ANNUAL REPORT 2022/23 (EARNINGS RELEASE)

For the full 2022/23 financial year, Ambu reported 7.6%

organic revenue growth. This was driven by Endoscope Solutions

posting 15% organic growth, the main drivers being urology and ENT

growing high double-digits, as well as pulmonology contributing

positively, with a strengthened offering. As a result of Ambu’s

focused execution, the company delivered an EBIT margin of 6.3%,

mainly driven by revenue growth and reduced operational costs in

distribution and staff, as well as a positive free cash flow of DKK

192m, corresponding to an increase of DKK 650m, compared to last

year.

The organic growth in Endoscopy Solutions was offset by

Ambu’s Anaesthesia and Patient Monitoring businesses, which,

combined, declined by 1% organically, affected by high comparables

in the 2021/22 financial year, as well as stockpiling last

year.

“2022/23 was a year of strong progress for Ambu on many fronts.

We strengthened our customer focus and organisation; we laid down

the right path for accelerated growth and profitability; we turned

around our cash position to positive cash flow; and we reduced our

debt to a level well in line with policy. I am pleased with the

progress on execution of our transformative ZOOM IN strategy, which

we launched a year ago, centred on increased focus and improved

execution. In addition, our strategy highlights

customer-centricity, our culture and ways of working, as well as

sustainability – all areas in which we have taken significant steps

forward during the past year. I am proud of my colleagues for their

engagement and change mindset, which is instrumental in our effort

to pave the way for future strong, profitable growth, in pursuit of

our purpose to rethink solutions that save lives and improve

patient care.”

BRITT MEELBY JENSENChief

Executive Officer, Ambu

Q4 2022/23 FINANCIAL HIGHLIGHTSLast year’s

comparative figures are presented in brackets

- Revenue for Q4 was DKK 1,259m (DKK 1,163m),

corresponding to a reported growth of 8% (13%). Adjusted for

currency effects, the underlying organic growth was 14% (4%).

- Endoscopy Solutions grew organically by 25%

(3%), with Pulmonology growing organically 16%

(-15%) and Endoscopy Solutions excluding

pulmonology growing 37% (44%)

- Anaesthesia and Patient

Monitoring posted organic growth of 7% (0%) and -3% (10%),

respectively.

- Gross profit was DKK 715m (DKK 644m) in Q4,

corresponding to a gross margin of 56.8% (55.4%).

- EBIT before special items was DKK 97m (DKK

-7m), representing an EBIT margin before special items of 7.7%

(-0.6%).

- Free cash flow before acquisitions of enterprises and

technology totalled DKK 188m (DKK -167m) in Q4, up DKK

355m from last year.

2022/23 FULL-YEAR HIGHLIGHTS

Financial highlightsLast year’s comparative

figures are presented in brackets

- Revenue for the financial year was DKK 4,775m

(DKK 4,444m), representing a 7% (11%) reported growth. Organic

growth was 7.6% (4%), driven by positive volume and mix

effects.

- Endoscopy Solutions revenue increased

organically by 15% (1%).

- Endoscopy Solutions excluding pulmonology

increased by 38%, mainly driven by urology and ENT. Pulmonology

posted 2% organic growth for the full year, driven by high

comparables in the first half of the financial year, however,

positively offset by accelerated growth in the second half of the

year. The accelerated growth was due to the market normalising

following Covid-19, as well as upgrades to Ambu’s pulmonology

offering.

- Anaesthesia organic revenue declined by 2%

(5%), and Patient Monitoring grew organically by

1% (13%). Both businesses were affected by high comparables in the

2021/22 financial year, combined with stockpiling last year.

- Revenue in North America increased organically

by 12% (11%), Europe increased by 3% (1%), and

Rest of World increased by 5% (-8%).

- Gross margin was 56.8% (57.5%). The positive

sales mix effect, driven by higher-margin products in Endoscopy

Solutions, was significantly offset by inflationary effects on

Ambu’s input prices and overhead cost from scaling up the factory

in Mexico.

- EBIT before special items was DKK 302m (DKK

122m), with an EBIT margin before special items of 6.3% (2.7%). The

improvement was mainly driven by revenue growth and reduced

operational costs in distribution and staff.

- Free cash flow before acquisitions of enterprises and

technology totalled DKK 192m (DKK -458m), up DKK 650m from

last year, corresponding to 4% of revenue (-10%).

Business highlightsQ4 highlights are presented

in italic

- Portfolio advancements:

- Compliance with the EU Medical Device Regulation

(MDR) of Ambu’s full product portfolio

- Endoscopy Systems: Global launch of the next-generation

Ambu® aView™ 2 Advance

- Pulmonology: Global launch of the complete Ambu®

aScope™ 5 Broncho portfolio, re-launch of Ambu®

Viva-Sight™ 2 DLT and launch of Ambu® VivaSight™ 2 SLT in

Europe

- Gastroenterology: Regulatory clearances of Ambu®

aScope™ Gastro Large in Europe and Ambu® aScope™

Colon in North America

- Urology: Regulatory clearance of Ambu® aScope™ 5 Cysto

HD in Europe

- Organisational advancements:

- Launch of Ambu’s transformation program,

focused on driving efficiencies, scalability and profitability

- Executive Leadership Team strengthened with

new Chief People & Culture Officer, Chief Operations Officer

and Chief Technology Officer – and announcement of new

Chief Financial Officer, Henrik Skak Bender, as of

1 January 2024.

- Global roll-out of Ambu’s new ZOOM IN strategy and

purpose, as well as launch of new Ambu

values

- Sustainability advancements:

- Launch of the world’s first endoscope made with

bioplastics - Ambu® aScopeTM Gastro Large

- 2030 target set for emission reductions and

submitted to the Science-Based Targets initiative

(SBTi)

In addition to the Annual Report, which includes Ambu’s

Sustainability Report, Ambu also publishes its Remuneration Report

and a Corporate Governance Report for 2022/23 today. All reports

can be accessed on Ambu.com.

