Revises Q4 Adjusted EBITDA loss(1) Expectations

to Approximately $3.9 - $4.2 Million to Reflect Incremental

Investment in Successful Holiday Marketing Campaign

Zevia PBC (“Zevia” or the “Company”) (NYSE: ZVIA), the Company

bringing naturally delicious, zero sugar, clean-label beverages,

provides an update on its fourth quarter and full year 2024

outlook. Zevia currently expects fourth quarter 2024 net sales of

approximately $39.5 million, at the high end of its previous

outlook. Adjusted EBITDA loss(1) is now expected to be $3.9 million

to $4.2 million, primarily due to the strategic decision to put

incremental investment behind its successful holiday campaign.

“We are pleased with the overwhelmingly positive response to our

now-viral holiday marketing campaign as well as the inflection in

business during the fourth quarter,” said Amy Taylor, President and

Chief Executive Officer of Zevia. “The ad, ‘Break from Artificial’

used exaggerated AI imagery to shine a light on artificiality in

advertising and in beverage in a light-hearted way. We saw an

opportunity to create a parody of a widely-discussed mainstream

soda holiday ad, which effectively positioned Zevia as an

alternative for consumers craving something more real. The response

validated our new marketing direction and served as an early launch

to a series of 2025 campaigns that position Zevia as the

anti-artificial alternative to mainstream soda.”

Ms. Taylor continued, “Based on the strong consumer response and

engagement levels of the original digital ad, we made the strategic

decision to increase our linear advertising in December during NCAA

football playoff games and key holiday NFL games, among others. In

total, the ad garnered over 292 million impressions, serving to

bring Zevia’s brand voice and unique positioning to a much broader

audience. We plan to continue to opportunistically invest in

initiatives to further build brand awareness and drive accelerated

future growth. This is in part fueled by the significant progress

we have made with our productivity initiative, which is expected to

result in $15 million in annual cost savings, the majority of which

we plan to reinvest in growth initiatives.”

Q4 and Full Year 2024 Outlook

For the fourth quarter of 2024, the Company now expects:

- Net sales of approximately $39.5 million.

- Adjusted EBITDA loss(1) of $3.9 million to $4.2 million as

compared to an Adjusted EBITDA loss(1) of $6.8 million in the

fourth quarter of 2023.

For the Full Year 2024, the Company now expects:

- Net sales of approximately $155.0 million.

- Adjusted EBITDA loss(1) of $15.2 million to $15.5 million as

compared to an Adjusted EBITDA loss(1) of $19.0 million in

2023.

We have not provided the forward-looking GAAP equivalent to our

Adjusted EBITDA outlook or a GAAP reconciliation due to timing

considerations required for stock-based compensation, income tax,

and charges associated with restructuring and cost saving

initiatives. Accordingly, a reconciliation of this non-GAAP

guidance metric to its corresponding GAAP equivalent is not

available without unreasonable effort. However, it is important to

note that the reconciling items could have a significant effect on

future GAAP results.

These preliminary results and updated forecasts presented herein

for the fourth quarter and full year of 2024 are estimates, based

on information available to management as of the date of this

release, and are subject to further changes upon completion of the

Company’s year-end closing procedures. This press release does not

present all necessary information for an understanding of the

Company's financial condition as of the date of this release, or

its results of operations for the fourth quarter and full year

2024.

ICR Conference

Management will present at the 27thAnnual ICR Conference today,

January 13, 2025, at approximately 3:00 pm ET. A live webcast of

the presentation will be available on the Investor Relations

section of Zevia’s website, investors.zevia.com. Shortly following

the event, a replay of the webcast will be available for

approximately thirty (30) days.

Use of Non-GAAP Financial Information

We use Adjusted EBITDA, a financial measure that is not

calculated in accordance with U.S. generally accepted accounting

principles (“GAAP”). The Company’s management believes that

Adjusted EBITDA, when taken together with our financial results

presented in accordance with GAAP, provides meaningful supplemental

information regarding our operating performance and facilitates

internal comparisons of our historical operating performance on a

more consistent basis by excluding certain items that may not be

indicative of our business, results of operations or outlook. In

particular, we believe that the use of Adjusted EBITDA is helpful

to our investors as it is a measure used by management in assessing

the health of our business, determining incentive compensation and

evaluating our operating performance, as well as for internal

planning and forecasting purposes.

We calculate Adjusted EBITDA as net income (loss) adjusted to

exclude: (1) other income (expense), net, which includes interest

(income) expense, foreign currency (gains) losses, (2) provision

(benefit) for income taxes, (3) depreciation and amortization, (4)

equity-based compensation, and (5) restructuring expenses (for

2024, in light of our Productivity Initiative). Adjusted EBITDA may

in the future also be adjusted for amounts impacting net income

related to the Tax Receivable Agreement liability and other

infrequent and unusual transactions.

