NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE

SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Canstar Resources Ltd. ("

Canstar" or the

“

Corporation”) (TSX-V:ROX), Adventus Zinc

Corporation (“

Adventus”) (TSX-V:ADZN) and Altius

Minerals Limited (“

Altius”) (TSX:ALS) are pleased

to provide an update in relation to Canstar’s acquisition of the

Newfoundland base metal exploration assets of Adventus and the

Daniel's Harbour Zinc Project from Altius, as previously announced

by Canstar on February 21, 2018 (the

“

Transaction”).

Private Placement Closing

On April 17, 2018 Canstar completed a

non-brokered private placement for aggregate gross proceeds of

$1,500,021 (the “Offering”). The Offering

consisted of the sale of 8,333,699 common share subscription

receipts (“Common Share Receipts”) at a price of

$0.06 per Common Share Receipt and 12,500,000 flow through

subscription receipts (“Flow Through Receipts”) at

a price of $0.08 per Flow Through Receipt (together, the

“Subscription Receipts”). Altius Resources Inc., a

wholly-owned subsidiary of Altius, has purchased 6,250,000 Flow

Through Receipts for the amount of $500,000.

Upon satisfaction of the Escrow Release

Conditions (as defined below), each Common Share Receipt shall be

exchangeable for one common share (“Common Share”)

of Canstar. Each Flow Through Receipt shall be exchangeable for one

flow through share (“Flow Through Share”) of

Canstar within the meaning of the Income Tax Act (Canada). The

gross proceeds of the Offering less offering costs (the

“Escrowed Funds”) are currently in escrow pending

delivery of the Release Notice (as defined below) by the

Corporation to Capital Transfer Agency Inc. (the “Escrow

Agent”) on or before May 31, 2018. The Escrowed Funds

shall be released from escrow by the Escrow Agent to the

Corporation upon the satisfaction of the following conditions

(together, the “Escrow Release Conditions”): (i)

the execution of the definitive share exchange agreement among the

Corporation, Adventus, Adventus Newfoundland Corporation, and

Altius Resources Inc., a wholly-owned subsidiary of Altius; (ii)

the execution of the definitive asset purchase agreement between

the Corporation and Altius Resources Inc.; (iii) the completion or

irrevocable waiver or satisfaction of all conditions precedent to

the Transaction; (iv) the receipt of all required shareholder,

third party (as applicable) and regulatory approvals including,

without limitation, the conditional approval of the TSX Venture

Exchange (the “TSX-V”) for the Transaction and the

Offering; and (v) the Corporation having delivered a Release Notice

to the Escrow Agent confirming that the conditions set forth above

have been met or waived (the “Release

Notice”).

If the Escrow Release Conditions are not

satisfied on or before May 31, 2018, the Escrowed Funds together

with accrued interest earned thereon will be returned to the

holders of the Subscription Receipts and the Subscription Receipts

will be cancelled. The securities issued and issuable pursuant to

the Offering will be subject to a four month and one day statutory

hold period.

In connection with the Offering, the Corporation

paid finders a cash commission of $52,806 equal to 6% of the

aggregate gross proceeds raised by finders. A total of 754,200

broker warrants (“Broker Warrants”) equal to 6% of

subscription receipts raised was paid to finders. Each Broker

Warrant will entitle the holder to purchase one Common Share at a

price of $0.06 until the date which is twenty-four (24) months

following the closing date of the Offering, whereupon the Broker

Warrants will expire.

The net proceeds of the Offering will be applied

to “Canadian exploration expenses” (within the meaning of the

Income Tax Act (Canada)) and for a first phase Newfoundland

exploration program, G&A, corporate activities, and working

capital expenses. Canstar will ensure that the proceeds received

from the amount allocated to the purchase of the Flow Through

Receipts will be used to incur expenses which qualify as Canadian

Exploration Expenses and Flow-Through Mining Expenditures for

purposes of the Income Tax Act (Canada) and will renounce such

expenses with an effective date of no later than December 31,

2018.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended (the “U.S.

Securities Act”), or applicable state securities laws, and may not

be offered or sold to persons in the United States absent

registration or an exemption from such registration requirements.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

The Offering is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals, including final approval of the TSX Venture Exchange and

applicable securities regulatory authorities.

Exploits Project Option

Agreement

On April 5, 2018 Canstar entered into an option

agreement (the “Option Agreement”) with local

prospectors (the “Optionees”) to purchase 11

mineral claims covering 275 hectares near Red Indian Lake in the

Province of Newfoundland and Labrador (the “Exploits

Project”). The Exploits Project, located approximately 5

km southwest of the Mary March Project, contains recently

discovered massive sulphide boulders with geological similarities

to the Duck Pond Deposit.

In consideration for entering into the Option

Agreement, Canstar will pay the Optionees $10,000 in cash and issue

to the Optionees the equivalent of $5,000 in Canstar Common Shares.

Assuming the completion of subsequent payments totaling $30,000 to

the Optionees in cash and the equivalent of $30,000 to be paid in

Common Shares by the third anniversary of the entering into the

Option Agreement, Canstar will own a 100% interest in the mineral

claims subject to a 1% royalty interest retained by the

Optionees.

The securities issued to the Optionees will be

subject to a four month and one day statutory hold period.

