0001819516FALSE00018195162023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

WHEELS UP EXPERIENCE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39541 | 98-1617611 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | |

601 West 26th Street, Suite 900 | |

New York, New York | 10001 |

| (Address of principal executive offices) | (Zip Code) |

(212) 257-5252

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | UP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Wheels Up Experience Inc. (the "Company") issued a press release announcing its financial results for the three months ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Current Report on Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | WHEELS UP EXPERIENCE INC. |

| | | | |

| | | | |

| Date: November 9, 2023 | By: | /s/ George Mattson |

| | | Name: | George Mattson |

| | | Title: | Chief Executive Officer |

Wheels Up Reports Third Quarter Results

New investment and deeper alignment with Delta underscore company’s improving position

NEW YORK – November 9, 2023 – Wheels Up Experience Inc. (NYSE:UP) today announced financial results for the third quarter, which ended September 30, 2023.

Third Quarter 2023 Highlights

•Revenue decreased $100 million year-over-year to $320 million

•Adjusted Contribution increased $14 million year-over-year to $35 million

•Net loss decreased slightly year-over-year to $145 million, and includes a $56 million non-cash goodwill impairment charge

•Adjusted EBITDA improved $27 million year-over-year to a loss of $19 million

“The strategic investment from Delta Air Lines, along with our new partners, demonstrates their confidence in our operational and commercial plan to deliver a compelling and differentiated experience for our customers,” said George Mattson, Chief Executive Officer. “I look forward to leveraging a deeper relationship with Delta and further integrating our collective offerings to provide a truly seamless connection between private and premium commercial travel.”

“Despite the challenging year, we are proud of the progress we have made on our operating and profitability goals and the renewed market confidence resulting from the recently closed capital infusion,” said Todd Smith, Chief Financial Officer. “Our on-time performance and controllable interruption rates are improving, and the third quarter marked our best profit performance since 2021.”

Recent Initiatives

•Secured $450 million of new capital backed by Delta Air Lines, Certares Management, Knighthead Capital Management, and Cox Enterprises. In active conversations with potential investors on the remaining $50 million term loan.

•Appointed directors designated by majority owners who have vested interest in long-term success of the company.

•Named longstanding Delta board member, George Mattson, as CEO to lead the company.

•Introduced new Up for Business program, offering a tailored private aviation solution for small and medium-sized enterprises jointly sold through Wheels Up and Delta sales organizations.

•Divested aircraft management business as part of previously communicated plan to focus on core operations.

Financial and Operating Highlights

| | | | | | | | | | | | | | | | | |

| As of September 30, | | |

| 2023 | | 2022 | | % Change |

Active Members(1) | 10,775 | | | 12,688 | | | (15) | % |

| | | | | |

| Three Months Ended September 30, | | |

(In thousands, except Active Users, Live Flight Legs and Flight revenue per Live Flight Leg) | 2023 | | 2022 | | % Change |

Active Users(1) | 11,988 | | | 13,339 | | | (10) | % |

Live Flight Legs(1) | 16,581 | | | 21,025 | | | (21) | % |

| Flight revenue per Live Flight Leg | 12,945 | | | 13,266 | | | (2)% |

| Revenue | $ | 320,063 | | | $ | 420,356 | | | (24) | % |

| Net loss | $ | (144,813) | | | $ | (148,838) | | | 3 | % |

Adjusted EBITDA(1) | $ | (18,529) | | | $ | (45,229) | | | 59 | % |

| | | | | |

| Nine Months Ended September 30, | | |

(In thousands) | 2023 | | 2022 | | % Change |

| Revenue | $ | 1,006,937 | | | $ | 1,171,503 | | | (14) | % |

| Net loss | $ | (406,272) | | | $ | (330,637) | | | (23) | % |

Adjusted EBITDA(1) | $ | (107,747) | | | $ | (141,546) | | | 24 | % |

(1) For information regarding Wheels Up's use and definition of this measure see “Definitions of Key Operating Metrics and Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Financial Measures” sections herein.For the third quarter:

•Active Members decreased 15% year-over-year to 10,775 offset by a higher mix of Core members, primarily as a result of the regionalization of our member programs and focus on more profitable flying.

•Active Users decreased 10% year-over-year to 11,988.

