Standard Lithium Reports Fiscal Second Quarter 2024 Results,

Schedules Investor Update Call

Standard Lithium Ltd. (“Standard Lithium” or the

“Company”) (TSXV:SLI) (NYSE American:SLI) (FRA:S5L), a leading

near-commercial lithium development company, today reported its

financial and operating results for the fiscal second quarter ended

December 31, 2023.

"In 2023, the lithium sector has been under

pressure, with lithium prices experiencing a significant decrease

from the all-time highs seen in 2022, a situation compounded by the

prevailing interest rate environment and other macroeconomic

factors," says Robert Mintak, CEO and Director of Standard Lithium.

"Despite the industry-wide market challenge, the long-term

fundamentals for lithium continue to be strong, particularly for

projects situated in geopolitically stable regions such as the

United States, where policy support and other key strategic

advantages are enabling for project differentiation. The Smackover

region, in particular, is attracting interest from major players in

the global energy sector. Discussions around strategic

partnerships, joint development opportunities, and long-term

off-take are robust and moving forward. In response to these market

dynamics, we are taking responsible and appropriate actions that

are in the best interests of our shareholders, ensuring that

Standard Lithium remains well-positioned to capitalize on what

continues to be an exciting sector with extraordinary growth

prospects."

Salah Gamoudi, Chief Financial Officer of

Standard Lithium added: “Despite a challenging commodity price

environment, we expect to sustain our current operations through

fiscal year 2024 with our cash available on-hand and the strategic

use of our ATM program in place. Our balance sheet remains strong,

with no long-term debt obligations and positive working capital,

giving us the flexibility and optionality to make prudent,

disciplined decisions for our shareholders. We continue to evaluate

and pursue attractive, non-dilutive financing options with the

guidance of our financial advisors, and as Robert mentioned, we are

progressing discussions with potential strategic partners and

off-takers. The need for additional capital at this point in our

Company’s evolution is natural as we continue to advance our suite

of projects in a responsible manner taking into account the various

market dynamics, and with a focus on opportunities that are the

most value accretive for our shareholders in the long-term.”

Highlights of the Second Fiscal Quarter

Ended December 31, 2023

- Appointed key executives to

the leadership team to support the Company’s next stage of

development and growth. Salah Gamoudi was appointed as

Chief Financial Officer and Michael Barman joined as Chief

Development Officer. Mr. Gamoudi brings extensive experience from

the oil and gas sector, including a transformative tenure at

Sandridge Energy that successfully generated significant value for

its shareholders. He is expected to lead the financing strategy as

well as enhance the Company’s accounting and investor relations

functions. Mr. Barman brings nearly 20 years of experience advising

senior executives and their boards, most recently serving as

Managing Director in Investment Banking at Stifel Nicolaus Canada

Inc. (formerly GMP Securities L.P.). He is leading late-stage

discussions related to project partnerships and off-take

agreements.

- Released the results of the

Company’s fully optimized and proven DLE Process. During a

representative period of continuous operation the LiPRO™ LSS

achieved an average lithium recovery of 96.1% and rejected, on

average, over 99% of key contaminants including over 95% of

boron.

- Concluded East Texas

drilling program that yielded the highest-ever reported lithium

brine values in North America. The Company identified a

globally-significant lithium brine asset with confirmed lithium

concentrations of up to 806 mg/L and an average grade of 644 mg/L

from three newly drilled wells. In addition, the results included

highly elevated concentrations of potassium and bromine,

demonstrating the potential for significant upside.

- Secured lithium brine

production rights on South West Arkansas (“SWA”) Project.

The Company exercised it’s option with TETRA Technologies, Inc. and

secured exclusive brine production rights on approximately 27,000

net acres of brine leases included within the footprint of the SWA

Project. The Company is now progressing SWA through front-end

engineering design (“FEED”) and the Definitive Feasiblity Study

(“DFS”) stages. Subsequent to the fiscal second quarter-end, the

Company selected Ausenco Engineering Canada ULC to lead the FEED

and DFS studies for the project.

- Progressed the Company’s

first commercial lithium project with the filing of Phase 1A’s

Definitive Feasiblity Study. The Phase 1A Project located

in El Dorado, Arkansas is expected to initially produce 5,700

tonnes per annum (“tpa”) of battery-quality lithium carbonate over

a 25-year operating life.

- Engaged Citi for strategic

financing and partnerships for the development of the Phase 1A

Project, as well as advancing the South West Arkansas Project and

initiatives in East Texas. LANXESS communicated it’s plans to

commercialize its role in the Phase 1A Project with agreements

under negotiation for brine supply, site lease, and infrastructure

services, key to defining the operational framework.

