ENDEAVOUR ANNOUNCES 1MOZ HIGH-GRADE INDICATED

RESOURCE ON KARI PUMP AT HOUNDéM&I Resources

increase by 40% · Discovery cost of $9/oz ·

Only 35% of the Kari target was tested

View News Release in PDF

HIGHLIGHTS:

- Kari Pump 1Moz maiden Indicated resource increases Houndé's

M&I resources by 40%

- Indicated resource of 11.3Mt at 2.71 g/t Au for 987koz;

Inferred resource of 0.2Mt at 2.21g/t Au for 20koz

- The mineralization covers an area 1.3km long by 0.8km wide and

remains open in numerous directions

- 98% of maiden resource has been classified to the Indicated

category

- Higher Indicated resource grade: 2.71g/t Au for Kari Pump

compared to 2.05g/t for the Houndé mine

- Amenable to open pit mining as mineralization starts at surface

- ~45% of the Indicated resource is located within the oxide and

transition zones, compared to most of the Houndé indicated resource

being located in fresh zones

- Low discovery cost of $9 per Indicated resource ounce

- Kari Pump represents only 35% of the large Kari gold in soil

anomaly

- Kari Pump is one of three high-grade discoveries made in the

large Kari gold in soil anomaly where more than 200,000m were

drilled over the past 18 months

- The Kari Center discovery extends 1.2km along strike and across

a width of over 200m, while the Kari West discovery extends at

least 1.0km along strike and across a width of 500m, with both

mineralized systems remaining open

- A second 200,000m drilling program will start before year-end,

focused on extending the mineralization at Kari Pump, and

delineating a maiden resource for Kari West and Kari Center

Abidjan, November 15, 2018 - Endeavour

Mining (TSX:EDV)(OTCQX:EDVMF) is pleased to announce a significant

maiden resource estimate for the previously announced Kari Pump

discovery at its flagship Houndé mine in Burkina Faso.

Kari Pump, located only 7km west of the

processing plant, is one of three high-grade discoveries made in

the large Kari gold in soil anomaly which covers a 6km-long by

2.5km-wide area. A total of 203,900 meters have been drilled over

the past 18 months, covering only 35% of the anomaly, with drill

results previously announced on November 13, 2017, and May 24,

2018.

Since May 2018, efforts have focused mainly on

the Kari Pump discovery, with over 71,000 meters drilled to extend

and in-fill its mineralization, which has led to the successful

delineation of a maiden resource. In addition, over 20,000 meters

were drilled on the Kari Center and Kari West discoveries, for

which a maiden resource is expected to be delineated in 2019.

The Kari Pump maiden resource estimate has

increased Houndé's Measured and Indicated resources by 40%, as

presented in Table 1 below, while adding high-grade material. The

Kari Pump maiden resource covers an area 1.3km long by 0.8km wide

and remains open towards the east, north, northwest and southwest.

Due to the intensive in-fill drill program completed, 98% of maiden

resource has been classified to the indicated category. As the

mineralization starts at surface, it is amenable to open pit

mining. In addition, approximately 45% of the indicated resource is

located within the oxide and transition zones, compared to most of

the Houndé indicated resource located in fresh zones.

Table 1: Kari Pump November 2018 Mineral

Resource Estimate

| On a 100% basis. Resources shown inclusive of

Reserves |

HOUNDÉ MINE (as at Dec. 31, 2017) |

|

KARI PUMP (as at Nov. 1, 2018) |

|

TOTAL (Current as at Dec. 31, 2017) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

