Dream Unlimited Corp. (TSX: DRM and DRM.PR.A) (“Dream”,

“the Company” or “we”) today announced its financial

results for the three months ended March 31, 2020 (“first

quarter”).

Key Operational Highlights for the

Quarter:

During the first quarter, we sold our 480-acre

Glacier Ridge residential community to Qualico, a neighbouring

property owner for the purposes of co-developing the land. The

aggregate sale price of $84 million generated net margin of $44.0

million in the period. Upon closing, we retained an indirect 27%

interest in the development and received $23.9 million in cash,

with the remaining $50.4 million in a vender take back mortgage,

providing us increased liquidity at this key time. In addition to

the margin generated on this acre sale, co-developing the lands

will continue to provide us with the opportunity to participate in

profits as the land is developed.

Dream has indirectly entered into a binding

agreement to sell its interest in a renewable power portfolio. The

transaction is subject to various closing conditions and is

expected to close in 2020. On close, we expect to generate

approximately $60 million in net after-tax proceeds for Dream,

while also eliminating approximately $150 million of term debt,

associated with the renewable power non recourse credit facilities.

The transaction proceeds will be used to increase our liquidity and

pay down debt.

We are pleased to announce the launch of Dream

Equity Partners, our asset management business for private real

estate clients, including institutional and retail clients such as

pensions funds, sovereign wealth funds and family offices. Rahul

Idnani has joined us as the President of Dream Equity Partners. Mr.

Idnani was formerly the Global Chief Operating Officer for Nuveen

Real Estate which has $127 billion of assets under management. At

Nuveen Real Estate, Mr. Idnani oversaw $90 billion of assets under

management across various property types and investment strategies

for the firm's institutional and retail clients. Prior to

this, he held senior leadership positions at TIAA and was

instrumental in the acquisition of Nuveen Investments and build-out

of its global real assets platform.

“Over the last 12 months we have generated $700

million in cash after debt from recycling capital including the

sale of a partial interest of Glacier Ridge in Calgary and the

agreement to sell our renewable assets, while increasing our

interest in or developing best in class assets,” said Michael

Cooper, President and Chief Responsible Officer. “We expect to

continue to increase the cash flow from, and quality of, our

recurring income generating assets over time. We have spent the

last four years making our company safer by increasing the quality

of our assets, diversifying our balance sheet and substantially

reducing corporate debt. We are prudently managing our capital to

weather the current global challenges and emerge as an even

stronger business through initiatives like growing our asset

management platform. We are committed to helping our communities,

customers and colleagues as best we can to manage through this

unprecedented environment.”

A summary of our consolidated results for the

three months ended March 31, 2020 is included in the table

below.

| |

|

|

Three months ended March 31, |

|

|

(in thousands of Canadian dollars, except per share amounts) |

|

|

|

|

|

|

2020 |

|

|

2019 |

|

| Revenue |

|

|

|

|

|

$ |

176,455 |

|

$ |

56,957 |

|

| Net margin |

|

|

|

|

|

$ |

58,627 |

|

$ |

18,968 |

|

| Net margin %(1) |

|

|

|

|

|

|

33.2% |

|

|

33.3% |

|

| Earnings (loss) before income

taxes |

|

|

|

|

|

$ |

232,779 |

|

$ |

(36,591) |

|

| Earnings (loss) for the

period(2) |

|

|

|

|

|

$ |

185,830 |

|

$ |

(33,524) |

|

| |

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per

share(3) |

|

|

|

|

|

$ |

1.89 |

|

$ |

(0.31) |

|

| Diluted earnings (loss) per

share |

|

|

|

|

|

$ |

1.86 |

|

$ |

(0.31) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2020 |

|

December 31, 2019 |

|

| Total assets |

|

|

|

|

|

$ |

2,905,747 |

|

$ |

3,034,033 |

|

| Total liabilities |

|

|

|

|

|

$ |

1,408,031 |

|

$ |

1,601,424 |

|

| Shareholders’

