Franklin Templeton Fund Adviser, LLC Announces Distributions for Certain Closed-End Funds Pursuant to their Managed Distribution Policy for the Months of December 2024, January and February 2025

25 November 2024 - 2:00PM

Business Wire

Franklin Templeton Fund Adviser, LLC announced today that

certain closed-end funds have declared their distributions pursuant

to their managed distribution policy for the months of December

2024, January and February 2025.

The following dates apply to the distribution schedule

below:

Month

Record Date

Ex-Dividend Date

Payable Date

December

12/23/2024

12/23/2024

12/31/2024

January

1/24/2025

1/24/2025

1/31/2025

February

2/21/2025

2/21/2025

2/28/2025

Ticker

Fund Name

Month

Amount

Change from

Previous

Distribution

WIA

Western Asset Inflation-Linked Income

Fund(a)

December

$0.05000

-

January

$0.05000

February

$0.05000

WIW

Western Asset Inflation-Linked

Opportunities

December

$0.06050

-

& Income Fund(a)

January

$0.06050

February

$0.06050

- Please see table below for each Fund’s estimated source of

distributions.

Under the terms of each Fund’s managed distribution policy, each

Fund seeks to maintain a consistent distribution level derived from

the income and capital gains generated from the Fund’s investment

portfolio. To the extent that sufficient distributable income is

not available on a monthly basis, each Fund will distribute

long-term capital gains and/or return of capital in order to

maintain its managed distribution rate. A return of capital may

occur, for example, when some or all of the money that was invested

in the Fund is paid back to shareholders. A return of capital

distribution does not necessarily reflect the Fund’s investment

performance and should not be confused with “yield” or “income”.

Even though the Fund may realize current year capital gains, such

gains may be offset, in whole or in part, by the Fund’s capital

loss carryovers from prior years. The Board of Trustees may modify,

terminate or suspend the managed distribution policy at any time.

Any such modification, termination or suspension could have an

adverse effect on the market price of the Fund’s shares.

Based on the Funds’ tax accounting records, which also factor in

currency fluctuations, each Fund’s estimated source of cumulative

fiscal year-to-date distributions is presented in the table

below:

Fund

Fiscal

Year End

Income

Short-Term

Capital

Gains

Long-Term

Capital

Gains

Return

of

Capital

WIA

Nov 30

100.00%

-

-

-

(a)

WIW

Nov 30

100.00%

-

-

-

(a)

- Sources of cumulative fiscal year-to-date distributions are

estimated through February 28, 2025.

The updated estimated components of the distributions announced

today will be provided to shareholders of record in a separate

notice when the distributions are paid.

Shareholders should not draw any conclusions about each Fund’s

investment performance from the amount of these distributions or

from the terms of each Fund’s managed distribution policy. The

amounts and sources of each Fund’s distributions to be reported

will be estimates and will not be provided for tax reporting

purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon each Fund’s investment

experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. Each Fund will send a

Form 1099-DIV to shareholders for the calendar year that will

describe how to report the Fund’s distributions for federal income

tax purposes.

Franklin Templeton Fund Adviser, LLC is an indirect,

wholly-owned subsidiary of Franklin Resources, Inc. (“Franklin

Resources”).

For more information about the Funds, please call 1-888-777-0102

or consult the Funds’ website at

www.franklintempleton.com/investments/options/closed-end-funds.

Hard copies of the Funds’ complete audited financial statements are

available free of charge upon request.

Data and commentary provided in this press release are for

informational purposes only. Franklin Resources and its affiliates

do not engage in selling shares of the Funds.

The Funds’ common shares are traded on the New York Stock

Exchange. Similar to stocks, Fund share price will fluctuate with

market conditions and, at the time of sale, may be worth more or

less than the original investment. Shares of closed-end funds often

trade at a discount to their net asset value, and can increase an

investor’s risk of loss. All investments are subject to risk,

including the risk of loss.

INVESTMENT PRODUCTS: NOT FDIC INSURED | NO BANK GUARANTEE | MAY

LOSE VALUE

Category: Distribution Related

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125439322/en/

Investor Contact: Fund Investor Services

1-888-777-0102

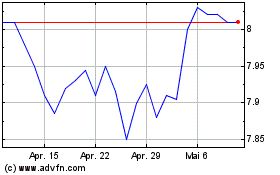

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

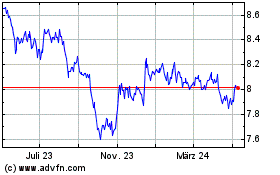

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024