Ag Growth International Inc. (TSX: AFN) (“AGI” or the “Company”)

announced today that it has reached an agreement with a syndicate

of underwriters led by CIBC Capital Markets, National Bank

Financial Inc., RBC Capital Markets and Scotiabank (the

“Underwriters”), pursuant to which AGI will issue on a “bought

deal” basis, subject to regulatory approval, $85,000,000 aggregate

principal amount of senior subordinated unsecured debentures (the

“Debentures”) at a price of $1,000 per Debenture (the “Offering”).

AGI has also granted to the Underwriters an over-allotment option,

exercisable in whole or in part for a period expiring 30 days

following closing, to purchase up to an additional $12,750,000

aggregate principal amount of Debentures at the same price. If the

over-allotment option is fully exercised, the total gross proceeds

from the Offering to AGI will be $97,750,000.

The net proceeds of the Offering will be used to

repay indebtedness and for general corporate purposes.

A preliminary short form prospectus qualifying

the distribution of the Debentures will be filed with the

securities regulatory authorities in each of the provinces of

Canada (other than Quebec). Closing of the Offering is expected to

occur on or about March 5, 2020. The Offering is subject to normal

regulatory approvals, including approval of the Toronto Stock

Exchange.

The Debentures will bear interest from the date

of issue at 5.25% per annum, payable semi-annually in arrears on

June 30 and December 31 each year commencing June 30, 2020. The

Debentures will have a maturity date of December 31, 2026.

The Debentures will not be redeemable by the

Company before December 31, 2022, except upon the occurrence of a

change of control of the Company in accordance with the terms of

the indenture (the "Indenture") governing the Debentures. On and

after December 31, 2022 and prior to December 31, 2023, the

Debentures may be redeemed at the Company’s option at a price equal

to 103.9375% of their principal amount plus accrued and unpaid

interest. On and after December 31, 2023 and prior to December 31,

2024, the Debentures may be redeemed at the Company’s option at a

price equal to 102.625% of their principal amount plus accrued and

unpaid interest. On and after December 31, 2024 and prior to

December 31, 2025, the Debentures may be redeemed at the Company’s

option at a price equal to 101.3125% of their principal amount plus

accrued and unpaid interest. On and after December 31, 2025 and

prior to maturity, the Debentures will be redeemable at the

Company’s option at a price equal to their principal amount plus

accrued and unpaid interest.

The Company will have the option to satisfy its

obligation to repay the principal amount of the Debentures due at

redemption or maturity by issuing and delivering that number of

freely tradeable common shares in accordance with the terms of the

Indenture.

The Debentures will not be convertible into

common shares of the Company at the option of the holders at any

time.

This press release is not an offer of Debentures

for sale in the United States. The Debentures may not be offered or

sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended, or an exemption from such

registration. The Company has not registered and will not register

the Debentures under the U.S. Securities Act of 1933, as amended.

The Company does not intend to engage in a public offering of

Debentures in the United States. This press release shall not

constitute an offer to sell, nor shall there be any sale of, the

Debentures in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

2020 Outlook

Management reaffirms its positive outlook for

2020. In 2019, AGI demonstrated the success of its AGI SureTrack

subscription model by increasing retail equivalent sales by 70%,

and as we enter 2020 that growth rate has accelerated as AGI builds

on existing relationships with processors, merchandisers, grain

buyers and producers throughout North America. In the fourth

quarter of 2019, AGI recorded negative adjusted EBITDA1 of $2.7

million related to the investment in its growing technology

platform and management plans to invest further in 2020 to

accelerate growth of the platform. In addition, management expects

demand for Farm products to increase with the new planting season

in the second quarter of 2020 due to an anticipated increase in

U.S. planted acres, improved weather conditions compared to

historically poor conditions in 2019 and better farmer economics

and sentiment should the U.S. and China fully implement Phase 1 of

a trade agreement. The Company’s early order programs for its Farm

products are at robust levels, supporting management’s positive

view for 2020. Offshore, management expects continued growth in

India and Brazil, and anticipates an improvement in the global

trade environment will result in increased demand in its Commercial

business. AGI’s international backlog is well above the levels

experienced at the same time in 2019. Commercial project bookings

picked up at the end of 2019 following a pause caused by global

trade tensions and has resulted in project completion more heavily

weighted to the second half of 2020 as these projects go through

final design, manufacturing and execution. Accordingly, management

expects sales and adjusted EBITDA to also be more heavily weighted

toward the second half of 2020 as compared to prior years. In

summary, Farm and Commercial backlogs are very strong and

management expects sales and adjusted EBITDA in fiscal 2020 to

significantly exceed 2019 results.