equity (excluding non-controlling interest)(4) |

|

|

|

$ |

1,471,893 |

|

$ |

1,410,960 |

|

| Total

issued and outstanding shares |

|

|

|

|

|

|

94,790,595 |

|

|

105,318,501 |

|

|

(1) |

Net margin % (see the “Non-IFRS Measures” section of our

Management’s Discussion and Analysis (“MD&A”) for the three

months ended March 31, 2020) represents net margin as a percentage

of revenue. |

|

(2) |

Earnings

(loss) for the period for the three months ended March 31, 2020

includes a gain of $174.2 million on Dream Alternatives units held

by other unitholders (three months ended March 31, 2019 – loss of

$61.9 million). Refer to the “Additional Information – Consolidated

Dream” section of our MD&A for results on a Dream standalone

basis. |

|

(3) |

Basic EPS

is computed by dividing Dream’s earnings attributable to owners of

the parent by the weighted average number of Class A Subordinate

Voting Shares and Class B common shares outstanding during the

period. Refer to Management’s discussion below on consolidated

results for the three months ended March 31, 2020. |

|

(4) |

Shareholders’ equity (excluding non-controlling interest) excludes

$25.8 million of non-controlling interest as at March 31, 2020

($21.6 million as at December 31, 2019). |

Basic earnings per share (“EPS”) for the first

quarter was $1.89, up from a loss per share of $0.31 in the

comparative quarter, which includes the consolidated results of

Dream Hard Asset Alternatives Trust (TSX: DRA.UN) (“Dream

Alternatives”). Adjusting for fair value gains/losses taken on

Dream Alternative units held by other unitholders, earnings before

income taxes for the period was $58.6 million, an increase of $33.5

million relative to the prior year. The increase was primarily due

to the sale of 480 acres in Glacier Ridge, income from our

condominium projects in Toronto and Ottawa, partially offset by

certain non-recurring transactional costs. In addition, prior

period results included fair value gains and distribution income

from our previously held Dream Global REIT units, with no

comparable activity in the current period.

In the first quarter the Company recognized

earnings of $185.8 million, relative to losses of $33.5 million in

the prior year. In addition to our operational results, the

increase of $219.4 million in consolidated earnings was due to the

impact of fair value changes on the Dream Alternatives trust units

held by other unitholders of $236.1 million.

Expansion of Asset Management

Team

Through the launch of Dream Equity Partners, we

intend to leverage our core competencies in managing and developing

office, multi-family, industrial and mixed-use assets in Canada,

the United States and Europe focused on core, core-plus and

value-add investments.

Jane Gavan, President of our Asset Management

division, which includes our public and private management

business, will become the Executive Chair of Dream Equity Partners

and will have oversight of the new business.

“I am very pleased to expand our asset

management business focus to investing private capital in real

estate. Rahul is a great addition to our team with his deep

knowledge of the business and his global relationships,” said Ms.

Gavan “We believe that globally the allocation of capital to

real estate will continue to grow and our unique track record,

operating platform and core strengths, position us well to attract

investors, especially given the successful sale of the Dream Global

business in late 2019, our track record of developing large scale

innovative mixed-use projects and our asset management of our

public vehicles.”

“I am very excited to join Dream and collaborate

with their management team to leverage their expertise to provide

private real estate offerings and solutions to clients,” said Mr.

Idnani. “I am confident that Dream’s vertically-integrated

operating platform, investment track record and history of astute

capital allocation positions them as an ideal investment

partner.”

Results of Operations Effective

this quarter we have redefined our segment information to better

reflect how we view and manage our business. Our operating results

have been defined as follows:

- Recurring income is comprised of

our asset management and development management agreements with

Dream Industrial REIT, Dream Office REIT and various development

partners, a 29% equity interest in Dream Office REIT, Dream

Alternatives' lending portfolio, and our stabilized income

producing assets in the Greater Toronto Area ("GTA"), Western

Canada and Colorado.

- Development is comprised of

mixed-use developments in the GTA and Ottawa/Gatineau, land,

housing and retail/commercial development in the Saskatchewan and

Alberta regions, and Dream Alternatives' investment in the Hard

Rock/Virgin Hotel in Las Vegas.

For further details by asset class and

geography, refer to the “Summary of Dream’s Assets & Holdings”

section of our MD&A.

Highlights: Recurring

Income

- In the three months ended March 31,

2020, our recurring income segment generated revenue and net

operating income of $36.6 million and $16.3 million, respectively,

compared to $48.6 million and $24.3 million in the prior year. The

decrease was driven by the closure of Arapahoe Basin and reduced

contributions from Dream Alternatives due to asset dispositions and

repayments on the Trust’s lending portfolio in the prior year. At

this point in time, it remains uncertain whether Arapahoe Basin

will remain closed for the remainder of the ski season which

typically ends mid-June.