•Live Flight Legs decreased 21% year-over-year to 16,581 reflecting a slowdown in the industry and our efforts to focus on profitable flying.

•Flight revenue per Live Flight Leg was relatively consistent year-over-year.

•Revenue decreased 24% year-over-year primarily driven by reduced flight revenue and reduced aircraft sales.

•Net loss improved by $4.0 million year-over-year to $144 million, including a $56.2 million non-cash goodwill impairment charge recognized during the quarter.

•Adjusted EBITDA loss improved by $26.7 million to $18.5 million, reflecting our operational efficiency and other spend reduction efforts, as well as one-time software license revenue and increased gains on sales of aircraft.

About Wheels Up

Wheels Up is a leading provider of on-demand private aviation in the U.S. and one of the largest private aviation companies in the world. Wheels Up offers a complete global aviation solution with a large, modern and diverse fleet, backed by an uncompromising commitment to safety and service. Customers can access membership programs, charter, aircraft management services and whole aircraft sales, as well as unique commercial travel benefits through a strategic partnership with Delta Air Lines. Wheels Up also offers freight, safety and security solutions and managed services to individuals, industry, government and civil organizations.

Wheels Up is guided by the mission to connect private flyers to aircraft, and one another, through an open platform that seamlessly enables life’s most important experiences. Powered by a global private aviation marketplace connecting its base of approximately 11,000 members and customers to a network of approximately 1,500 safety-vetted and verified private aircraft, Wheels Up is widening the aperture of private travel for millions of consumers globally. With the Wheels Up mobile app and website, members and customers have the digital convenience to search, book and fly.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside of the control of Wheels Up Experience Inc. (“Wheels Up”, or “we”, “us”, or “our”), that could cause actual results to differ materially from the results discussed in the forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding: (i) the impact of Wheels Up’s cost reduction efforts and measures intended to increase Wheels Up’s operational efficiency on its business and results of operations, including the timing and magnitude of such expected actions and any associated expenses in relation to liquidity levels and working capital needs; (ii) Wheels Up’s liquidity, future cash flows and certain restrictions related to its debt obligations; (iii) the size, demands, competition in and growth potential of the markets for Wheels Up’s products and services and Wheels Up’s ability to serve and compete in those markets; (iv) the degree of market acceptance and adoption of Wheels Up’s products and services, including member program changes implemented in June 2023 and the new corporate member program introduced in November 2023; (v) Wheels Up’s ability to perform under its contractual obligations and maintain or establish relationships with third-party vendors and suppliers; (vi) the expected impact of any potential strategic actions involving Wheels Up or its subsidiaries or affiliates, including realizing any anticipated benefits relating to any such transactions or asset sales, and any potential impacts on the trading market and prices for the Company’s Class A common stock, $0.0001 par value per share (“Common Stock”), including due to future dilutive Common Stock issuances; (vii) the impact of the goodwill impairment charges recognized for the three and nine months ended September 30, 2023 or future impairment losses, which may adversely impact the perception of Wheels Up held by stockholders, investors, members and customers or the Company's business and results of operations or the market price of Common Stock; and (viii) general economic and geopolitical conditions, including due to fluctuations in interest rates, inflation, foreign currencies, consumer and business spending decisions, and general levels of economic activity. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. We have identified certain known material risk factors applicable to Wheels Up in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (“SEC”) and our other filings with the SEC. Moreover, it is not always possible for us to predict how new risks and uncertainties that arise from time to time may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Except as required by law, we do not intend to update any of these forward-looking statements after the date of this press release.

Use of Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures such as Adjusted EBITDA, Adjusted Contribution and Adjusted Contribution Margin. These non-GAAP financial measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and should not be considered as an alternative to net income (loss), operating income (loss) or any other performance measures derived in accordance with GAAP. Definitions and reconciliations of non-GAAP financial measures to their most comparable GAAP counterparts are included in the "Definitions of Non-GAAP Financial Measures" and "Reconciliations of Non-GAAP Financial Measures" sections, respectively, in this press release. Wheels Up believes that these non-GAAP financial measures of financial results provide useful supplemental information to investors about Wheels Up. However, there are a number of limitations related to the use of these non-GAAP financial measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required by GAAP to be recorded in Wheels Up’s financial measures. In addition, other companies may calculate non-GAAP financial measures differently, or may use other measures to calculate their financial performance, and therefore, Wheels Up’s non-GAAP financial measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP financial measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

For more information on these non-GAAP financial measures, see the sections titled “Definitions of Key Operating Metrics," "Definitions of Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Financial Measures” included at the end of this earnings press release.

