NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN

OR INTO THE UNITED STATES OF AMERICA OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES OF AMERICA, ITS TERRITORIES AND

POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF

COLUMBIA.

Baylin Technologies Inc. (TSX:BYL) (the “

Company”

or “

Baylin”) today announced that it has entered

into a share purchase agreement (the “

Share

Purchase Agreement”) to acquire

all of the issued and outstanding shares of Alga Microwave Inc.

(“

Alga”) for total consideration of $27 million,

consisting of up-front cash consideration of $21 million, $4

million in Baylin shares and $2 million in deferred consideration,

as well as a related agreement to purchase Alga’s operational

facilities in Kirkland, Quebec (the

“

Acquisition”).

In connection with the Acquisition, Baylin has

entered into an agreement on a “bought deal” basis with a syndicate

of underwriters (the “Underwriters”) led by

Raymond James Ltd. (“Raymond James”) for an

offering of 6,451,613 subscription receipts (the

“Subscription Receipts”) of the Company at a price

of $3.10 per Subscription Receipt (the “Subscription

Receipt Price”) for gross proceeds of $20 million and $15

million principal amount of 6.5% extendible convertible unsecured

debentures (the “Debentures”) of the Company at a

price of $1,000 per Debenture for aggregate gross proceeds of $35.0

million (together, the “Offering”).

“The addition of Alga is synergistic with our recent acquisition

of Advantech, helping us to further expand our rapidly growing

radio frequency and microwave components business. Alga’s new

state-of-the-art facility, situated closely to Advantech, will set

the stage for a robust platform for future growth” said Randy

Dewey, Baylin’s President and CEO. “We look forward to working with

the team at Alga to incorporate their top-of-the-line products into

Baylin’s broad offering to provide the best experience for our

customers” said Mr. Dewey.

“As a market leader in radio frequency and microwave, we are a

natural fit in helping Baylin achieve its vision of becoming the

frontrunner in data transmission. We are very excited to be able to

bring our deep sector expertise and best-in-class product

development capabilities to Baylin to help drive growth and

profitability in the satellite connectivity segment. Alga will be

able to leverage Baylin’s world-class sales force and relationships

with tier-one customers to expand the reach of our products” said

Michael Perelshtein, Alga’s CEO.

“This acquisition is a key strategic move that is expected to

benefit both operations in a significant way. Alga's modern factory

and precision machining capability will allow us to control more of

the supply chain and provide for rapid product development.

Additionally, Alga brings extensive high frequency passive

microwave component capability expanding our addressable markets.

Bringing together both Advantech’s broad portfolio, sales and

marketing channels along with Alga's manufacturing efficiencies,

products and passive capabilities will allow us to address a wider

more diversified market and provide our customers with broader

networking solutions.” says John Restivo, President, Advantech.

The Acquisition

Baylin is to purchase all of the outstanding

shares of Alga, through a newly incorporated subsidiary, for

up-front consideration of $25.0 million (the “Share

Purchase Price”), subject to customary adjustments. The

Share Purchase Price will be satisfied by the payment of $21.0

million in cash and $4.0 million in common shares in the

capital of the Company (“Common Shares”) at a

price of $3.40 per share. The vendors may also receive up to

an additional $2.0 million in earn-out payments if certain criteria

are met over the two year period post-closing of the

Acquisition.

Alga is a market leader in the engineering,

design and development of radio frequency and microwave components,

and a leading supplier of radio frequency and microwave solid state

power amplifiers, pulsed amplifiers for radar applications,

transmitter and transceiver products as well as radio frequency

passive components and systems. Alga enjoys a fast development

cycle for its products, which has been a key success factor. Alga’s

product offering covers all major frequency standards.

