Brookfield Asset Management (NYSE: BAM, TSX: BAM) (“Brookfield”)

and Alterra Management Limited announced today the launch of the

Catalytic Transition Fund (“CTF” or “the Fund”) focused on

directing capital into clean energy and transition assets in

emerging economies.

With the urgent need to cut emissions and

accelerate the climate transition, the Brookfield-managed CTF will

harness a $1 billion commitment by ALTÉRRA funds (“ALTÉRRA”) to

catalyze up to $5 billion in total capital for deployment into

emerging markets. Since announcing the launch of CTF in December

2023, Brookfield has been focused on developing the investment

strategy, identifying an advanced pipeline of potential investments

and pre-marketing to potential investment partners.

Launched at COP28 in Dubai, ALTÉRRA is the

world’s largest private investment vehicle for climate finance. It

responds to the call for more ambitious funding models for the

climate transition, particularly in developing countries, and to

the urgent need to accelerate and scale climate action. At this

critical juncture for driving climate action, ALTÉRRA is committed

to deploying $30 billion in climate investments with the goal to

catalyze $250 billion with partners by 2030.

Emerging and developing economies outside of

China receive less than 15% of global clean energy investment,

despite representing nearly one third of global emissions and often

yielding greater emissions reductions per dollar invested than in

developed countries. To align with the goals of the Paris

Agreement, clean energy investment in these markets will need to

increase six times over current levels to reach $1.6 trillion per

year by the early 2030s.

CTF represents a unique private capital approach

to crowd in capital for clean energy and transition assets in

emerging markets. Managed by Brookfield and driven by the catalytic

capital of ALTÉRRA, it will accelerate decarbonization investments

while generating attractive risk-adjusted returns in traditionally

underserved emerging markets. ALTÉRRA is offering a capped return

on its CTF commitment, improving the risk-adjusted returns for

investors in the Fund and unlocking compelling investment

opportunities for private investors. By acting as a catalyst,

ALTÉRRA aims to significantly expand private finance and fuel

ambitious new climate strategies in both developing and developed

markets.

The strategic partnership between Brookfield and

ALTÉRRA benefits from Brookfield’s global leadership and strong

track record as the world’s largest transition investor among

private fund managers. The first fund in the Brookfield Global

Transition Fund series (BGTF I) raised a record $15 billion in

2022. In February 2024, the second fund in the series (BGTF II)

announced a first close of $10 billion and is on track to be larger

than its predecessor.

For CTF, the capital raised will be deployed in

target emerging markets, including in South and Central America,

South and Southeast Asia, the Middle East, and Eastern Europe. At

least 10% of the Fund’s total capital will be contributed by

Brookfield ensuring that its interests align with investment

partners. A first close for CTF is expected by the end of 2024.

Mark Carney, Chair and Head of

Transition Investing at Brookfield Asset Management,

said:

“The Catalytic Transition Fund is a private

market solution to the global challenge of delivering transition

investment to emerging markets. Brookfield is already a leading

transition investor in these regions and has first-hand knowledge

of the incredible opportunity and impact that is available in these

chronically underfunded markets. Having this dedicated capital for

emerging markets will complement our existing Brookfield Global

Transition Fund strategy and further accelerate the growth of clean

energy and transition investments in the future.”

H.E Majid Al-Suwaidi, CEO of ALTÉRRA,

said:

“While we are making progress in addressing

climate change, we need to pick up the pace and scale significantly

to meet our collective climate goals. ALTÉRRA wants to challenge

the status quo of how we invest in climate solutions, and our

investment in the Catalytic Transition Fund reflects our ongoing

commitment to go beyond business-as-usual. We are passionate about

ensuring capital goes where it is needed and that it drives impact

for countries, communities and business. Our catalytic capital will

be deployed to supercharge investment in emerging markets –

wherever we see great potential for delivering meaningful climate

impact and positive economic return.”

