Endeavour Silver Corp. (NYSE:EXK)(TSX:EDR) is pleased to announce financial

results for the period ended March 31, 2014. Endeavour owns and operates three

underground silver-gold mines in Mexico: the Guanacevi mine in Durango state,

and the Bolanitos and El Cubo mines in Guanajuato state.

The Consolidated Interim Financial Statements and Management's Discussion &

Analysis can be viewed on the Company's website at www.edrsilver.com, on SEDAR

at www.sedar.com and EDGAR at www.sec.gov. All amounts are reported in US$.

Highlights of First Quarter 2014 (Compared to First Quarter 2013)

Financial

-- Net earnings of $4.0 million ($0.04 per share) compared to $14.4 million

($0.14 per share)

-- Adjusted earnings(1) of $5.5 million ($0.05 per share) compared to $12.9

million ($0.13 per share)

-- EBITDA(1) decreased 38% to $19.3 million

-- Cash flow from operations before working capital changes decreased 28%

to $18.3 million

-- Mine operating cash flow before taxes(1) decreased 22% to $25.4 million

-- Revenue decreased 24% to $53.0 million

-- Realized silver price fell 30% to $20.50 per ounce (oz) sold (consistent

with average spot price)

-- Realized gold price fell 19% to $1,306 per oz sold (consistent with

average spot price)

-- Cash costs(1) fell 52% to $4.87 per oz silver payable (net of gold

credits)

-- All-in sustaining costs fell 51% to $12.15 per oz silver payable (net of

gold credits)

-- Cash and equivalents rose 27% to $44.3 million compared to $35.0 million

at year end.

Operations

-- Silver production increased 27% to 1,898,999 oz

-- Gold production increased 23% to 18,519 oz

-- Silver equivalent production increased 26% to 3.0 million oz (at a 60:1

silver:gold ratio)

-- Bullion inventory at quarter-end included 295,839 silver ounces and 421

gold ounces

-- Concentrate inventory at quarter-end included 60,512 silver ounces and

1,113 gold ounces

-- Ore grades and metal recoveries were higher at all three mines

-- Guanacevi in particular had a strong Q1 thanks to sharply higher ore

grades at Porvenir Cuatro

(1) Adjusted earnings, mine operating cash flow, EBITDA, cash costs and all-

in sustaining costs are non-IFRS measures. Please refer to the

definitions in the Company's Management Discussion & Analysis.

Endeavour CEO Bradford Cooke stated: "We delivered another strong quarter of

silver and gold production in Q1, 2014, which puts us well ahead of our

production plan for the year. Both cash costs and all-in sustaining costs were

well below guidance thanks to our cost cutting strategies initiated last year.

However, our earnings were lower due to the sharply lower metal prices, in spite

of achieving higher grades and recoveries at all three mines. We continue to

work toward optimizing operating costs and improving profit margins given the

current low silver and gold prices."

Financial Results

For the first quarter ended March 31, 2014, the Company generated revenue

totaling $53.0 million (2013 - $69.9 million). During the quarter, the Company

sold 1,537,665 silver ounces and 16,445 gold ounces at realized prices of $20.50

and $1,306 per ounce respectively, compared to sales of 1,345,832 silver ounces

and 13,037 gold ounces at realized prices of $29.38 and $1,613 per ounce

respectively in the First Quarter of 2013.

After cost of sales of $41.7 million (2013 - $51.0 million), mine operating

earnings amounted to $11.3 million (2013 - $18.9 million) from mining and

milling operations in Mexico.

Excluding depreciation and depletion of $14.1 million (2013 - $12.1 million) and

stock-based compensation of $0.1 million (2013- $0.1 million), mine operating

cash flow before taxes was $25.4 million (2013 - $32.5 million excluding the

inventory write down) in the first quarter of 2014. Net earnings were $4.0

million (2013 -$14.4 million).

Net earnings also included a mark-to-market derivative liabilities loss related

to share purchase warrants issued in 2009 denominated in Canadian dollars, while

the Company's functional currency is the US dollar. Under IFRS, these warrants

are classified and accounted for as a financial liability at fair market value

with adjustments recognized through net earnings. The appreciation of these

warrants, prior to being exercised in the quarter, resulted in a derivative

liability loss of $1.4 million during the first quarter of 2014 (2013 - gain of

$1.5 million).

Excluding the mark-to market derivative liabilities gain, adjusted earnings were

$5.5 million ($0.05 per share) compared to $12.9 million ($0.13 per share) in

the same period of 2013. The drop in precious metals prices was the primary

reason for the decrease in the Company's earnings year over year.