Contacts

Investors:

ir@wheelsup.com

Media:

press@wheelsup.com

WHEELS UP EXPERIENCE INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands, except share data)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 244,847 | | | $ | 585,881 | |

| Accounts receivable, net | 46,773 | | | 112,383 | |

| Other receivables | 7,452 | | | 5,524 | |

| Parts and supplies inventories, net | 23,979 | | | 29,000 | |

| Aircraft inventory | 2,073 | | | 24,826 | |

| Aircraft held for sale | 26,855 | | | 8,952 | |

| Prepaid expenses | 46,506 | | | 39,715 | |

| Other current assets | 11,283 | | | 13,338 | |

| Total current assets | 409,768 | | | 819,619 | |

| Property and equipment, net | 362,053 | | | 394,559 | |

| Operating lease right-of-use assets | 73,788 | | | 106,735 | |

| Goodwill | 214,808 | | | 348,118 | |

| Intangible assets, net | 122,783 | | | 141,765 | |

| | | |

| Other non-current assets | 144,494 | | | 112,429 | |

| Total assets | $ | 1,327,694 | | | $ | 1,923,225 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 25,227 | | | $ | 27,006 | |

| Accounts payable | 25,568 | | | 43,166 | |

| Accrued expenses | 100,814 | | | 148,947 | |

| Deferred revenue, current | 691,214 | | | 1,075,133 | |

| | | |

| | | |

| Other current liabilities | 26,197 | | | 49,968 | |

| Total current liabilities | 869,020 | | | 1,344,220 | |

| Long-term debt, net | 235,429 | | | 226,234 | |

| Deferred revenue, non-current | 1,155 | | | 1,742 | |

| Operating lease liabilities, non-current | 58,912 | | | 82,755 | |

| Warrant liability | 66 | | | 751 | |

| | | |

| Other non-current liabilities | 17,873 | | | 15,603 | |

| Total liabilities | 1,182,455 | | | 1,671,305 | |

| | | |

| | | |

| | | |

| Equity: | | | |

| Common Stock, $0.0001 par value; 250,000,000 authorized; 167,080,450 and 25,198,298 shares issued and 166,804,743 and 24,933,857 shares outstanding as of September 30, 2023 and December 31, 2022, respectively | 17 | | | 3 | |

| Additional paid-in capital | 1,849,093 | | | 1,545,530 | |

| Accumulated deficit | (1,682,145) | | | (1,275,873) | |

| Accumulated other comprehensive loss | (14,007) | | | (10,053) | |

| Treasury stock, at cost, 275,707 and 264,441 shares, respectively | (7,718) | | | (7,687) | |

| Total Wheels Up Experience Inc. stockholders’ equity | 145,239 | | | 251,920 | |

| Non-controlling interests | — | | | — | |

| Total equity | 145,239 | | | 251,920 | |

| Total liabilities and equity | $ | 1,327,694 | | | $ | 1,923,225 | |

WHEELS UP EXPERIENCE INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 320,063 | | | $ | 420,356 | | | $ | 1,006,937 | | | $ | 1,171,503 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of revenue | 299,887 | | | 403,042 | | | 981,581 | | | 1,144,698 | |

| Technology and development | 19,962 | | | 16,639 | | | 50,265 | | | 42,436 | |

| Sales and marketing | 22,548 | | | 30,830 | | | 71,500 | | | 87,761 | |

| General and administrative | 42,853 | | | 44,323 | | | 122,334 | | | 130,200 | |

| Depreciation and amortization | 15,459 | | | 16,500 | | | 45,027 | | | 46,862 | |

| Gain on sale of aircraft held for sale | (7,841) | | | (1,316) | | | (11,328) | | | (3,950) | |

| Impairment of goodwill | 56,200 | | | 62,000 | | | 126,200 | | | 62,000 | |

| Total costs and expenses | 449,068 | | | 572,018 | | | 1,385,579 | | | 1,510,007 | |