About Brookfield Asset

Management

Brookfield Asset Management (NYSE: BAM, TSX:

BAM) is a leading global alternative asset manager with over $925

billion of assets under management. We invest client capital for

the long-term with a focus on real assets and essential service

businesses that form the backbone of the global economy. We offer a

range of alternative investment products to investors around the

world — including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors.

Brookfield operates one of the world’s largest

platforms for renewable power and sustainable solutions. Our

renewable power portfolio consists of hydroelectric, wind,

utility-scale solar and storage facilities in North America, South

America, Europe and Asia, and totals approximately 34,000 megawatts

of installed capacity and a development pipeline of approximately

157,000 megawatts. Our portfolio of sustainable solutions assets

includes our investments in Westinghouse, a leading global nuclear

services business, and a utility and independent power producer

with operations in the Caribbean and Latin America, as well as both

operating assets and a development pipeline of carbon capture and

storage capacity, agricultural renewable natural gas and materials

recycling.

As a signatory to the Net Zero Asset Managers

initiative, Brookfield is committed to supporting the goal of

achieving net-zero greenhouse gas emissions by 2050 or sooner—in

line with the Paris Agreement.

For more information, please visit our website

at www.brookfield.com.

About ALTÉRRA

ALTÉRRA is the world’s largest private

investment vehicle for climate finance. Launched at COP28 with a

US$30 billion commitment from the UAE, ALTÉRRA aims to build

innovative partnerships to mobilize US$250 billion globally by 2030

to finance the new climate economy and accelerate the climate

transition.

ALTERRA's dual-arm structure enhances its

impact: the US$25 billion Acceleration Fund directs capital towards

projects crucial for accelerating the global transition to a

net-zero and climate-resilient economy at scale. The US$5 billion

Transformation Fund incentivizes investment flows in high-growth

climate opportunities in underserved markets by providing catalytic

capital.

Alterra Management Limited is duly licensed and

authorised by the ADGM Financial Services Regulatory Authority

under the Financial Services Permission No. 200001.

Brookfield

|

Communications & MediaSimon MaineTel: +44

(0)7398 909 278Email: simon.maine@brookfield.com |

Investor Relations:Jason FooksTel: +1 (866) 989

0311Email: jason.fooks@brookfield.com |

ALTÉRRA

|

Simon HailesManaging Director Middle

East Edelman SmithfieldM: +971 50 973 1173Email:

simon.hailes@edelmansmithfield.com |

Notice to Readers

This news release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of

the U.S. Securities Act of 1933,

the U.S. Securities Exchange Act of 1934, “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations (collectively, “forward-looking statements”).

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future results, events or

conditions, and include, but are not limited to, statements which

reflect management’s current estimates, beliefs and assumptions and

which are in turn based on our experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors management believes are

appropriate in the circumstances. The estimates, beliefs and

assumptions of Brookfield are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and as such, are subject

to change. Forward-looking statements are typically identified by

words such as “expect”, “anticipate”, “believe”, “foresee”,

“could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”,

“will”, “may” and “should” and similar expressions. In particular,

the forward-looking statements contained in this news release

include statements referring to, among other things, the total

capital deployed by CTF and how such capital will be deployed, the

expected impact and returns of CTF and the expected first close of

CTF .

Although Brookfield believes that such

forward-looking statements are based upon reasonable estimates,

beliefs and assumptions, certain factors, risks and uncertainties,

which are described from time to time in our documents filed with

the securities regulators in Canada and the United States, or that

are not presently known to Brookfield or that Brookfield currently

believes are not material, could cause actual results to differ

materially from those contemplated or implied by forward-looking

statements.

Readers are urged to consider these risks, as

well as other uncertainties, factors and assumptions carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements, which are

based only on information available to us as of the date of this

news release. Except as required by

law, Brookfield undertakes no obligation to publicly

update or revise any forward-looking statements, whether written or

oral, that may be as a result of new information, future events or

otherwise.

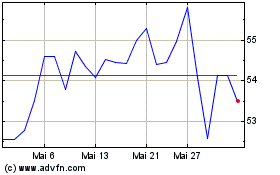

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024