Cost cutting initiatives that commenced in Q2, 2013 are now well established

which resulted in a 7% drop in direct production costs to $93 per tonne from Q1,

2013.

Cash costs per ounce, net of by-product credits (a non-IFRS measure and a

standard of the Silver Institute) fell 52% to $4.87 per ounce of payable silver,

compared to $10.04 per ounce in the same period of 2013. All-in-sustaining costs

per ounce (also a non-IFRS measure) fell 51% to $12.15 due in part to lower

exploration and mine development expenditures compared to Q1, 2013. Exploration

and mine development expenditures fluctuate quarter to quarter, and all-in

sustaining costs are expected to increase in the second and third quarters with

higher planned exploration and mine development expenditures. Going forward,

management expects cash costs per ounce to move closer to guidance as mined

grades revert to reported reserve grades.

Annual General Meeting of Shareholders Results

Shareholders voted in favour of all items of business, including the re-election

of each director nominee by show of hands. A total of 63.4 million votes were

submitted by proxy, representing 62.6% of the outstanding common shares as of

the record date. The following is a tabulation of the votes submitted by proxy:

Votes

Director Votes for withheld Percent for Percent withheld

----------------------------------------------------------------------------

Ricardo M. Campoy 27,266,442 668,204 97.61% 2.39%

Bradford J. Cooke 27,149,666 784,980 97.19% 2.81%

Geoffrey A. Handley 27,248,581 686,065 97.54% 2.46%

Rex J. McLennan 27,508,899 425,747 98.48% 1.52%

Kenneth Pickering 27,277,032 657,614 97.65% 2.35%

Mario D. Szotlender 16,406,845 11,527,801 58.73% 41.27%

Godfrey J. Walton 27,663,567 271,079 99.03% 0.97%

Shareholders also voted 76.4% in favour to reconfirm the Shareholders Rights

plan. In addition, shareholders voted to re-appoint KPMG LLP as auditors, and to

authorize the Board of Directors to fix the auditor's remuneration for the

ensuing year.

At the Board of Directors meeting following the AGM, Geoff Handley was

re-appointed Chairman of the Board and Chair of the Corporate Governance and

Nominating Committee; Rex McLennan was re-appointed Chair of the Audit

Committee; Ricardo Campoy was re-appointed Chair of the Compensation Committee;

and Ken Pickering was appointed Chair of the Sustainability Committee.

Conference Call

A conference call to discuss the results will be held on Tuesday, May 13. The

call - formerly scheduled for 10am PDT - will be held at 12pm PDT (3pm EDT). To

participate in the conference call, please dial the following:

Toll-free in Canada and the US: 1-800-319-4610

Local Vancouver: 604-638-5340

Outside of Canada and the US: 1-604-638-5340

No pass-code is necessary to participate in the conference call.

A replay of the conference call will be available by dialing 1-800-319-6413 in

Canada and the US (toll-free) or 1-604-638-9010 outside of Canada and the US.

The required pass-code is 4890 followed by the # sign. The replay will also be

available on the Company's website at www.edrsilver.com.

About Endeavour - Endeavour is a mid-tier silver mining company focused on

growing production, reserves and resources in Mexico. Since start-up in 2004,

Endeavour has posted nine consecutive years of accretive growth of its silver

mining operations. The organic expansion programs now underway at Endeavour's

three silver-gold mines in Mexico combined with its strategic acquisition and

exploration programs should facilitate Endeavour's goal to become a premier

senior silver producer.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of

the United States private securities litigation reform act of 1995 and

"forward-looking information" within the meaning of applicable Canadian

securities legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding Endeavour's anticipated

performance in 2014 and the timing and results of exploration drill programs.

The Company does not intend to, and does not assume any obligation to update

such forward-looking statements or information, other than as required by

applicable law.

Forward-looking statements or information involve known and unknown risks,

uncertainties and other factors that may cause the actual results, level of

activity, performance or achievements of Endeavour and its operations to be

materially different from those expressed or implied by such statements. Such

factors include, among others, changes in national and local governments,

legislation, taxation, controls, regulations and political or economic

developments in Canada and Mexico; operating or technical difficulties in

mineral exploration, development and mining activities; risks and hazards of

mineral exploration, development and mining; the speculative nature of mineral

exploration and development, risks in obtaining necessary licenses and permits,

and challenges to the Company's title to properties; fluctuations in the prices

of commodities and their impact on reserves and resources as well as those

factors described in the section "risk factors" contained in the Company's most

recent form 40F/Annual Information Form filed with the S.E.C. and Canadian

securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be

reasonable, including but not limited to: the continued operation of the

Company's mining operations, no material adverse change in the market price of

commodities, mining operations will operate and the mining products will be

completed in accordance with management's expectations and achieve their stated

production outcomes, and such other assumptions and factors as set out herein.

Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements or information, there may be other factors that cause

results to be materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any forward-looking

statements or information will prove to be accurate as actual results and future

events could differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance on

forward-looking statements or information.

ENDEAVOUR SILVER CORP.

COMPARATIVE HIGHLIGHTS

Three Months Ended March 31

Q1 2014 Highlights

2014 2013 % Change

----------------------------------------------------------------------------

Production

----------------------------------------------------------------------------

Silver ounces produced 1,898,999 1,489,716 27%

Gold ounces produced 18,519 15,032 23%

Payable silver ounces produced 1,844,165 1,459,706 26%

Payable gold ounces produced 17,796 14,787 20%

Silver equivalent ounces produced

(1) 3,010,139 2,391,636 26%

Cash costs per silver ounce(2)(3) 4.87 10.04 (52%)

Total production costs per

ounce(2)(4) 13.07 18.07 (28%)

All -in sustaining costs per

ounce(2)(5) 12.15 24.60 (51%)

Processed tonnes 346,525 376,344 (8%)

Direct production costs per

tonne(2)(6) 92.93 99.63 (7%)

Silver co-product cash costs (7) 10.46 16.20 (35%)

Gold co-product cash costs (7) 666 889 (25%)

----------------------------------------------------------------------------

Financial

----------------------------------------------------------------------------

Revenue ($ millions) 53.0 69.9 (24%)

Silver ounces sold 1,537,665 1,345,832 14%

Gold ounces sold 16,445 13,037 26%

Realized silver price per ounce 20.50 29.38 (30%)

Realized gold price per ounce 1,306 1,613 (19%)

Net earnings (loss) ($ millions) 4.0 14.4 (72%)

Adjusted net earnings (8) ($

millions) 5.5 12.9 (58%)

Mine operating earnings ($

millions) 11.3 18.9 (40%)

Mine operating cash flow(9) ($

millions) 25.4 32.5 (22%)

Operating cash flow before working

capital changes (10) 18.3 25.3 (28%)

Earnings before ITDA (11) 19.3 31.0 (38%)

Working capital ($ millions) 46.4 42.0 10%

----------------------------------------------------------------------------

Shareholders

----------------------------------------------------------------------------

Earnings (loss) per share - basic 0.04 0.14 (71%)

Adjusted earnings per share -

basic (8) 0.05 0.13 (58%)

Operating cash flow before working

capital changes per share (10) 0.18 0.25 (28%)

Weighted average shares

outstanding 100,494,157 99,660,016 1%

----------------------------------------------------------------------------

ENDEAVOUR SILVER CORP.

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

Three Months Ended

March 31, March 31,

2014 2013

----------------------------------------------------------------------------

Operating activities

Net earnings for the period $ 4,037 $ 14,357

Items not affecting cash:

Share-based compensation 459 563

Depreciation and depletion 14,155 12,148

Deferred income tax provision (recovery) (2,274) 2,453

Unrealized foreign exchange loss (gain) (3) (85)

Mark-to-market loss (gain) on derivative

liability 1,434 (1,452)

Mark-to-market loss (gain) on contingent

liability 41 (2,491)

Finance costs 436 117

Write down of inventory to net realizable

value - 1,495

Gain on sale of investments - (1,777)

Net changes in non-cash working capital (1,178) (15,790)

----------------------------------------------------------------------------

Cash from operating activities 17,107 9,538

----------------------------------------------------------------------------

Investing activities

Property, plant and equipment expenditures (9,234) (28,716)

Investment in short term investments - (130)

Proceeds from sale of short term investments - 4,720

----------------------------------------------------------------------------

Cash used in investing activities (9,234) (24,126)

----------------------------------------------------------------------------

Financing activities

Proceeds from (repayments to) revolving

credit facility (1,000) 24,000

Common shares issued on exercise of options

and warrants 2,727 293

Interest paid (311) (42)

----------------------------------------------------------------------------

Cash from financing activities 1,416 24,251

----------------------------------------------------------------------------

Effect of exchange rate change on cash and

cash equivalents 2 85

Increase (decrease) in cash and cash

equivalents 9,289 9,663

Cash and cash equivalents, beginning of period 35,004 18,617

----------------------------------------------------------------------------

Cash and cash equivalents, end of period $ 44,295 $ 28,365

----------------------------------------------------------------------------

----------------------------------------------------------------------------

This statement should be read in conjunction with the condensed consolidated

interim financial statements for the period ended March 31, 2014 and the

related notes contained therein.