Var. Au Content |

| Measured Resource |

3.6 |

2.40 |

281 |

|

|

|

|

|

3.6 |

2.40 |

281 |

0% |

| Indicated

Resources |

33.7 |

2.01 |

2,178 |

|

11.3 |

2.71 |

987 |

|

45.0 |

2.19 |

3,165 |

45% |

| M&I

Resources |

37.3 |

2.05 |

2,459 |

|

11.3 |

2.71 |

987 |

|

48.7 |

2.20 |

3,446 |

40% |

| Inferred

Resources |

3.2 |

2.64 |

275 |

|

0.3 |

2.21 |

20 |

|

3.5 |

2.61 |

295 |

7% |

Mineral Reserve estimates follow the Canadian

Institute of Mining, Metallurgy and Petroleum ("CIM") definitions

standards for mineral resources and reserves and have been

completed in accordance with the Standards of Disclosure for

Mineral Projects as defined by National Instrument 43-101. Reported

tonnage and grade figures have been rounded from raw estimates to

reflect the relative accuracy of the estimate. Minor variations may

occur during the addition of rounded numbers. Mineral Resources

that are not Mineral Reserves do not have demonstrated economic

viability. Resources were constrained by MII 1500$/oz Pit Shell and

based on a cutoff of 0.5 g/t Au. For the notes related to the

Houndé Mine resource estimate, please consult the March 13, 2018

press release available on the Company's website. The Houndé Mine

Mineral Resource is inclusive of Houndé Mine production of 201,390

ounces of gold between December 31, 2017, and September 30, 2018.

The updated Mineral Resource has an effective date of November 1,

2018, and is current as of December 31, 2017.

Another aggressive 200,000-meter drill program

is expected to start before year-end focused on extending the

mineralization of Kari Pump and delineating a maiden resource for

both the Kari West and Kari Center discoveries, in addition to

testing other nearby targets.

Sébastien de Montessus, President and CEO,

stated: "The maiden resource announced today at Kari Pump is

extremely encouraging. The size and high-grade nature of the

resource confirms Houndé as a world-class asset with significant

exploration potential to extend its status as a long-life, low-cost

flagship mine within our portfolio.

I would like to congratulate our Houndé

Exploration team for its commitment, enthusiasm and professionalism

and to thank them for their efforts which are bearing fruit today.

It is impressive to delineate a maiden resource with more than 98%

classified in the indicated category and at a discovery cost of

just $9/oz."

Patrick Bouisset, Executive Vice-President

Exploration and Growth, stated: "We are very pleased with the

maiden resource at Kari Pump as it confirms the high potential we

see at Houndé. With over 200,000 meters drilled, processed and

analyzed in less than 18 months over the Kari area, our team has

proven the ability to deliver quickly on high-priority targets.

Looking ahead, we are excited by the upside

potential in the wider Kari area and the other regional targets. As

such we have launched another intensive 200,000-meter drill

campaign with the goal of quickly delineating more resources.

More broadly, the exploration success achieved

notably at Kari Pump, Ity and Fetekro just two years since the

implementation of our 5-year strategic exploration plan in late

2016, demonstrates that we remain on track to reach our ambitious

discovery target set at a discovery cost lower than $20/oz."

ABOUT THE KARI AREA EXPLORATION

PROGRAM

Following the decision to develop the Houndé

mine, exploration resumed in early 2017 with an initial

reconnaissance drilling campaign prioritizing various targets

identified during the 2016 exploration strategic review. In 2017,

the campaign validated Houndé's significant exploration potential

as high-grade mineralization was intercepted at the Kari,

Sia/Sianikoui, and Bouéré extension targets. Given the potential

size of the Kari gold in soil anomaly, which covers a 6km-long by

2.5km-wide area, the target was identified as a top priority and an

extensive drill campaign was launched.

As shown in Figure 1 below, the Kari area is

located only 7km west of the processing plant and in proximity to

an existing haul road that will be used to transport ore from

Bouéré.

Figure 1: Kari Area General location and

Mineralized Envelops (500 ppb Leapfrog Envelops)

Over the past 18 months, a total of 2,237 holes

have been drilled (comprised of 1,431 AC, 716 RC and 90 DD)

amounting to 203,900 meters, on an area which represents only 35%

of the large Kari gold in soil anomaly.

- In 2017, most of the initial reconnaissance drilling focused on

the Kari Pump target with a total of 337 AC holes totaling 30,460

meters, 23 RC holes totaling 3,400 meters, and few DD holes.

- The follow up drilling campaign which started in late December

2017 and ran until May 2018, consisted of 1,020 holes totaling

78,400 meters comprised of 900 AC reconnaissance holes totaling

63,500 meters and 120 RC holes totaling 14,900 meters. This

campaign extended the Kari Pump mineralization and outlined the

Kari West and Kari Center discoveries, as published on May 24,

2018. Mineralization at the Kari West discovery extends at least

1.0 kilometers along strike and across a width of 500 meters while

the mineralization at the Kari Center discovery extends 1.2

kilometers along strike and across a width of over 200 meters.