- During the quarter, the Company

commenced an at-the-market offering program, issuing a total of

100,100 common shares on the TSX Venture Exchange and 1,326,259

common shares on the NYSE American LLC, providing gross proceeds of

Ca$0.3 million and US$3.3 million, respectively.

- The Company has no term or

revolving debt obligations as of December 31, 2023.

- Cash and equivalents and working

capital of Ca$15.8 million and Ca$5.7 million, respectively, as of

second fiscal quarter end, and in combination with the prudent and

strategic use of our at-the-market offering program as a tool to

fund any short term financing needs, are expected to sustain the

Company through the 2024 fiscal year.

Consolidated Financial

Statements

The Company’s interim financial statements and

management's discussion and analysis for the second quarter 2024

ended December 31, 2023, are available on the Company's website at

https://www.standardlithium.com/ and under the Company’s profiles

on SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov.

Q2 FISCAL RESULTS CONFERENCE CALL AND

WEBCAST

The Company will hold a conference call and

webcast to discuss its second quarter fiscal results on Monday,

February 12 at 11:00 a.m. EST. Access to the call is available via

webcast or direct dial. A link to the webcast and direct dial

numbers are provided below:

Conference Call and Webcast Details:Standard

Lithium Fiscal Q2 Earnings Call and WebcastFebruary 12, 2024 11:00

AM (GMT-05:00) Eastern Time (US and Canada)

Participant Information:North

America Toll-Free: (800) 715-9871UK Toll-Free:

+44.800.358.0970International Toll: (646) 307-1963

Attendee Webcast

Link:https://events.q4inc.com/attendee/233770702

Qualified Person

Steve Ross, P.Geol., a qualified person as

defined by National Instrument 43-101, and Vice President Resource

Development for the Company, has reviewed and approved the relevant

scientific and technical information in this news release.

About Standard Lithium Ltd.

Standard Lithium is a leading near-commercial

lithium development company focused on the sustainable development

of a portfolio of lithium-brine bearing properties in the United

States. The Company prioritizes brine projects characterized by

high-grade resources, robust infrastructure, skilled labor, and

streamlined permitting. The Company aims to achieve sustainable,

commercial-scale lithium production via the application of a

scalable and fully-integrated Direct Lithium Extraction (“DLE”) and

purification process. The Company’s signature projects, the Phase

1A Project and the South West Arkansas Project, are located on the

Smackover Formation in southern Arkansas, a region with a

longstanding and established brine processing industry. The Company

has also identified a number of highly prospective lithium brine

project areas in the Smackover Formation in East Texas and began an

extensive brine leasing program in the key project areas. In

addition, the Company has an interest in certain mineral leases

located in the Mojave Desert in San Bernardino County,

California.

Standard Lithium trades on both the TSX Venture

Exchange and the NYSE American under the symbol “SLI”; and on the

Frankfurt Stock Exchange under the symbol “S5L”. Please visit the

Company’s website at www.standardlithium.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release. This news release may contain

certain “Forward-Looking Statements” within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws. When used in this news

release, the words “anticipate”, “believe”, “estimate”, “expect”,

“target, “plan”, “forecast”, “may”, “schedule” and other similar

words or expressions identify forward-looking statements or

information. These forward-looking statements or information may

relate to intended development timelines, future prices of

commodities, accuracy of mineral or resource exploration activity,

reserves or resources, regulatory or government requirements or

approvals, the reliability of third party information, continued

access to mineral properties or infrastructure, fluctuations in the

market for lithium and its derivatives, changes in exploration

costs and government regulation in Canada and the United States,

and other factors or information. Such statements represent the

Company’s current views with respect to future events and are

necessarily based upon a number of assumptions and estimates that,

while considered reasonable by the Company, are inherently subject

to significant business, economic, competitive, political and

social risks, contingencies and uncertainties. Many factors, both

known and unknown, could cause results, performance or achievements

to be materially different from the results, performance or

achievements that are or may be expressed or implied by such

forward-looking statements. The Company does not intend, and does

not assume any obligation, to update these forward-looking

statements or information to reflect changes in assumptions or

changes in circumstances or any other events affecting such

statements and information other than as required by applicable

laws, rules and regulations.

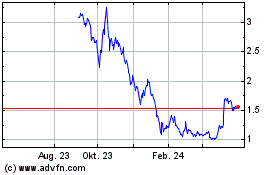

Standard Lithium (TG:S5L)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

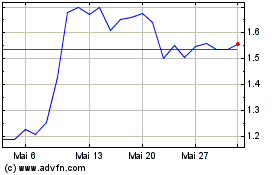

Standard Lithium (TG:S5L)

Historical Stock Chart

Von Dez 2023 bis Dez 2024