Exchange Income Corporation (TSX: EIF) (“EIC”, the “Corporation”,

or “we”) announced today that it has entered into an agreement to

sell, on a bought deal basis, 1,860,000 common shares (the

“Shares”) from treasury to a syndicate of underwriters (the

“Underwriters”) co-led by CIBC Capital Markets, National Bank

Financial Inc. and Laurentian Bank Securities Inc. The Shares will

be offered at a price of $37.65 per Share, for gross proceeds to

the Corporation of approximately $70 million (the “Offering”). The

net proceeds of the sale of the Shares will be used to fund two

acquisitions (as described below), and for general corporate

purposes.

The Corporation has also granted to the Underwriters an

over-allotment option to purchase up to 279,000 additional

Shares, representing 15% of the size of the Offering. The

over-allotment option may be exercised, in whole or in part, at the

sole discretion of the Underwriters, until 30 days following the

closing of the offering.

Closing of the Offering is expected to occur on or about October

29, 2019. We expect to report third quarter results on November 7,

2019, which we expect to be in-line with or above analyst consensus

estimates, prior to an adjustment for a small, one-time bad debt

allowance charge related to the insolvency of a single airline

customer.

The Offering is subject to normal regulatory approvals,

including approval of the Toronto Stock Exchange of the listing of

the Shares, and will be offered in each of the provinces of Canada

by way of a short form prospectus. The Shares have not been and

will not be registered under the United States Securities Act of

1933, as amended, and accordingly will not be offered, sold or

delivered, directly or indirectly within the United States, its

possessions and other areas subject to its jurisdiction or to, or

for the account or for the benefit of a United States person,

except pursuant to applicable exemptions from the registration

requirements.

Acquisitions

EIC announced today it has acquired L.V. Control Mfg. Ltd.

(“L.V. Control”) and expects to close the acquisition of Advance

Window, Inc. (“AWI”) next week. Further details on L.V. Control

follows below. AWI is a full-service glazier that operates in the

Northeastern United States. Upon the close of the

transaction, EIC will announce its completion and provide further

details on the acquisition. The closing of the Offering is not

contingent on the closing of the AWI acquisition.

The aggregate purchase price for the two

companies is up to $78 million if certain post-closing targets are

achieved. At closing, EIC will pay $72 million funded with $62.6

million in cash and $9.4 million in EIC shares.

The acquisitions, after giving effect to the

Offering, are expected to be immediately accretive to EIC,

resulting in increases to both Adjusted Net Earnings per share and

Free Cash Flow less Maintenance Capital Expenditures per share. As

a result, the payout ratios calculated using both metrics are

expected to further improve. In addition to being immediately

accretive, the leverage of the Corporation will decrease as a

result of these transactions as, at closing, the acquisitions will

be fully financed with equity.

L.V. Control

Founded in 1975, L.V. Control is an electrical and control

systems integrator focused on the agriculture material handling

segment with primary activities in grain handling, crop input, feed

processing, and seed cleaning. L.V. Control has their own

proprietary technology, which enables them to integrate multiple

systems into one seamless interface. With decades of

industry-specific knowledge they have developed unique products

that help to increase the efficiency of their customers’ operations

by improving product flow-through, reducing energy and human

resource costs, and capturing data. Through significant investment

in product development and delivering value to their customer, they

are the established leader in agriculture process control systems

and automation in Canada.

“We are very excited about the acquisition of

L.V. Control,” stated CEO Mike Pyle. “As a leader in their market,

they are a great addition to our growing manufacturing segment. The

transaction is accretive to our earnings, cash flow and ability to

pay a growing dividend. Brent and Grant have built an outstanding

business with exceptional customer relationships, a skilled and

experienced team of employees and substantial growth

opportunities.”

The two owners, Brent Murray and Grant Floren,

have committed to continue in their current roles at L.V. Control.