Adjusted EBITDA is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not

be considered in isolation or as a substitute for financial

information presented in accordance with GAAP. Some of the

limitations of Adjusted EBITDA include that (1) it does not

properly reflect capital commitments to be paid in the future, (2)

although depreciation and amortization are non-cash charges, the

underlying assets may need to be replaced and Adjusted EBITDA does

not reflect these capital expenditures, (3) it does not consider

the impact of equity-based compensation expense, including the

potential dilutive impact thereof, and (4) it does not reflect

other non-operating expenses, including interest (income) expense,

foreign currency (gains) losses, and restructuring. In addition,

our use of Adjusted EBITDA may not be comparable to similarly

titled measures of other companies because they may not calculate

Adjusted EBITDA in the same manner, limiting its usefulness as a

comparative measure. Because of these limitations, when evaluating

our performance, you should consider Adjusted EBITDA alongside

other financial measures, including our net loss or income and

other results stated in accordance with GAAP.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, any statement that may

predict, forecast, indicate or imply future results, performance or

achievements, and may contain words such as “anticipate,”

“believe,” “consider,” “contemplate,” “continue,” “could,’”

“estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “on

track,” “outlook,” “plan,” “potential,” “predict,” “project,”

pursue,” “seek,” “should,” “target,” “will,” “would,” or the

negative of these words or other similar words, terms or

expressions with similar meanings. Forward-looking statements

should not be read as a guarantee of future performance or results

and will not necessarily be accurate indications of the times at,

or by, which such performance or results will be achieved.

Forward-looking statements contained in this press release relate

to, among other things, statements regarding financial guidance or

outlook, expected benefits of and annualized cost savings from the

Productivity Initiative, long-term growth opportunities, future

results of operations or financial condition, strategic direction,

and plans and objectives of management for future operations,

including marketing, distribution expansion and product innovation.

Forward-looking statements are based on current expectations,

forecasts and assumptions that involve risks and uncertainties,

including, but not limited to, the ability to develop and maintain

our brand, our ability to successfully execute on our rebranding

strategy, cost reduction initiatives, and to compete effectively,

our ability to maintain supply chain service levels and any

disruption of our supply chain, product demand, changes in the

retail landscape or in sales to any key customer, change in

consumer preferences, pricing factors, our ability to manage

changes in our workforce, future cyber incidents and other

disruptions to our information systems, failure to comply with

personal data protection and privacy laws, the impact of inflation

on our sales growth and cost structure such as increased commodity,

packaging, transportation and freight, warehouse, labor and other

input costs and other economic conditions, our reliance on contract

manufacturers and service providers, competitive and governmental

factors outside of our control, such as pandemics or epidemics,

adverse global macroeconomic conditions, including relatively high

interest rates, instability in financial institutions and a

recessionary environment, any potential shutdown of the U.S.

government, and geopolitical events or conflicts, including the

military conflicts in Ukraine and the Middle East and trade

tensions between the U.S. and China, our ability to maintain our

listing on the New York Stock Exchange, failure to adequately

protect our intellectual property rights or infringement on

intellectual property rights of others, potential liabilities,

costs from litigation, claims, legal or regulatory proceedings,

inquiries or investigations, and completion of customary annual

audit procedures that may cause our business, strategy or actual

results to differ materially from the forward-looking statements.

We do not intend and undertake no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by applicable

law. Investors are referred to our filings with the U.S. Securities

and Exchange Commission for additional information regarding the

risks and uncertainties that may cause actual results to differ

materially from those expressed in any forward-looking

statement.

About Zevia

Zevia PBC, a Delaware public benefit corporation designated as a

“Certified B Corporation,” is focused on addressing the global

health challenges resulting from excess sugar consumption by

offering a broad portfolio of zero sugar, zero calorie, naturally

sweetened beverages. All Zevia® beverages are made with a handful

of simple, plant-based ingredients, contain no artificial

sweeteners, and are Non-GMO Project verified, gluten-free, Kosher,

and vegan. Zevia is distributed in more than 37,000 retail

locations in the U.S. and Canada through a diverse network of major

retailers in the grocery, drug, warehouse club, mass, natural,

convenience and ecommerce channels.

(ZEVIA-F)

(1) Adjusted EBITDA is a non-GAAP

financial measure. See below for a discussion of how we define and

calculate this measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113685259/en/

Investors Greg Davis Zevia PBC 424-343-2654

Greg@zevia.com

Reed Anderson ICR 646-277-1260 Reed.Anderson@icrinc.com

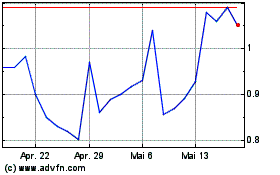

Zevia PBC (NYSE:ZVIA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Zevia PBC (NYSE:ZVIA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025