- Since May 2018, a follow-up drilling campaign, consisting of

573 RC holes totaling 61,537 meters and 69 DD holes totaling 10,106

meters, has been conducted on Kari Pump. In addition, a follow-up

drilling campaign consisting of 205 AC and RC holes totaling 20,074

meters has been conducted on the Kari Center and Kari West

discoveries, for which a maiden resource is expected to be

delineated in 2019.

Another intensive 200,000-meter drill program,

comprised of Air Core ("AC") reconnaissance, reverse circulation

("RC"), and diamond drilling ("DD"), is expected to start before

year-end focused on extending the mineralization of Kari Pump and

delineating a maiden resource for both the Kari West and the Kari

Center discoveries. In addition, drilling is also expected to be

done on new targets in close proximity to the Vindaloo pit

(currently being mined) and on other nearby

targets.

ABOUT KARI PUMP Since May 2018,

exploration efforts at Houndé have mainly been focused on the Kari

Pump discovery, with over 71,000 meters drilled to extend and

in-fill its mineralization which led to the successful delineation

of a maiden resource. Due to the intensive in-fill drill program

completed, based on a 40m by 40m drilling grid, 98% of the maiden

resource has been classified to the indicated category. The

drilling program was very successful, as over 84% of the drilled RC

and DD holes encountered at least one interval of mineralization of

0.5g/t Au with a minimum width of more than 2 meters. In addition,

the average drill hole intercept amounted to 6.54 meters at 3.01

g/t Au uncapped.

The Kari Pump maiden resource covers an area

1.3km long by 0.8km wide and remains open towards the east, north,

northwest and southwest. As the mineralization starts at surface,

it is amenable to open pit mining. In addition, approximately 45%

of the indicated resource is located within the oxide and

transition zones, compared to most of the Houndé Indicated resource

located in fresh zones.

A sensitivity analysis performed at a gold price

of $1,250/oz demonstrates the robustness of the Kari Pump resources

model due to its shallow and high-grade mineralization, as shown in

Table 2 below.

Table 2: Kari Pump November 2018 Mineral

Resource Estimate

| |

Tonnage |

Grade |

Content |

|

|

(Mt) |

(Au g/t) |

(Au koz) |

| INDICATED

RESOURCE |

|

|

|

| Based on a gold

price of $1,500/oz |

11.33 |

2.71 |

987 |

| Based on a gold

price of $1,500/oz |

7.86 |

3.15 |

796 |

| |

|

|

|

| INFERRED

RESOURCE |

|

|

|

| Based on a gold

price of $1,500/oz |

0.28 |

2.21 |

20 |

| Based on a gold

price of $1,500/oz |

0.20 |

2.36 |

15 |

|

|

|

|

|

No Measure resources have been estimated.

Mineral Reserve estimates follow the Canadian Institute of Mining,

Metallurgy and Petroleum ("CIM") definitions standards for mineral

resources and reserves and have been completed in accordance with

the Standards of Disclosure for Mineral Projects as defined by

National Instrument 43-101. Reported tonnage and grade figures have

been rounded from raw estimates to reflect the relative accuracy of

the estimate. Minor variations may occur during the addition of

rounded numbers. Mineral Resources that are not Mineral Reserves do

not have demonstrated economic viability. Resources were

constrained by MII 1500$/oz Pit Shell and for sensitivity purpose

by MII 1250$/oz pit shell and based on a cutoff of 0.5 g/t Au.