In addition to its owners, the company has a solid depth of tenured

key managers, and the average tenure of all the company’s employees

is over ten years. In explaining the decision to sell to EIC,

Murray stated, “We decided to sell the business to ensure a smooth

succession and strengthen the company’s long-term future. We wanted

a partner who would work with us to help the company grow.” Floren

added, “L.V. Control is a family run company and it’s very

important to us that we are able to maintain our unique culture, as

it’s critical to our success. EIC’s approach resonated with how we

envision the future of L.V. and how we want to treat our valued

employees. EIC’s track record speaks for itself and we are

confident that this is the right fit for our company, our employees

and our customers.”

“This is an attractive investment for EIC, as it

meets both our financial and qualitative requirements and has a

solid outlook,” stated Adam Terwin, Chief Corporate Development

Officer of EIC. “L.V. Control is a successful family business in a

niche market, combining engineering with proprietary products and

software to generate a one-of-a-kind solution to their customers.

It is a unique opportunity to grow our manufacturing segment and

increase our exposure to the agricultural sector with a

best-in-class operator.”

About Exchange Income Corporation:

Exchange Income Corporation is a diversified

acquisition-oriented company, focused in two sectors: aerospace

& aviation services and equipment, and manufacturing. The

Corporation uses a disciplined acquisition strategy to identify

already profitable, well-established companies that have strong

management teams, generate steady cash flow, operate in niche

markets and have opportunities for organic growth.

The Corporation currently operates two segments: Aerospace &

Aviation and Manufacturing. The Aerospace & Aviation segment

consists of the operations of Perimeter Aviation, Keewatin Air,

Calm Air International, Bearskin Lake Air Service (operating as a

division of Perimeter Aviation), Custom Helicopters, Regional One,

Provincial Aerospace and Moncton Flight College, and an investment

in Wasaya Group. The Manufacturing segment consists of the

operations of Overlanders Manufacturing, Water Blast, Stainless

Fabrication, WesTower Communications, Ben Machine and Quest Window

Systems. For more information on the Corporation, please visit

www.ExchangeIncomeCorp.ca. Additional information relating to the

Corporation, including all public filings, is available on SEDAR

(www.sedar.com).

About L.V. Control

For over 40 years, L.V. Control has specialized in the design

and manufacturing of electrical distribution equipment and process

control systems. The company’s focus on expertise is primarily

concentrated on meeting the needs of the agricultural industry,

including automation of grain handling, feed processing, seed

cleaning and fertilizer blending facilities. For more

information please visit www.lvcontrol.com

Caution Concerning Forward-Looking

Statements

The statements contained in this news release

that are forward-looking are based on current expectations and are

subject to a number of uncertainties and risks, and actual results

may differ materially. These uncertainties and risks include, but

are not limited to, the dependence of Exchange Income Corporation

on the operations and assets currently owned by it, the degree to

which its subsidiaries are leveraged, the fact that cash

distributions are not guaranteed and will fluctuate with the

Corporation’s financial performance, dilution, restrictions on

potential future growth, the risk of shareholder liability,

competitive pressures (including price competition), changes in

market activity, the cyclicality of the industries, seasonality of

the businesses, poor weather conditions, and foreign currency

fluctuations, legal proceedings, commodity prices and raw material

exposure, dependence on key personnel, and environmental, health

and safety and other regulatory requirements. Further information

about these and other risks and uncertainties can be found in the

disclosure documents filed by Exchange Income Corporation with the

securities regulatory authorities, available at www.sedar.com.

For further information, please

contact:

| Mike Pyle |

Trevor Heisler |

| Chief Executive Officer |

Investor Relations |

| Exchange Income Corporation |

NATIONAL Capital Markets |

| (204) 982-1850 |

(416) 848-1434 |

| MPyle@eig.ca |

theisler@national.ca |

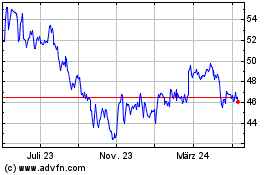

Exchange Income (TSX:EIF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

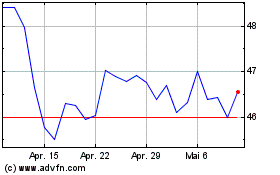

Exchange Income (TSX:EIF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025