Cogeco Inc. (TSX: CGO) (“Cogeco”) and Cogeco Communications

Inc. (TSX: CCA) (“Cogeco Communications”, and together with Cogeco,

the “Corporations”) announced today that CDPQ (Caisse de dépôt et

placement du Québec) will become an anchor investor in

Cogeco Communications as part of the sale by Rogers

Communications Inc. (“Rogers”) of the entirety of its holdings in

Cogeco and Cogeco Communications. Cogeco will repurchase for

cancellation 5,969,360 of its Cogeco subordinate voting shares (the

“CGO SVS”) from CDPQ. Cogeco Communications will repurchase for

cancellation 2,266,537 Cogeco Communications subordinate

voting shares (the “CCA SVS”) from Cogeco, following the

conversion of the same number of Cogeco Communications multiple

voting shares. CDPQ has also entered into an agreement to

sell 5,302,278 of the CCA SVS acquired from Rogers by way of a

bought block trade (the “Bought Block Trade”) facilitated by a

syndicate of underwriters led by CIBC Capital Markets and UBS

Securities Canada.

The purchase price in all transactions for each

CGO SVS was set at $46.91 (the “CGO SVS

Price”) and the purchase price for each CCA SVS was set at

$51.40 (the “CCA SVS Price”), representing, in each case, a

10% discount relative to the closing price of each of the CGO SVS

and the CCA SVS on December 11, 2023. The price per share to be

paid by CDPQ to Rogers to acquire the CGO SVS and CCA SVS currently

held by Rogers was negotiated at arms’ length between CDPQ and

Rogers.

Structure of the

Transactions

CDPQ will initially acquire all of the 5,969,390

CGO SVS and all of the 10,687,925 CCA SVS currently held by Rogers

for an aggregate amount of $829 million.

Cogeco will then purchase for cancellation from

CDPQ all of the CGO SVS previously held by Rogers at the CGO SVS

Price, for an aggregate purchase price of $280 million. In

order to partially finance such purchase, Cogeco will concurrently

sell to Cogeco Communications and CDPQ, 2,266,537 CCA SVS

and 1,423,692 CCA SVS, respectively, following the conversion

and cancellation of an equivalent number of Cogeco Communications

multiple voting shares (the “CCA MVS”), at the CCA SVS Price.

CDPQ will concurrently sell CCA SVS through the

Bought Block Trade. The CCA SVS being sold by CDPQ have not been

registered under the U.S. Securities Act of 1933, as amended. This

news release is not an offer of securities for sale in the United

States and CCA SVS may not be offered or sold in the United States

except pursuant to an exemption from registration.

The net effect of the foregoing transactions

will be the following:

- Cogeco

Communications share repurchase of $117 million of CCA SVS

(2,266,537 shares) representing approximately 5.1% of all

outstanding Cogeco Communications shares

- Cogeco share

repurchase of $280 million of CGO SVS (5,969,390 shares)

