forsys Metals. "Norasa is now at an

advanced stage of development and the improved economics, coupled with the

commencement of the nuclear power market recovery add to the momentum we

continue to build."

Economic analysis and parameters

A financial model was prepared to assess the economics for Norasa based on the

Mineral Reserve and mining schedule to report NPV, payback and IRR. The

financial model quantifies the revenues, costs and capital expenditure over a

13-year life of mine. It is believed that these results are accurate to within

+/-25%, within the constraints of the associated assumptions.

NPVs were calculated on post-tax, uninflated cash flows at discount rates of 0%,

6% and 8% and outcomes are shown in Table 3. The IRR for the project is 36%. A

long-term uranium price of US$68/lb is assumed. The project has a payback period

of 3 years after commencement of production.

Table 3. Norasa Project NPV

----------------------------------

Discount Rate NPV (US$ M)

----------------------------------

0% 851

6% 491

8% 410

----------------------------------

The financial modelling was based on the following production assumptions:

-- construction to commence in early 2015,

-- plant commissioning by mid 2016,

-- mining to commence in early 2016 to prepare pit benches and open mining

faces,

-- the mining rate steadily increases to 68Mtpa in 2021,

-- radiometric sorting is introduced in mid 2018, after 2 years of plant

operation,

-- nameplate Norasa plant capacity obtained in 2019.

Economic parameters include:

-- metal price of US$68/lb throughout the life of mine,

-- as of the end of 2013, deferred exploration expenditures of US$32.9M for

Valencia and US$7.3M for Namibplaas are capital deductible and included

in the model.

The production schedule is described in Figure 1 and forms the basis for the

economic model with consideration of the above development schedule. The

resulting annual uranium production is given in Figure 2.

To view Figure 1. Plant feed tonnages and grade, please visit the following

link: http://media3.marketwire.com/docs/FSY1.jpg.

To view Figure 2. Planned uranium production, please visit the following link:

http://media3.marketwire.com/docs/FSY2.jpg.

To view Figure 3. Locality of Norasa's Valencia and Namibplaas deposits with

proposed pit outlines, please visit the following link:

http://media3.marketwire.com/docs/FSY3.jpg.

NI 43-101 and Qualified Persons

Mr. Martin Hirsch, M.Sc in Geology and a member of the British IMMM, Chief

Geologist for Forsys Metals Corp., is the designated Qualified Person

responsible for the Company's exploration programs and reporting of Mineral

Resources. Mr. Hirsch has sufficient experience that is relevant to the style

and mineralization, type of deposit and the use of radiometrics in resource

estimation to qualify as a Qualified Person under NI 43-101.

Mr. Dag Kullmann, M.Sc. Mining Engineering from the University of Alberta, a

Fellow of the Southern African Institute of Mining and Metallurgy (SAIMM),

Engineering Manager for Forsys, is the designated QP responsible for the

reporting of Mineral Reserves. Mr. Kullmann has sufficient experience in the

assessment and application of modifying factors required for the determination

of reserves for open pit operations to qualify as a QP under NI 43-101.

About Forsys Metals Corp.

Forsys Metals Corp. is an emerging uranium producer with 100% ownership of the

fully permitted Valencia uranium project and the Namibplaas uranium project in

Namibia, Africa a politically stable and mining friendly jurisdiction.

Information regarding current National Instrument 43-101 compliant Resource and

Reserves at Valencia and Namibplaas are available on our website. Shares

outstanding: 109.9M

On behalf of the Board of Directors of Forsys Metals Corp. Marcel Hilmer, Chief

Executive Officer

Sedar Profile #00008536

Forward-Looking Information

This news release contains projections and forward-looking information that

involve various risks and uncertainties regarding future events. Such

forward-looking information can include without limitation statements based on

current expectations involving a number of risks and uncertainties and are not

guarantees of future performance of the Company. The following are important

factors that could cause Forsys actual results to differ materially from those

expressed or implied by such forward looking statements: fluctuations in uranium

prices and currency exchange rates; uncertainties relating to interpretation of

drill results and the geology; continuity and grade of mineral deposits;

uncertainty of estimates of capital and operating costs; recovery rates,

production estimates and estimated economic return; general market conditions;

the uncertainty of future profitability; and the uncertainty of access to

additional capital. Full description of these risks can be found in Forsys

Annual Information Form, dated March 15, 2013, available on the Company's

profile on the SEDAR website at www.sedar.com. These risks and uncertainties

could cause actual results and the Company's plans and objectives to differ

materially from those expressed in the forward-looking information. Actual

results and future events could differ materially from anticipated in such

information. These and all subsequent written and oral forward looking

information are based on estimates and opinions of management on the dates they

are made and expressed qualified in their entirety by this notice. The Company

assumes no obligation to update forward-looking information should circumstances

or management's estimates or opinions change.

The Toronto Stock Exchange has not reviewed and does not accept responsibility

for the adequacy or accuracy of this release

FOR FURTHER INFORMATION PLEASE CONTACT:

Forsys Metals Corp.

Marcel Hilmer

Chief Executive Officer

+61 417 177 942

mhilmer@forsysmetals.com

www.forsysmetals.com

TMX Equicom

Joe Racanelli

+1 416-815-0700 Ext 243

jracanelli@tmxequicom.com

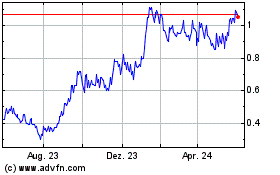

Forsys Metals (TSX:FSY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Forsys Metals (TSX:FSY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024