Expected benefits of the Acquisition for Baylin

include:

- Strategic acquisition expected to

generate revenue and cost synergies

- Enhances one of Baylin’s faster

growing segments, Satellite Connectivity Products○ The

Acquisition represents a unique and strategic opportunity to expand

its radio frequency and microwave components business, which the

Company entered into with its acquisition of assets from Advantech

Wireless Inc. (“Advantech”) in January 2018

- Expected to be accretive to 2018

earnings per share

- Immediate cost savings

identified

- Alga’s principals to take on

executive positions at Baylin, adding further depth and

experience○ Michael Perelshtein, President and CEO of Alga to

take on role of Chief Operating Officer of Alga, with oversight of

both Advantech and Alga operations. Michael spent the majority of

his career at Alga, and has previous work experience at Wavesat

Telecom and C-Mac / Selectron. Michael holds countless

relationships with OEMs and has significant business development

experience.○ Frank Panarello, COO of Alga to take on role

Vice President Operations of Alga, with oversight of both Advantech

and Alga operations. Frank is an experienced operations and finance

professional who has a decade of experience at Alga and previously

worked at Nortel Networks.

In connection with the closing of the

Acquisition, Baylin has also agreed to acquire the facility in

which the operations of Alga are located in Kirkland, Quebec for a

total purchase price of $6.2 million.

The closing of the Acquisition is subject to a

number of closing conditions including the approval of the Toronto

Stock Exchange (“TSX”) and is expected to close on

or about July 16, 2018.

The Offering

Each Subscription Receipt will entitle the

holder thereof to receive one Common Share, subject to adjustment

in certain circumstances.

The Subscription Receipts will be issued

pursuant to a subscription receipt agreement to be dated as of the

Offering Closing Date (as defined herein), pursuant to which the

gross proceeds of the Subscription Receipt Offering less the

Underwriters’ expenses and 50% of the Underwriters’ commission

payable in connection with the Subscription Receipt Offering (the

“Escrowed Proceeds”), will be held in escrow in an

interest bearing account pending the closing of the Acquisition.

Upon satisfaction or waiver of the conditions to completion of the

Acquisition in accordance with the terms of the Share Purchase

Agreement, without amendment or waiver materially adverse to the

Company (except for payment of the purchase price) (the

“Escrow Release Condition”), the remaining 50% of

the Underwriters’ commission (plus accrued interest) will be

released to the Underwriters, the Escrowed Proceeds remaining

thereafter will be released to the Company and each Subscription

Receipt will be exchanged for one Common Share. If the Acquisition

is not completed prior to 5:00 p.m. (EST) on the Initial Maturity

Date (as defined herein), the Share Purchase Agreement is

terminated at an earlier time or Baylin advises the subscription

receipt agent and Raymond James Ltd., or announces to the public,

that it does not intend to proceed with the Acquisition (the date

on which each such event occurs, the “Termination

Date”), holders of the Subscription Receipts will receive

an amount per Subscription Receipt equal to the Subscription

Receipt Price. To the extent that the Escrowed Proceeds (plus

accrued interest) are not sufficient to redeem all of the

Subscription Receipts for cancelation at the Subscription Receipt

Price, the Company will contribute such amounts as are necessary to

satisfy any shortfall.

The Debentures will be issued pursuant to a

debenture indenture to be dated as of the Offering Closing

Date. The initial maturity date of the Debentures is August

15, 2018, which may be extended at the discretion of Baylin to

September 12, 2018 (the “Initial Maturity Date”).

If the Acquisition is completed prior to the Termination Date, the

maturity date of the Debentures will be automatically be extended

to the date that is five years following the Offering Closing Date

(the “Final Maturity Date” and, together with the

Initial Maturity Date, as the context requires, the

“Maturity Date”).

The Debentures will bear interest at a rate of

6.5% per annum payable semi-annually in arrears on June 30 and

December 31 in each year. Each $1,000 principal amount of

Debentures will be convertible into approximately 260 Common Shares

at any time following the Acquisition and prior to the close of

business on the last business day immediately preceding the

Maturity Date, at the option of the holder, representing a

conversion price of $3.85 per share (the “Conversion

Price”).

Except in certain limited circumstances, the

Debentures will not be redeemable before July 10, 2021.

Subject to automatic extension, on or after July 10, 2021 and prior

to the Maturity Date, Baylin may, at its option, redeem the

Debentures, in whole or in part, at par plus accrued and unpaid

interest provided that the weighted average trading price of the

Common Shares on the TSX for the 20 consecutive trading days ending

five trading days prior to the applicable date (the

“Current Market Price”) is not less than 125% of

the Conversion Price. On redemption or on maturity, as applicable,

the Company will repay the principal amount of the Debentures and

any accrued and unpaid interest thereon either in cash or, at its

option, subject to regulatory approval and certain conditions, the

Company may elect to satisfy its obligation to pay the principal

amount of Debentures by delivering that number of freely tradeable

Common Shares obtained by dividing the principal amount of the

Debentures being repaid by 95% of the Current Market Price on the

date of redemption or maturity, as applicable.