| | | | | | | |

| Loss from operations | (129,005) | | | (151,662) | | | (378,642) | | | (338,504) | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Loss on divestiture | (2,991) | | | — | | | (2,991) | | | — | |

| Loss on extinguishment of debt | (1,936) | | | — | | | (2,806) | | | — | |

| Change in fair value of warrant liability | (61) | | | 2,504 | | | 685 | | | 8,265 | |

| Interest income | 404 | | | 1,130 | | | 6,090 | | | 1,612 | |

| Interest expense | (11,258) | | | — | | | (27,035) | | | — | |

| Other income (expense), net | 613 | | | (625) | | | (822) | | | (1,505) | |

| Total other income (expense) | (15,229) | | | 3,009 | | | (26,879) | | | 8,372 | |

| | | | | | | |

| Loss before income taxes | (144,234) | | | (148,653) | | | (405,521) | | | (330,132) | |

| | | | | | | |

| Income tax benefit (expense) | (579) | | | (185) | | | (751) | | | (505) | |

| | | | | | | |

| Net loss | (144,813) | | | (148,838) | | | (406,272) | | | (330,637) | |

| Less: Net loss attributable to non-controlling interests | — | | | — | | | — | | | (387) | |

| Net loss attributable to Wheels Up Experience Inc. | $ | (144,813) | | | $ | (148,838) | | | $ | (406,272) | | | $ | (330,250) | |

| | | | | | | |

| Net loss per share of Common Stock | | | | | | | |

| Basic and diluted | $ | (3.51) | | | $ | (6.09) | | | $ | (13.22) | | | $ | (13.52) | |

| | | | | | | |

| | | | | | | |

| Weighted-average shares of Common Stock outstanding: | | | | | | | |

| Basic and diluted | 41,261,003 | | | 24,435,096 | | | 30,737,324 | | | 24,434,787 | |

| | | | | | | |

WHEELS UP EXPERIENCE INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (406,272) | | | $ | (330,637) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 45,027 | | | 46,862 | |

| Equity-based compensation | 21,650 | | | 65,839 | |

| Payment in kind interest | 972 | | | — | |

| Amortization of deferred financing costs and debt discount | 2,390 | | | — | |

| Change in fair value of warrant liability | (685) | | | (8,265) | |

| | | |

| | | |

| | | |

| Gain on sale of aircraft held for sale | (11,328) | | | (3,950) | |

| Loss on divestiture | 2,991 | | | — | |

| Loss on extinguishment of debt | 2,806 | | | — | |

| Impairment of goodwill | 126,200 | | | 62,000 | |

| Other | (2,099) | | | (489) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 22,513 | | | (31,474) | |

| | | |

| Parts and supplies inventories | 5,074 | | | (8,544) | |

| Aircraft inventory | 386 | | | (33,231) | |

| Prepaid expenses | (8,589) | | | (8,065) | |

| | | |

| Other non-current assets | (36,988) | | | (27,534) | |

| | | |

| Accounts payable | (15,177) | | | (2,885) | |

| Accrued expenses | (36,293) | | | (1,131) | |

| | | |

| Deferred revenue | (378,949) | | | (2,653) | |

| Other assets and liabilities | 4,877 | | | (4,184) | |

| Net cash used in operating activities | (661,494) | | | (288,341) | |

| | | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (12,312) | | | (80,039) | |

| Purchases of aircraft held for sale | (2,311) | | | (39,894) | |

| Proceeds from sale of aircraft held for sale, net | 53,911 | | | 41,833 | |

| Proceeds from sale of divested business, net | 13,200 | | | — | |

| Acquisitions of businesses, net of cash acquired | — | | | (75,093) | |

| Capitalized software development costs | (16,041) | | | (18,532) | |

| Other | 172 | | | — | |

| Net cash (used in) provided by investing activities | 36,619 | | | (171,725) | |

| | | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| Purchase shares for treasury | — | | | (7,347) | |

| Purchase of fractional shares | (3) | | | — | |

| | | |

| Proceeds from notes payable | 70,000 | | | — | |

| Repayment of notes payable | (70,000) | | | — | |

| Proceeds from long-term debt, net | 343,000 | | | — | |

| Payment of debt issuance costs in connection with debt | (19,630) | | | — | |

| Repayments of long-term debt | (40,196) | | | — | |

| | | |

| Net cash (used in) provided by financing activities | 283,171 | | | (7,347) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (4,287) | | | (7,395) | |

| | | |

| Net decrease in cash, cash equivalents and restricted cash | (345,991) | | | (474,808) | |

| Cash, cash equivalents and restricted cash, beginning of period | 620,153 | | | 786,722 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 274,162 | | | $ | 311,914 | |