Some selected best intersects from the second

campaign over Kari Pump include (true width uncapped):

- H-18-030 : 8.91m @ 6.59 g/t Au including 2.48m @

18.85 g/t Au

- HA-18-002 : 8.00m @18.57 g/t Au including 1.80m @

77.50 g/t Au

- RC-18-071 : 20.86m @ 17.34 g/t Au including 2.98m @

112.80 g/t Au

- RC-18-110 : 5.00m @16.64 g/t Au Including 1.00m @

61.20 g/t Au, and 2.00m @ 7.81 g/t Au, and 2.00m @ 1.47 g /t

Au, and 33.99m @ 5.35 g/t Au including 1.00m @ 10.75 g/t Au, and

1.00m @ 9.79g/t Au, and 1.00m @ 8.36 g/t Au, and 3m @12.57 g/t Au,

and 2.00m @ 7.68 g/t Au, and 3.00m @ 7.11 g/t Au

- RC-18-127 : 3.93m @ 2.57 g /t Au Iincluding

0.98m @ 7.80 g/t Au, and 19.65m @ 4.30 g/t Au including 0.98m @

5.39 g/t Au, and 6.89m @ 8.06 g/t Au

- RC-18-164 : 6.94m @ 11.22 g/t Au including 0.99m@

47.20 g/t Au

- RC-18- 207 : 6.96m @ 15.47 g/t Au including 2.98m @

31.29 g/t Au

- RC-18-209 : 5.94m @ 48.32 g /t Au including

2.97m @ 95.40 g/t Au

- RC-18-212 : 11.89m @ 5.02 g/t Au including 0.99m @

7.36 g/t Au, and 1.98m @ 12.09 g/t Au

- RC-18-244 : 6.90m @ 28.85 g/t Au including 2.96m @

66.47 g/t Au

- RC-18-261 : 6.93m@ 8.02 g/t Au including 1.98m @

24.65 g/t Au

- RC-18-276 : 2.98m @ 17.15 g /t Au including

0.99m @ 50.40 g/t Au

- RCA-18-086 : 9.95m @ 6.31 g/t Au including 2.98m @

17.09 g/t Au

- RCB-18-034 : 11.81m @ 31.44 g/t Au including 0.98m

@ 344.00 g/t Au

- RCB-18-109 : 2.90m @ 44.49 g/t Au including 0.97m @

126.50 g/t Au

- RCB-18-112 : 5.00m @ 109.25 g/t Au including 2.00m

@ 270.75 g/t Au

- RCB-18-114 : 8.95m @ 15.29 g/t Au including 1.99m @

57.90 g/t Au

- RCB-18-124 : 8.00m @ 25.81 g/t Au including 2.00m @

95.35 g/t Au

- RCB-18-125 : 1.95m @2.14 g/t Au, and 18.60m @ 6.34

g/t Au including 6.85m @ 15.02g/t Au

- RCB-18-128 : 16.76m @ 6.94 g/t Au including 4.93m @

12.85 g/t Au, and 0.99m @ 33.60 g/t Au

Figure 2: Kari Pump drill map and selected

intercepts (true width/grade) per area

Geologically, Kari Pump is underlain by andesite flows with

minor volcano-sediment and sediments that are locally intruded by

few diorite sills. Gold mineralization occurs within a sheared

reverse fault (D2) that appears to be folded and dipping from 0-40

degrees to the west-northwest and northwest. Observed clear

alteration consists of pervasive creamy sericite, intermittent

rhodochrosite, chlorite seams and pyritized quartz/carbonate

veining. The laterite and saprolite are relatively thick at Kari

Pump with an average thickness which is ranging from 50 to 85

meters.

As shown in Figures 3 and 4, mineralization exhibits excellent

continuity over the 1.3km long section and displays its typical

pinch and swell characteristics with often very high-grade quartz

veining systems over significant thickness alternating with thinner

intercepts associated with more moderate grades.

Kari Pump mineralization has also been significantly extended

since May 2018 and exhibits now some significant intercepts in the

oxide section within the saprolite and in some instances very close

from surface.

Figure 3: Kari Pump section A-A'

Figure 4: Kari Pump section B-B'

NEXT STEPS

- A 200,000-meter drilling program will be launched in December

2018 and will continue in 2019, with the main following objectives,

as shown in Figure 5 below:

- Pursue Kari Pump extensions with the goal of delineating

additional resources

- Delineate a maiden resource for both the Kari West and Center

discoveries

- Explore other highly ranked targets including notably Vindaloo

Deep and South, Dohun/Sia/Sianikoui and Grand Espoir

- Metallurgical tests on Kari Pump are underway and a reserve

calculation will then follow.

Figure 5: Houndé 2019 Exploration

Program

KARI PUMP RESOURCE MODELLING

The statistical analysis, geological modelling

and resource estimation were prepared by Kevin Harris, CPG. Mr.

