Financial Year 2008/2009 - Heidelberg Presents Final First-Quarter Figures

05 August 2008 - 7:26AM

Business Wire

In the first quarter of financial year 2008/2009, Heidelberger

Druckmaschinen AG (Heidelberg) (FWB: HDD) recorded a significant

improvement in incoming orders over the previous year thanks to

industry trade show drupa. In the period under review, the

Heidelberg Group increased its incoming orders by around 23 percent

over the same quarter the previous year to EUR�1.151 billion

(previous year: EUR 934 million). As already announced on July 10,

2008, sales and earnings were significantly down on the equivalent

figures for the previous year due to difficult market conditions

and customers� reluctance to invest in the run-up to drupa. Sales

by the Heidelberg Group in the first three months (April 1 to June

30) totaled EUR�657 million (previous year: EUR 742 million). The

order backlog at the end of the first quarter was EUR 1.298 billion

(previous quarter to March 31, 2008: EUR 874�million). �Healthy

incoming orders from drupa will mean better operating results in

the second and third quarters than in the first three months,�

stated Bernhard Schreier, CEO of Heidelberger Druckmaschinen AG.

�The trade show enabled us to underline our position as the world

leader in the industry, but difficult underlying conditions are

still impacting on the current market situation. The package of

measures already introduced to improve our cost structure will

compensate these effects in the medium term,� he added. The

Heidelberg Group recorded an operating result of EUR -35 million in

the period under review (previous year: EUR 26 million). The net

result in the first quarter was EUR -39 million (previous year: EUR

8 million). Due to the purchase of Hi-Tech Coatings, the cost of

drupa, and falling sales, the free cash flow in the first quarter

was clearly below the previous year�s level at EUR�-211 million

(previous year: EUR -81 million). �As already indicated, weak sales

and additional costs led to a negative operating result for the

first quarter of the financial year,� explained Heidelberg CFO Dirk

Kaliebe. �We are working hard to ensure successful implementation

of the package of cost-cutting measures introduced so that the

resultant savings can be achieved as planned.� As of June 30, 2008,

the Heidelberg Group had a workforce of 19,737 worldwide (previous

quarter: 19,596). The reasons for the increase in the first quarter

of financial year 2008/2009 were the acquisition of the Hi-Tech

Coatings companies and the initial consolidation of the production

site in Qingpu, China. Adjusted to take into account these initial

consolidation effects, the workforce fell by 77 in the first

quarter. Results in the Press and Postpress divisions A successful

drupa resulted in healthy incoming orders in the Press Division

(offset printing) in the first quarter of the year under review. At

EUR�1.030 billion, they were 26 percent up on the previous year�s

level (previous year: EUR 817 million). Sales in the first three

months totaled EUR 568 million (previous year: EUR�639 million).

The poor performance of sales combined with additional costs,

including those associated with drupa, led to an operating result

of EUR -29 million (previous year: EUR 21 million). Incoming orders

in the Postpress Division (finishing) also increased in the first

quarter thanks to drupa and were 5 percent up on the same period of

the previous year at EUR�114 million (previous year: EUR 109

million). Quarterly sales amounted to EUR 82 million (previous

year: EUR 95 million). The operating result for the period under

review was EUR -11 million (previous year: EUR -4 million). This

was caused by poor sales and the additional costs associated with

drupa. In the EMEA, North America, Latin America and Asia/Pacific

regions, incoming orders were up on the previous year�s level

thanks to drupa. The improvement was particularly marked in

Germany, but France also benefited greatly from orders placed at

the trade show. drupa did not have the same impact on the Eastern

Europe region as it did, for example, in Central Europe. Sales in

all regions were down on the previous year�s level for the first

quarter. The company does not expect to match the previous year�s

sales and operating result for the financial year 2008/2009 as a

whole. Due to the uncertain economic situation worldwide and the

volatile market environment, it will not be possible to provide a

forecast of the key figures for the financial year 2008/2009 as a

whole until later in the year. An outlook should be published no

later than with the half-yearly results at the beginning of

November 2008. The complete report for the first quarter of

2008/2009 is available online at www.heidelberg.com. For further

details, visit the Internet Press Lounge at www.heidelberg.com.

Other dates: The scheduled publication date for the half-yearly

results for financial year 2008/2009 is November 6, 2008. Important

note: This Press Information contains statements about future

development that are based on assumptions and estimates by the

management of Heidelberger Druckmaschinen Aktiengesellschaft. Even

if the management is of the opinion that these assumptions and

estimates are accurate, future actual developments and future

actual results may differ significantly from these assumptions and

estimates due to a variety of factors. These factors can include

changes to the overall economic climate, changes to exchange rates

and interest rates and changes in the graphic arts industry.

Heidelberger Druckmaschinen Aktiengesellschaft provides no

guarantee that future developments and the results actually

achieved in the future will agree with the assumptions and

estimates set out in this press release and assumes no liability

for such. Heidelberg Group - in numbers � � � � � � � in EUR

million � Q 1 2008/09(04/01-06/30/08) � Q 1 2007/08(04/01-06/30/07)

� Change in % � � � Net sales 657 742 -11.5 % � � Press 568 639

-11.1 % Postpress 82 95 -13.7 % Financial Services 7 8 -12.5 % � �

� � � � � � Incoming orders 1,151 934 +23.2 % � � Press 1,030 817

+26.1 % Postpress 114 109 +4.6 % Financial Services 7 8 -12.5 % � �

� � � � � � Order backlog 1,298 1,196 +8.5 % � � Press 1,197 1,094

+9.4 % Postpress 101 102 -1.0 % Financial Services - - - � � � � �

� � � Operating result -35 26 � � Press -29 21 Postpress -11 -4

Financial Services 5 9 � � � � � � � � � Financial result -16 -14 �

Income before taxes -50 12 � Net profit -39 8 Heidelberg Group -

regional split � � � � � � � � � � � � � in EUR million � Q 1

2008/09(04/01-06/30/08) � Q 1 2007/08(04/01-06/30/07) � Changein %

� Share 08/09in % � Net sales 657 742 -11.5 % 100 � EMEA 323 331

-2.4 % 49.2 Eastern Europe 71 90 -21.1 % 10.8 North America 84 114

-26.3 % 12.8 Latin America 31 40 -22.5 % 4.7 Asia/Pacific 148 167

-11.4 % 22.5 � � � � � � � � � � Incoming orders 1,151 934 +23.2 %

100 � EMEA 595 446 +33.4 % 51.7 Eastern Europe 116 127 -8.7 % 10.1

North America 137 122 +12.3 % 11.9 Latin America 59 53 +11.3 % 5.1

Asia/Pacific 244 186 +31.2 % 21.2

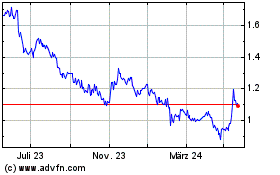

Heidelberger Druckmaschi... (TG:HDD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

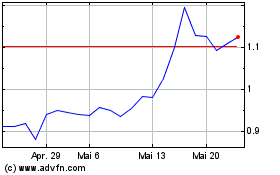

Heidelberger Druckmaschi... (TG:HDD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025