- Included in recurring income are

fees generated from our asset management contracts. In the current

period, total asset management and development management fees

generated from contracts with Dream Industrial REIT, Dream Office

REIT and our partnerships was $5.7 million. We expect these fees to

grow once the global impact of COVID-19 stabilizes and are actively

pursuing new asset management opportunities. Fees earned on the

asset management contract with Dream Alternatives are eliminated

from the Company’s consolidated financial results.

- Across the Dream group platform,

which includes assets held through the Company, Dream Alternatives

and Dream Office REIT, we have approximately 6.7 million square

feet (“sf”) of gross leasable area (“GLA”) in stabilized retail and

commercial properties, in addition to our recreational properties.

As at May 11, 2020, the Company had a 24% interest in Dream

Alternatives and 29% interest in Dream Office REIT.

- Subsequent to March 31, 2020, the

Company closed on the acquisition of the Gladstone Hotel, in

downtown Toronto’s west end. The Gladstone Hotel will be the sister

to our Broadview Hotel which is located in downtown Toronto, just

east of the Don Valley Parkway. The vibrant and dynamic environment

in both properties make a significant impact on their respective

neighbourhoods. Managing both hotels will allow for efficiencies

which we expect will increase the margin generated from each hotel.

Both the Gladstone and Broadview hotel are owned in 50/50

partnership with Streetcar Developments.

Highlights: Development

- Across the Dream group platform, we

have approximately 5.2 million sf of GLA in retail or commercial

properties and over 12,300 condominium or purpose-built rental

units (at the project level) in our development pipeline.

- Our development segment generated

revenue and net margin of $139.8 million and $43.9 million,

respectively, in the quarter up by $131.4 million and

$47.7 million from the prior year. These increases were

primarily driven by condominium unit occupancies at Riverside

Square, BT Towns and Kanaal at Zibi, as well as our 480 acre sale

in Calgary, Alberta. Earnings from equity accounted investments

were $5.0 million in the quarter due to condominium unit

occupancies at Canary Block, with no comparable activity in 2019.

Due to the impact of COVID-19, final closings at Riverside Square,

BT Towns, Kanaal and Canary Block have been temporarily delayed. At

this point in time, we anticipate further occupancy income to be

recognized for the remaining units in 2020.

- Zibi is a 34-acre mixed-use

waterfront development along the Ottawa River in Gatineau, Quebec

and Ottawa, Ontario, consisting of 4 million sf of density expected

to consist of 1,800 residential units (inclusive of purpose-built

rental units), over 2 million sf of commercial space and nearly 8

acres of riverfront parks and plazas. Zibi will be one of Canada's

most sustainable communities and the country's first One Planet

community. In partnership with a utility company, we have developed

the District Thermal Energy System, the first post-industrial waste

heat recovery system in a master-planned community in North

America, which will provide net-zero heating and cooling for all

tenants, residents and visitors at Zibi.We have commenced with site

servicing to allow for development to commence on the individual

blocks as soon as we are ready. In total, there is over 630,000 sf

of residential rental, retail and commercial space in various

planning/development stages at Zibi, of which 83% of the retail and

commercial space has been pre-leased as of March 31, 2020.

Kanaal is the first condominium unit building on the Ontario lands.

In the three months ended March 31, 2020, over 50% of the

71-unit building occupied with 10% of the remaining units

pre-sold.

COVID-19 – Update

- The COVID-19 outbreak has had a

pervasive impact on our economy and communities. In response to

COVID-19, government mandates have required us to cease

construction on certain development sites and close operations of

Arapahoe Basin, our ski hill in Colorado. In addition, a number of

our restaurants, non-essential retail and hotel have either closed

or significantly reduced their operating hours. Some of these

temporary restrictions have now been lifted and we are continuing

to assess the long-term implications on our business. We are

working closely with our tenants who have been significantly

impacted by COVID-19, assessing rent deferrals on a case-by-case

basis. As of today, over 85% of April rent has been collected from

the Company’s investment property tenants.

- As at March 31, 2020, the Company

had $174.7 million of cash as well as $261.1 million of funds

available under its Western Canada operating line and margin

facility. Our debt to total asset ratio as at March 31, 2020 was

27.4%. The majority of debt maturing in 2020 is project specific

and will be funded through proceeds generated from condominium unit

closings. Subsequent to March 31, 2020, we executed on an amendment

to our operating line, extending the maturity date to January 31,

2023. The amendment and anticipated renewable sale in 2020 will

generate an additional $90.0 million of liquidity for the

Company.

