ZipRecruiter Study Finds U.S. Employers Have Renewed Optimism for Labor Market

11 Dezember 2024 - 3:15PM

Business Wire

Second Annual Employer Survey reveals insights

into The Great Stay, hybrid work, the state of pay, and the year

ahead

ZipRecruiter®, a leading online employment marketplace, today

released the results from its Second Annual Employer Survey,

providing an in-depth look into the challenges, motivations, and

latest hiring practices of employers across the U.S. According to

the new report, employers are optimistic about 2025. 76% of

surveyed employers say they plan to expand headcount in the coming

year, with 53% anticipating modest increases and 23% expecting more

significant growth. Meanwhile, 21% expect hiring to remain steady,

and fewer than 4% predict workforce reductions.

“Over 80% of employers across tech, financial services, and

healthcare plan to expand hiring in 2025, signaling renewed labor

market optimism after two years of declines,” said Julia Pollak,

ZipRecruiter's Chief Economist. “Easing inflation and stabilizing

interest rates are fueling employer confidence. 64% say

macroeconomic conditions will support hiring in 2025.”

ZipRecruiter surveyed individuals responsible for hiring

decisions at 2,000 businesses of varying sizes and industries

throughout the U.S. The report provides insights into three key

categories, including employee retention, remote work, and pay. Key

insights include:

From Attrition to Stability: How Employers Perceive “The

Great Stay”

- Employers see internal efforts leading to retention

success. The average turnover rates reported by surveyed

employers fell 37% year-over-year. Many employers credit their own

efforts for declines in attrition rates citing enhanced job

security and stability (47%), better work-life balance (46%), and

improvements in benefits and pay, career development, and employee

engagement (42%).

- Churn falling in sectors with both strong and weak labor

markets. Declines in turnover rates year-over-year were uneven

across industries. Business Support & Logistics saw the largest

drop, with turnover falling 73%. In contrast, Manufacturing (-18%)

and Entertainment & Leisure (-4%) recorded only modest

declines.

- Not all employers shared in the gains. Nearly 4 in 10

respondents said they thought turnover had risen due to inadequate

compensation or benefits (43%), limited career growth opportunities

(41%), and poor work-life balance (40%).

Remote Work in 2024: Companies Shift Toward Hybrid Models and

Stricter Oversight

- Companies have solidified hybrid work as the dominant

model. 40% of employers surveyed support a mix of in-office and

remote work in 2024, whereas fully remote work sharply declined to

only 7% compared to 21% in 2023.

- Employers emphasize consistency and predictability.

Companies mandating employees to work in-office at least three days

per week rose from 37% in 2023 to 53% in 2024, while five day

office attendance increased from 16% to 20%.

- Pay differentials are being adopted for remote work. The

share of organizations actively recruiting remote workers rose to

22%, up from 16% the year prior, and 12% of companies widened or

introduced geographic pay differentials in the past year, while

only 8% narrowed or removed them.

The State of Pay: Pay Set to Climb in 2025

- Employers are reshaping compensation: Nearly half (41%)

of employers reported increasing base salaries for new hires in

2024, while a third (32%) introduced new pay scales or job tiers,

and 30% increased the share of compensation tied to

performance.

- The majority of businesses are planning raises. 55% of

employers are planning modest pay increases of 1-4%, and 24%

anticipate raises of 5% or more, marking a sharp turnaround from

2023 when nearly half of employers (48%) reported resetting pay

downward amid recession fears.

- Larger companies are much more likely to give major pay

increases. 30% of organizations with 5,000 or more employees

are planning pay increases of 5% or more, compared with just 13% of

organizations with 10-49 employees.

To view the full report, please visit:

ziprecruiter-research.org/annual-employer-survey.

Methodology

ZipRecruiter conducted a national online survey between

September 24 and October 16, 2024, to explore employer attitudes

toward recent hiring trends and their experiences of current U.S.

labor market conditions. The survey was administered to a Qualtrics

panel of 2,000+ verified talent acquisition professionals and

hiring managers, each with considerable responsibility for hiring

processes and decisions. They were drawn from businesses of various

sizes across a wide range of industries. In addition to standard

screening and demographic questions, respondents were asked about

their recruiting, hiring, employment, and retention practices, as

well as their expectations, desires, and requirements for future

talent acquisition activities.

About ZipRecruiter

ZipRecruiter® (NYSE:ZIP) is a leading online employment

marketplace that actively connects people to their next great

opportunity. ZipRecruiter’s powerful matching technology improves

the job search experience for job seekers and helps businesses of

all sizes—including enterprise businesses—find and hire the right

candidates quickly. ZipRecruiter has been the #1 rated job search

app on iOS & Android for the past seven years1 and is rated the

#1 employment job site by G2.2 For more information, visit

www.ziprecruiter.com

1 Based on job seeker app ratings, during the period of January

2017 to January 2024 from AppFollow for ZipRecruiter,

CareerBuilder, Glassdoor, Indeed, LinkedIn, and Monster 2 Based on

G2 satisfaction ratings as of December 18, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211269162/en/

Media Contacts ZipRecruiter Claire Walsh, Press Relations

press@ziprecruiter.com

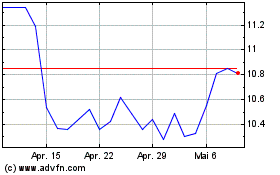

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

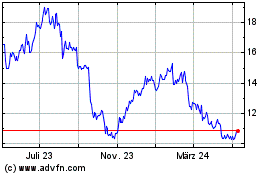

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024