representing approximately 38.2% of all outstanding Cogeco

shares

- The number of CCA

MVS outstanding will be reduced by 23.5% due to the

conversion described above, the number of CCA SVS outstanding will

be increased by 4.9%, and the number of outstanding CGO SVS will be

reduced by 42.6%

- Bought Block Trade

of 5.3 million CCA SVS representing an increase in Cogeco

Communications’ public float of 29.5%

- CDPQ will hold

6,809,339 CCA SVS representing approximately 16.1% of all

outstanding Cogeco Communications shares

Cogeco

|

|

Status Quo as of December

11th, 2023, Before Aforementioned

Transactions |

Pro Forma1 |

|

|

Number of SharesOutstanding |

% of Total Shares

Outstanding |

Number of SharesOutstanding |

% of Total Shares

Outstanding |

|

Gestion Audem |

1,748,469 |

11.20% |

1,748,469 |

18.13% |

|

Other Directors & Officers |

36,320 |

0.23% |

36,320 |

0.38% |

|

Rogers |

5,969,390 |

38.24% |

- |

- |

|

Public |

7,857,990 |

50.33% |

7,857,990 |

81.49% |

|

Total |

15,612,169 |

100.00% |

9,642,779 |

100.00% |

Cogeco Communications

|

|

Status Quo as of December

11th, 2023, Before Aforementioned

Transactions |

Pro Forma1 |

|

|

Number of SharesOutstanding |

% of Total Shares

Outstanding |

Number of SharesOutstanding |

% of Total Shares

Outstanding |

|

Cogeco |

15,691,100 |

35.27% |

12,000,871 |

28.42% |

|

Other Directors & Officers |

162,872 |

0.37% |

162,872 |

0.39% |

|

Rogers |

10,687,925 |

24.02% |

- |

- |

|

CDPQ |

- |

- |

6,809,339 |

16.13% |

|

Public |

17,946,581 |

40.34% |

23,248,858 |

55.06% |

|

Total |

44,488,478 |

100.00% |

42,221,940 |

100.0% |

Benefits of the transactions for Cogeco

and Cogeco Communications shareholders

- Immediately

accretive on a net asset value per share and free cash flow per

share basis for Cogeco shareholders resulting from the share

repurchase and the sale of a portion of its investment in Cogeco

Communications

- Immediately

accretive on a free cash flow per share basis for Cogeco

Communications shareholders resulting from the share

repurchase

- The public float of

CCA SVS will be increased by 29.5% to 23,248,858 shares

therefore enhancing trading liquidity

“This transaction is a unique opportunity for

the Corporations to repurchase shares at an attractive price to

realize multiple benefits while ensuring we have the ability to

deliver our strategic plan,” said Philippe Jetté, President and

Chief Executive Officer of Cogeco Inc. and Cogeco Communications

Inc. “Given the current prices of our stocks, which we believe are

undervalued, buying back shares represents an attractive use of our

capital to build shareholder value,” added Mr. Jetté.

“Already active with Cogeco Communications

through past acquisitions, CDPQ is supporting the growth projects

of this leading telecommunications company as connectivity needs

continue to grow. This major share purchase, orchestrated by CDPQ,

is key for the company and its plan to develop the North American

market,” said Kim Thomassin, Executive Vice-President and Head of

Québec at CDPQ

Financial Details

Concurrently with the closing of the

transactions, Cogeco will put in place a three-year $75 million

term loan. Cogeco will initially finance its $280 million

repurchase of CGO SVS and other related transaction costs and

expenses through (i) $117 million in proceeds resulting from a

repurchase for cancellation by Cogeco Communications from Cogeco of

CCA SVS (resulting from the conversion of the same number of CCA

MVS) at the CCA SVS Price; (ii) $73 million in proceeds

resulting from a sale by Cogeco to CDPQ of CCA SVS (resulting from

the conversion of the same number of CCA MVS) at the CCA SVS Price;

and (iii) a drawdown from its term loan and credit facilities.

Cogeco Communications will initially finance the

$117 million repurchase of CCA SVS and other related

transaction costs and expenses through a drawdown on Cogeco

Communications’ existing term revolving facility.

Governance and Approvals

A special committee of the board of directors of

Cogeco (the “CGO Independent Committee”),

established in connection with the transactions and composed

exclusively of independent directors of Cogeco, unanimously

determined, after consultation with its external independent legal

and financial advisors, that the repurchase of CGO SVS is in the

best interests of Cogeco. RBC Capital Markets provided the CGO

Independent Committee with a fairness opinion stating that the

consideration to be paid by Cogeco to repurchase its CGO SVS is

fair from a financial point of view to Cogeco. After receipt of the

unanimous recommendation of the CGO Independent Committee, the

repurchase of CGO SVS was unanimously approved by the board of

directors of Cogeco.

A special committee of the board of directors of

Cogeco Communications (the “CCA Independent

Committee”), established in connection with the

transactions and composed exclusively of independent directors of

Cogeco Communications, unanimously determined, after consultation

with its external independent legal and financial advisors, that

the repurchase of CCA SVS is in the best interests of Cogeco

Communications. National Bank Financial provided the CCA

Independent Committee with a fairness opinion stating that the

consideration to be paid by Cogeco Communications to repurchase CCA

SVS is fair from a financial point of view to Cogeco

Communications. After receipt of the unanimous recommendation of

the CCA Independent Committee, the repurchase of CCA SVS was

unanimously approved by the board of directors of Cogeco

Communications.

A favorable decision was obtained from the

Autorité des marchés financiers to exempt the Corporations from the

issuer bid requirements under applicable securities legislation

with respect to the repurchases of CGO SVS and CCA SVS by Cogeco

and Cogeco Communications, respectively.

The repurchases of CGO SVS by Cogeco and CCA SVS

by Cogeco Communications are expected to be completed on December

13, 2023.

ABOUT COGECO AND COGECO COMMUNICATIONS

Rooted in the communities it serves, Cogeco Inc.

is a growing competitive force in the North American

telecommunications and media sectors, serving 1.6 million

residential and business customers. Its Cogeco Communications Inc.

subsidiary provides Internet, video and phone services in Canada as

well as in thirteen states in the United States through its

business units Cogeco Connexion and Breezeline. Through Cogeco

Media, it owns and operates 21 radio stations primarily in the

province of Québec as well as a news agency. Cogeco's subordinate

voting shares are listed on the Toronto Stock Exchange (TSX: CGO).

The subordinate voting shares of Cogeco Communications Inc. are

also listed on the Toronto Stock Exchange (TSX: CCA).

