Dundee Corporation to Acquire 100% of 360 VOX Corporation by Way of

Plan of Arrangement

TORONTO, ONTARIO--(Marketwired - May 12, 2014) - Dundee

Corporation (TSX:DC.A) ("Dundee") and 360 VOX Corporation

(TSX-VENTURE:VOX) ("360 VOX") are pleased to announce the entering

into by the parties of an arrangement agreement ("Arrangement

Agreement") pursuant to which Dundee will acquire all of the issued

and outstanding Class A common shares (each a "360 VOX Share") of

360 VOX that it and its affiliates do not already own pursuant to a

plan of arrangement (the "Arrangement"). Dundee and its affiliates

currently own 49,028,138 360 VOX Shares representing approximately

18% of the 271,482,441 360 VOX Shares currently outstanding.

Under the Arrangement, 360 VOX shareholders will receive 0.01221

of a Class A subordinate voting share in the capital of Dundee

(each whole share a "Dundee Share") for each 360 VOX Share held,

representing an effective price per 360 VOX Share of $0.20 based on

the 20-day volume weighted average trading price of the Dundee

Shares for the period ended on May 9, 2014, the trading day

preceding the entering into of the Arrangement Agreement. The

transaction provides total consideration to 360 VOX shareholders

(other than Dundee and its affiliates) of approximately $45.5

million and implies an equity value for 360 VOX of approximately

$55.3 million. Approximately 2.8 million Dundee Shares

(representing approximately 5.5% of the 50,387,648 outstanding

Dundee Shares) are expected to be issued in connection with the

completion of the Arrangement based on the 222,454,303 360 VOX

Shares currently outstanding that are not owned by Dundee and its

affiliates and an additional 5,250,000 360 VOX Shares that are

expected to be issued by 360 VOX prior to the completion of the

Arrangement to the sellers of the Sotheby's International Realty

Canada, Sotheby's International Realty Quebec and Blueprint Global

Marketing businesses in partial satisfaction of their earn-out in

respect of 2013.

The consideration represents a premium of 150% to the closing

price of the 360 VOX Shares of $0.08 on May 9, 2014, and a premium

of 122% to the 20-day volume weighted average trading price of the

360 VOX Shares of $0.09 for the period ending on the trading day

preceding the entering into of the Arrangement Agreement.

360 VOX's management team will continue to run 360 VOX's

day-to-day business following completion of the Arrangement.

The directors of 360 VOX entitled to vote on the Arrangement

have unanimously determined that the Arrangement is in the best

interests of 360 VOX and is fair to its shareholders and recommends

that 360 VOX shareholders vote in favour of the Arrangement at the

special meeting that will be called to approve the transaction. The

determination of the Board was made upon the recommendation of a

special committee of independent directors (the "Independent

Committee"), and after consideration of the advice of legal and

financial advisors to the Independent Committee and 360 VOX. The

Independent Committee has engaged Crosbie & Company Inc. as

financial advisor. Crosbie & Company has provided an opinion to

the Board of 360 VOX that, based upon and subject to the

assumptions, limitations and qualifications stated therein, the

consideration to be received by holders of 360 VOX Shares (which

does not include Dundee and its affiliates) is fair from a

financial point of view to such holders. As financial advisor to

360 VOX, Crosbie & Company did not consider the fairness, from

a financial point of view, of the Arrangement to Dundee and its

affiliates.

"We are extremely pleased with this transaction as we believe it

represents great value for shareholders. We also look forward to

being able to create new ongoing value for 360 VOX through the

advancement of its projects and others that we can bring to them,"

said Ned Goodman, President and Chief Executive Officer of

Dundee.

Robin Conners, President and Chief Executive Officer of 360 VOX,

stated, "This transaction will be an important step in 360 VOX's

development stage and expansion projects, combining strong

managerial and financial capabilities and the well-established

reputation of both organizations, and further enhances the

opportunities for our real estate construction, sales and marketing

business. It provides 360 VOX shareholders enhanced liquidity and

an ownership interest in an organization whose objective is to

achieve outstanding long-term growth."

The completion of the Arrangement is subject to customary

conditions, including receipt of all necessary court and stock

exchange approvals and the approval of the shareholders of 360 VOX

at a special meeting (the "Special Meeting") expected to be held in

June 2014. As the transaction will constitute a "business

combination" for the purposes of Multilateral Instrument 61-101

- Protection of Minority Security Holders in Special

Transactions, the implementation of the Arrangement will be

subject to disinterested shareholder approval, in addition to

approval by 66 2/3% of the votes cast by holders of 360 VOX

Shares.