The Option Agreement is subject to the receipt

of applicable regulatory approvals by Canstar being received on or

before April 25, 2018 and the satisfaction of certain other closing

conditions customary in transactions of this nature.

Warrant Extension

Canstar has applied to the TSX-V to extend by

one year the term of the common share purchase warrants

(“2016 Warrants”) issued pursuant to a private

placement of its units completed on May 2, 2016, as described in

more detail in its news release dated May 2, 2016. When originally

issued, the 2016 Warrants were exercisable into Canstar Common

Shares at $0.175 per Common Share until May 2, 2018, subject to the

option of the Corporation to accelerate the expiry of the 2016

Warrants upon giving a thirty days’ written notice in the event of

the trading price of the Common Shares on the TSX-V equaling or

exceeding for 20 consecutive trading days $0.25 (the

“Acceleration Option”). Subject to final approval

of the TSX-V, the 2016 Warrants will be exercisable into Canstar

Common Shares at $0.175 per Common Share until May 2, 2019, subject

to the Acceleration Option.

About CanstarCanstar Resources

is a Canadian mineral exploration and development company.

Canstar's objective is to discover and develop economic mineral

deposits primarily in North America. Currently, Canstar's focus is

on its mineral exploration properties in Newfoundland.

About AdventusAdventus is a

well-financed and unique company focused on zinc-related

exploration and project development globally. Its strategic

shareholders include Altius Minerals Corporation, Greenstone

Resources LP, and Resource Capital Funds; as well as other highly

respected investors in the mining business. Adventus owns large

prospective land packages in both Ireland and Newfoundland and

Labrador, Canada, and is earning a 75% ownership interest in the

Curipamba copper-gold-zinc project in Ecuador. In addition,

Adventus has a country-wide generative exploration alliance with

its partners in Ecuador. Adventus is based in Toronto, Canada, and

is listed on the TSX-V under the symbol ADZN.

About AltiusAltius’ directly

and indirectly held diversified royalties and streams generate

revenue from 15 operating mines. These are located in Canada and

Brazil and produce copper, zinc, nickel, cobalt, iron ore, potash

and thermal (electrical) and metallurgical coal. The portfolio also

includes numerous pre-development stage royalties covering a wide

spectrum of mineral commodities and jurisdictions. It also holds a

large portfolio of exploration stage projects which it has

generated for deal making with industry partners that results in

newly created royalties and equity and minority interests. The

Altius exploration team was recently awarded the 2017

Prospector/Explorer Award from the Newfoundland Branch of the CIMM

for its recent work on project generation.

Completion of the transaction is subject to a

number of conditions, including but not limited to, TSX-V

acceptance and shareholder approval. Where applicable, the

transaction cannot close until the required shareholder approval is

obtained. There can be no assurance that the transaction will be

completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the transaction, any

information released or received with respect to the transaction

may not be accurate or complete and should not be relied upon.

Trading in the securities of Canstar should be considered highly

speculative.

The TSX Venture Exchange Inc. has in no way

passed upon the merits of the proposed transaction and has neither

approved nor disapproved the contents of this news release.

Forward-looking StatementThis

press release contains “forward -looking information” within the

meaning of applicable Canadian securities laws. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, identified

by words or phrases such as “believes”, “anticipates”, “expects”,

“is expected”, “scheduled”, “estimates”, “pending”, “intends”,

“plans”, “forecasts”, “targets”, or “hopes”, or variations of such

words and phrases or statements that certain actions, events or

results “may”, “could”, “would”, “will”, “should” “might”, “will be

taken”, or “occur” and similar expressions) are not statements of

historical fact and may be forward-looking statements.

Forward-looking information in this news release includes, but is

not limited to, the closing of the Transaction, anticipated

drilling at Buchans Camp, satisfaction of closing conditions,

approval of the TSX-V, approval by the shareholders of Canstar and

the potential for exploration.

Forward-looking information herein includes, but

is not limited to, statements that address activities, events or

developments that Canstar, Adventus and Altius expect or anticipate

will or may occur in the future. Although Canstar, Adventus and

Altius has attempted to identify important factors that could cause

actual actions, events or results to differ materially from those

described in forward-looking information, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. Canstar, Adventus and

Altius do not undertake to update any forward-looking information

except in accordance with applicable securities laws.

All monetary figures referenced in this press

release are in Canadian dollars unless otherwise stated.

For further information from Canstar, please

contact: Karen Willoughby, Director Corporate Communications,

at 1-866-936-6766

or kwilloughby@canstarresources.com.

For further information from Adventus, please

contact Christian Kargl-Simard, Chief Executive Officer, at

1-416-230-3440 or christian@adventuszinc.com.

For further information from Altius, please

contact Chad Wells cwells@altiusminerals.com or Flora Wood at

1-877-576-2209.

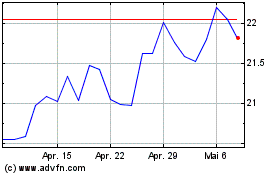

Altius Minerals (TSX:ALS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

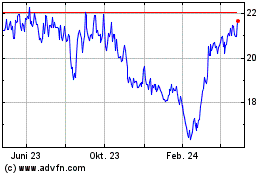

Altius Minerals (TSX:ALS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024