Definitions of Key Operating Metrics

Active Members. We define Active Members as the number of Connect, Core, and Business membership accounts that generated membership revenue in a given period and are active as of the end of the reporting period. We use Active Members to assess the adoption of our premium offerings which is a key factor in our penetration of the market in which we operate and a key driver of membership and flight revenue.

Active Users. We define Active Users as Active Members and jet card holders as of the reporting date plus unique non-member consumers who completed a revenue generating flight at least once in the given quarter and excludes wholesale flight activity. While a unique consumer can complete multiple revenue generating flights on our platform in a given period, that unique user is counted as only one Active User. We use Active Users to assess the adoption of our platform and frequency of transactions, which are key factors in our penetration of the market in which we operate and our growth in revenue.

Live Flight Legs. We define Live Flight Legs as the number of completed one-way revenue generating flight legs in a given period. The metric excludes empty repositioning legs and owner legs related to aircraft under management. We believe Live Flight Legs are a useful metric to measure the scale and usage of our platform, and our growth in flight revenue.

Definitions of Non-GAAP Financial Measures

Adjusted EBITDA. We calculate Adjusted EBITDA as net income (loss) adjusted for (i) interest income (expense), (ii) income tax expense, (iii) depreciation and amortization, (iv) equity-based compensation expense, (v) acquisition and integration related expenses and (vi) other items not indicative of our ongoing operating performance, including but not limited to, restructuring charges.

We include Adjusted EBITDA because it is a supplemental measure used by our management team for assessing operating performance. Adjusted EBITDA is used in conjunction with bonus program target achievement determinations, strategic internal planning, annual budgeting, allocating resources and making operating decisions. In addition, Adjusted EBITDA provides useful information for historical period-to-period comparisons of our business, as it removes the effect of certain non-cash expenses and variable amounts.

Adjusted Contribution and Adjusted Contribution Margin. We calculate Adjusted Contribution as gross profit (loss) excluding depreciation and amortization and adjusted further for (i) equity-based compensation included in cost of revenue, (ii) acquisition and integration expense included in cost of revenue, (iii) restructuring expense in cost of revenue and (iv) other items included in cost of revenue that are not indicative of our ongoing operating performance. Adjusted Contribution Margin is calculated by dividing Adjusted Contribution by total revenue.

We include Adjusted Contribution and Adjusted Contribution Margin as supplemental measures for assessing operating performance. Adjusted Contribution and Adjusted Contribution Margin are used to understand our ability to achieve profitability over time through scale and leveraging costs. In addition, Adjusted Contribution and Adjusted Contribution Margin provides useful information for historical period-to-period comparisons of our business and to identify trends.

Reconciliations of Non-GAAP Financial Measures

Adjusted EBITDA

The following table reconciles Adjusted EBITDA to net loss, which is the most directly comparable GAAP measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | $ | (144,813) | | | $ | (148,838) | | | $ | (406,272) | | | $ | (330,637) | |

| Add back (deduct) | | | | | | | |

| Interest expense | 11,258 | | | — | | | 27,035 | | | — | |

| Interest income | (404) | | | (1,130) | | | (6,090) | | | (1,612) | |

| Income tax expense | 579 | | | 185 | | | 751 | | | 505 | |

| Other expense, net | (613) | | | 625 | | | 822 | | | 1,505 | |

| Depreciation and amortization | 15,459 | | | 16,500 | | | 45,027 | | | 46,862 | |

| Change in fair value of warrant liability | 61 | | | (2,504) | | | (685) | | | (8,265) | |

| Loss on divestiture | 2,991 | | | — | | | 2,991 | | | — | |

| Equity-based compensation expense | 3,508 | | | 22,504 | | | 21,650 | | | 65,839 | |

Acquisition and integration expenses(1) | — | | | 4,747 | | | 2,108 | | | 16,092 | |