Harris is Endeavour Mining's V.P. Resource Manager and a Qualified

Person as defined by NI 43-101.The Kari Pump resource model was

developed in Geovia's Surpac software. A total of six mineralized

zones were defined from the current drilling data and geologic

interpretations across Kari Pump. The gold assays from the

drill holes were composited to 1.0 meter intervals within the

mineralized wireframes and capped at from 10 to 40 g/t Au based on

the statistics of each mineralized zone. Spatial analysis of

the gold distribution within the mineralized zone using variograms

indicated a good continuity of the grades along strike and down dip

of the mineralized zones and were used to establish ordinary

kriging parameters.Density was measured in 4,016 core samples

within the various rock types then averaged within the model by the

weathered zones. The laterite density is 2.0, the saprolite

is 1.8, the transition is 2.25, and the fresh rock is 2.74.The gold

grade was estimated with the ordinary kriging method constrained

within the mineralized domains. The grade was estimated in

multiple passes to define the higher confidence areas and extend

the grade to the interpreted mineralized zone extents. The

grade estimation was validated with visual analysis by comparison

with the drilling data on sections, comparing with inverse distance

squared estimation, and with swath plots comparing the block grades

with the composites.The mineralized domains were classified as

indicated and inferred resource classifications depending on the

sample spacing, number samples, confidence in mineralized zone

continuity, and geostatistical analysis. Indicated

classification was generally applied to blocks within the

mineralized zoned defined by a minimum of six samples from at least

three drill holes with a 50-meter search. Inferred

classification is defined by a minimum of three samples within a

75-meter search from two drill holes.The resource was constrained

by a $1,500 and a $ 1,250 pit shell and 0.50 g/t cutoff. The

Whittle pit shell optimization assumed a base mining cost of $2.00

per tonne, and an adjusted ore mining cost of $3/tonne for oxide,

$3.8 /tonne for transition, and $3.85/tonne for fresh rock.

mining recovery of 95%, mining dilution of 20%, pit slope of 40o,

gold recovery of 90% in oxide, transition and fresh rock, and

processing and G&A cost of $16.20 per tonne for oxide,

$17.50/tonne for transition, and $20.50 for fresh rock.

ASSAYS AND QUALITY ASSURANCE/QUALITY CONTROL

/ DRILLING AND ASSAY PROCEDURES

Reverse Circulation drill samples were collected

at 1-meter intervals using dual tube, a percussion hammer and drop

center bit. Samples were split at the drill site using a 3-tier

riffle splitter with both total and laboratory sample weights

recorded. Wet samples were minimized, however if they occurred the

entire sample was dried and split using the same method and

equipment as the rest of the samples. A split of the sample

was taken and kept for reference. Representative samples for each

interval were collected with a spear, sieved into chip trays during

the course of geological logging and stored in a secure location.

Drill core (PQ, HQ and NQ size) samples are selected by geologists

and sawn in half with a diamond blade at the project site. Half of

the core is retained at the site for reference purposes. The

average sample interval is approximately one meter in length and

2kg to 3kg in weight. All samples are transported by road to ALS

Burkina SARL in Ouagadougou (Burkina Faso). A record of all stages

of the sample transportation is documented for chain of custody

purposes. Sample preparation includes, crushing the entire sample

to 2mm at 80% passing and pulverizing a 1kg split to 75 micro

meters at 85% passing. Samples are analyzed for gold using standard

fire assay technique with a 50-gram charge and an Atomic Absorption

(AA) finish. Assay results over 5 and 10 g/t Au are analysed by

gravimetric and screen fire assay methods, respectively. Coarse

blanks, field duplicates and certified reference material are

inserted by geologists in the sample stream for quality control and

to ensure there are adequate quality control samples in each fire

assay batch.All aspects of sampling and assaying at Kari is

monitored through the implementation of a quality assurance -

quality control (QA-QC) program, compliant with NI 43-101

standards. Kari drill and QA-QC programs were audited in 2017 and

the primary laboratory was audited in Q2 2018.

Full drill results are available by clicking

here.