Share Repurchase Activity & Return

to Shareholders

- In the three months ended March 31,

2020, the Company completed a substantial issuer bid ("SIB") and

purchased for cancellation 10.0 million Class A Subordinate Voting

Shares ("Subordinate Voting Shares") at a price of $11.75 per

share. Inclusive of the SIB and units repurchased through our

normal course issuer bid, 10.7 million Subordinate Voting Shares

were purchased for cancellation for total proceeds of $125.4

million in the quarter.

- On February 25, 2020, the Company

announced an increase to the annual dividend from $0.10 to $0.12

per Subordinate Voting Share and Class B common share ("Class B

Share").

Select financial operating metrics for Dream’s

segments for the three months ended March 31, 2020 are summarized

in the table below.

| |

|

|

|

Three months ended March 31, 2020 |

|

| (in

thousands of dollars except outstanding share amounts) |

Recurring income |

|

Development |

|

Corporate and other |

|

Total |

|

|

Revenue |

$ |

36,633 |

|

$ |

139,822 |

|

$ |

— |

|

$ |

176,455 |

|

| % of total revenue |

|

20.8% |

|

|

79.2% |

|

|

—% |

|

|

100.0% |

|

| Net margin |

$ |

14,678 |

|

$ |

43,949 |

|

$ |

— |

|

$ |

58,627 |

|

| Net margin (%)(1) |

|

40.1% |

|

|

31.4% |

|

|

n/a |

|

|

33.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at March 31, 2020 |

|

| Segment assets |

$ |

1,155,850 |

|

$ |

1,605,261 |

|

$ |

144,636 |

|

$ |

2,905,747 |

|

| Segment liabilities |

$ |

247,882 |

|

$ |

505,722 |

|

$ |

654,427 |

|

$ |

1,408,031 |

|

| Segment shareholders’ equity |

$ |

907,968 |

|

$ |

1,073,716 |

|

$ |

(509,791) |

|

$ |

1,471,893 |

|

|

Book equity per share(2) |

$ |

9.58 |

|

$ |

11.33 |

|

$ |

(5.38) |

|

$ |

15.53 |

|

| |

|

|

|

Three months ended March 31, 2019 |

|

| (in

thousands of dollars except outstanding share amounts) |

Recurring income |

|

Development |

|

Corporate and other |

|

Total |

|

|

Revenue |

$ |

48,573 |

|

$ |

8,384 |

|

$ |

— |

|

$ |

56,957 |

|

| % of total revenue |

|

85.3% |

|

|

14.7% |

|

|

—% |

|

|

100.0% |

|

| Net margin |

$ |

22,708 |

|

$ |

(3,740) |

|

$ |

— |

|

$ |

18,968 |

|

| Net margin (%)(1) |

|

46.8% |

|

|

n/a |

|

|

n/a |

|

|

33.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at December 31, 2019 |

|

| Segment assets |

$ |

1,133,201 |

|

$ |

1,546,373 |

|

$ |

354,459 |

|

$ |

3,034,033 |

|

| Segment liabilities |

$ |

255,863 |

|

$ |

444,407 |

|

$ |

901,154 |

|

$ |

1,601,424 |

|

| Segment shareholders’ equity |

$ |

877,338 |

|

$ |

1,080,317 |

|

$ |

(546,695) |

|

$ |

1,410,960 |

|

|

Book equity per share(2) |

$ |

8.33 |

|

$ |

10.26 |

|

$ |

(5.19) |

|

$ |

13.40 |

|

|

(1) |

Net margin (%)

is a non-IFRS measures. Refer to the "Non-IFRS Measures" section of

our MD&A for further details. |

|

(2) |

Book equity per share represents shareholders’ equity divided

by total number of share outstanding at period end. |

Other InformationInformation

appearing in this press release is a select summary of results. The

financial statements and MD&A for the Company are available at

www.dream.ca and on www.sedar.com.

About Dream Unlimited Corp.

Dream is a leading developer of exceptional

office and residential assets in Toronto, owns stabilized income

generating assets in both Canada and the U.S., and has an

established and successful asset management business, inclusive of

$9 billion of assets under management across three Toronto Stock

Exchange ("TSX") listed trusts and numerous partnerships. We also

develop land and residential assets in Western Canada for immediate

sale. Dream expects to generate more recurring income in the future

as its urban development properties are completed and held for the

long term. Dream has a proven track record for being innovative and

for our ability to source, structure and execute on compelling

investment opportunities. A comprehensive overview of our holdings

is included in the "Summary of Dream's Assets & Holdings"

section of our MD&A.

