FirstService Increases Debt Funding Capacity and Flexibility With Existing Senior Unsecured Noteholders

29 September 2022 - 10:30PM

FirstService Corporation (TSX: FSV; NASDAQ: FSV)

("

FirstService") announced today that it has

entered into two new revolving, uncommitted financing facilities

(the “Facilities”) for potential future private placement issuances

of senior unsecured notes (“Notes”) aggregating US$450 million with

its existing lenders, NYL Investors LLC (“New York Life”) of up to

US$150 million and PGIM Private Capital, the direct private debt

and structured equity investment affiliate of PGIM, Inc.

(“Prudential”), of up to US$300 million, in each case, net of any

existing Notes held by them. The Facilities each have a three-year

term ending September 29, 2025. FirstService has the ability to

issue incremental Note tranches under the Facilities, subject to

acceptance by New York Life or Prudential, with varying maturities

as determined by FirstService, and with coupon pricing determined

at the time of each Note issuance.

As part of the closing of the New York Life

facility, FirstService issued, on a private placement basis to New

York Life, US$60 million of 4.53% Notes due September 29, 2032.

Together with the previously outstanding US$90 million of 3.84%

Notes due January 16, 2025, which are equally held by New York Life

and Prudential, FirstService currently has US$150 million of issued

and outstanding Notes, leaving US$300 million of remaining capacity

under the Facilities at the present time. The proceeds from any

issued Notes are intended to be utilized for working capital and

general corporate purposes and to fund future tuck-under

acquisitions, as well as potential repayment of amounts outstanding

under FirstService’s revolving bank credit facility. Covenants and

restrictions under the Facilities are substantively equivalent to

those contained in FirstService’s revolving bank credit

facility.

“We appreciate the long-standing relationships

and support from Prudential and New York Life, who have both

participated for many years as lenders within our capital

structure. The Facilities provide us with the potential for

incremental liquidity, financial flexibility and a streamlined

process to tap into multiple tranches of Notes in varying amounts

and tenors over the next three years,” said Jeremy Rakusin, Chief

Financial Officer. “These arrangements and the simultaneous US$60

million 10-year Note issuance have also further optimized our fixed

and floating debt mix and enhanced the balance between our short

and long debt funding obligations, thus reinforcing our debt

capacity and overall strength of our balance sheet in support of

our future growth,” he concluded.

About FirstService

CorporationFirstService Corporation is a North

American leader in the property services sector, serving its

customers through two industry-leading service

platforms: FirstService Residential, North

America's largest manager of residential communities;

and FirstService Brands, one of North

America's largest providers of essential property services

delivered through individually branded franchise systems and

company-owned operations.

FirstService generates more than US$3.4 billion

in annual revenues and has approximately 25,000 employees across

North America. With significant insider ownership and an

experienced management team, FirstService has a long-term track

record of creating value and superior returns for

shareholders. The Common Shares of FirstService trade on the

NASDAQ and the Toronto Stock Exchange under the symbol "FSV", and

are included in the S&P/TSX 60 Index. For the latest news

from FirstService Corporation, visit www.firstservice.com.

Forward-looking StatementsThis

press release includes or may include forward-looking statements.

Much of this information can be identified by words such as “expect

to,” “expected,” “will,” “estimated” or similar expressions

suggesting future outcomes or events. FirstService believes the

expectations reflected in such forward-looking statements are

reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements should

not be unduly relied upon. These statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results to be materially different from any future results,

performance or achievements contemplated in the forward-looking

statements. Such factors include: (i) general economic and business

conditions, which will, among other things, impact demand for

FirstService’s services and the cost of providing services; (ii)

the ability of FirstService to implement its business strategy,

including FirstService’s ability to acquire suitable acquisition

candidates on acceptable terms and successfully integrate newly

acquired businesses with its existing businesses; (iii) changes in

or the failure to comply with government regulations; and (iv)

other factors which are described in FirstService’s annual

information form for the year ended December 31, 2021 under the

heading “Risk factors” (a copy of which may be obtained at

www.sedar.com) and Annual Report on Form 40-F filed with the United

States Securities and Exchange Commission (a copy of which may be

obtained at www.sec.gov), and subsequent filings (which factors are

adopted herein). Forward-looking statements contained in this press

release are made as of the date hereof and are subject to change.

All forward-looking statements in this press release are qualified

by these cautionary statements. Unless otherwise required by

applicable securities laws, we do not intend, nor do we undertake

any obligation, to update or revise any forward-looking statements

contained in this press release to reflect subsequent information,

events, results or circumstances or otherwise.

COMPANY CONTACTS:

D. Scott PattersonChief

Executive Officer(416) 960-9566

Jeremy RakusinChief

Financial Officer(416) 960-9566

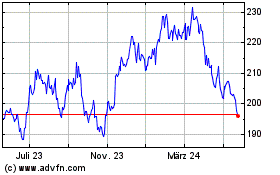

FirstService (TSX:FSV)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

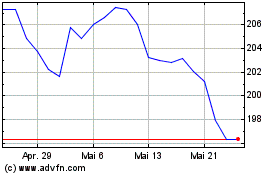

FirstService (TSX:FSV)

Historical Stock Chart

Von Jan 2024 bis Jan 2025