QUALIFIED PERSONS

The scientific and technical content of this

news release has been reviewed, verified and compiled by Gérard de

Hert, EurGeol, Senior VP Exploration for Endeavour Mining. Gérard

de Hert has more than 20 years of mineral exploration and mining

experience and is a "Qualified Person" as defined by National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

("NI 43-101"). The resource estimation was completed by Kevin

Harris, CPG, VP Resources for Endeavour Mining and "Qualified

Person" as defined by National Instrument 43-101.

CONTACT INFORMATION

|

Martino De CiccioVP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

Brunswick Group LLP in LondonCarole Cable, Partner +44 7974

982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate

African gold producer with a solid track record of operational

excellence, project development and exploration in the highly

prospective Birimian greenstone belt in West Africa. Endeavour is

focused on offering both near-term and long-term growth

opportunities with its project pipeline and its exploration

strategy, while generating immediate cash flow from its

operations.Endeavour operates 5 mines across Côte d'Ivoire (Agbaou

and Ity), Burkina Faso (Houndé, Karma), and Mali (Tabakoto) which

are expected to produce 670-720koz in 2018 at an AISC of

$840-890/oz. Endeavour's high-quality development projects

(recently commissioned Houndé, Ity CIL and Kalana) have the

combined potential to deliver an additional 600koz per year at an

AISC well below $700/oz between 2018 and 2020. In addition, its

exploration program aims to discover 10-15Moz of gold between 2017

and 2021 which represents more than twice the reserve depletion

during the period.For more information, please

visit www.endeavourmining.com.Corporate Office: 5 Young St,

Kensington, London W8 5EH, UK This news

release contains "forward-looking statements" including but not

limited to, statements with respect to Endeavour's plans and

operating performance, the estimation of mineral reserves and

resources, the timing and amount of estimated future production,

costs of future production, future capital expenditures, and the

success of exploration activities. Generally, these forward-looking

statements can be identified by the use of forward-looking

terminology such as "expects", "expected", "budgeted", "forecasts",

and "anticipates". Forward-looking statements, while based on

management's best estimates and assumptions, are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to the

successful integration of acquisitions; risks related to

international operations; risks related to general economic

conditions and credit availability, actual results of current

exploration activities, unanticipated reclamation expenses; changes

in project parameters as plans continue to be refined; fluctuations

in prices of metals including gold; fluctuations in foreign

currency exchange rates, increases in market prices of mining

consumables, possible variations in ore reserves, grade or recovery

rates; failure of plant, equipment or processes to operate as

anticipated; accidents, labour disputes, title disputes, claims and

limitations on insurance coverage and other risks of the mining

industry; delays in the completion of development or construction

activities, changes in national and local government regulation of

mining operations, tax rules and regulations, and political and

economic developments in countries in which Endeavour operates.

Although Endeavour has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Please refer to Endeavour's most recent Annual

Information Form filed under its profile at www.sedar.com for

further information respecting the risks affecting Endeavour and

its business. AISC, all-in sustaining costs at the mine level, cash

costs, operating EBITDA, all-in sustaining margin, free cash flow,

net free cash flow, free cash flow per share, net debt, and

adjusted earnings are non-GAAP financial performance measures with

no standard meaning under IFRS, further discussed in the section

Non-GAAP Measures in the most recently filed Management Discussion

and Analysis.

- Figure 2: Kari Pump drill map and selected intercepts per

area.jpg

- Figure 3: Kari Pump section A-A’.jpg

- Kari drill results.xlsx

- View News Release in PDF.pdf

- Figure 1: Kari area general location and mineralized

envelops.jpg

- Figure 5: Houndé 2019 exploration program.jpg

- Figure 4: Kari Pump section B-B’.jpg

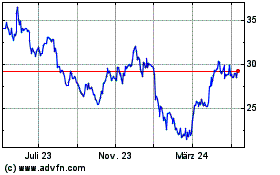

Endeavour Mining (TSX:EDV)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

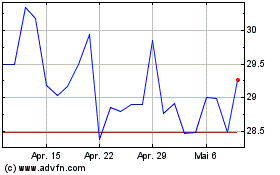

Endeavour Mining (TSX:EDV)

Historical Stock Chart

Von Dez 2023 bis Dez 2024