Financial Year 2009/10: Heidelberg Presents Figures for First Six Months – Orders Stabilize at Low Level

10 November 2009 - 7:00AM

Business Wire

Incoming orders in the first six months of the financial year

2009/10 (April 1 to September 30) at Heidelberger Druckmaschinen AG

(Heidelberg) (FWB: HDD) have stabilized at the current low level.

In total, however, the figures for the first six months are down

significantly on equivalent figures for the previous year. As print

shops are still running well below capacity due to low advertising

budgets, the company does not expect any marked increase in

investments in the print media industry for the financial year as a

whole.

Incoming orders of EUR 534 million in the second quarter

(July 1 to September 30) were roughly on a par with the previous

quarter (EUR 550 million), having stabilized at a low level since

October 2008. The significant fall in incoming orders to EUR 1.084

billion in the first half of the year was also influenced by the

high order volumes stemming from last year’s drupa show (previous

year: EUR 1.872 billion).

“Developments within the individual regions differ considerably.

Asia is showing signs of recovery, which are not sufficient to

fully compensate for the downturns in the other regions,” says

Heidelberg CEO Bernhard Schreier. “Incoming orders are bottoming

out now, but we do not expect to see clear signs of improvement in

the subsequent quarters of the current financial year. We can only

expect to see an improvement in production values and capacity

utilization in the print industry when the economy as a whole shows

signs of a lasting recovery, which in turn will encourage a greater

readiness to invest.”

The order backlog of the Heidelberg Group remained

constant in the second quarter of the current financial year at EUR

617 million (previous quarter: EUR 616 million).

The low level of incoming orders led to a slight drop in

sales in the second quarter over the first quarter, falling

from EUR 514 million to EUR 499 million. In the first six months of

the current financial year, sales amounted to a total of EUR 1.013

billion and were thus down around 31 percent on the previous year

(EUR 1.461 billion).

The operating result excluding special items amounted to

EUR minus 65 million in the second quarter (previous year excluding

special items: EUR minus 10 million). As a result of low profit

contributions due to weak sales, the cumulative figure for the

operating result after two quarters was EUR minus 128 million

(previous year: EUR minus 45 million). Further expenditure for

special items amounting to EUR 11 million has been incurred up to

September 30, 2009 (expenditure for special items in the previous

year: EUR 40 million). The net result for the first six

months was EUR minus 147 million (previous year: EUR minus 95

million).

As a result of a further reduction in the working capital, a

positive free cash flow of EUR 11 million was recorded in

the second quarter. In the first six months as a whole, free cash

flow was only slightly negative at EUR minus 18 million, up

significantly on the previous year’s level of EUR minus 273

million.

“All our measures aimed at cutting costs by around EUR 400

million a year are currently in the process of being implemented.

This is going some way to compensating the burden on results

brought about by falling sales,” explains Heidelberg CFO Dirk

Kaliebe. “The cost savings achieved so far and the positive effects

in asset management have enabled us to achieve a positive free cash

flow in the second quarter and reduce the net debt over the

previous quarter.”

As a result of the slight increase in volumes in comparison with

the previous quarter and higher cost savings anticipated over the

further course of financial year 2009/10, the company expects to

keep the operating result fairly level in the second six months of

the year.

With the conclusion of negotiations on a reconciliation of

interests and a redundancy plan at the start of October, the

planned cutbacks at Heidelberg are progressing. On September 30,

2009, Heidelberg had a workforce of 18,201 worldwide,

representing a reduction of around 2,400 employees since the end of

March 2008. In total, the company plans to cut around 4,000 jobs

worldwide by the end of financial year 2010/11.

The weak economic conditions worldwide have impacted on the

company’s business in all sectors. Sales and incoming orders

in this area were therefore down on last year. However, incoming

orders for the new large-format presses exceeded expectations.

Looking at the individual regions, Asia/Pacific was the only

region to improve in terms of incoming orders. At EUR 172 million,

orders for the second quarter were up on the previous year’s figure

(EUR 147 million). By contrast, incoming orders in all other

regions fell compared to the previous year.

Outlook

As a result of the business developments in the first six months

of the year and the current economic and market forecasts,

Heidelberg does not expect the level of investment in the print

media industry to rise in the current financial year. For the

subsequent quarters in financial year 2009/10, the company expects

no significant increase in incoming orders and sales over the

previous quarters, which means that the figures will likely fall

short of the original expectations. Consequently, for the financial

year as a whole, Heidelberg sales will fall well short of the

figure for financial year 2008/09. As a result of the low sales

volume, Heidelberg forecasts an operating result (excluding special

items) of between EUR minus 110 million and EUR minus 150 million.

All the cost-cutting measures planned at Heidelberg are currently

in progress. Moreover, the agreements made to date mean that

personnel costs can still be adapted flexibly as needs dictate.

The tables as well as additional information can be found at the

Heidelberg Press Lounge at www.heidelberg.com.

Other dates:

Publication of the figures for the third quarter for financial

year 2009/2010 is scheduled for February 9, 2010.

Important note:

This press release contains forward-looking statements based on

assumptions and estimations by the Management Board of Heidelberger

Druckmaschinen Aktiengesellschaft. Even though the Management Board

is of the opinion that those assumptions and estimations are

realistic, the actual future development and results may deviate

substantially from these forward-looking statements due to various

factors, such as changes in the macro-economic situation, in the

exchange rates, in the interest rates and in the print media

industry. Heidelberger Druckmaschinen Aktiengesellschaft gives no

warranty and does not assume liability for any damages in case the

future development and the projected results do not correspond with

the forward-looking statements contained in this press release.

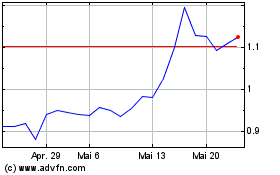

Heidelberger Druckmaschi... (TG:HDD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

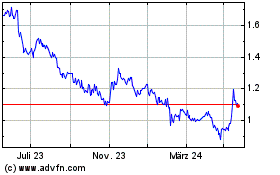

Heidelberger Druckmaschi... (TG:HDD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025