The Arrangement Agreement provides for, among other matters, a

non-solicitation covenant on the part of 360 VOX (subject to

customary fiduciary out provisions). The Arrangement Agreement also

provides Dundee with a "right to match" and requires 360 VOX to pay

a termination fee equal to $1,800,000 in certain circumstances. All

of the directors and senior officers of 360 VOX and certain

shareholders and other securityholders of 360 VOX, who together

hold an aggregate of approximately 35.3% of the outstanding 360 VOX

Shares, have entered into voting agreements pursuant to which,

among other matters, they have agreed to vote their 360 VOX Shares

in favour of the Arrangement and not to exercise any options or

warrants held by them prior to completion of the Arrangement. In

connection with the transaction, all of the options and warrants of

360 VOX (other than warrants to purchase 360 VOX Shares issued in

connection with the private placement of units of 360 VOX on May

26, 2013 not held by Dundee and its affiliates) will be cancelled

pursuant to the Arrangement.

The terms and conditions of the proposed Arrangement will be

disclosed in an information circular that will be mailed in late

May or early June 2014 to the shareholders of 360 VOX that will be

entitled to vote at the Special Meeting. It is anticipated that the

transaction, if approved by 360 VOX shareholders, the Court and

stock exchanges, will be completed in the second quarter of

2014.

In connection with entering into the Arrangement Agreement and

conditional on completion of the Arrangement, 360 VOX has agreed to

pay the sellers of the Sotheby's International Realty Canada,

Sotheby's International Realty Quebec and Blueprint Global

Marketing businesses the amount of their earn-out in respect of

2014 in cash within 15 days following closing of the

transaction.

Copies of the Arrangement Agreement, the information circular

for the Special Meeting and certain related documents will be filed

with Canadian securities regulators and will be available on the

Canadian SEDAR website at www.sedar.com.

ABOUT DUNDEE

Dundee is a public Canadian independent holding company listed

on the Toronto Stock Exchange under the symbol "DC.A". Through its

operating subsidiaries, Dundee is engaged in diverse business

activities in the areas of its core competencies including

investment advisory and corporate finance, energy, resources,

agriculture, real estate and infrastructure. Dundee also holds,

directly and indirectly, a portfolio of investments mostly in these

core focus areas, as well as other select investments in both

publicly listed and private companies.

ABOUT 360 VOX

360 VOX is a publicly traded company listed on the TSX Venture

Exchange (the "TSXV") under the symbol "VOX". 360 VOX is engaged in

the business of developing and managing international hotel,

resort, residential and commercial real estate projects through its

wholly-owned subsidiaries 360 VOX Asset Management Inc., 360 VOX

GP, 360 VOX LLC, 360 VOX Developments Inc. and Wilton Properties

Ltd. 360 VOX is also engaged in the sales and marketing of real

estate through Sotheby's International Realty Canada and Blueprint

Global Marketing.

NEITHER THE TSXV NOR ITS REGULATION SERVICES PROVIDER (AS THAT

TERM IS DEFINED IN THE POLICIES OF THE TSX-VENTURE EXCHANGE)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS

RELEASE.

This press release contains "forward-looking statements"

within the meaning of applicable securities laws that are intended

to be covered by the safe harbours created by those laws, including

statements that use forward-looking terminology such as "may",

"will", "expect", "anticipate", "believe", "continue", "potential",

or the negative thereof or other variations thereof or comparable

terminology. Such forward-looking statements may include, without

limitation, statements regarding the completion of the proposed

transaction and other statements that are not historical facts.

While such forward-looking statements are expressed by Dundee and

360 VOX as stated in this release, in good faith and believed to

have a reasonable basis, they are subject to important risks and

uncertainties including, without limitation, approval of applicable

governmental authorities, required 360 VOX securityholder approval

and necessary Court approvals, the satisfaction or waiver of

certain other conditions contemplated by the Arrangement Agreement,

and changes in applicable laws or regulations, which could cause

actual results to differ materially from future results expressed,

projected or implied by the forward-looking statements. As a result

of these risks and uncertainties, the proposed transaction could be

modified, restructured or not be completed, and the results or

events predicted in these forward-looking statements may differ

materially from actual results or events. These forward-looking

statements are not guarantees of future performance, given that

they involve risks and uncertainties. Neither Dundee nor 360 VOX is

affirming or adopting any statements made by any other person in

respect of the proposed transaction and each expressly disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except in accordance with applicable securities laws

or to comment on expectations of, or statements made by any other

person in respect of the proposed transaction. Investors should not

assume that any lack of update to a previously issued

forward-looking statement constitutes a reaffirmation of that

statement. Reliance on forward-looking statements is at the

investors' own risk.

FOR FURTHER INFORMATION IN RESPECT OF DUNDEEPLEASE

CONTACT:Dundee CorporationNed GoodmanPresident and Chief Executive

Officer(416) 365-5665Dundee CorporationLucie PresotVice President

and Chief Financial Officer(416) 365-5157FOR FURTHER INFORMATION IN

RESPECT OF 360 VOXPLEASE CONTACT:360 VOX CorporationColin YeeChief

Financial Officer(514) 987-6452

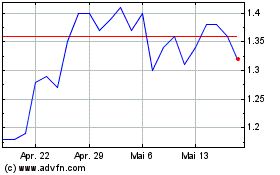

Dundee (TSX:DC.A)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Dundee (TSX:DC.A)

Historical Stock Chart

Von Dez 2023 bis Dez 2024