Company Profile

AGI is a leading provider of equipment solutions

for agriculture bulk commodities including seed, fertilizer, grain,

and feed systems with a growing platform in providing equipment and

solutions for food processing facilities. AGI has manufacturing

facilities in Canada, the United States, the United Kingdom,

Brazil, France, Italy, and India and distributes its product

globally.

Further information can be found in the

disclosure documents filed by AGI with the securities regulatory

authorities, available at www.sedar.com and on AGI's website

www.aggrowth.com.

1 See Non-IFRS Measures.

For More Information Contact:

Investor Relations Steve Sommerfeld 204-489-1855

steve@aggrowth.com

CAUTIONARY STATEMENTS

Preliminary Unaudited Financial

Information

The Company's expectations for fourth quarter

2019 EBITDA related to investment in its growing technology

platform are based on, among other things, AGI's financial results

for the three months and year ended December 31, 2019. AGI's

financial results for the three months and year ended December 31,

2019, have not yet been finalized or approved and as such, such

estimates and guidance are subject to the same limitations and

risks as discussed under Forward-Looking Information set out below.

Accordingly, AGI's guidance for the three months and year ended

December 31, 2019, may change upon the completion, audit and

approval of the financial statements for such periods and the

changes could be material.

Forward-Looking Information

This news release contains forward-looking

statements and information (collectively, "forward-looking

information") within the meaning of applicable securities laws that

reflect the Company's expectations regarding its future growth,

results of operations, performance, business prospects, and

opportunities. All information and statements contained herein that

are not clearly historical in nature constitute forward-looking

information, and the words “anticipate”, “believe”, “continue”,

“could”, “estimate”, "expect”, “intend”, “plans”, "postulates",

"predict", “should”, “will” or similar expressions suggesting

future conditions or events or the negative of these terms are

generally intended to identify forward-looking information.

Forward-looking information involves known or unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. Undue reliance should not be placed on

forward-looking information, as there can be no assurance that the

plans, intentions or expectations upon which it is based will

occur. In particular, the forward-looking information in this press

release includes information relating to AGI's business and

strategy, including, the Company's expectations for: fourth quarter

2019 EBITDA related to investment in its growing technology

platform; AGI SureTrack historical and future sales and sales

growth; financial and operating performance in 2020 including

expectations for future financial results including sales and

adjusted EBITDA, industry demand and market conditions; and the

proposed timing of completion of the Offering and the anticipated

use of the net proceeds of the Offering. Such forward-looking

information reflects AGI's current beliefs and is based on

information currently available to us, including certain key

expectations and assumptions concerning: anticipated grain

production in AGI's market areas; financial performance; the

financial and operating attributes of recently acquired businesses

and the anticipated future performance thereof and contributions

therefrom; business prospects; strategies; product and input

pricing; regulatory developments; tax laws; the sufficiency of

budgeted capital expenditures in carrying out planned activities;

political events; currency exchange and interest rates; the cost of

materials; labour and services; the value of businesses and assets

and liabilities assumed pursuant to recent acquisitions; the impact

of competition; the general stability of the economic and

regulatory environment in which AGI operates; the timely receipt of

any required regulatory and third party approvals; the ability of

AGI to obtain and retain qualified staff and services in a timely

and cost efficient manner; the timing and payment of dividends; the

ability of AGI to obtain financing on acceptable terms; the

regulatory framework in the jurisdictions in which AGI operates;

the ability of AGI to successfully market its products and

services; the estimated costs associated with the equipment

supplied including the total cost of project rework and any

additional associated costs.