OUTLOOK FOR FY 2023/24In 2022/23, Ambu took

significant steps in executing on its transformation program to

deliver profitable growth – the key objective of Ambu’s ZOOM IN

strategy. The company focused on stabilising its financial

situation, thus ending the 2022/23 financial year with delivering

financial targets slightly above expectations. Similarly, Ambu’s

free cash flow was significantly improved, ending the year with a

positive cash flow.

Market conditionsDuring

2022/23, Ambu witnessed increased geopolitical uncertainty and a

volatile macroenvironment, affecting the global economy and

resulting in inflationary effects on raw materials, energy prices

and logistics costs. This is a tendency that the company expects to

continue throughout 2023/24. Despite this, Ambu expects the

single-use endoscopy market to continue to grow in 2023/24, driven

by hospital systems’ and clinics’ growing needs for workflow

efficiencies and improved economics, as well as the increased

awareness of infection control and the strong clinical performance

that single-use solutions bring to healthcare professionals and

patients.

Organic revenue growthAmbu’s Endoscopy

Solutions business remains the key growth engine for the company,

and it makes up 56% of the company’s total revenue in 2022/23. In

2023/24, this business area is expected to grow 15% organically,

with the ENT and urology segments expected to continue their

double-digit organic growth trajectory. Similarly, due to Ambu’s

strengthened pulmonology portfolio, as well as the company’s

expanded gastroenterology (GI) portfolio, both the pulmonology and

GI businesses are expected to contribute positively towards a solid

organic revenue growth in 2023/24. Also, with the objective of

increasing long-term profitability in the Anaesthesia & Patient

Monitoring business areas, Ambu will continue to drive the

strategic initiatives launched in 2022/23, related to addressing

selected low-margin areas with sizable price increases and exiting

40 countries to reduce geographical complexity.

Overall, Ambu’s total organic growth is expected to be 7-10% for

the 2023/24 financial year, compared to 7.6% in 2022/23.

EBIT margin before special itemsFor 2023/24 the

EBIT margin before special items is expected to be 8-10%, compared

to 6.3% in 2022/23. This will be driven by an improved gross margin

from a strengthened product mix, as well as from a continued

overarching cost focus. Ambu’s free cash flow before acquisitions

is expected to improve to around DKK +270m, compared to DKK 192m in

2022/23. The continued increased cash flow will be driven by a

higher EBIT margin before special items and continued annual

savings from the cost reduction program, reflecting a disciplined

capital allocation.

ANNUAL GENERAL MEETINGAmbu’s Annual General

Meeting 2023 will be held on Wednesday 13 December 2023 at 13.00

(CET) at the headquarters of Ambu A/S, Baltorpbakken 13, DK-2750

Ballerup.

CONFERENCE CALLAn investor conference call will

be held today, Wednesday 8 November 2023, at 11:00 (CET).The

conference will be broadcast live via

Ambu.com/webcastQ42023.To ask questions during the

Q&A session, please register prior to the call via

Ambu.com//conferencecallQ42023register.Upon

registration, you will receive dedicated dial-in details via e-mail

to access the call, including a passcode, a unique PIN, dial-in

numbers and a calendar invitation.The presentation will be made

available for download at

Ambu.com/presentations.

Ambu A/SBaltorpbakken 13 2750 Ballerup DenmarkTel. +45 7225 2000

CVR no.: 63 64 49 19www.Ambu.com

CONTACT

Investors Anders Hjort Head of Investor

Relationsanhj@ambu.com +45 2892 8881

MediaTine Bjørn SchmidtHead of Corporate

Communicationstisc@ambu.com+45 2264 0697

ABOUT AMBU

Since 1937, Ambu has been rethinking solutions,

together with healthcare professionals, to save lives and improve

patient care. Today, millions of patients and healthcare

professionals worldwide depend on the efficiency, safety and

performance of our single-use endoscopy, anaesthesia and patient

monitoring solutions. Headquartered near Copenhagen in Denmark,

Ambu employs around 4,400 people in Europe, North America, Latin

America and Asia Pacific. For more information, please visit

Ambu.com.

- Annual Report 2022-23, earnings release - Company announcement

no 4 2023-24

- Ambu-2023-09-30-en

- Ambu Corporate Governance Report 2022-23

- Ambu Remuneration Report 2022-23

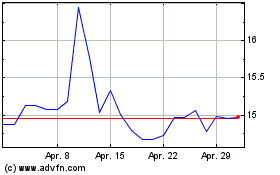

Ambu AS (TG:547A)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ambu AS (TG:547A)

Historical Stock Chart

Von Nov 2023 bis Nov 2024