ABOUT CDPQ

At CDPQ, we invest constructively to generate

sustainable returns over the long term. As a global investment

group managing funds for public pension and insurance plans, we

work alongside our partners to build enterprises that drive

performance and progress. We are active in the major financial

markets, private equity, infrastructure, real estate and private

debt. As at June 30, 2023, CDPQ’s net assets totalled

CAD 424 billion. For more information,

visit cdpq.com, consult

our LinkedIn or Instagram pages, or follow us

on X.

FORWARD-LOOKING STATEMENTS RELATED TO COGECO AND COGECO

COMMUNICATIONS

Certain statements contained in this press

release may constitute forward-looking information within the

meaning of securities laws. Forward-looking information may relate

to the Corporations’ future outlook and anticipated events,

business, operations, financial performance, financial condition or

results and, in some cases, can be identified by terminology such

as "may"; "will"; "should"; "expect"; "plan"; "anticipate";

"believe"; "intend"; "estimate"; "predict"; "potential";

"continue"; "foresee", "ensure" or other similar expressions

concerning matters that are not historical facts. Particularly,

statements regarding the completion and timing of the transactions

described herein, their anticipated benefits and the financing

thereof, as well as anticipated credit ratings following the

transactions, and statements regarding the Corporations’ objectives

and strategies are forward-looking statements. These statements are

based on certain factors and assumptions including the settlement

of the transactions and completion of the related financing

arrangements within the intended timing and on the terms described

herein, and more generally expected growth, results of operations,

purchase price allocation, tax rates, weighted average cost of

capital, performance and business prospects and opportunities,

which each Corporation believes are reasonable as of the current

date. Refer in particular to the "Corporate objectives and

strategies" and "Fiscal 2024 financial guidelines" sections of each

Corporation’s 2023 annual Management's Discussion and Analysis

("MD&A") for a discussion of certain key economic, market and

operational assumptions we have made in preparing forward-looking

statements. While management considers these assumptions to be

reasonable based on information currently available to the

Corporations, they may prove to be incorrect. Forward-looking

information is also subject to certain factors, including risks and

uncertainties that could cause actual results to differ materially

from what the Corporations currently expect. These factors include

risks such as general market and other conditions, competitive

risks (including changing competitive ecosystems and disruptive

competitive strategies adopted by our competitors), business risks,

regulatory risks, technology risks (including cybersecurity),

financial risks (including variations in currency and interest

rates), economic conditions (including inflation pressuring

revenue, reduced consumer spending and increasing costs), talent

management risks (including highly competitive market for limited

pool of digitally skilled employees), human-caused and natural

threats to the Corporations’ network (including increased frequency

of extreme weather events with the potential to disrupt

operations), infrastructure and systems, community acceptance

risks, ethical behavior risks, ownership risks, litigation risks

and public health and safety, many of which are beyond the

Corporations’ control. Moreover, Cogeco’s radio operations are

significantly exposed to advertising budgets from the retail

industry, which can fluctuate due to changing economic conditions.

For more exhaustive information on these risks and uncertainties,

the reader should refer to the "Uncertainties and main risk

factors" section of each Corporation’s 2023 MD&A. These factors

are not intended to represent a complete list of the factors that

could affect the Corporations and future events and results may

vary significantly from what management currently foresees. The

reader should not place undue importance on forward-looking

information contained in this press release which represent the

Corporations’ expectations as of the date of this press release (or

as of the date they are otherwise stated to be made) and are

subject to change after such date. While management may elect to do

so, the Corporations are under no obligation (and expressly

disclaim any such obligation) and do not undertake to update or

alter this information at any particular time, whether as a result

of new information, future events or otherwise, except as required

by law.

All amounts are stated in Canadian dollars unless otherwise

indicated.

FOR INFORMATION:

|

Investors |

|

| Patrice OuimetSenior Vice

President and Chief Financial OfficerCogeco Inc. and Cogeco

Communications Inc.Tel.: 514-764-4600patrice.ouimet@cogeco.com |

Troy CrandallHead, Investor

RelationsCogeco Inc. and Cogeco Communications Inc.Tel.:

514-764-4700troy.crandall@cogeco.com |

| |

|

| Media |

|

| Marie-Hélène LabrieSenior Vice

President and Chief Public Affairs,Communications and Strategy

OfficerCogeco Inc. and Cogeco Communications Inc.Tel.:

514-764-4600marie-helene.labrie@cogeco.com |

|

_______________________________

1 The Pro Forma numbers of shares outstanding give effect to the

transactions described above as if all such transactions had

occurred on December 11, 2023.

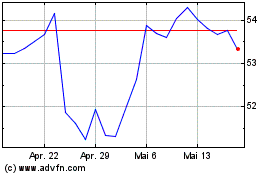

Cogeco (TSX:CGO)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Cogeco (TSX:CGO)

Historical Stock Chart

Von Nov 2023 bis Nov 2024