Forward-looking information involves significant

risks and uncertainties. A number of factors could cause actual

results to differ materially from results discussed in the

forward-looking information, including changes in international,

national and local macroeconomic and business conditions, as well

as sociopolitical conditions in certain local or regional markets,

weather patterns, crop planting, crop yields, crop conditions, the

timing of harvest and conditions during harvest, the ability of

management to execute AGI’s business plan, seasonality, industry

cyclicality, volatility of production costs, agricultural commodity

prices, the cost and availability of capital, currency exchange and

interest rates, the availability of credit for customers,

competition, AGI’s failure to achieve the expected benefits of

recent acquisitions including to realize anticipated synergies and

margin improvements; changes in trade relations between the

countries in which AGI does business and elsewhere including

between Canada and the United States and between the United States

and China; changes in the estimate of the costs associated with the

rework of equipment supplied including the potential for additional

associated or incidental costs and liabilities; the finalization of

AGI's financial statements for the three months and year ended

December 31, 2019; and the failure or delay in satisfying any of

the conditions to the completion of the Offering. These risks and

uncertainties are described under “Risks and Uncertainties” in

AGI's Q3 MD&A, annual MD&A and in our most recently filed

Annual Information Form, all of which are available under AGI's

profile on SEDAR [www.sedar.com]. These factors should be

considered carefully, and readers should not place undue reliance

on AGI’s forward-looking information. AGI cannot assure readers

that actual results will be consistent with this forward-looking

information. Readers are further cautioned that the preparation of

financial statements in accordance with IFRS requires management to

make certain judgments and estimates that affect the reported

amounts of assets, liabilities, revenues and expenses and the

disclosure of contingent liabilities. These estimates may change,

having either a negative or positive effect on profit and other

financial information, as further information becomes available and

as the economic environment changes. The forward-looking

information contained herein is expressly qualified in its entirety

by this cautionary statement. The forward-looking information

included in this press release is made as of the date of this press

release and AGI undertakes no obligation to publicly update such

forward-looking information to reflect new information, subsequent

events or otherwise unless so required by applicable securities

laws.

Non-IFRS Measures

In analyzing the Company's results, AGI

supplements its use of financial measures that are calculated and

presented in accordance with International Financial Reporting

Standards ("IFRS") with a number of non-IFRS financial measures

including “EBITDA” and “adjusted EBITDA”. A non-IFRS financial

measure is a numerical measure of a company's historical

performance, financial position or cash flow that excludes

[includes] amounts, or is subject to adjustments that have the

effect of excluding [including] amounts, that are included

[excluded] in the most directly comparable measures calculated and

presented in accordance with IFRS. Non-IFRS financial measures are

not standardized; therefore, it may not be possible to compare

these financial measures with other companies' non-IFRS financial

measures having the same or similar businesses. AGI strongly

encourages investors to review its consolidated financial

statements and publicly filed reports in their entirety and not to

rely on any single financial measure.

AGI uses these non-IFRS financial measures in

addition to, and in conjunction with, results presented in

accordance with IFRS. These non-IFRS financial measures reflect an

additional way of viewing aspects of its operations that, when

viewed with the Company's IFRS results and the accompanying

reconciliations to corresponding IFRS financial measures, may

provide a more complete understanding of factors and trends

affecting AGI's business.

Management believes that the Company's financial

results may provide a more complete understanding of factors and

trends affecting its business and be more meaningful to management,

investors, analysts and other interested parties when certain

aspects of its financial results are adjusted for the gain (loss)

on foreign exchange and other operating expenses and income. These

measurements are non-IFRS measurements. Management uses the

non-IFRS adjusted financial results and non-IFRS financial measures

to measure and evaluate the performance of the business and when

discussing results with the Board of Directors, analysts,

investors, banks and other interested parties. Reconciliations of

historical non-IFRS financial measures to the most directly

comparable historical IFRS financial measures are contained in

AGI's previously filed management’s discussion and analysis.

References to “EBITDA” are to profit before

income taxes, finance costs, depreciation, amortization and AGI’s

share of Associate’s net income (loss). References to “adjusted

EBITDA” are to EBITDA before the gain or loss on foreign exchange,

non-cash share based compensation expenses, gain or loss on

financial instruments, M&A expenses, other transaction and

transitional costs, gain or loss on the sale of property, plant

& equipment, gain or loss on disposal of assets held for sale,

fair value of inventory from acquisitions, impairment and equipment

rework. Management believes that, in addition to profit or loss,

EBITDA and adjusted EBITDA are useful supplemental measures in

evaluating the Company’s performance. Management cautions investors

that EBITDA and adjusted EBITDA should not replace profit or loss

as indicators of performance, or cash flows from operating,

investing, and financing activities as a measure of the Company’s

liquidity and cash flows.

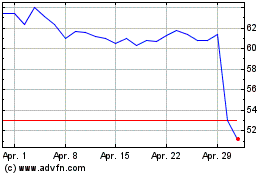

Ag Growth (TSX:AFN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

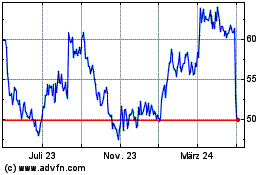

Ag Growth (TSX:AFN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024