The debenture indenture governing the Debentures

will contain certain customary conditions, obligations, rights and

entitlements.

The Company has agreed to grant the Underwriters

an over-allotment option to purchase up to an additional 967,742

Subscription Receipts at the Subscription Receipt Price and up to

an additional $2.25 million aggregate principal amount of

Debentures (the “Over-Allotment Option”),

exercisable in whole or in part at any time for a period ending 30

days from the Offering Closing Date. In the event the

Over-Allotment Option is exercised in full, the aggregate gross

proceeds of the Offering will be $40.25 million.

The Company intends to use the net proceeds of

the Offering to finance the acquisition of the outstanding Alga

shares and for working capital and general corporate purposes.

The Offering is being made pursuant to the

Company’s base shelf prospectus dated November 16, 2017 and the

terms of the Offering will be described in a prospectus supplement

to be filed with securities regulators in each of the provinces of

Canada.

The Offering is expected to close on or about

July 10, 2018 (the “Offering Closing

Date”) and is subject to certain conditions including, but

not limited to, the receipt of all necessary approvals, including

the approval of the Toronto Stock Exchange.

The securities have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any U.S.

state securities laws, and may not be offered or sold in the United

States without registration under the U.S. Securities Act and all

applicable state securities laws or compliance with the

requirements of an applicable exemption therefrom. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy securities in the United States, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

Advisors

Raymond James is acting as exclusive financial

advisor and Aird & Berlis LLP is acting as legal counsel to

Baylin on the Acquisition. Raymond James is also acting as

bookrunner and lead underwriter in respect of the Offering.

Conference Call Information

Baylin will host a conference call on June 28,

2018, at 8:30 a.m. (ET) to discuss the Acquisition. The call will

be hosted by Randy Dewey, President and Chief Executive Officer,

and Michael Wolfe, Chief Financial Officer. All interested parties

are invited to participate.

| DATE: |

June 28, 2018 |

| |

|

| TIME: |

8:30 a.m. (ET) |

| |

|

| DIAL IN NUMBER: |

888-231-8191 or

647-427-7450 |

| |

|

| CONFERENCE ID#: |

4261199 |

| |

|

| REPLAY NUMBER: |

855-859-2056 or

403-451-9481 |

| |

|

| WEBCAST DETAILS: |

https://event.on24.com/wcc/r/1788043/7F32FFC529F395D987F7597B9BE61F5D |

About Baylin

Baylin is a diversified leading global wireless

technology management company. Baylin focuses on research, design,

development, manufacturing and sales of passive and active radio

frequency products and services. Baylin aspires to meet customers'

needs and anticipate the direction of the market.

For further information contact:Investor Relations:Kelly Myles,

Marketing and Communications ManagerBaylin Technologies

Inc.kelly.myles@baylintech.com

Forward-looking Information Cautionary

Statement

Statements in this press release contain

forward-looking information including, without limitation, the

approval of the Toronto Stock Exchange, the timing and completion

of the Acquisition, the Offering and the anticipated use of

proceeds from the Offering by Baylin. The completion and timing of

the Acquisition and Offering are based on a number of assumptions,

including, that all approvals for the Acquisition and Offering will

be received, no material adverse change will occur in Baylin’s

operations nor will any events occur that would trigger termination

rights under the underwriting agreement with the Underwriters. The

intended use of the net proceeds of the Offering by Baylin might

change if the board of directors of Baylin determines that it would

be in the best interests of Baylin to deploy the proceeds for some

other purpose. The words “will”, “expect”, “may” and similar

expressions are intended to be among the statements that identify

forward-looking statements. The forward-looking statements are

founded on the basis of expectations and assumptions made by

Baylin.

______________________________________i Based on

consensus research estimates.

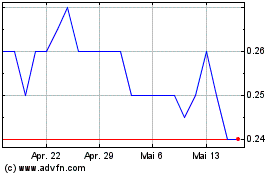

Baylin Technologies (TSX:BYL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Baylin Technologies (TSX:BYL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024