Dream Unlimited Corp.

|

Meaghan Peloso |

Kim Lefever |

| VP & Chief Accounting

Officer |

Director, Investor Relations |

| (416) 365-6322 |

(416) 365-6339 |

| mpeloso@dream.ca |

klefever@dream.ca |

Non-IFRS Measures

Dream’s consolidated financial statements are

prepared in accordance with International Financial Reporting

Standards (“IFRS”). In this press release, as a complement to

results provided in accordance with IFRS, Dream discloses and

discusses certain non-IFRS financial measures, including: Dream

standalone, net margin %, assets under management, net operating

income and debt to total assets ratio, as well as other measures

discussed elsewhere in this release. These non-IFRS measures are

not defined by IFRS, do not have a standardized meaning and may not

be comparable with similar measures presented by other issuers.

Dream has presented such non-IFRS measures as Management believes

they are relevant measures of our underlying operating performance

and debt management. Non-IFRS measures should not be considered as

alternatives to comparable metrics determined in accordance with

IFRS as indicators of Dream’s performance, liquidity, cash flow and

profitability. For a full description of these measures and, where

applicable, a reconciliation to the most directly comparable

measure calculated in accordance with IFRS, please refer to the

“Non-IFRS Measures” section in Dream’s MD&A for the three

months ended March 31, 2020.

Forward-Looking Information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, including, but not limited to, statements regarding

our objectives and strategies to achieve those objectives; our

beliefs, plans, estimates, projections and intentions, and similar

statements concerning anticipated future events, future growth,

results of operations, performance, business prospects and

opportunities, acquisitions or divestitures, tenant base, future

maintenance and development plans and costs, capital investments,

financing, the availability of financing sources, income taxes,

vacancy and leasing assumptions, litigation and the real estate

industry in general; as well as specific statements in respect of

the launch of our asset management business for private real estate

clients; our ability to weather the COVID-19 pandemic and resulting

disruptions; our development plans and proposals for future retail

and condominium and mixed-use projects and future stages of current

retail and condominium and mixed-use projects, including projected

sizes, density, uses and tenants; development timelines and

anticipated returns or yields on current and future retail and

condominium and mixed-use projects, including timing of

construction, marketing, leasing, completion, occupancies and

closings; anticipated current and future unit sales and occupancies

of our condominium and mixed-use projects; our pipeline of retail,

commercial, condominium and mixed-use developments projects; our

anticipated ownership levels of proposed investments; the

development plans and proposals for Dream Alternatives’ current and

future projects, including projected sizes, timelines, density,

uses and tenants; anticipated levels of development, asset

management and other management fees in future periods; and our

overall financial performance, profitability and liquidity for

future periods and years. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond Dream’s control, which

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

assumptions include, but are not limited to: the nature of

development lands held and the development potential of such lands,

our ability to bring new developments to market, anticipated

positive general economic and business conditions, including low

unemployment and interest rates, positive net migration, oil and

gas commodity prices, our business strategy, including geographic

focus, anticipated sales volumes, performance of our underlying

business segments and conditions in the Western Canada land and

housing markets. Risks and uncertainties include, but are not

limited to, general and local economic and business conditions,

uncertainties surrounding the COVID-19 pandemic, employment levels,

regulatory risks, mortgage rates and regulations, environmental

risks, consumer confidence, seasonality, adverse weather

conditions, reliance on key clients and personnel and competition.

All forward-looking information in this press release speaks as of

May 12, 2020. Dream does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise, except as required by law. Additional

information about these assumptions and risks and uncertainties is

disclosed in filings with securities regulators filed on SEDAR

(www.sedar.com).

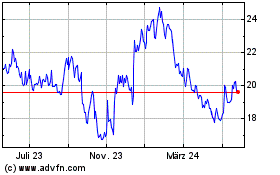

DREAM Unlimited (TSX:DRM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

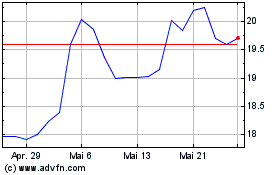

DREAM Unlimited (TSX:DRM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025