Restructuring charges(2) | 22,213 | | | 682 | | | 40,905 | | | 6,165 | |

Atlanta Member Operations Center set-up expense(3) | 10,765 | | | — | | | 26,895 | | | — | |

Certificate consolidation expense(4) | 3,279 | | | — | | | 10,799 | | | — | |

Impairment of goodwill(5) | 56,200 | | | 62,000 | | | 126,200 | | | 62,000 | |

Other(6) | 988 | | | — | | | 117 | | | — | |

| Adjusted EBITDA | $ | (18,529) | | | $ | (45,229) | | | $ | (107,747) | | | $ | (141,546) | |

__________________(1)Consists of expenses incurred associated with acquisitions, as well as integration-related charges incurred within one year of acquisition date primarily related to system conversions, re-branding costs and fees paid to external advisors.

(2)For the three and nine months ended September 30, 2023, includes restructuring charges related to the Restructuring Plan and related strategic business expenses incurred to support significant changes to our member programs and certain aspects of our operations, primarily consisting of consultancy fees associated with designing and implementing changes to our member programs and obtaining financing, and severance and recruiting expenses associated with executive transitions and other employee separation programs as part of our cost reduction initiatives. For the three and nine months ended September 30, 2022, includes restructuring charges for employee separation programs following strategic business decisions.

(3)Consists of expenses associated with establishing the Atlanta Member Operations Center and its operations primarily including redundant operating expenses during the transition period, relocation expenses for employees and costs associated with onboarding new employees. The Atlanta Member Operations Center began operating on May 15, 2023.

(4)Consists of expenses incurred to execute consolidation of our FAA operating certificates primarily including pilot training and retention programs and consultancy fees associated with planning and implementing the consolidation process.

(5)Represents non-cash impairment charge related to goodwill recognized in the second and third quarters of 2023. See Note 1, Summary of Business and Significant Accounting Policies of the Notes to Condensed Consolidated Financial Statements included in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

(6)Includes collections of certain aged receivables which were added back to Net Loss in the reconciliation presented for the twelve months ended December 31, 2022, as well as recognition of charges related to an individually immaterial litigation settlement.

Refer to “Supplemental Expense Information” below, for further information

Adjusted Contribution and Adjusted Contribution Margin

The following table reconciles Adjusted Contribution to gross profit (loss), which is the most directly comparable GAAP measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 320,063 | | | $ | 420,356 | | | $ | 1,006,937 | | | $ | 1,171,503 | |

| Less: Cost of revenue | (299,887) | | | (403,042) | | | (981,581) | | | (1,144,698) | |

| Less: Depreciation and amortization | (15,459) | | | (16,500) | | | (45,027) | | | (46,862) | |

| Gross profit (loss) | 4,717 | | | 814 | | | (19,671) | | | (20,057) | |

| Gross margin | 1.5% | | 0.2% | | (2.0)% | | (1.7)% |

| Add back: | | | | | | | |

| Depreciation and amortization | 15,459 | | | 16,500 | | | 45,027 | | | 46,862 | |

| Equity-based compensation expense in cost of revenue | 826 | | | 3,581 | | | 3,097 | | | 11,320 | |

Acquisition and integration expense in cost of revenue(1) | — | | | 650 | | | — | | | 650 | |

Restructuring expense in cost of revenue(2) | 320 | | | — | | | 1,075 | | | — | |

Atlanta Member Operations Center set-up expense in cost of revenue(3) | 10,642 | | | — | | | 22,440 | | | — | |

Certificate consolidation expense in cost of revenue(4) | 3,279 | | | — | | | 7,720 | | | — | |

| Adjusted Contribution | $ | 35,243 | | | $ | 21,545 | | | $ | 59,688 | | | $ | 38,775 | |

| Adjusted Contribution Margin | 11.0% | | 5.1% | | 5.9% | | 3.3% |

__________________(1)Consists of expenses incurred associated with acquisitions, as well as integration-related charges incurred within one year of acquisition date

(2)For the three and nine months ended September 30, 2023, includes restructuring charges related to the Restructuring Plan and other strategic business initiatives.

(3)Consists of expenses associated with establishing the Atlanta Member Operations Center and its operations primarily including redundant operating expenses during the transition period, relocation expenses for employees and costs associated with onboarding new employees. The Atlanta Member Operations Center began operating on May 15, 2023.