ENDEAVOUR SILVER CORP.

CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE INCOME

(expressed in thousands of US dollars, except for shares and per share

amounts)

----------------------------------------------------------------------------

Three Months Ended

March 31, March 31,

2014 2013

----------------------------------------------------------------------------

Revenue $ 53,000 $ 69,873

Cost of sales:

Direct production costs 27,220 36,887

Royalties 334 450

Share-based compensation 68 75

Depreciation and depletion 14,073 12,074

Write down of inventory to net realizable

value - 1,495

----------------------------------------------------------------------------

41,695 50,981

Mine operating earnings 11,305 18,892

Expenses:

Exploration 2,168 4,190

General and administrative 2,438 3,130

----------------------------------------------------------------------------

4,606 7,320

Operating earnings 6,699 11,572

Mark-to-market loss/(gain) on derivative

liabilities 1,434 (1,452)

Mark-to-market loss/(gain) on contingent

liability 41 (2,491)

Finance costs 446 247

Other income (expense):

Foreign exchange (257) 1,400

Investment and other income 184 1,978

----------------------------------------------------------------------------

(73) 3,378

Earnings before income taxes 4,705 18,646

Current income tax expense 2,942 1,836

Deferred income tax expense (recovery) (2,274) 2,453

----------------------------------------------------------------------------

668 4,289

----------------------------------------------------------------------------

Net earnings for the period 4,037 14,357

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Other comprehensive income, net of tax

Net change in fair value of available for

sale investments 8 (2,839)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Comprehensive income (loss) for the period 4,045 11,518

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings (loss) per share based on net

earnings $ 0.04 $ 0.14

----------------------------------------------------------------------------

Diluted earnings (loss) per share based on net

earnings $ 0.04 $ 0.13

----------------------------------------------------------------------------

Basic weighted average number of shares

outstanding 100,494,157 99,660,016

----------------------------------------------------------------------------

Diluted weighted average number of shares

outstanding 101,435,506 101,507,642

----------------------------------------------------------------------------

This statement should be read in conjunction with the condensed consolidated

interim financial statements for the period ended March 31, 2014 and the

related notes contained therein.

ENDEAVOUR SILVER CORP.

CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(expressed in thousands of US dollars)

----------------------------------------------------------------------------

March 31, December 31,

2014 2013

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 44,295 $ 35,004

Investments 1,471 1,463

Accounts receivable 21,537 23,749

Inventories 27,160 23,647

Prepaid expenses 2,332 3,341

----------------------------------------------------------------------------

Total current assets 96,795 87,204

Non-current deposits 1,131 1,186

Mineral property, plant and equipment 272,374 278,533

----------------------------------------------------------------------------

Total assets $ 370,300 $ 366,923

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 15,932 $ 17,221

Income taxes payable 2,484 3,259

Derivative liabilities - 1,491

Revolving credit facility 32,000 33,000

----------------------------------------------------------------------------

Total current liabilities 50,416 54,971

Provision for reclamation and rehabilitation 6,662 6,652

Contingent liability 140 99

Deferred income tax liability 46,778 49,053

----------------------------------------------------------------------------

Total liabilities 103,996 110,775

----------------------------------------------------------------------------

Shareholders' equity

Common shares, unlimited shares authorized, no

par value, issued and outstanding 101,255,314

shares (Dec 31, 2013 - 99,784,409 shares) 364,735 358,408

Contributed surplus 14,620 14,836

Accumulated comprehensive income (loss) (4,073) (4,081)

Deficit (108,978) (113,015)

----------------------------------------------------------------------------

Total shareholders' equity 266,304 256,148

----------------------------------------------------------------------------

Total liabilities and shareholders' equity $ 370,300 $ 366,923

----------------------------------------------------------------------------

----------------------------------------------------------------------------

This statement should be read in conjunction with the condensed consolidated

interim financial statements for the period ended March 31, 2014 and the

related notes contained therein.

FOR FURTHER INFORMATION PLEASE CONTACT:

Endeavour Silver Corp.

Meghan Brown

Director Investor Relations

Toll free: 1-877-685-9775 / 604-640-4804

604-685-9744 (FAX)

mbrown@edrsilver.com

www.edrsilver.com

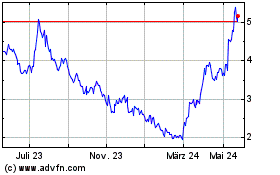

Endeavour Silver (TSX:EDR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

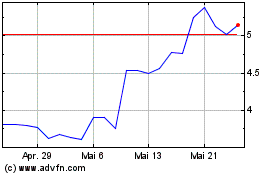

Endeavour Silver (TSX:EDR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024