(4)Consists of expenses incurred to execute consolidation of our FAA operating certificates primarily including pilot training and retention programs and consultancy fees associated with planning and implementing the consolidation process.

Supplemental Revenue Information

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Three Months Ended September 30, | | Change in |

| 2023 | | 2022 | | $ | | % |

| Membership | $ | 20,622 | | | $ | 22,409 | | | $ | (1,787) | | | (8) | % |

| Flight | 214,645 | | | 278,917 | | | (64,272) | | | (23) | % |

| Aircraft management | 53,235 | | | 58,962 | | | (5,727) | | | (10) | % |

| Other | 31,561 | | | 60,068 | | | (28,507) | | | (47) | % |

| Total | $ | 320,063 | | | $ | 420,356 | | | $ | (100,293) | | | (24) | % |

| | | | | | | |

| | | | | | | |

| (In thousands) | Nine Months Ended September 30, | | Change in |

| 2023 | | 2022 | | $ | | % |

| Membership | $ | 63,780 | | | $ | 67,076 | | | $ | (3,296) | | | (5) | % |

| Flight | 681,691 | | | 799,351 | | | (117,660) | | | (15) | % |

| Aircraft management | 165,431 | | | 180,186 | | | (14,755) | | | (8) | % |

| Other | 96,035 | | | 124,890 | | | (28,855) | | | (23) | % |

| Total | $ | 1,006,937 | | | $ | 1,171,503 | | | $ | (164,566) | | | (14) | % |

Supplemental Expense Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 | | | | |

| Cost of revenue | | Technology and development | | Sales and marketing | | General and administrative | | Total | | |

| Equity-based compensation expense | $ | 826 | | | $ | 620 | | | $ | 440 | | | $ | 1,622 | | | $ | 3,508 | | | | | |

| | | | | | | | | | | | | |

| Restructuring charges | 320 | | | 4,641 | | | 703 | | | 16,549 | | | 22,213 | | | | | |

| Atlanta Member Operations Center set-up expense | 10,642 | | | — | | | — | | | 123 | | | 10,765 | | | | | |

| Certificate consolidation expense | 3,279 | | | — | | | — | | | — | | | 3,279 | | | | | |

| Other | — | | | — | | | — | | | 988 | | | 988 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 | | | | |

| Cost of revenue | | Technology and development | | Sales and marketing | | General and administrative | | Total | | | | |

| Equity-based compensation expense | $ | 3,097 | | | $ | 1,777 | | | $ | 1,781 | | | $ | 14,995 | | | $ | 21,650 | | | | | |

| Acquisition and integration expenses | — | | | 53 | | | 134 | | | 1,921 | | | 2,108 | | | | | |

| Restructuring charges | 1,075 | | | 6,940 | | | 2,761 | | | 30,130 | | | 40,905 | | | | | |

| Atlanta Member Operations Center set-up expense | 22,440 | | | 201 | | | — | | | 4,254 | | | 26,895 | | | | | |

| Certificate consolidation expense | 7,720 | | | — | | | — | | | 3,079 | | | 10,799 | | | | | |

| Other | — | | | — | | | — | | | 117 | | | 117 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 | | | | |

| Cost of revenue | | Technology and development | | Sales and marketing | | General and administrative | | Total | | |

| Equity-based compensation expense | $ | 3,581 | | | $ | 751 | | | $ | 2,756 | | | $ | 15,416 | | | $ | 22,504 | | | | | |

| Acquisition and integration expense | 650 | | | — | | | — | | | 4,097 | | | 4,747 | | | | | |

| Restructuring charges | — | | | — | | | — | | | 682 | | | 682 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 | | | | |

| Cost of revenue | | Technology and development | | Sales and marketing | | General and administrative | | Total | | | | |

| Equity-based compensation expense | $ | 11,320 | | | $ | 2,047 | | | $ | 8,314 | | | $ | 44,158 | | | $ | 65,839 | | | | | |

| Acquisition and integration expense | 650 | | | — | | | — | | | 15,442 | | | 16,092 | | | | | |

| Restructuring charges | — | | | — | | | — | | | 6,165 | | | 6,165 | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

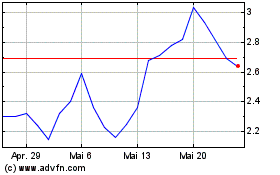

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024